MSMEs-focused fintech lending platform FlexiLoans secured $90 million in its Series B round through an equity and debt mix during FY23 which helped the company to register a two-fold scale during the fiscal year ending March 2023.

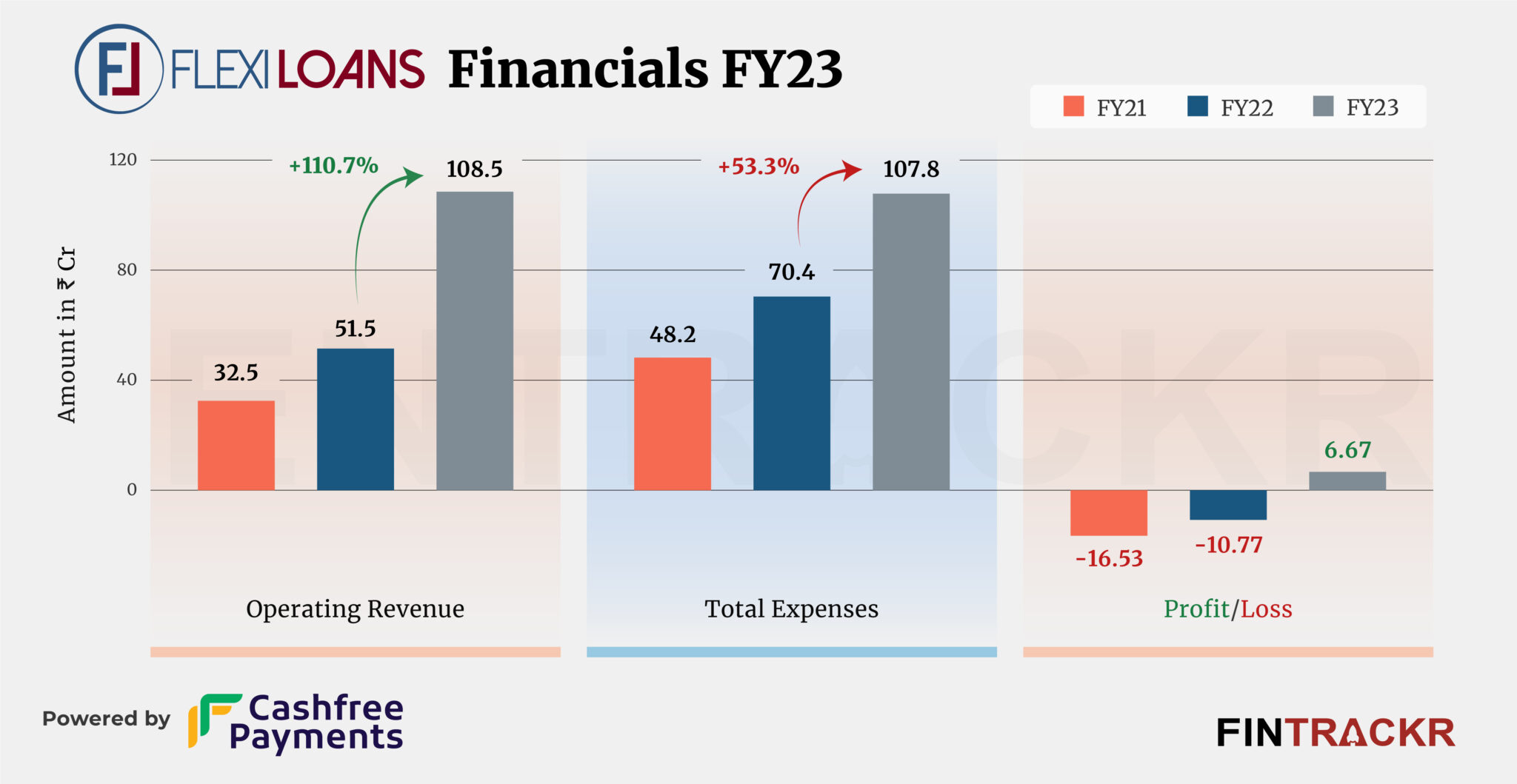

Flexiloan’s operating revenue grew 2.1X to Rs 108.5 crore during FY23 from Rs 51.5 crore in FY22, according to its annual financial statements filed with the Registrar of Companies.

FlexiLoans provides MSMEs access to collateral-free funds through its digital lending platform. The company uses proprietary technology and risk models to appraise customers and approve loans within 48 hours.

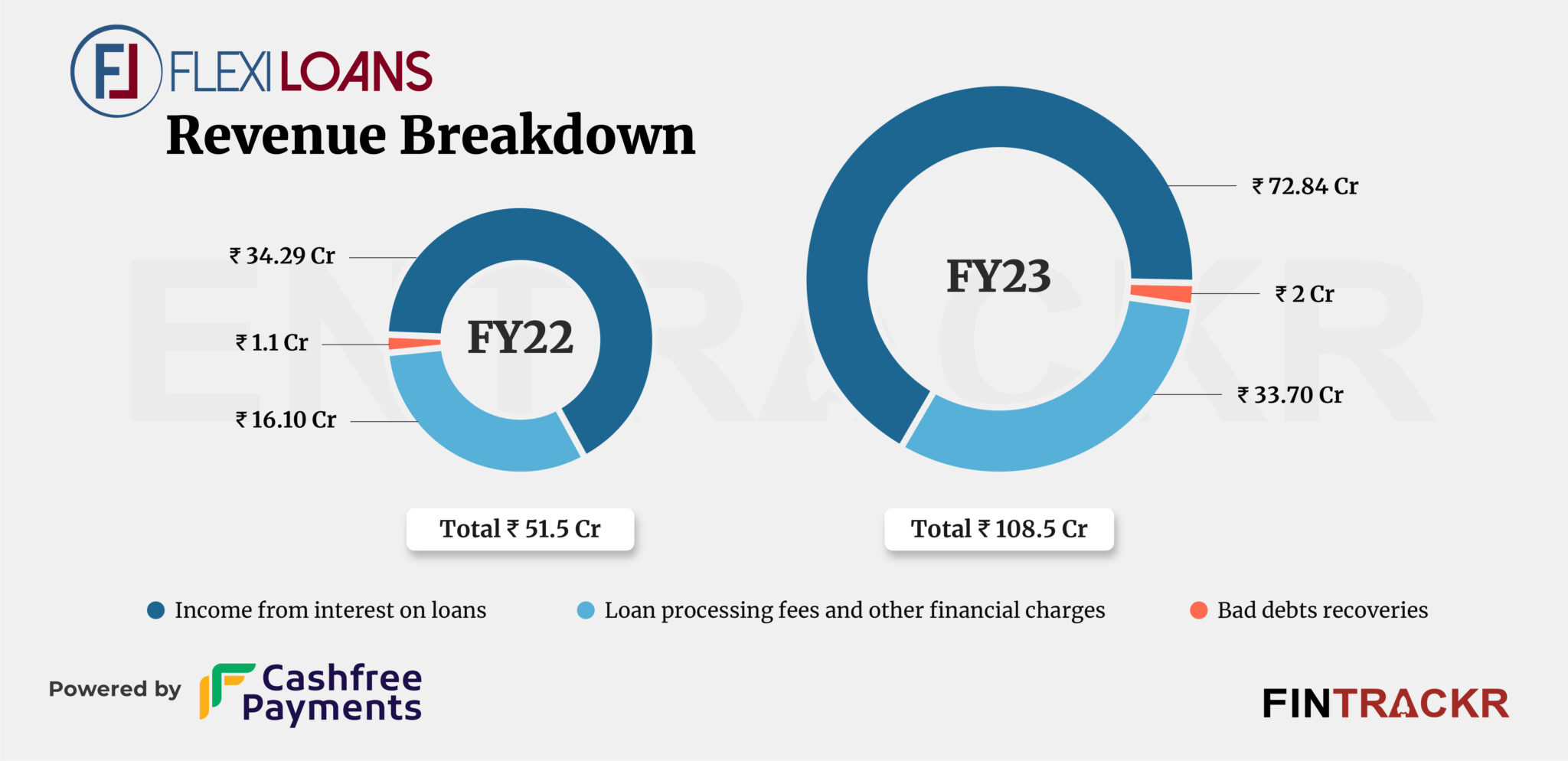

Being a loan disbursal company, income from interest on loans formed 67.1% of the overall collections which grew 2.1X to Rs 72.84 crore in FY23. The company also earned Rs 33.7 crore and Rs 2 crore from loan processing fees and bad debt recoveries during the previous fiscal year.

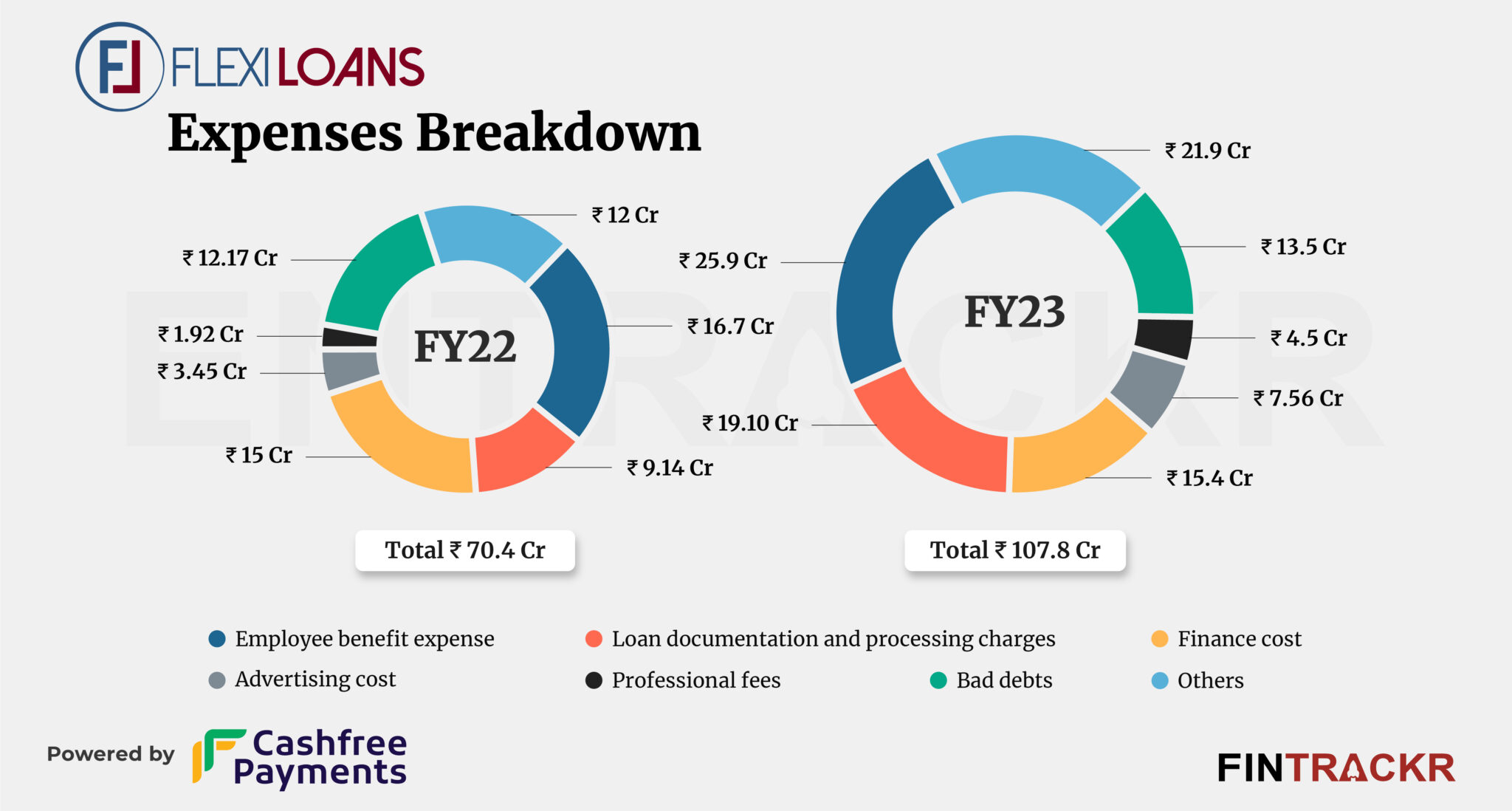

On the cost side, employee benefits accounted for 24% of the overall expenditure. This cost soared by 55.1% to Rs 25.9 crore in FY23. Its loan documentation cost and finance cost increased by 109% and 2.7% to Rs 19.1 crore and Rs 15.4 crore respectively during FY23.

FlexiLoan incurred another Rs 7.56 crore and Rs 4.5 crore towards advertisement and professional fees, pushing its overall cost by 53.3% to Rs 107.8 crore in FY23 from Rs 70.4 crore in FY22.

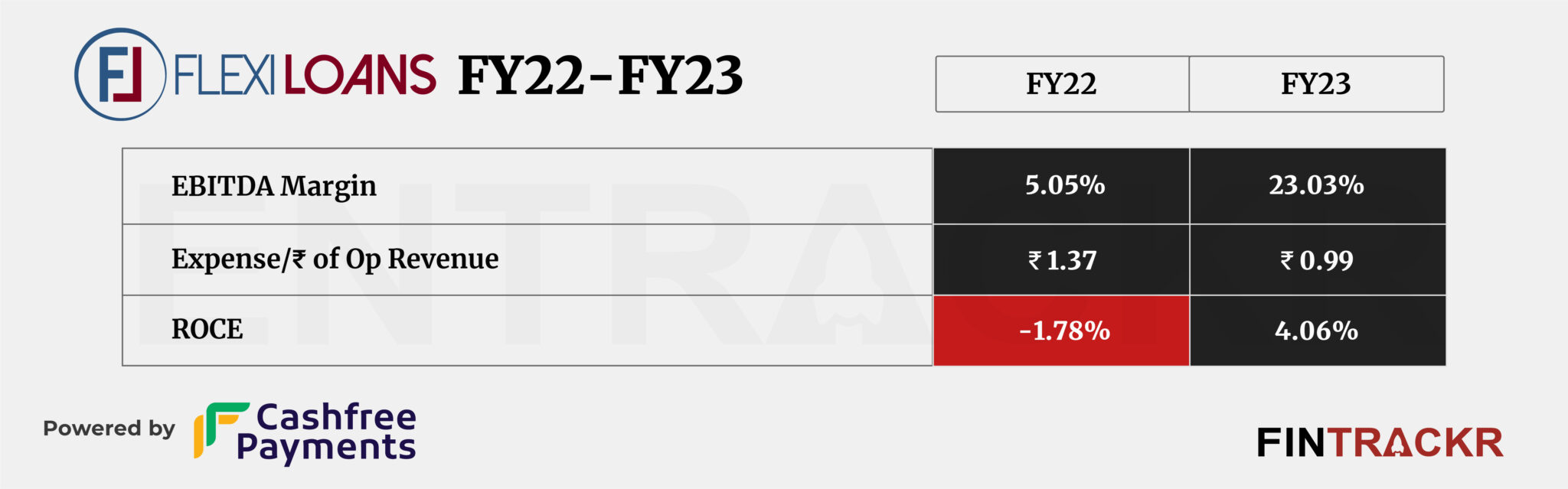

The significant surge in scale and prudent cost management helped FlexiLoan to register its first-ever profit during FY23. The company reported Rs 6.67 crore profits during FY23 where the figures stood at a loss of Rs 10.77 crore during FY22. Its ROCE and EBITDA registered at 4.06% and 22.03% during FY23. On a unit level, it spent Rs 0.99 to earn a unit of operating revenue.

As a lending firm, growth in finance costs has been tamped to an extent by the fresh equity raise but is likely to rear up as a larger item in the current financial year. That could mean a return back to losses, or if things have gone really well on the disbursement and collection front, a slight growth in profits. Like any good lending firm, employee costs should grow much more slowly as compared to overall growth, after the initial higher costs towards establishing systems and processes for high volumes. From all indications, these might have some more room for growth at a base, employee numbers level, before tapering off. In its competitive marketplace, that means the road to meaningful, sustainable profits remains a long, if predictable one for FlexiLoans, if all goes to plan.