SaaS-based B2B fintech firm Perfios raised $229 million in its Series D round led by private equity firm Kedaara Capital through a combination of primary and secondary sales this year. Kedaara’s strong conviction on the prospects of the company has probably been influenced in part by Perfios’ remarkable growth in FY23.

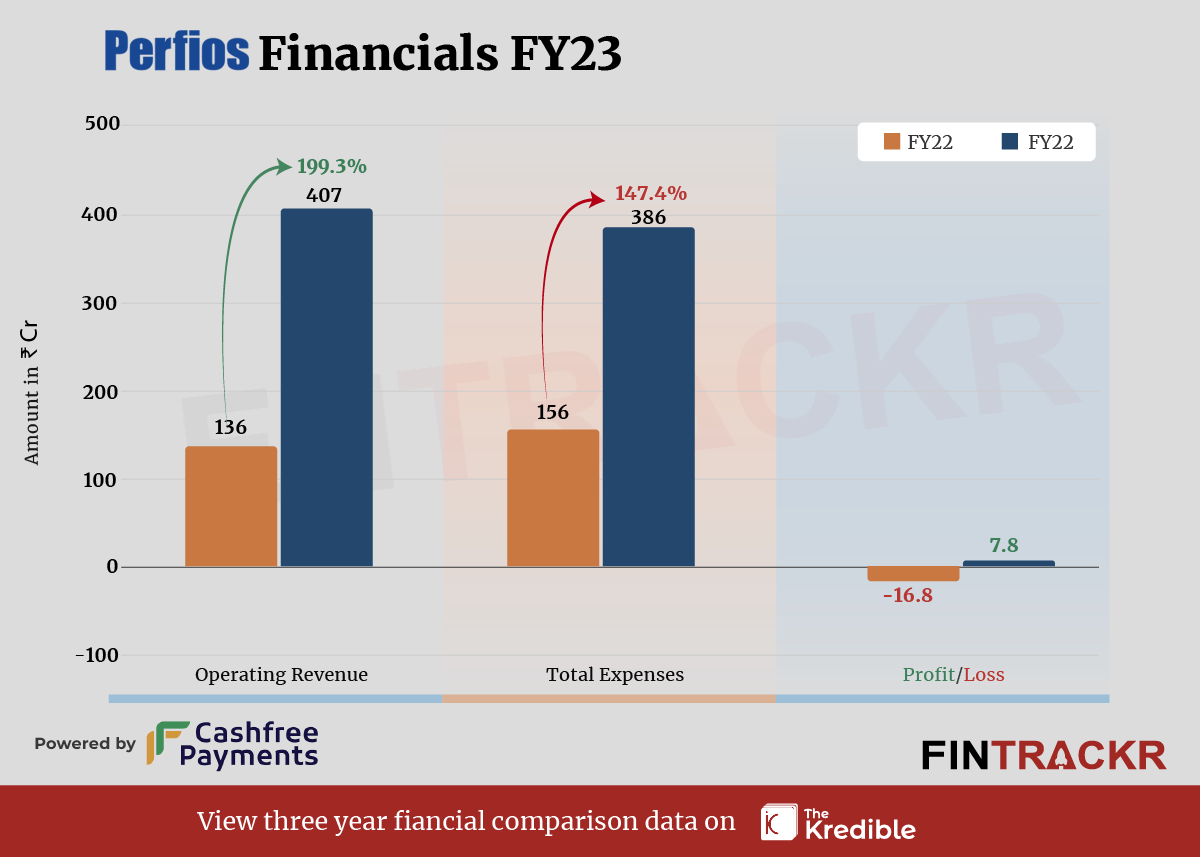

Perfios’ revenue from operations spiked three-fold to Rs 407 crore in the fiscal year ending March 2023 from Rs 136 crore in FY22, according to its consolidated financial statements filed with the Registrar of Companies.

Perfios provides a comprehensive suite of services for financial institutions, encompassing income analysis, fraud checks, verification, and automated customer onboarding. These services cater to various sectors such as consumer lending, SME lending, wealth management, and more.

Revenue Breakdown

https://thekredible.com/company/perfios/financials

View Full Data

Income from software support for loan processing formed 49% of the total operating revenue which increased 91.3% to Rs 199 crore in FY23. Income from service and software coding & maintenance were other sources of collection for the company. See Thekredible for a detailed revenue breakdown.

According to its website, the firm claims to have over 3 billion transactions categorized per month with 400 data formats and 850 plus data sources. It has 1,200 clients across 18 countries.

On the expenses side, mirroring other SaaS companies, employee benefits accounted for 55% of the total expenditure which grew 2.1X to Rs 214 crore in FY23. Its legal, professional fees, advertising, finance costs, and other overheads pushed the overall expenditure by 2.47X to Rs 386 crore in FY23 from Rs 156 crore in FY22.

Expense Breakdown

https://thekredible.com/company/perfios/financials

View Full Data

https://thekredible.com/company/perfios/financials

View Full Data

- Employee benefit expense

- Legal professional charges

- Advertising promotional expenses

- Finance costs and depreciation

- Others

Check TheKredible for the detailed expense breakup.

The three-fold growth helped the company to turn into the black and Perfios registered profits of Rs 7.8 crore in FY23 as compared to a loss of Rs 16.8 crore in FY22. Its ROCE and EBITDA margins improved to 5% and 17% respectively. On a unit level, it spent Rs 0.95 to earn a rupee in the last fiscal year (FY23).

Ahead of FY23, Perfios acquired fintech startup Karza Technologies and the Rs 600 crore acquisition seems to have paid off. Karza alone registered Rs 168 crore in revenue and Rs 51 crore profit after tax in FY23 and has helped Perfios book profit on a consolidated basis in the last fiscal year.

FY22-FY23

| FY22 | FY23 |

| Expense/Rupee of ops revenue | ₹1.15 | ₹0.95 |

| ROCE | -2% | 5% |

| EBITDA Margin | -4% | 17% |

Perfios recently said that it is preparing for initial public offering (IPO) and targets listing in the next 18-24 months. The firm also announced two key hirings including Sumit Nigam to the post of chief technology officer (CTO) and Anu Mathew who will be chief people officer (CPO) as a part of its IPO plan.