Flexible workspace provider IndiQube has continued its growth with a notable financial performance during the fiscal year ending March 2023. The firm recorded a 69% growth in its scale accompanied by a positive bottom line.

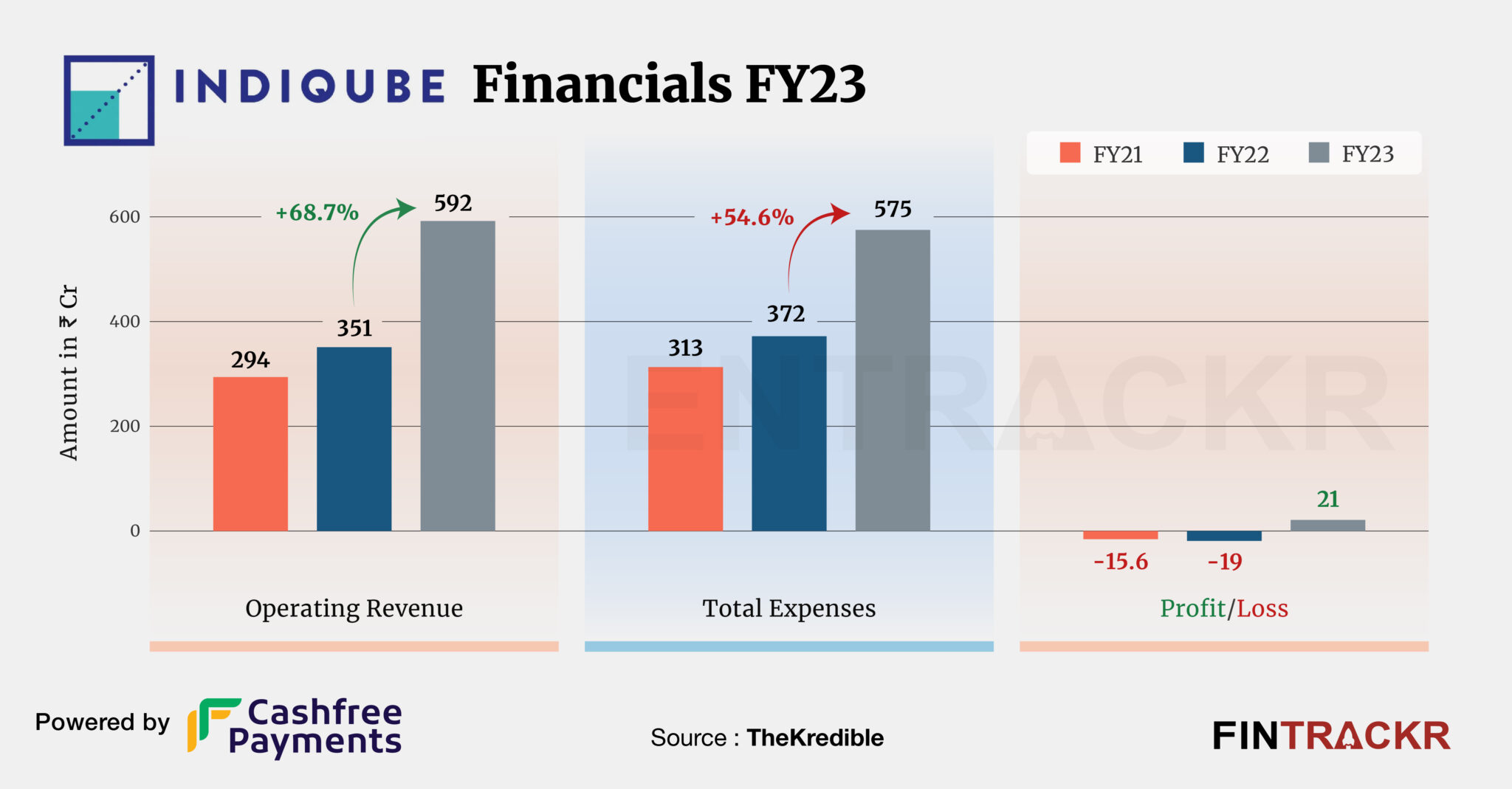

WestBridge-backed IndiQube’s revenue from operations spiked to Rs 592 crore in FY23 from Rs 351 crore in FY22, according to its consolidated financial statements filed with the Registrar of Companies (RoC).

IndiQube provides workspaces to startups, offshore development centers, and large enterprises across India. The rental income received from the companies accounted for 80% of the total collections. This collection grew 70% to Rs 474 crore in FY23 from Rs 279 crore in FY22.

The rest of the income came from electricity, maintenance, and other allied services for IndiQube. Check TheKredible for the detailed revenue breakup.

Revenue Breakdown

https://thekredible.com/company/indiqube/financials

View Full Data

Being a workspace solution provider, the cost of rent and lease formed 49% of the overall expenditure. This cost surged by 54.1% to Rs 282 crore in FY23 from Rs 183 crore in FY22.

Its employee benefits, power-electricity, repair-maintenance of buildings and offices, brokerage, and other overheads pushed IndiQube’s overall expenditure by 54.6% to Rs 575 crore in FY23 from Rs 372 crore in FY22.

Check TheKredible for the detailed expense breakdown.

Expenses Breakdown

https://thekredible.com/company/indiqube/financials

View Full Data

https://thekredible.com/company/indiqube/financials

View Full Data

- Employee benefit expense

- Purchase of goods

- Rent and lease

- Power and fuel

- Repair and maintenance

- Brokerage expenses

- Others

The noteworthy growth and controlled expenditure helped IndiQube to turn itself green. The company recorded Rs 21 crore profits in FY23 as compared to Rs 19 crore loss in FY22. Its ROCE and EBITDA improved to 6% and 15% respectively. On a unit level, it spent Rs 0.97 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | 12% | 15% |

| Expense/₹ of Op Revenue | ₹1.06 | ₹0.97 |

| ROCE | 1% | 6% |

The Bengaluru-based startup has secured $45 million across rounds and was valued at $145 million. According to the data intelligence platform Thekredible, Westbridge is the largest external stakeholder with 31.22%. Its co-founders Rishi Das and Meghna Agarwal command 31.2% of the company.

Head to TheKredible for complete captable.

Indian coworking spaces have generally demonstrated a better financial performance than their global counterparts, notably WeWork. Even WeWork India, thanks to its management by an Indian partner has managed to escape the worst of WeWork’s shenanigans. IndiQube is another emerging success story in the sector, with a long potential runaway ahead, even as it only gets better at managing costs well, perhaps the most important aspect of running a workspace in India. Paired with the founders experience in the HR space, IndiQube has demonstrated a disciplined approach to the tough business that has delivered for it.