This week, 25 Indian startups raised about $201 million in funding. Following this, weekly funding again witnessed a drop of over 12% as compared to the previous week.

The 25 deals comprised four growth stage deals grabbing $131.75 million, 19 early stage deals contributing $68.9 million meanwhile the details of two startup funding remained undisclosed.

Last week, 26 startups cumulatively raised around $229 million while the seven funding deals remained undisclosed.

[Growth-stage deals]

During the week, three growth-stage startups raised funding. Logistics company XpressBees led the pack with $80 million funding followed by the newest unicorn Zepto which raised $31.25 million in an extended funding round.

Three-wheeler electric vehicle manufacturer Euler Motors and automobile car service and repair firm GoMechanic secured $14.5 million and $6 million, respectively.

[Early-stage deals]

In early-stage deals, tech platform for co-lending in affordable housing, Bharat Housing Network bagged $14.5 million in Series A followed by 3D designing startup Snaptrude with $14 million fundraise.

Other firms in the list include Sequretek, Hearzap, Stackr Labs, Vaaree, and Bimaplan among others.

Besides this, the details of two funding deals remained undisclosed including ready-to-drink cocktails brand O’Be Cocktails’s pre-Series A round and two wheeler rental startup Royal Brothers’ seed funding. For more information, visit TheKredible.

[City and segment-wise deals]

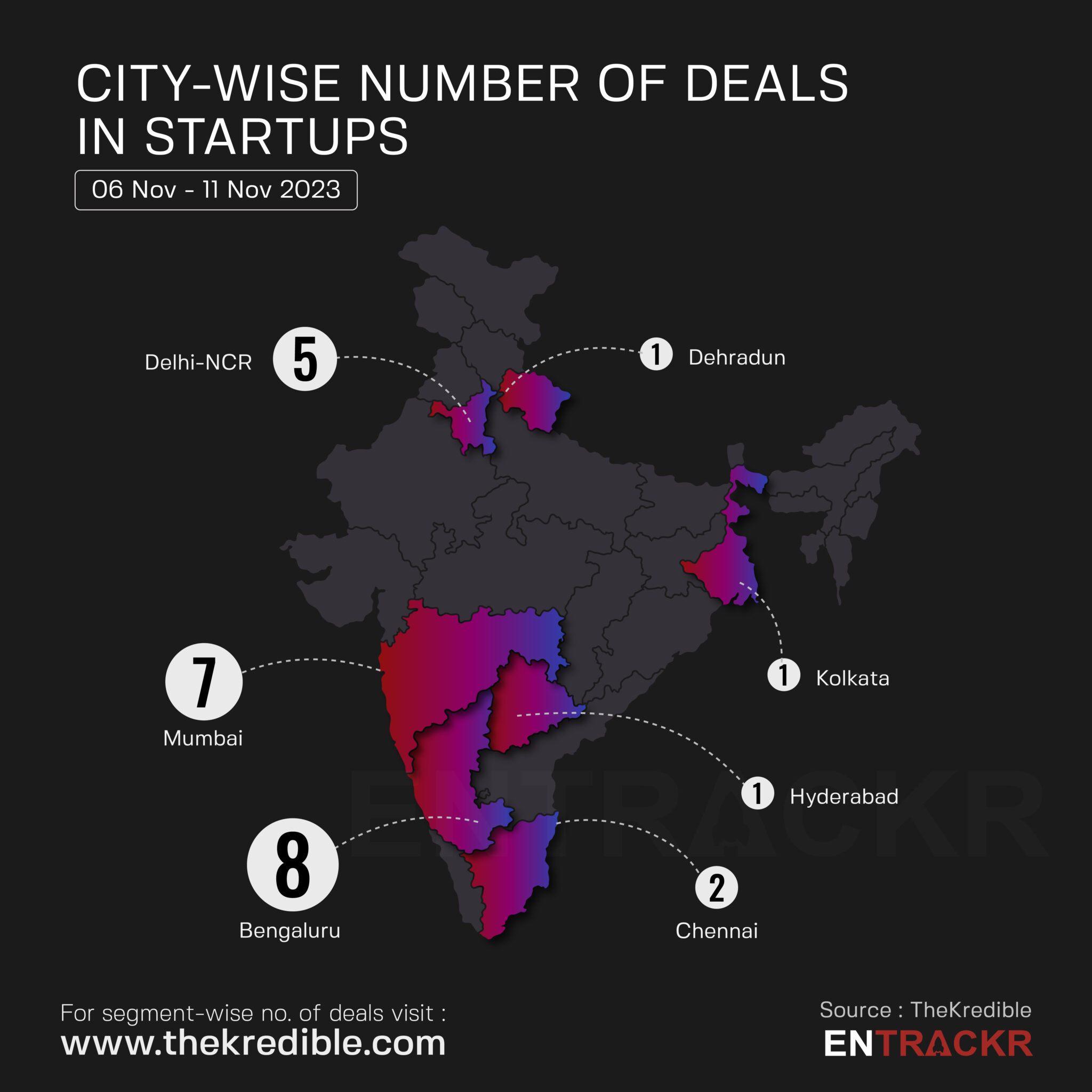

Bengaluru-based startups again regained the top spot in terms of number of funding deals with eight deals while Delhi-NCR-based startups remained on top in terms of the amount raised. As per TheKredible, Mumbai, Delhi-NCR, and Chennai were next on the list with 7, 5 and 2 deals, respectively. Further, Hyderabad, Kolkata and Dehradun-based startups remained in the tail with one deal each.

The complete breakdown of the city and segment can be found at TheKredible.

[Series wise deals]

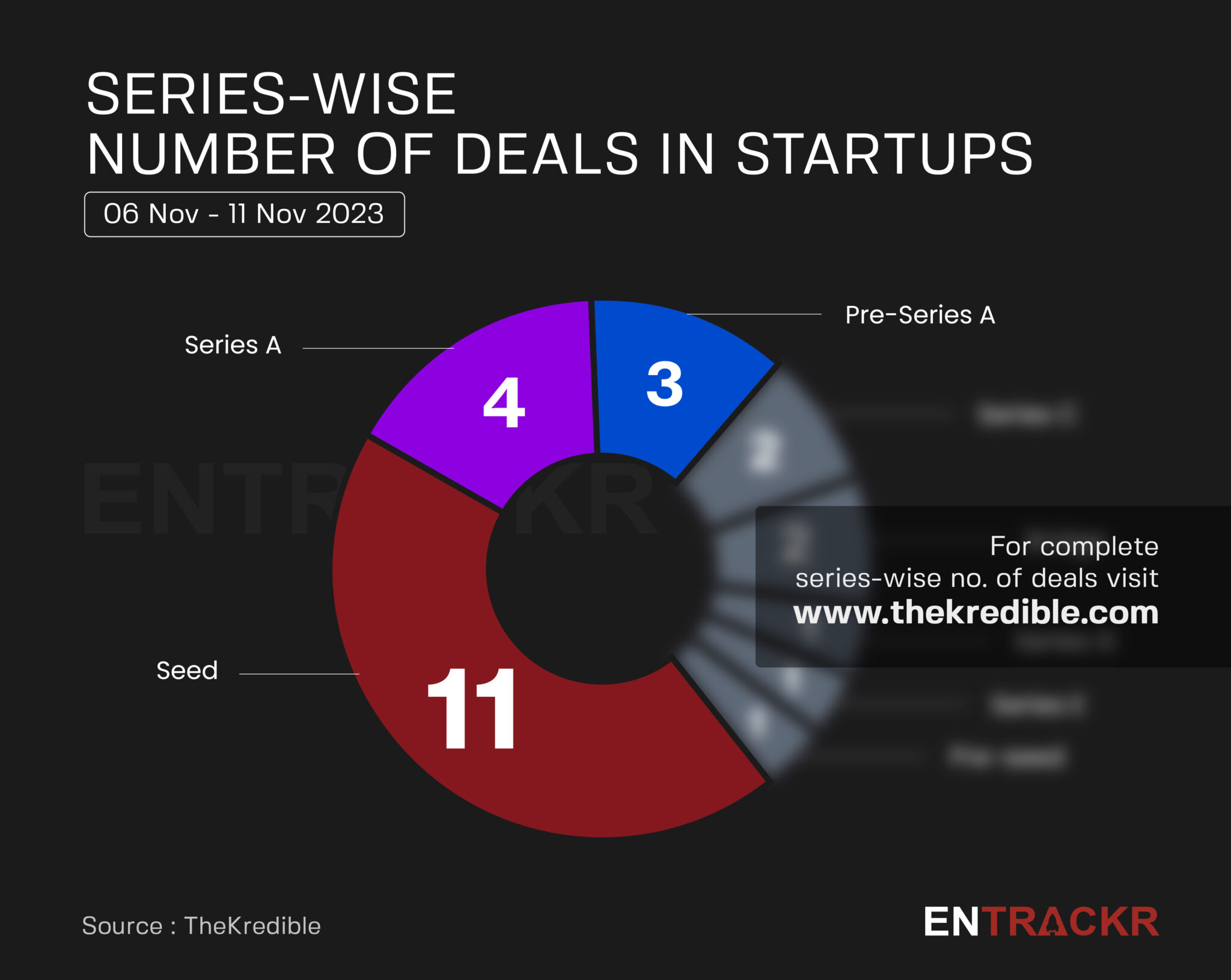

Seed stage startups again dominated the chart with 11 deals followed by 4 deals by Series A stage startups. Further, the list counts pre-Series A, Series C, Bridge, Series G, Series E and pre-seed funding deals.

[Week-on-week funding trend]

On a weekly basis, funding continued to shrink by over 12% to $201 million. Last week, the weekly funding slipped over 30% to $229.3 million. Subsequently, the average funding in the last eight weeks stands close to $218 million with a deal size of 22 per week.

[M&A]

During the week, Zerodha’s founder backed Game Theory acquired deeptech startup Matchday.ai. Mediatech unicorn Amagi also signed an agreement to acquire the business of Tellyo, a UK-based social media platform.

Visit TheKredible to see layoffs, shutdowns, series wise deals and amount breakup, and more insights.

[New launches]

[Financial results this week]

[News flash this week]

[Entrackr’s analysis]

For the first time in the past few months, weekly startup funding dropped consecutively for two weeks, impacting the recent trend towards stability. Meanwhile, MamaEarth, despite listing on the stock exchange with a 2% premium, faced a over 10% drop the next day. However, it managed to regain momentum, closing the week at Rs 317.9. Additionally, Travel Boutique Online (TBO) filed the DRHP with SEBI to raise Rs 400 crore through a fresh issue.

GoMechanic grabbed the headlines as the Gurugram-based startup raised a new tranche at a valuation of $20 million. The firm was valued at $325 million before getting acquired by Lifelong Group.