Tourism and hospitality was one of the worst affected sectors hit by COVID 19 in the past couple of years. The fall in tourism directly impacted all travel booking platforms such as ixigo, MakeMyTrip and its subsidiary Goibibo. However, the industry is bouncing back from the impact of the pandemic which can be seen from the financial performance of one of these players: ixigo.

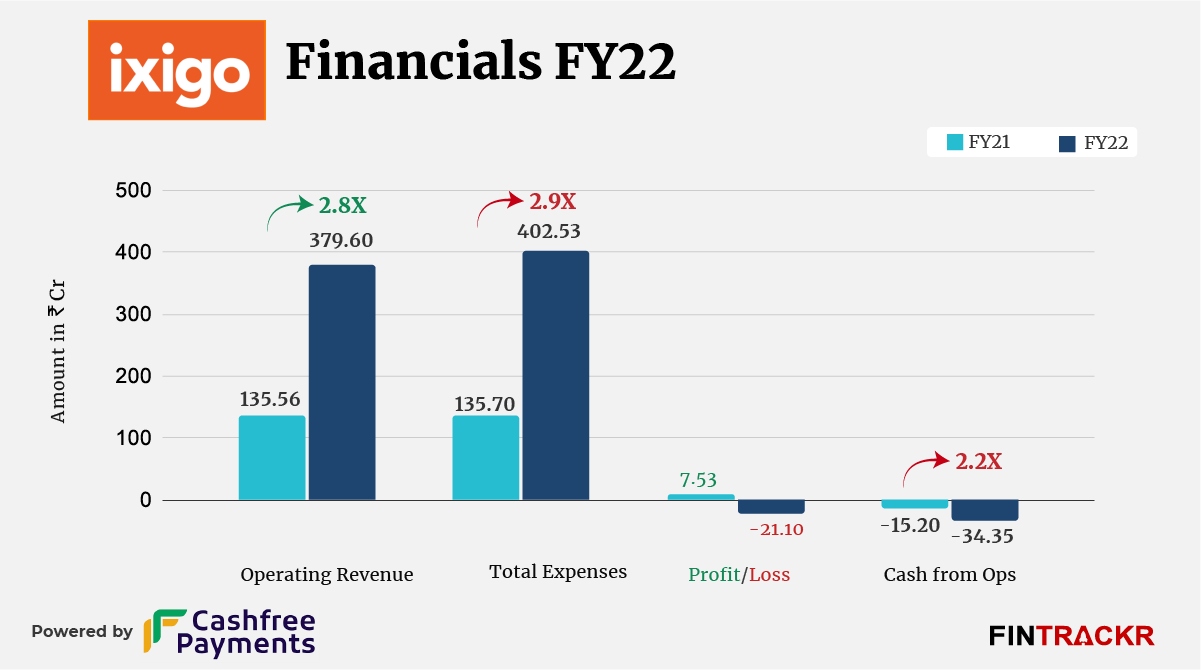

Gurugram-based travel booking app ixigo’s revenue grew 2.8X to Rs 379.6 crore in FY22 from Rs 135.56 crore in previous year (FY21), as per the company’s annual financial statement published on its website.

It’s worth mentioning that Confirmtkt (a wholly owned subsidiary) contributed with Rs 128.2 crore revenue or more than 33% of the ixigo balance sheet. This is almost equal to ixigo’s entire revenue in FY21. Venture Catalysts-backed Confirmtkt was acquired by ixigo in February 2021 in a cash and stock deal. The Bengaluru-based startup, which is an official partner of IRCTC, was profitable before being acquired by ixigo.

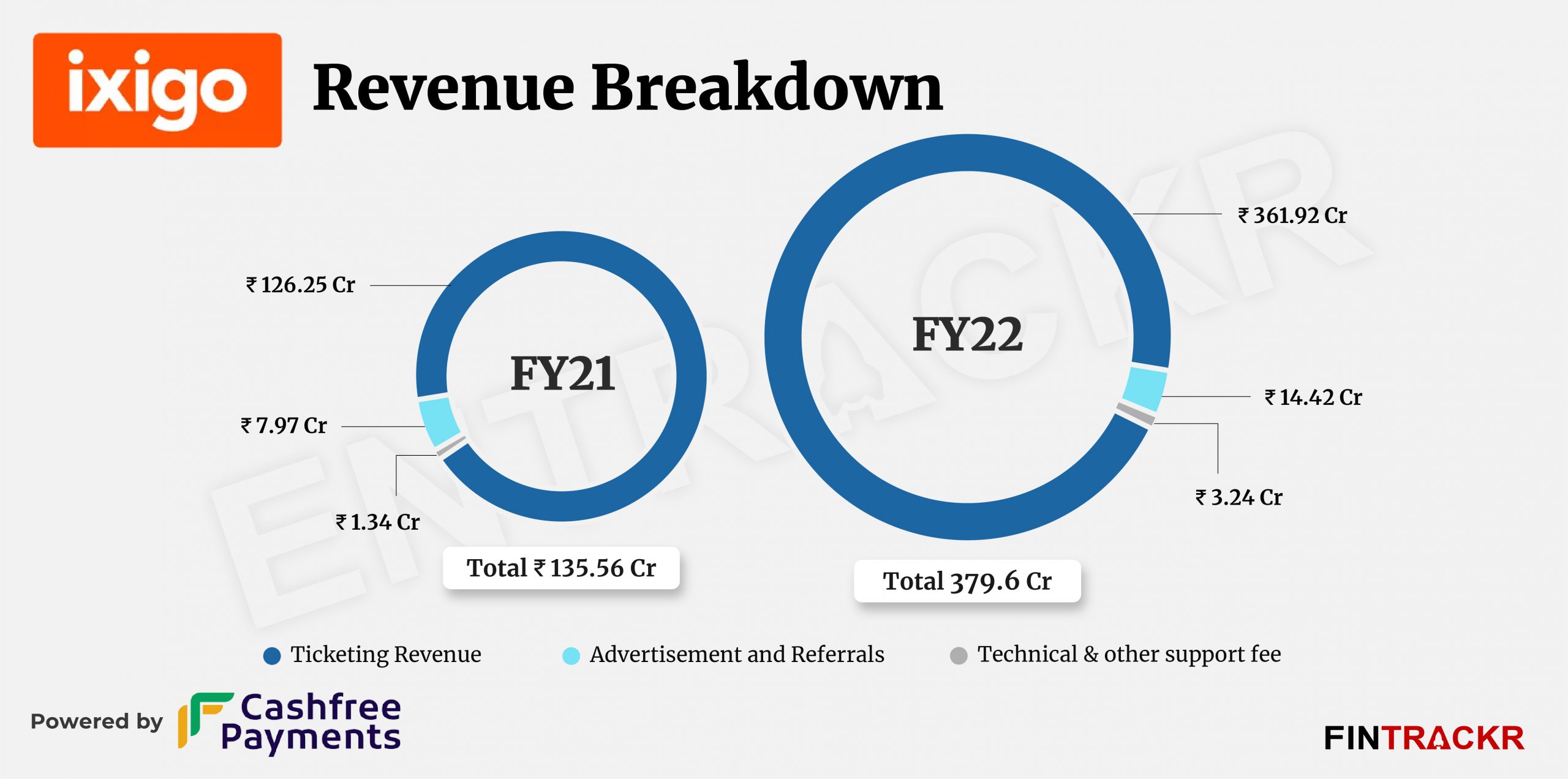

Ticketing income was the major source of revenue for ixigo constituting 95.3% of the total operating revenue which surged 2.9X to Rs 361.92 crore in FY22 from Rs 126.25 crore in the previous fiscal year (FY21). Collection from advertisements and referrals grew 81% to Rs 14.42 crore in FY22 from Rs 7.97 crore in FY21.

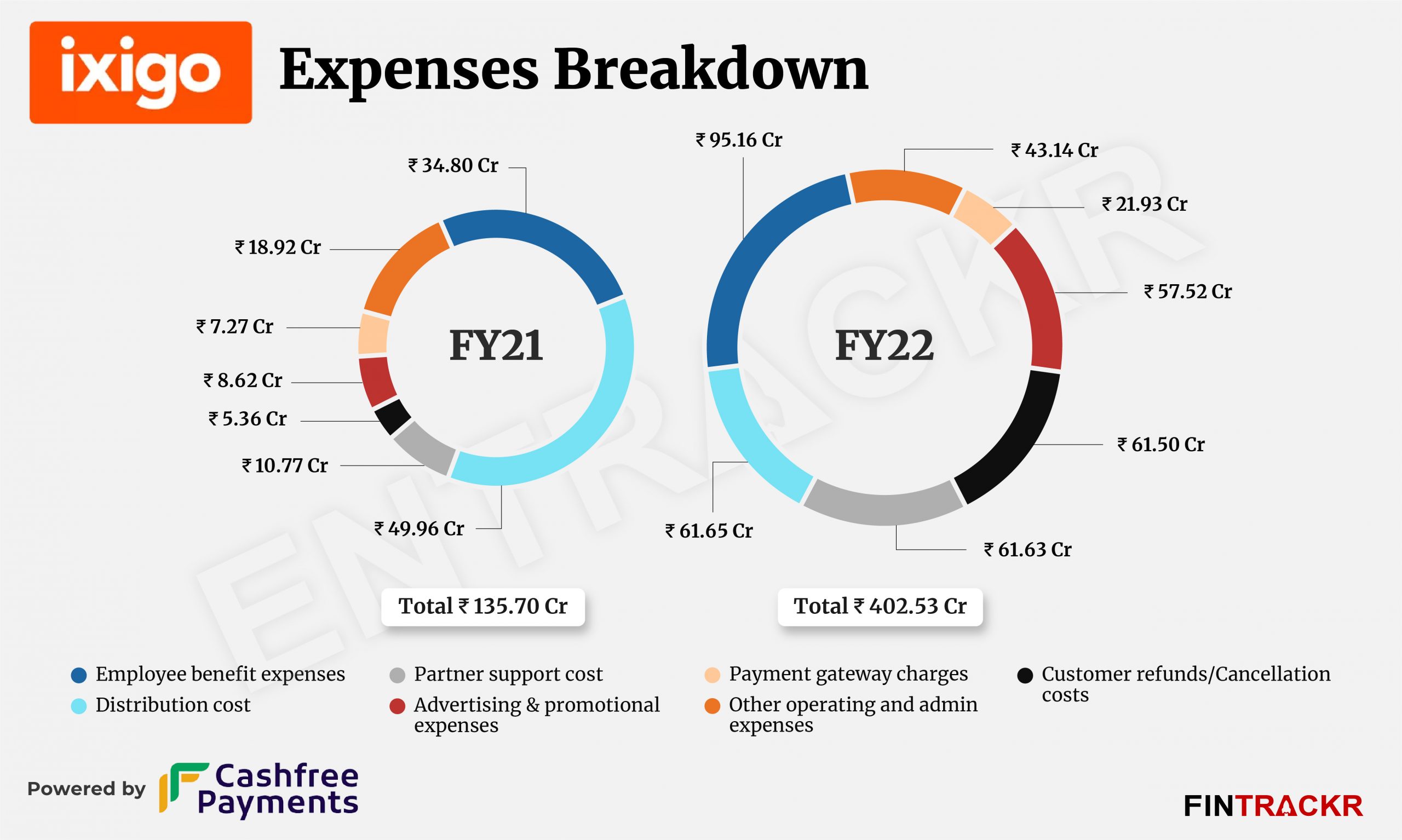

Moving to the cost sheet, employee benefit expenses were the biggest cost center for Ixigo constituting 23.6% of the total cost which surged 2.73X to Rs 95.16 crore in FY22 from Rs 34.80 crore in the previous year (FY21). This cost also includes ESOP expenses of Rs 18.5 crore (which was a non-cash expenditure). The surge in this cost was largely driven by the acquisition of Confirmtkt and Abhibus which increased ixigo’s workforce significantly.

As the number of bookings and ticketing volume increased, distribution and partner support costs soared 23.4% and 472% respectively to Rs 61.6 crore each. The company also launched a free cancellation product – ixigo Assured – for the flight tickets business in August 2021, resulting in customer refunds/cancellations cost increasing 11X to Rs 61.50 crore in FY22 from Rs 5.36 crore in FY21.

Advertisement and promotion costs also soared 6.7X to Rs 57.5 crore in FY22. The Company spent another Rs 21.93 crore on payment gateway charges pushing the overall cost to Rs 402.5 crore in FY22 as compared to Rs 135.7 crore in FY21.

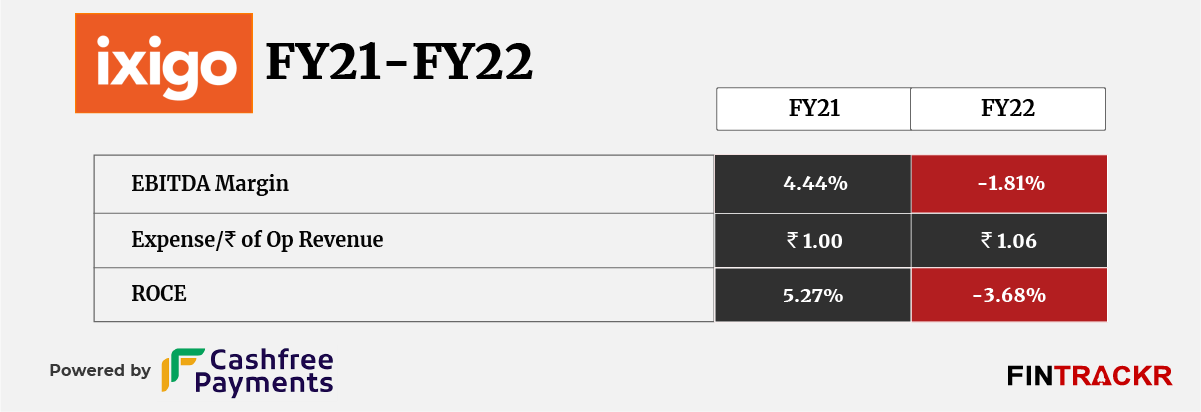

The steep rise in employee benefits and advertising costs dragged the company into losses which were recorded at Rs 21.10 crore in FY22. The company had booked a profit of Rs 7.53 crore in FY21.

With a 2.9X surge in the cost, the operating cash outflow of the company increased 2.2X to Rs 34.35 crore in FY22 from Rs 15.20 crore in FY21. On a unit level, ixigo spent Rs 1.06 to earn a single unit of operating revenue during the last fiscal year.

ixigo is among the few tech startups which managed to book profits before filing papers to go public. In August 2021, the Aloke Bajpai-led company filed its draft red herring prospectus (DRHP) with SEBI to raise Rs 1,600 crore through an initial public offering (IPO). EaseMyTrip, another travel tech company which went public in March last year, also posted a profit of Rs 61 crore in FY21.

While ixigo has received approval from the market regulator, the company is likely to wait for the right market conditions to hit the bourses now.