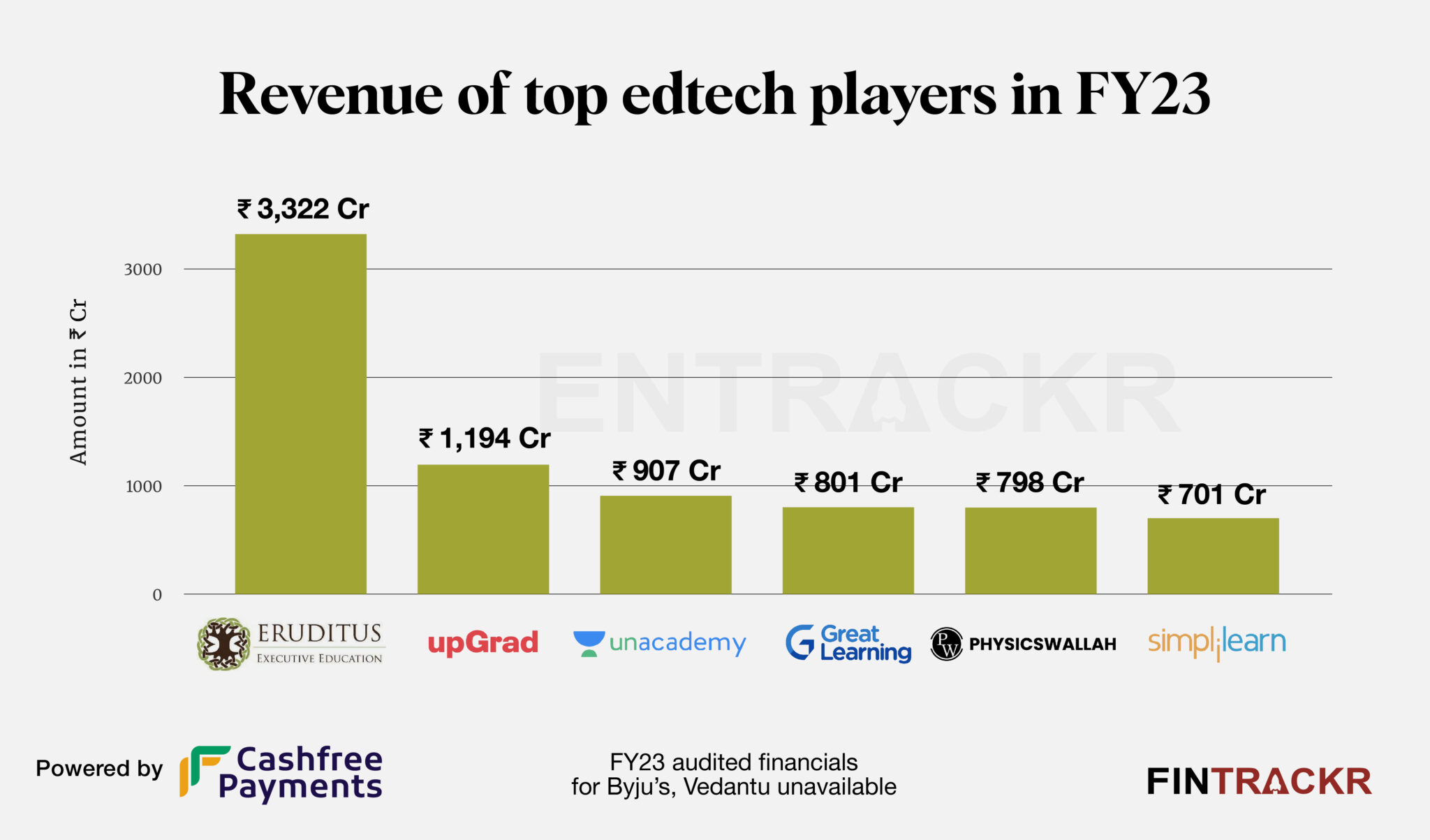

Executive education firm Eruditus has continued to hold second position in terms of scale in the Indian edtech space as its operating collection crossed Rs 3,300 crore in their fiscal year ending June 2023. Significantly, the company narrowed down losses by two-third in the same period, continuing its march towards a growth driven sustainable model.

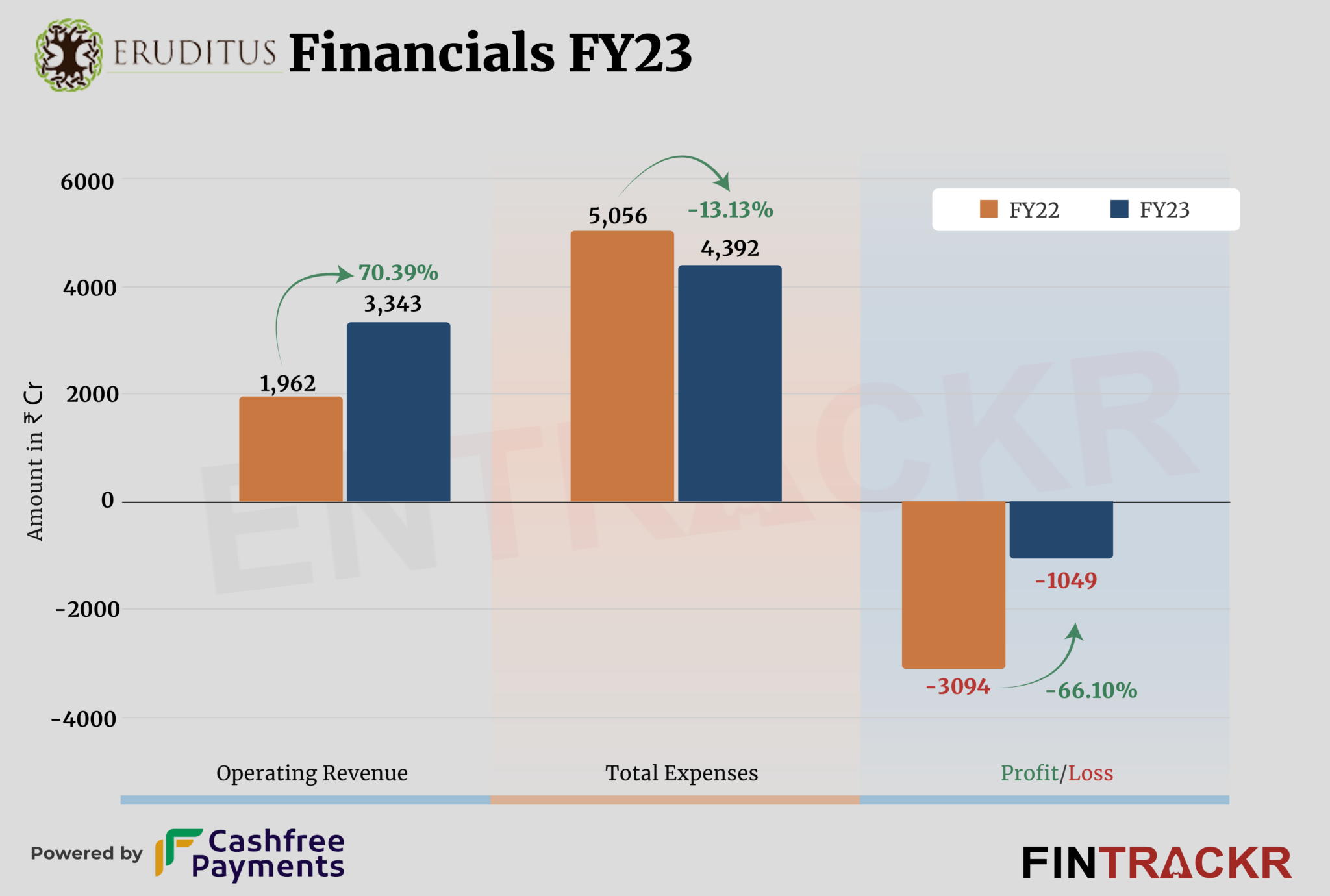

Eruditus’ revenue from operations spiked 70.39% to Rs 3,343 crore in FY23 from Rs 1,962 crore in FY22, according to its consolidated financial statements filed by the group entity in Singapore.

The company offers online and classroom management education programs in collaboration with business schools. The sale of these services was the sole source of revenue for Eruditus. It also provides upskilling and training to the corporate workforce via Emeritus which claims to have educated over 2,50,000 individuals across 80 countries.

The Eruditus group has 10 subsidiaries across 7 countries including the USA, China, India, Mexico, UK, Singapore, and UAE. These numbers consolidate all these entities.

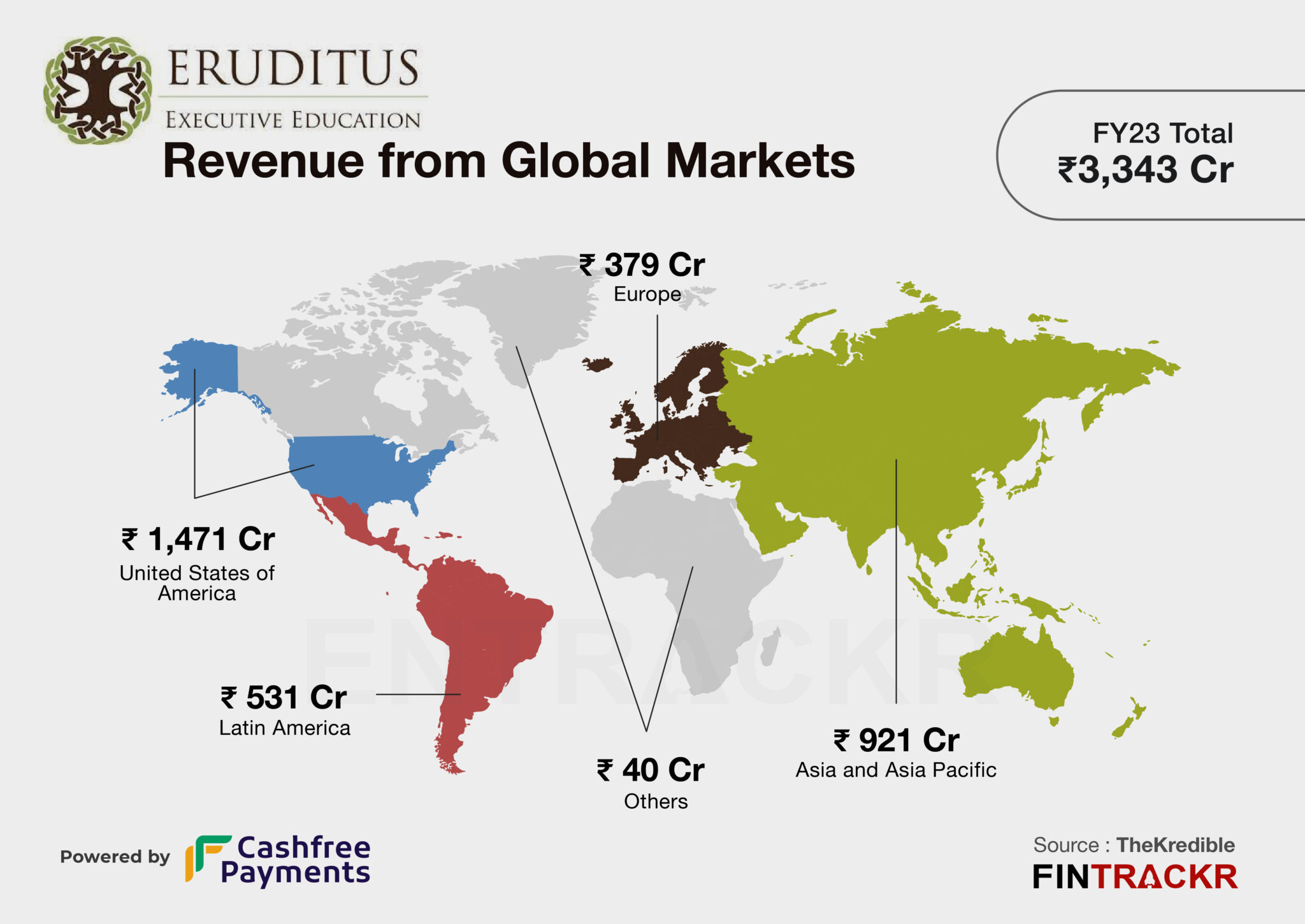

The United States was the largest geographical market in terms of revenues, accounting for around 44% of its annual revenues followed by Asia and Asia Pacific countries. Latin America and Europe contributed 16% and 11% to the total collections in FY23.

For the executive education provider firm, the program fee paid to schools was the largest cost center accounting for 31% of the total expenditure. This cost increased by 56.8% to Rs 1,356 crore in FY23.

Eruditus’ employee benefits and marketing costs saw a dip of 53.1% and 12.7% respectively. Its information technology, legal professional, and other overheads took the firm’s total expenditure to Rs 4,392 crore in FY23 as compared to Rs 5,056 crore in FY22.

Check TheKredible for the complete expense breakup.

Expense Breakdown

https://thekredible.com/company/eruditus/financials

View Full Data

https://thekredible.com/company/eruditus/financials

View Full Data

- Program fees to schools

- Employee benefits

- Marketing

- Information technology

- Professional fees

- Others

Eruditus’s effective cost mechanism helped it to reduce losses by 66.1% to Rs 1,049 crore in FY23 from Rs 3094 crore in FY23. Its ROCE and EBITDA margin stood at 25.6% and 15.2% respectively. The company has total outstanding losses of Rs 7,142 crore till June 2023.

On a unit level, it spent Rs 1.31 to earn a rupee in FY23.

Byju’s will remain the top edtech grosser in the last fiscal year but it’s yet to report FY23 numbers. Nevertheless, Eruditus is the top revenue generating company in its space followed by upGrad with Rs 1,194 core revenue. Unacademy also entered into the Rs 1,000 crore revenue club and improved its bottom line significantly. Byju’s-owned Great Learning, PhysicsWallah and Simplilearn are other sizable players.

Eruditus is also planning to foray into the study abroad category which eventually puts itself in direct competition with upGrad, Leverage Edu, Leap Scholar, CollegeDekho, and AdmitKard.

According to an ET report, Eruditus is planning to move its domicile to India as it may tap the IPO route. However, Eruditus co-founder and CEO Ashwin Damera denied any plans for public listing soon.

But there is no doubt that the firm has a firm grip on reality, seen in its carefully managed geographical spread as well as expansions into corporate upskilling and more. As firms struggle to keep their in-house training modules relevant and updated, Eruditus and the likes have a great opportunity to deliver a service that will always be in demand. From junior level to mid-management especially, demand is expected to go up significantly over the coming decade, creating every opportunity for Eruditus to do justice to its promise. As we have been pointing out regularly in its case, the drop in marketing costs could also portend a stronger brand that requires less support to make inroads.