This week, 22 Indian startups have collectively raised $113 million. This comprises three growth-stage deals and 11 early-stage funding deals. Details of eight startups’ funding deal remained undisclosed.

Last week, 12 startups raised around $44.37 million including two growth stage and 10 early stage deals.

[Growth-stage deals]

During the week, three growth-stage startups raised $62.3 million funding. Dental clinic chain Clove Dental raised $50 million in Series E funding round followed by omnichannel luxury fashion brand Purple Style Labs and meat delivery platform ZappFresh which raised $8 million and $4.3 million, respectively.

[Early-stage deals]

Among early-stage deals, fintech startup Scapia grabbed the top spot with $23 million fundraise. Virtual credit card platform Kiwi, full-stack electric vehicle for gig workers Baaz Bikes, ayurvedic and organic personal care brand Herby Angel and commercial real estate services provider Hanto followed the list.

Furthermore, the list includes spiritualtech firm Vama, ecommerce startups Jodaro and Sohamm Snacks, among others.

Among the early-stage deals this week, eight startups did not disclose the amount raised. This includes Conscious Chemist, Tagda Raho, RedWings and others. For more information, visit TheKredible.

[City and segment-wise deals]

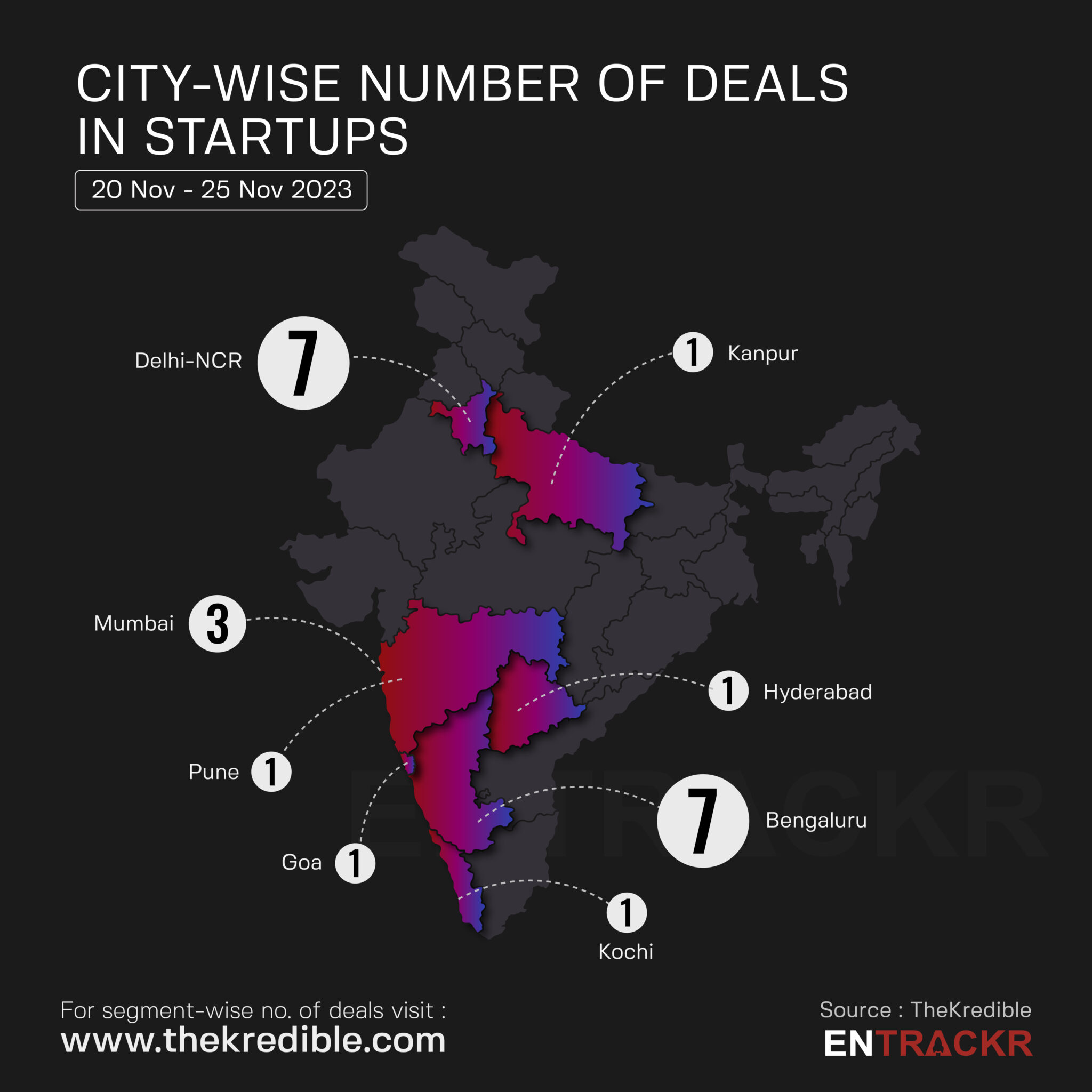

In terms of city-wise number of funding deals, Bengaluru and Delhi-NCR-based co-led the list in terms of number of deals with seven deals each. However, the Delhi-NCR-based startups dominated in terms of amount raised during the week.

Mumbai is on the third spot with three deals while Hyderabad, Goa and Kochi are next among others with one deal each.

The complete breakdown of the city and segment can be found at TheKredible.

[Series wise deals]

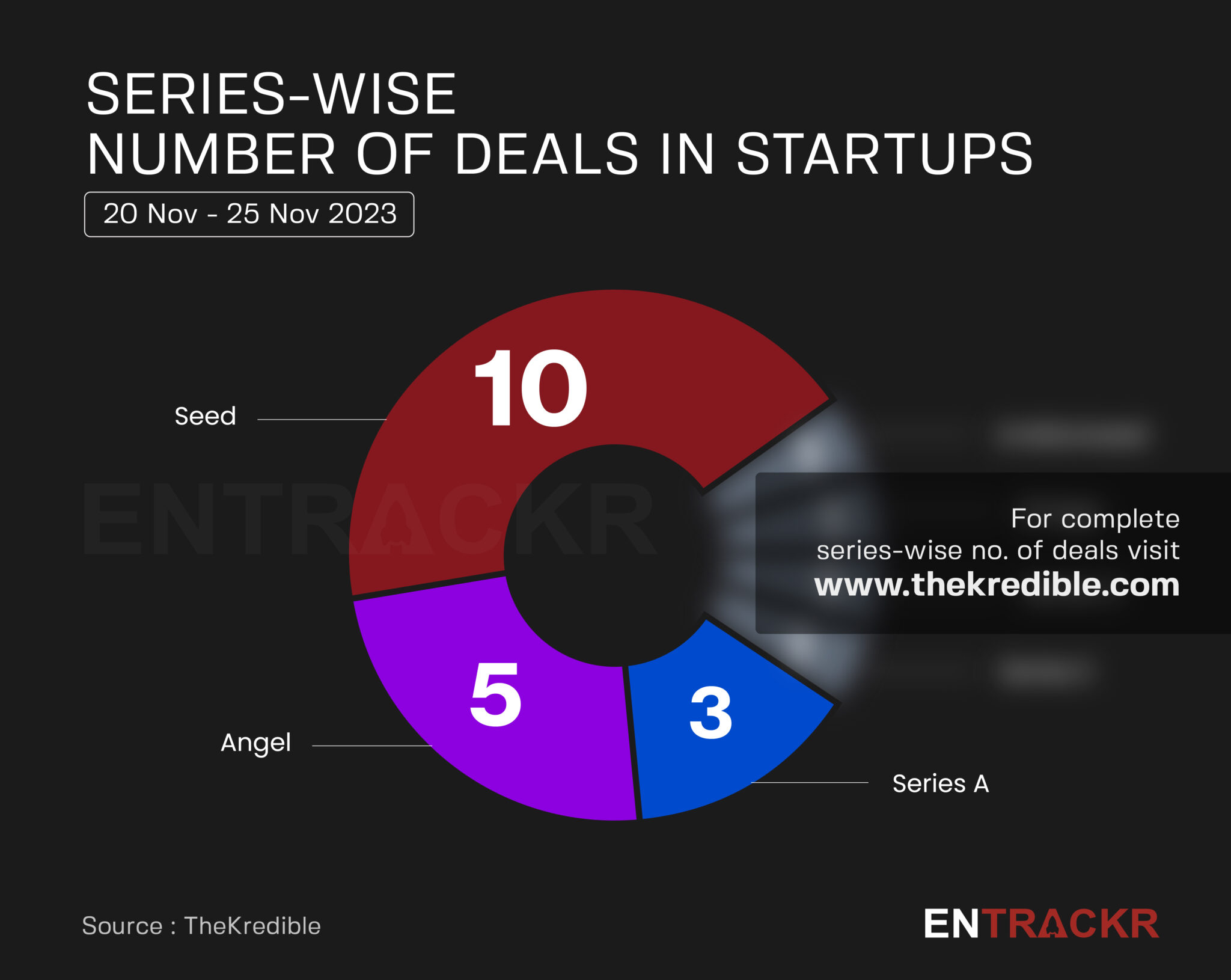

This week, seed funding topped with 10 deals followed by five angel funding and three Series A funded startups. Further the list counts Series E, Series D, and Bridge funding round.

[Week-on-week funding trend]

Followed by a steep fall in the last week, funding again flourished 2.5X to $113 million on a weekly basis. Last week funding saw a huge drop from $201 million to only $44.37 million. While the average funding in the last eight weeks stood at around $202 million with a deal size of 21 per week.

[M&A]

During the week, vendor-digitisation platform Bizongo acquired FactoryPlus, a digitisation app for MSME factories. To ramp up its NBFC vertical, fintech startup Wint Wealth acquired Ambium while Adobe acquired AI- video creation startup Rephrase.ai.

[Layoffs/Shutdown/Exit]

Edtech unicorn PhysicsWallah (PW) fired 70-120 employees this week while Tiger Global-backed Jodo let go of around 100 people. B2B networking platform Anar decided to shut-down its operations and will return the capital left with the company to investors.

The week also witnessed two key departures from the grocery delivery unicorn DealShare. Vineet Rao who stepped down from his role a few months back, has now left the company. COO Sankar Bora also left DealShare.

Visit TheKredible to see exits, series wise deals and amount breakup, and more insights.

[New launches]

▪ PriyaGold enters D2C space, launches new website

▪ Uber set to launch bus shuttle service in Kolkata, unveils new rewards program for drivers

[Financial results this week]

▪ ShareChat spent Rs 3,959 Cr to make Rs 533 Cr in FY23

▪ InShorts posts Rs 310 Cr loss in FY23 with flat scale

▪ Servify’s income spikes around 2X to Rs 611 Cr in FY23

▪ Chaayos posts Rs 237 Cr revenue in FY23; losses spike 34%

▪ Wakefit records Rs 813 Cr revenue in FY23; losses go up

▪ Decoding the financial performance of India’s top OTA players

[News flash this week]

▪ Unicommerce plans IPO in 2024

▪ Tiger Global’s private investment head Scott Shleifer steps down

▪ Warren Buffett-led Berkshire Hathaway exits Paytm

▪ ED issues show cause notice to Byju’s over FEMA violations

▪ India warns social media firms against deepfake proliferation

[Entrackr’s analysis]

After a lull post-Diwali week, startup funding surged 2.5X to $113 million. It’s likely the funding will get slower until late-December and bounce back early next year, as has been the case for quite some years. It also remains to be seen what impact Tiger Global’s management rejig has on the Indian startup ecosystem.

Large-scale layoffs have returned to the startup space with PhysicsWallah (PW) and Jodo collectively firing over 200 people. As mentioned above, B2B networking platform Anar also decided to shut-down operations.

But there’s much to look forward to. Profitable SaaS firm Unicommece is eyeing an IPO in 2024, joining the likes of Swiggy, OYO, Ola Electric which also have plans to go public by next year.