Prop tech unicorn NoBroker has finally reported its FY22 financial results after a delay of 15 months from its due date. The firm registered around two-fold growth in its operating scale in the fiscal year ending in March 2022. However, its losses spiked 62.6% in the same period.

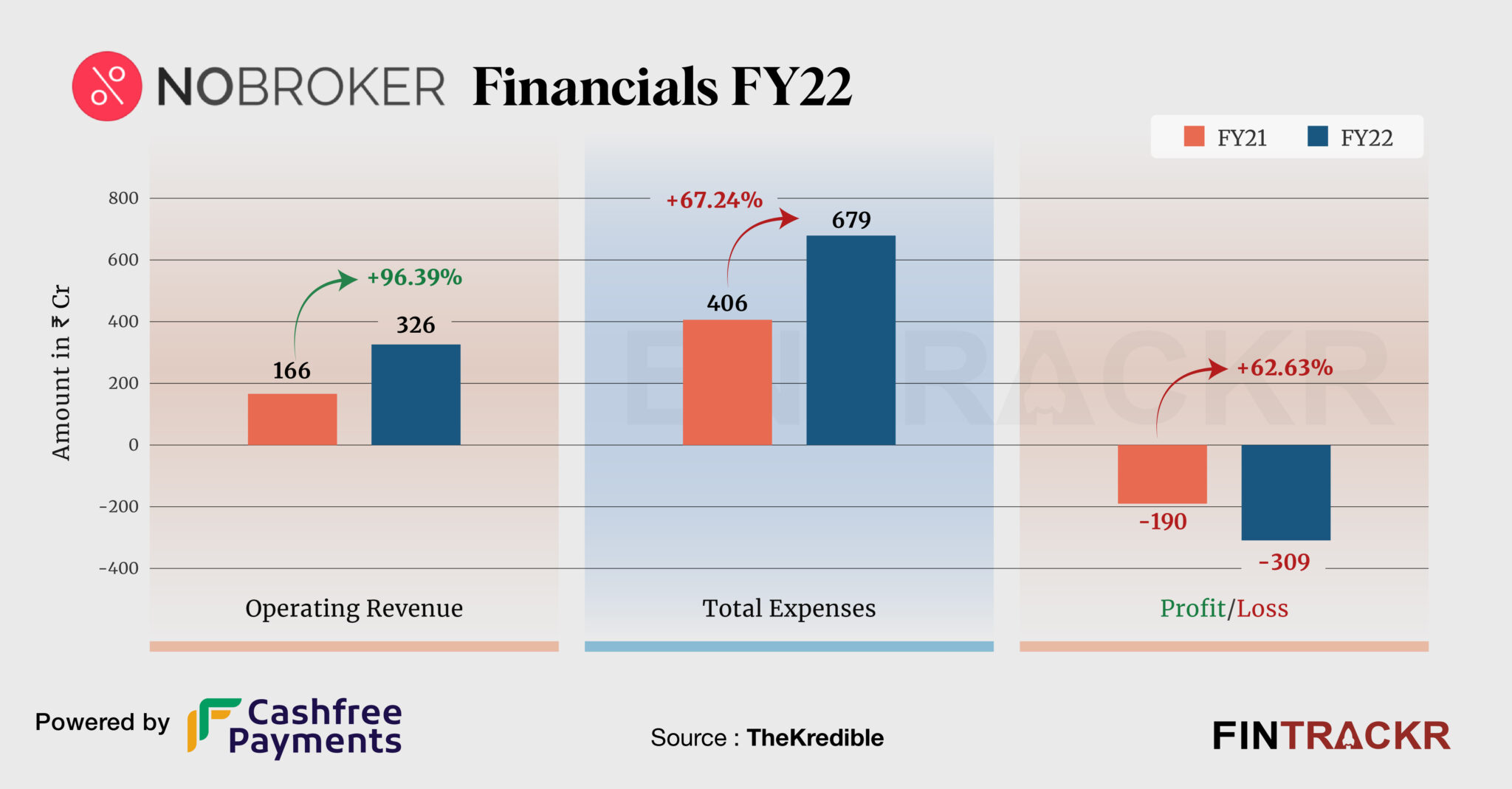

Bengaluru-based NoBroker’s revenue from operations grew by 96.4% to Rs 326 crore in FY22 from Rs 166 crore in FY21, its annual financial statements sourced from the Registrar of Companies show.

Nine-year-old NoBroker is a real estate platform that connects property owners directly to tenants, eliminating the need for brokers or agents. The sale of subscription plans was the primary source of revenue for NoBroker.

The company additionally offers rental agreements, home insurance, and property management services, simplifying the process of renting or buying properties and saving time and money for both parties.

NoBroker also recorded non-operating income of Rs 43.95 crore from the interest of fixed deposit and gain on current investments/mutual funds which took its overall income to Rs 370 crore in FY23.

On the cost side, employee benefits accounted for 39% of the overall expenditure. This cost increased 47.2% to Rs 262 crore in FY22. The company posted Rs 366 crore as miscellaneous expenses which might be advertisement, payment gateways, and other overheads during FY22.

With a 67% surge in the total cost, losses for the firm grew 62.6% to Rs 309 crore in FY22 as compared to Rs 190 crore in FY21. Its ROCE and EBITDA margin stood at -16% and -80% respectively. On a unit level, it spent Rs 2.08 to earn a rupee in FY22.

NoBroker has raised over $400 million to date including its series E round of $210 million led by Tiger Global, General Atlantic and Moore Strategic. According to the startup intelligence platform TheKredible, General Atlantic is the largest shareholder with 30% while Elevation Capital and Tiger Global follow, each holding over 15% of the company.