This week, 18 Indian startups have collectively raised around $60 million. This includes one growth-stage deal and 14 early-stage funding deals. Details of three startups’ funding deal remained undisclosed.

Last week, 22 startups raised about $113 million including three growth stage and 11 early stage deals (amount of eight deals was undisclosed).

[Growth-stage deals]

During the week, Electric cycle manufacturing company EMotorad was the only growth-stage startup raised funding. The startup led the chart with $20 million fundraise in a Series B round led by Panthera Growth Partners.

[Early-stage deals]

Among early-stage deals, omnichannel payment solutions provider PhiCommerce grabbed the top spot with $10 million fundraise. D2C brands Innovist, fintech firm GrowXCD, healthtech company Zyla Health secured $7 million, $6 million and $4 million funding, respectively.

Furthermore, the list includes proptech firm Elivaas, logistics startup ShipGlobal, e-commerce firm Frendy and more.

Among the early-stage deals this week, three startups did not disclose the amount raised. This includes Stage, PatilKaki, and Woovly. For more information, visit TheKredible.

[City and segment-wise deals]

In terms of city-wise number of funding deals, Delhi-NCR-based startups led the list with 10 deals. Bengaluru and Pune remained in the second and third position, respectively.

Further, Chennai, Ahmedabad and Mumbai-based startups saw one deal each.

The complete breakdown of the city and segment can be found at TheKredible.

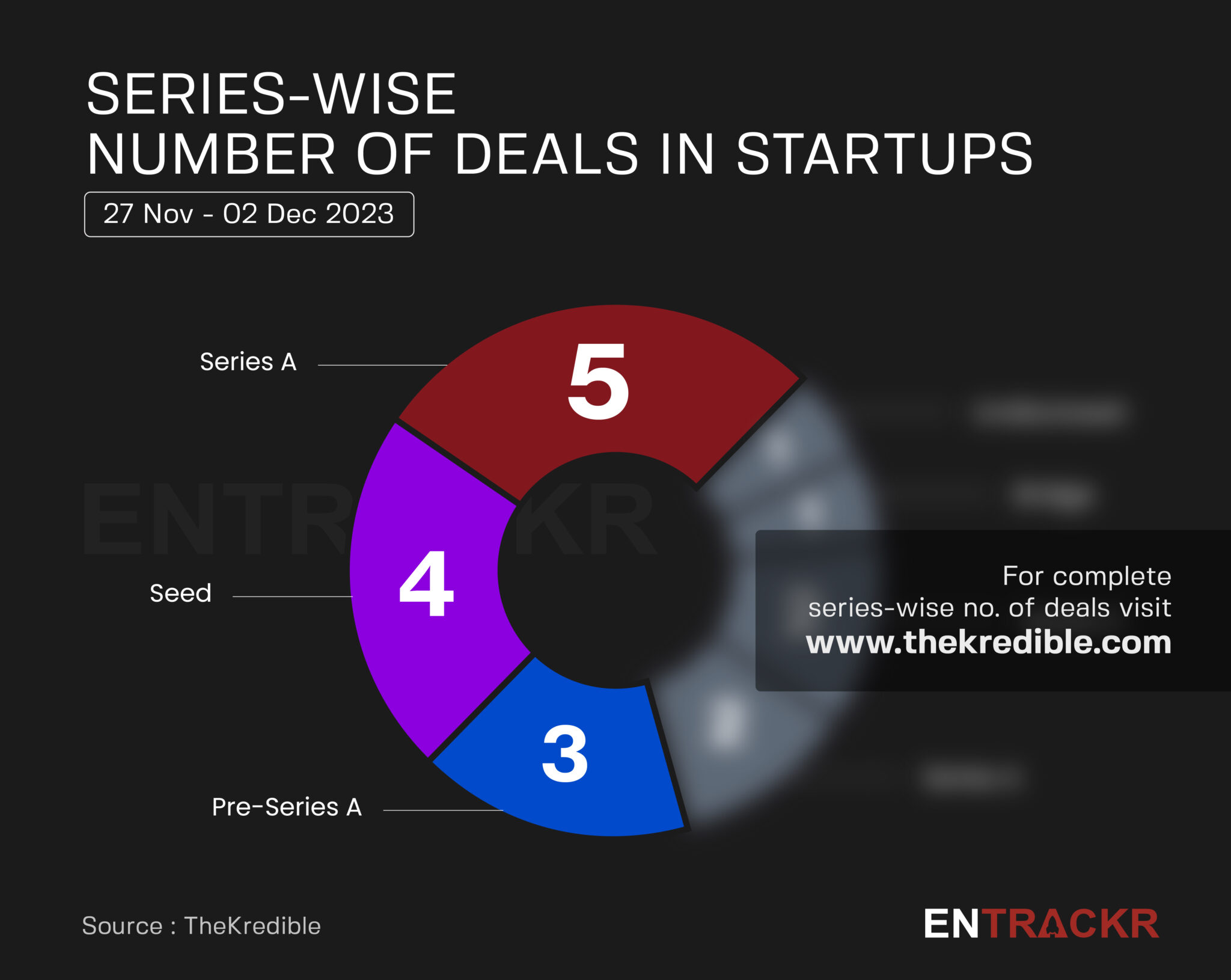

[Series wise deals]

This week, Series A funding topped with five deals followed by four seed funding and three pre-Series A funded startups. Further the list counts bridge, angel, Series B and funding round.

[Week-on-week funding trend]

With a surge in funding last week, funding again slipped 47% to $60 million on a weekly basis. Last week funding saw a significant rise to $113 million from $44.37 million in the previous week. The average funding in the last eight weeks stood at around $193 million with a deal size of 21 per week.

[M&A]

During the week, venture debt firm Stride Ventures acquired startup MoEVing while used car retailer CarDekho acquired majority stakes in Revv and plans to merge it with the rest of its offerings.

[Fund launches]

On a rescue mission following the funding winter, this week three startup focused funds announced the closure of their funds. This list coins, Pantomath Financials Services Group, Lighthouse Canton’s LC Nueva AIF and early stage venture capital firm Sprout Venture Partners.

[Layoffs/Exit]

This week, game streaming platform Loco has laid off around 36% of its 110 workforce, impacting 40 employees.

While edtech giant BYJU’s witnessed key departures, its Group CTO, Anil Goel resigned the company.

Visit TheKredible to see exits, series wise deals and amount breakup, and more insights.

[New launches]

▪ Audio streaming company Spotify launches audience network in India

▪ To help banks and fintechs, Pine Labs launches Credit+

▪ BharatPe to launch new entity BharatPe Money for lending vertical

▪ Cuemath goes offline, launches first physical math learning center

[Financial results this week]

▪️ Park+ revenue spikes 2.5X to Rs 100 Cr in FY23

▪️ Minimalist posts Rs 184 Cr revenue and Rs 5 Cr loss in FY23

▪️ Arya.ag nears Rs 300 Cr revenue in FY23, turns profitable

▪️ upGrad’s scale spikes to Rs 1,194 Cr in FY23 with flat losses

▪️ Xoxoday’s revenue crosses Rs 800 in FY23

▪️ AstroTalk posts Rs 283 Cr revenue in FY23

[News flash this week]

▪ Allen set to acquire edtech startup DoubtNut

▪ BharatPe claims positive EBITDA in October

▪ MobiKwik to file DRHP next month

▪ PayU India shutdown the BNPL prepaid card service Lazycard

▪ After 3 years, OYO relaunches self-operated hotels

▪ Prosus marks down BYJU’s valuation to under $3 Bn

[Entrackr’s analysis]

This the the second time in the past couple of months when weekly funding tumbled under the $100 million mark while weekly average funding of the last eight weeks also slipped under $200 million.

On the lines of many others, BharatPe also claimed operational profits during the month of October. The list features Fractal, CarTrade and Groww.

Following the success of MamaEarth in the public market, a couple of startups including MobikWik again resumed their IPO process. As per media reports, MobiKwik is set to file DRHP in the coming days.