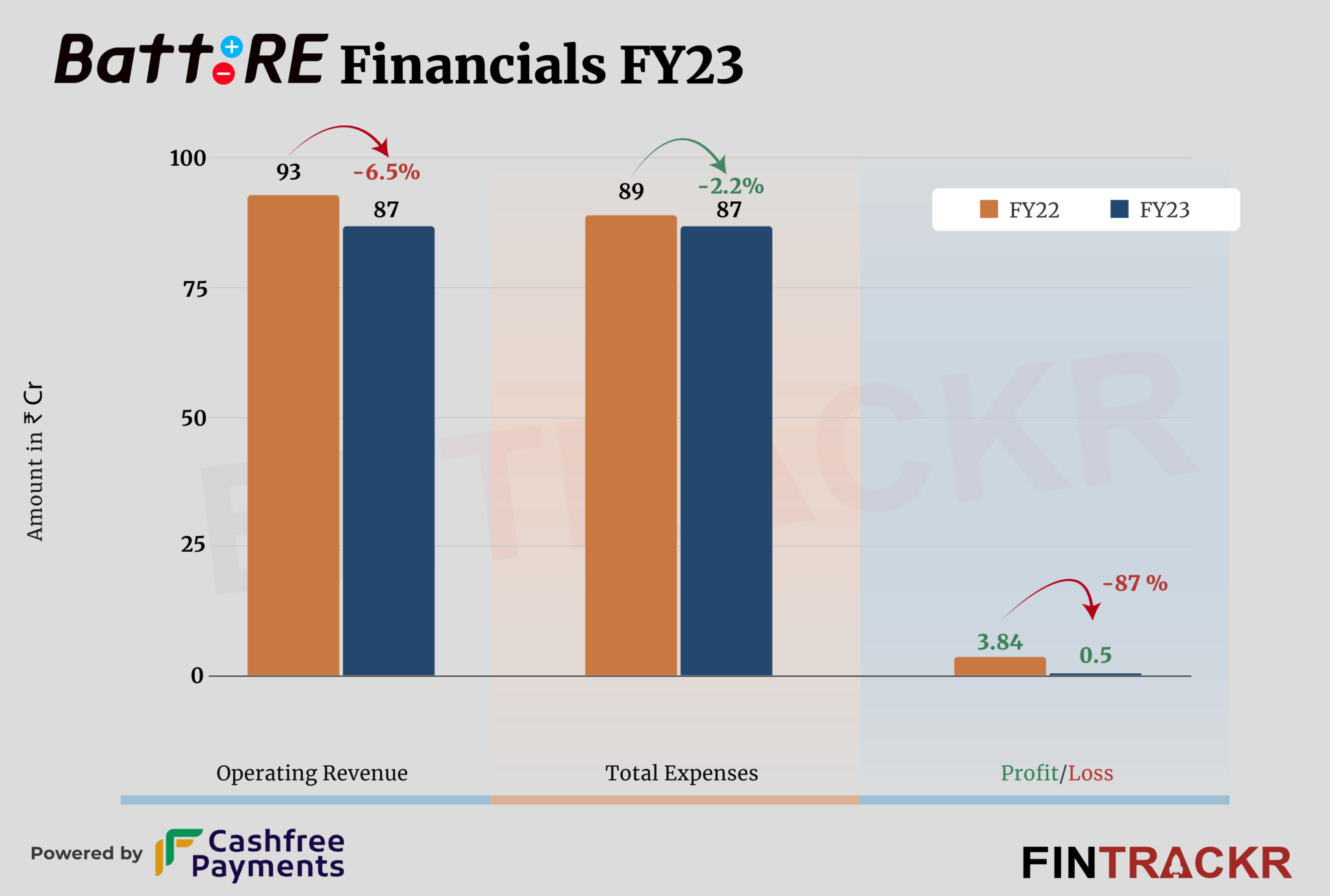

BattRE grew four-fold in FY22 but the EV mobility startup couldn’t manage even double digit growth in the last fiscal year, FY23. Moreover, the Agility Ventures-backed firm’s profit plummeted by 87% in the same period as compared to FY22

BattRE’s revenue from operations declined 6.5% to Rs 87 crore in FY23 from Rs 93 crore in FY22, its annual financial statements filed with the Registrar of Companies show.

Founded in 2017 by Niscahl Choudhary and Panjak Sharma, BattRE manufactures two-wheeler electric scooters and has three models named Storie, Loev, and One. It claims to have more than 400 outlets across 21 states in the country.

The sale of scooters was the primary source of income forming 97.7% of the total operating revenue which decreased 5.6% to Rs 85 crore in FY23. The rest of the income came from the sale of allied services.

Revenue Breakdown

https://thekredible.com/company/battre/financials

View Full Data

Last year, BattRE also partnered with eight financial institutions including Bajaj Finance, ICICI Bank, Credit Fair and Loan Tap.

For the EV manufacturing unit, the cost of procurement formed 79.3% of its total operating expenses. This cost remained constant at Rs 69 crore during the fiscal year ending March 2023.

Burn on employee benefits, import customs, freight, transportation, sales cum marketing, legal, and other overheads pushed BattRe’s overall cost to Rs 87 crore in FY23 which stood at Rs 89 crore in FY22.

See TheKredible for the complete expense breakup

Expense Breakdown

https://thekredible.com/company/battre/financials

View Full Data

https://thekredible.com/company/battre/financials

View Full Data

- Cost of material consumed

- Employee benefit

- Import custom

- Freight

- Sale and marketing

- Others

The stagnant revenue impacted their profits which dwindled by 87% to Rs 50 lakhs in FY23 from Rs 3.84 crore in FY22. Its ROCE and EBITDA margin worsened to 11% and 2.8% respectively. On a unit level, it spent Rs 1.00 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | 5% | 2.8% |

| Expense/₹ of Op Revenue | ₹0.96 | ₹1.00 |

| ROCE | 51% | 11% |

BattRE directly competes with Ola which reported Rs Rs 2,631 crore income during FY23, and Ather which had a turnover of Rs 1,784 crore in the last fiscal. Bounce, Okinawa, Pure, and others are also key players in the market.

It is obvious that for smaller players like BattRE, the going will keep getting tougher as larger and legacy players rev up their own game and output in the segment. Both TVS and Bajaj have made a splash since it had its big year in 2022, making the future uncertain, short of a breakout offering for the firm. Something that has always looked unlikely.