Unicommerce, operating under AceVector Group which also houses Snapdeal and Stellaro Brands, has filed a draft red herring prospectus (DRHP) with the Security Exchange Board of India (SEBI) for an initial public offering (IPO).

The company has proposed to raise funds through an offer for sale (OFS) of up to 2,98,40,486 equity shares.

It’s worth noting that Unicommerce’s DRHP does not include fresh issues and offer proceeds will be received by the selling shareholders.

AceVector Limited (formerly known as Snapdeal Limited) is selling up to 1,14,59,840 equity shares while B2 Capital Partners and SB Investment Holdings (SoftBank) are off loading up to 2,210,406 and 16,170,240 equity shares.

IIFL Securities Limited and CLSA India Private Limited are the book-running lead managers of the issue.

As per the DRHP, veteran investor Madhusudan Kela’s wife Madhuri Kela, American investment management firm Anchorage Capital, CitiusTech co-founders Rizwan Koita and Jagdish Moorjani, and Sutherland Global Services’ founder Dilip Vellodi invested in the company ahead of IPO.

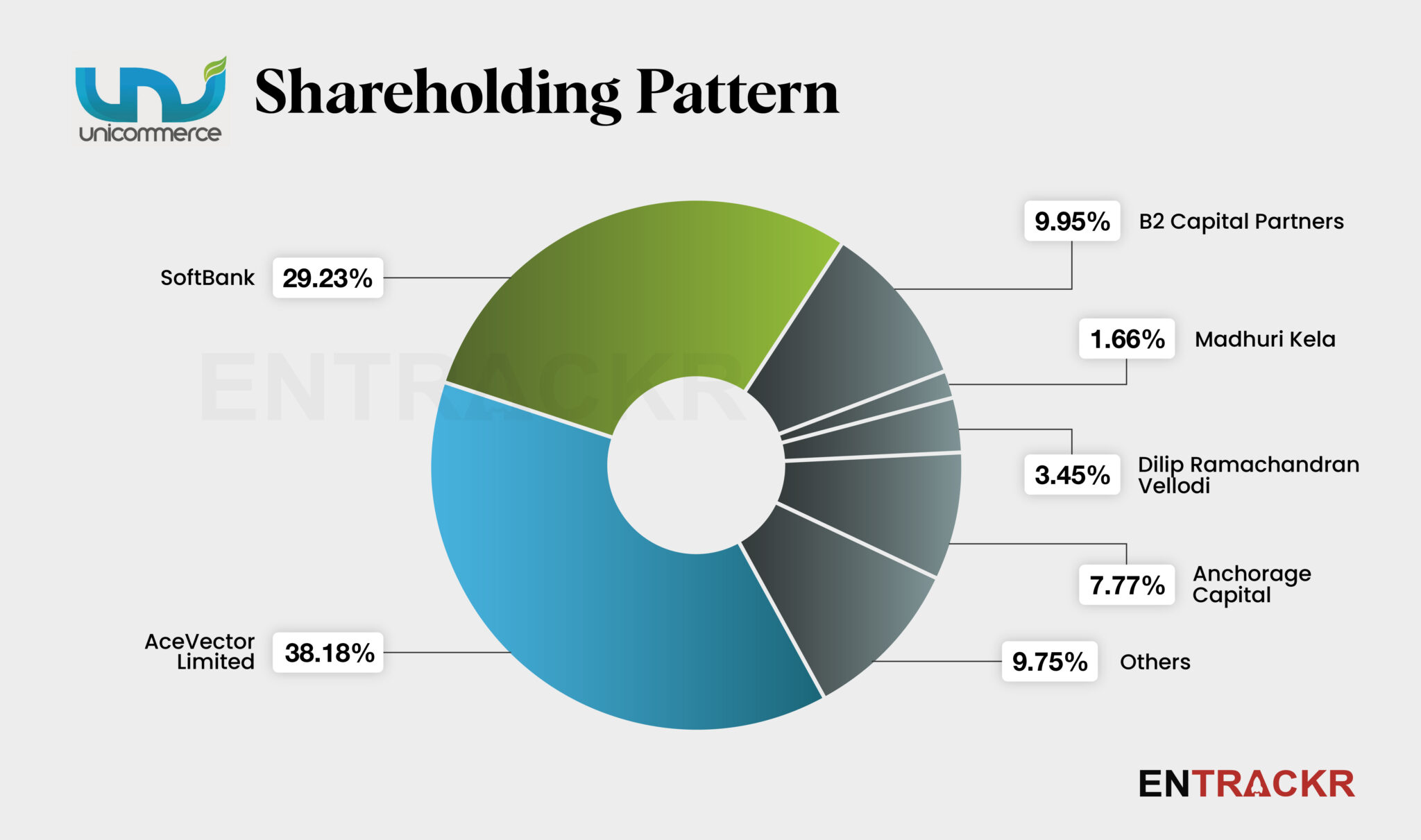

At the time of filing DRHP, AceVector Limited holds a 38.18% stake followed by SoftBank and B2 Capital Partners which command 29.23% and 9.95% shares, respectively. Madhuri Madhusudan Kela (1.66%), Dilip Vellodi (3.45%) and Anchorage Capital (7.77%) also command significant stakes in the company.

Unicommerce offers integrated e-commerce enablement SaaS solutions covering order and inventory, return, and omnichannel management.

The SoftBank-backed company recorded Rs 51 crore revenue from operations during H1 of FY24 while its profit stood at Rs 6.3 crore during the same period. In FY23, its scale went up 52.54% to Rs 90 crore from Rs 59 crore in FY22. Further, its profits increased 7.8% to Rs 6.47 crore during FY23.

Besides India, Unicommerce operates in Indonesia, Philippines, Singapore, Malaysia, UAE & Saudi Arabia, with clients like Edamama, RedTag, RSA Global et al. During FY23, it generated 97.3% of revenue (Rs 87.6 crore) from India while the rest 2.7% (Rs 2.4 crore) came from overseas operations.

This is the third SoftBank-funded company that has filed DRHP in the past two weeks. In the last week of December, Ola Electric and FirstCry also filed their draft IPO papers. Overall, five startups including MobiKwik and Awfis have initiated their IPO process in the last two weeks. Notably, only Unicommerce and MobiKwik are profitable until H1 FY24.