This week as many as 33 Indian startups bagged a total funding of $957 million. The deals comprised six growth-stage deals and 21 early-stage funding deals. Details of six fundings remained undisclosed.

Last week, around 20 growth and early stage startups collectively raised nearly $550 million, including two undisclosed deals.

[Growth-stage deals]

Ecommerce giant Flipkart led the pack this week with $600 million fundraise led by Walmart. The round may close at $1 billion as per media reports. Robotics firm GreyOrange secured $135 million followed by cloud kitchen startup Kitchen@ with its $65 million fundraise.

Further, video-editing SaaS platform VideoVerse and EV ride-hailing service BluSmart raised $45 million and $24 million, respectively. MSME-focused NBFC, U Gro Capital also secured $30 million debt funding.

Gadget and wearable brand Noise also raised funding this week without disclosing the amount raised.

[Early-stage deals]

This week, among 21 early-stage deals, full-stack horticulture firm Fasal is on top of the list followed by D2C healthy snacking brand Farmley and lithium battery recycling startup BatX Energies.

Further, the list includes AI driven customer support platform Kapture CX, insurance platform Finhaat, community building and marketing campaigns firm Intract, and EV finance and asset management platform Finayo among others.

Healthtech companies Ugees, Helo Health and FlexifyMe, gaming firm Marcos Gaming and fintech startup Reeudo did not disclose the amount raised during the week. For more information, visit TheKredible.

[City and segment-wise deals]

In terms of city-wise number of funding deals, Delhi-NCR-based startups led the list with 12 deals followed by Bengaluru with nine deals and Mumbai with six deals.

Moreover, Chennai, Hyderabad, Pune, and Sirsa-based startups were next on the list.

The complete breakdown of the city and segment can be found at TheKredible.

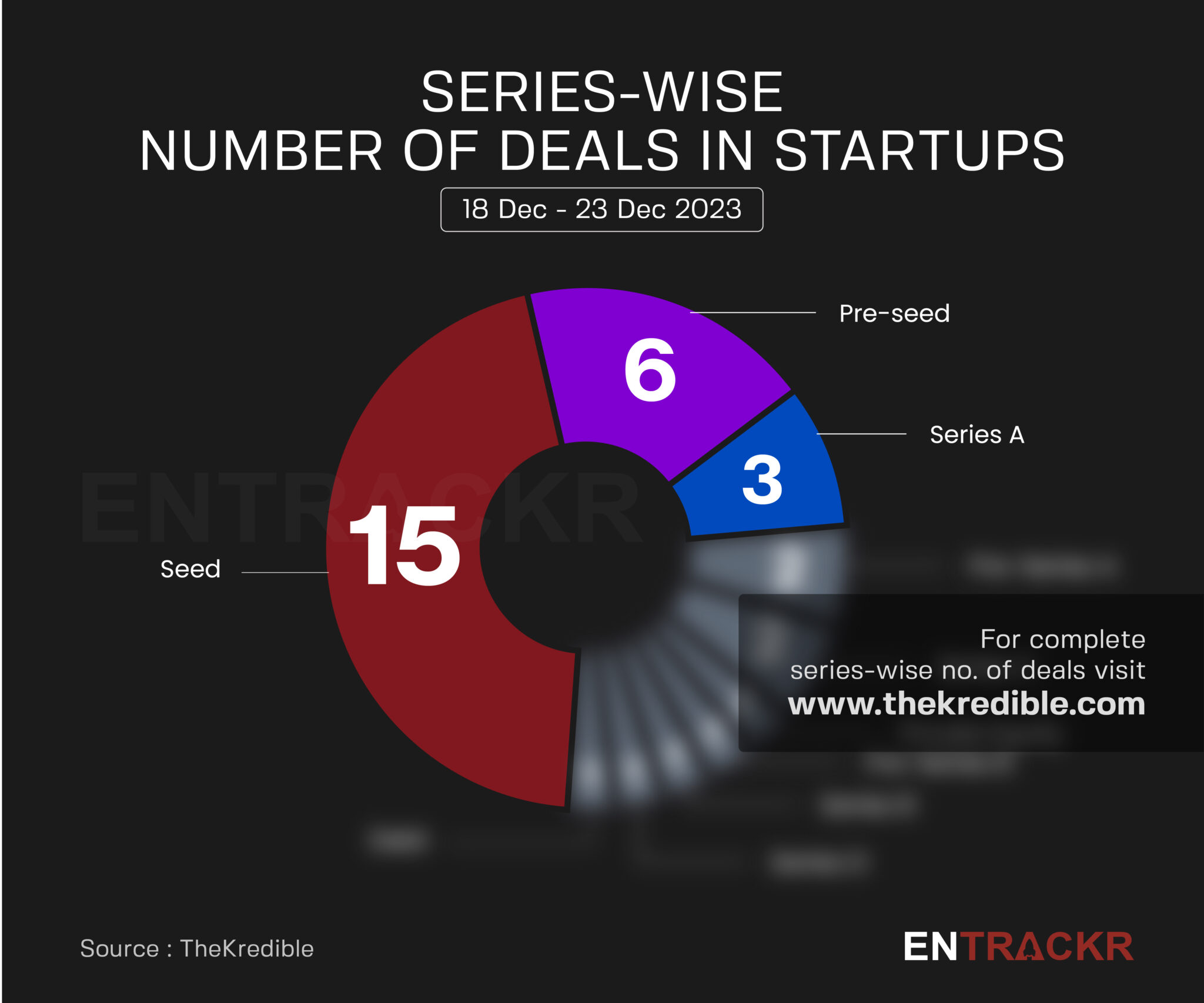

[Series wise deals]

This week, seed stage deals grabbed the top spot with 15 deals followed by pre-seed, Series A, pre-Series A and Series C with 6, 3, 2, and 2 deals, respectively.

The list also counts one private equity, debt, pre-Series B, Series B and Series D deal each.

[Week-on-week funding trend]

Following the propulsion, the weekly funding again surged over 70% to $957 million this week as compared to around $550 million raised in the previous week.

The average funding in the last eight weeks rose to around $286 million with deal numbers at 22 per week.

The week-on-week funding trend can be seen below:

[M&A]

During the week, ChrysCapital-backed Livguard acquired mobility startup Emuron, coworking space provider BHIVE acquired product-engineering firm Praemineo and IPO-bound TBO Tek acquired Jumbo Tours Group’s online biz.

[Fund launches]

The Mumbai-based early-stage investor We Founder Circle launched a $10 million worth fund. In terms of the average investment size, the fund targets investing in the range of $50,000-1.5 million.

[Layoffs]

B2B ecommerce platform Udaan laid off more than 100 employees after restructuring in September. Mohalla Tech, the parent entity of the vernacular social media platform ShareChat and short video entertainment app Moj, also laid off 15% of its workforce.

Visit TheKredible to see series wise deals and amount breakup, and more insights.

[New launches]

▪ YouTube launches a branded content platform in India

▪ Shadowfax introduces 30-min delivery service Flash

[Financial results this week]

▪️ Lendingkart posts Rs 118 Cr profit after tax in FY23

▪️ Rario writes off NFTs worth Rs 458 Cr in FY23

▪️ Jumbotail’s FY23 revenue grows over 2x to Rs 819 Cr

▪️ Healthkart’s scale spikes 2.7X to Rs 832 Cr in last two fiscals

▪️ BharatPe’s revenue crosses Rs 1,000 Cr in FY23

▪️ Zupee’s revenue zooms to Rs 832 Cr in FY23; cuts losses by 73%

[News flash this week]

▪️ Razorpay, Cashfree, Open and others get final Payment Aggregator license

▪️ The Telecommunications Bill, 2023 passed by Lok Sabha

▪️ Awfis files DRHP; Peak XV to offload 32.7% of its holding

▪️ Ola Electric files IPO papers with SEBI

▪️ ShareChat in talks to raise over $50 million at haircut valuation

▪️ BharatPe to raise Rs 500 crore debt funding next year

[Entrackr’s analysis]

The penultimate week of 2023 saw one of the most funded periods of this year. The weekly funding crossed the $900 million threshold with a significant week-on-week growth. Last week, the Indian startup ecosystem crossed $500 million in weekly funding for the first time in the last quarter of the ongoing calendar year. Moreover, December has already become the most funded month of 2023 with $1.6 billion surpassing the previous record of $1.3 billion in March.

Meanwhile, Razorpay, Cashfree, Open and other fintech firms, got the final license for payment aggregator from the Reserve Bank of India (RBI).

Additionally, EV company Ola Electric and workspace solution provider Awfis filed their draft red herring prospectus with the markets regulator Securities and Exchange Board of India this week.