This week as many as 19 Indian startups secured a total funding of approximately $548 million. This comprised seven growth-stage deals and 10 early-stage funding deals. Notably, details of two startups’ funding were undisclosed.

Comparatively, in the previous week, a total of 20 startups raised funding, amounting around $130 million, with the funding amounts for two deals remaining undisclosed.

[Growth-stage deals]

Throughout the week, seven growth-stage startups secured a total funding of $503.7 million. The B2B e-commerce platform Udaan took the lead with $340 million in a Series E round. Subsequently, B2B fruits marketplace Vegrow, a microlending firm, a biopharmaceutical company PlasmaGen, and an electric vehicle-focused rapid charging startup Exponent Energy, which raised $46 million, $37.3 million, $27 million, and $26.4 million, respectively.

Further, electric vehicle firm Ather Energy and natural personal care D2C startup Nat Habit also raised funding this week.

[Early-stage deals]

Among early-stage deals, D2C menswear fashion brand Snitch topped the list this week followed by sportswear and athleisure solutions platform Agilitas Sports, cybersecurity firm QNu Labs and healthtech startup GoApptiv.

Furthermore, the list includes fashion and lifestyle platform Absolute Brands, EMI/EMC simulation and testing platform SimYog and D2C hair extensions startup HairOriginals among others.

QSR brand Burger Singh and EV charging solutions provider ChargeZone did not disclose the amount raised during the week. For more information, visit TheKredible.

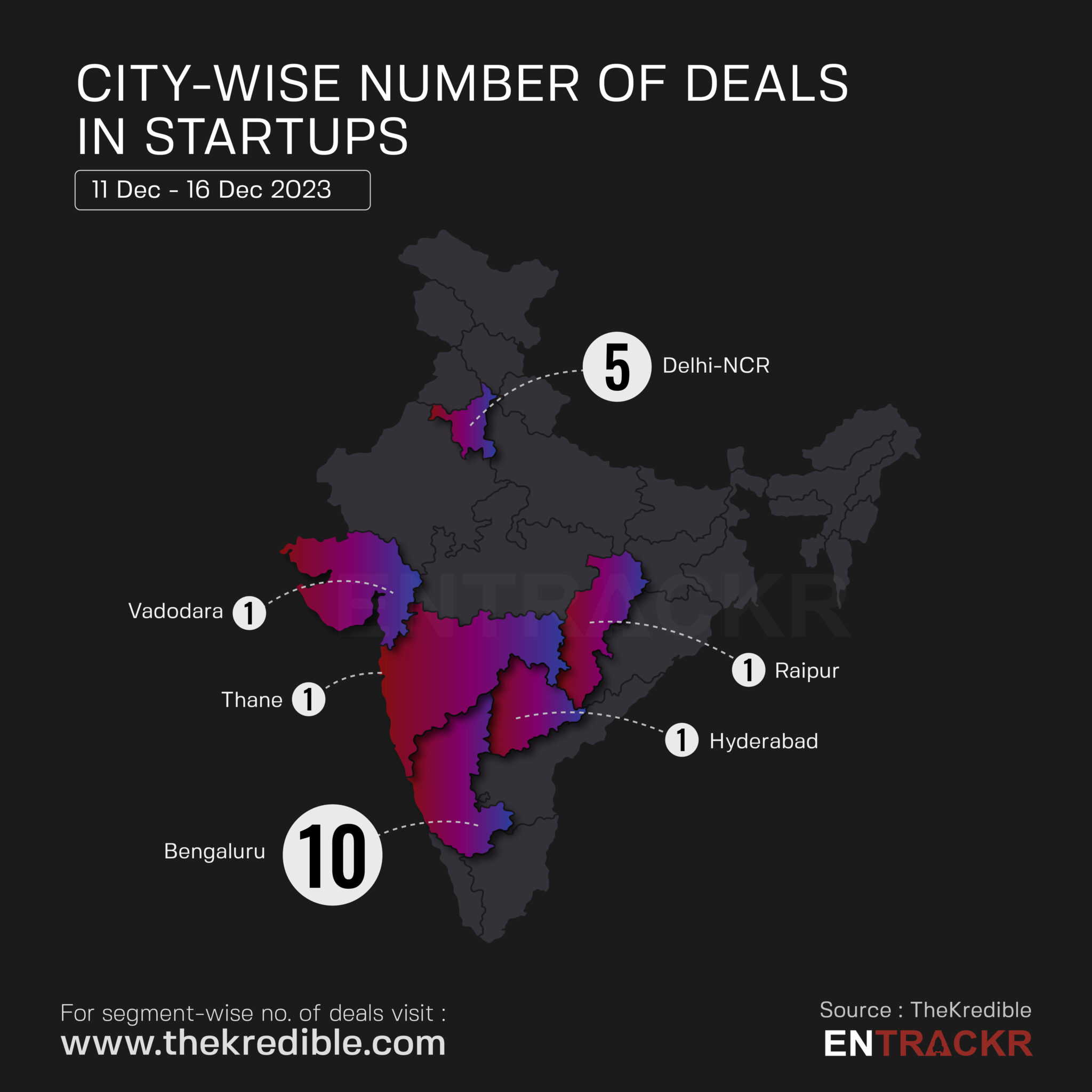

[City and segment-wise deals]

In terms of city-wise number of funding deals, Bengaluru-based startups led the list with 10 deals followed by Delhi-NCR with five deals.

Furthermore, Hyderabad, Thane, Raipur and Vadodara-based startups saw one deal each.

The complete breakdown of the city and segment can be found at TheKredible.

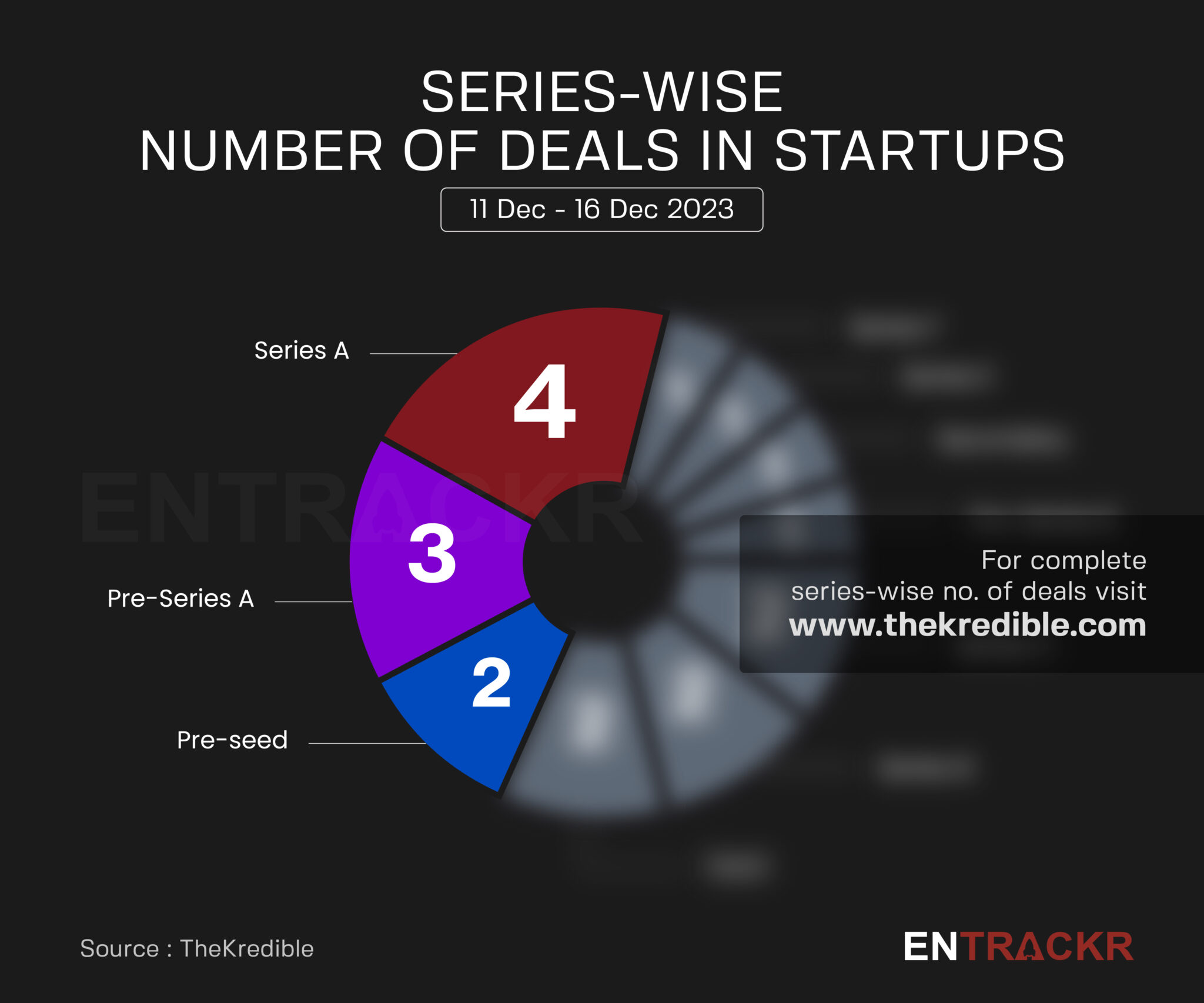

[Series wise deals]

This week, Series A funding topped with four deals followed by three pre-Series A deals. Pre-seed, Seed, Series B and Series C rounds saw two deals each, respectively.

The list also counts one Pre-Series B, Secondary, Series E and Series F deal each.

[Week-on-week funding trend]

The weekly funding saw a sudden rise of over 4X to $548 million as compared to $130 million in the previous week. However, this was majorly due to the Udaan’s $340 million fundraise which pushed the weekly funding to over $500 million mark. The average funding in the last eight weeks stood at around $208 million with deal numbers at 20 per week.

[M&A]

During the week, Fantasy sports company Acquired NFT marketplace Good Game Exchange, Nourish You Acquired Vegan food brand One Good and M2P Fintech Acquired Goals101.

Further, gaming company Octro took over DGN Games, fintech firm Anq acquired Kiwimoney and healthtech startup picked up majority stakes in AI firm Waybeo.

[Fund launches]

The Mumbai-based venture capital firm Asha Ventures marked the first close of its maiden fund this week amounting to $50 million (Rs 416 crore).

[Layoffs/Shutdowns]

Coffee chain firm Third Wave Coffee has reportedly fired more than 100 employees this week. Amid GST regulations and other legal challenges, MPL-funded gaming platform Striker shutting down its operations.

Visit TheKredible to see series wise deals and amount breakup, and more insights.

[New launches]

▪ The Karnataka govt to launch a ride-hailing app by Feb 2024

▪ CoinSwitch launches PeepalCo to foray into wealth tech

▪ boAt to launch smartwatch with eSIM connectivity, partners with Jio

▪ Ola’s Bhavish Aggarwal officially launches AI startup Krutrim

[Financial results this week]

▪️ Mensa closed FY23 with Rs 1,317 Cr revenue and Rs 329 Cr loss

▪️ ShopKirana’s gross revenue nears Rs 700 Cr in FY23, losses surge 34%

▪️ Purple Style Labs posts Rs 372 Cr revenue in FY23, cuts losses

▪️ Niyo’s revenue surges 2.8X to Rs 131 Cr in FY23

▪️ Starbucks India revenue goes past Rs 1,000 Cr in FY23

▪️ Pepperfry struggles to scale in FY23 but reduces losses

[News flash this week]

▪️ Juspay got an in-principle nod from RBI for payment aggregator

▪️ Omidyar Network to wind up from India, stop making new investments

▪️ FreshBus is reportedly in talks to raise Rs 100 Cr funds

[Entrackr’s analysis]

The weekly funding crossed the $500 million threshold this week with an over four fold jump as compared to $130 million raised during the previous week. Notably, the Indian startup ecosystem has crossed $500 million in weekly funding for the first time in the last quarter of the ongoing calendar year.

Having invested in over 70 startups in India with $673 million assets under management, Omidyar Network India is shutting down operations in India. The entity will no longer make new investments and plans to phase out from the market by the end of the next year. The layoffs in The Third Wave Coffee was the second surprise of the week as the Bengaluru-based startup fired more than 100 employees soon after raising a $35 million round.