Startup funding has dried up, and the monsoons have brought no revival yet. Here is the data to prove it. Once again in July, there was a lack of growth stage deals, no backing from large funds, ongoing layoffs and uncertainty looming over upcoming funding rounds that has created trouble for the entire startup ecosystem.

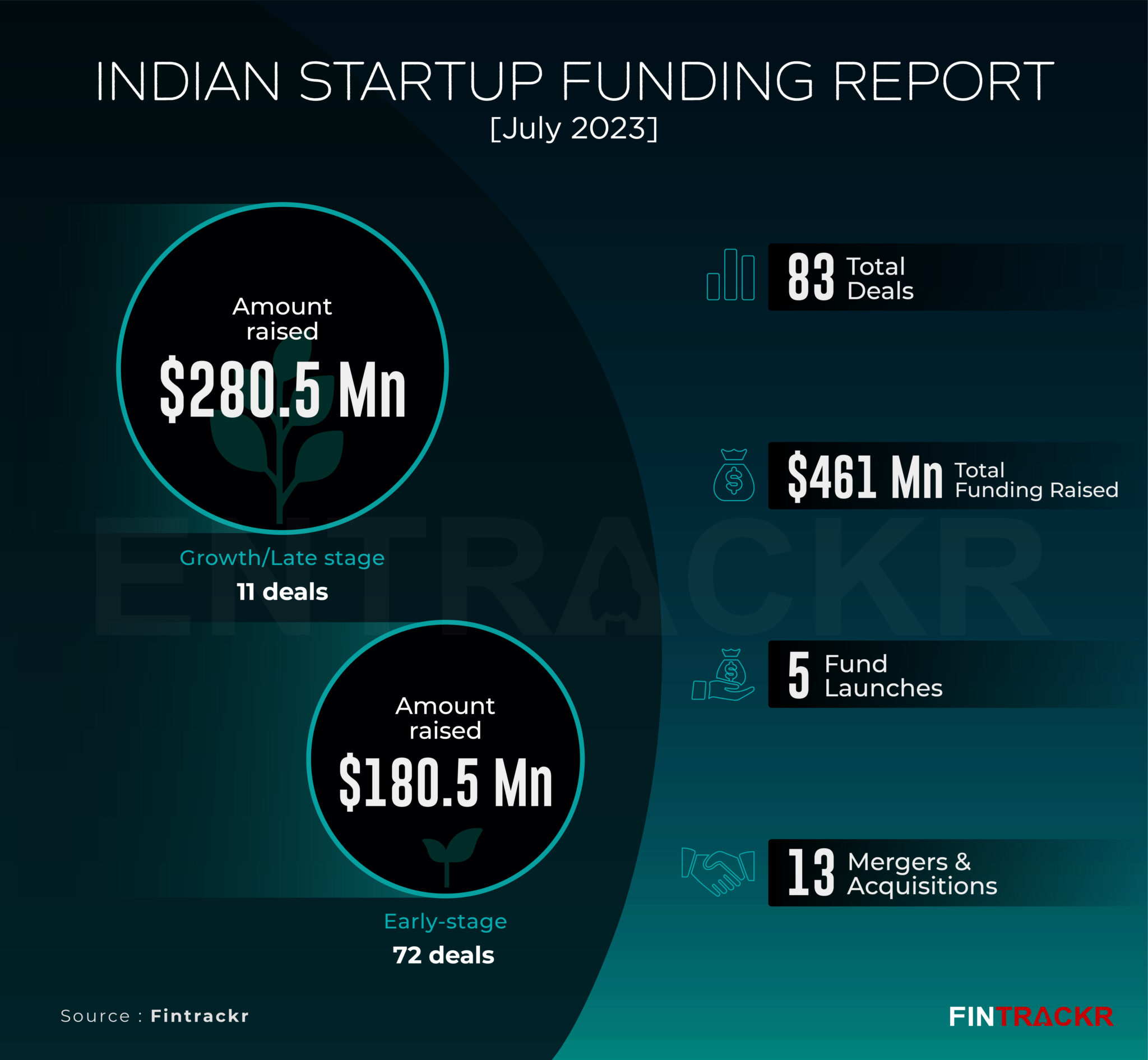

Data compiled by Fintrackr shows that more than 80 startups announced fresh fundraises worth around $461 million in July. This counts 11 growth stage deals worth $280.5 million and 72 early-stage startups raising over $180 million including 16 undisclosed deals. This is the lowest amount of fundraise on a monthly basis since January 2021 or in the past 30 months.

[Month-on-month and year-on-year trend]

While Indian startups managed to score around $1 billion on an average in the ongoing year, June saw a sharp dip with $636 million in funding. However, the number of startups participating in the fundraise in July was almost at par with June.

On a yearly basis, homegrown startups in July 2022 scooped up $869 million and a whopping $4.6 billion in July 2021. If we check the trend of startup funding in 2022, July was the lowest funded month.

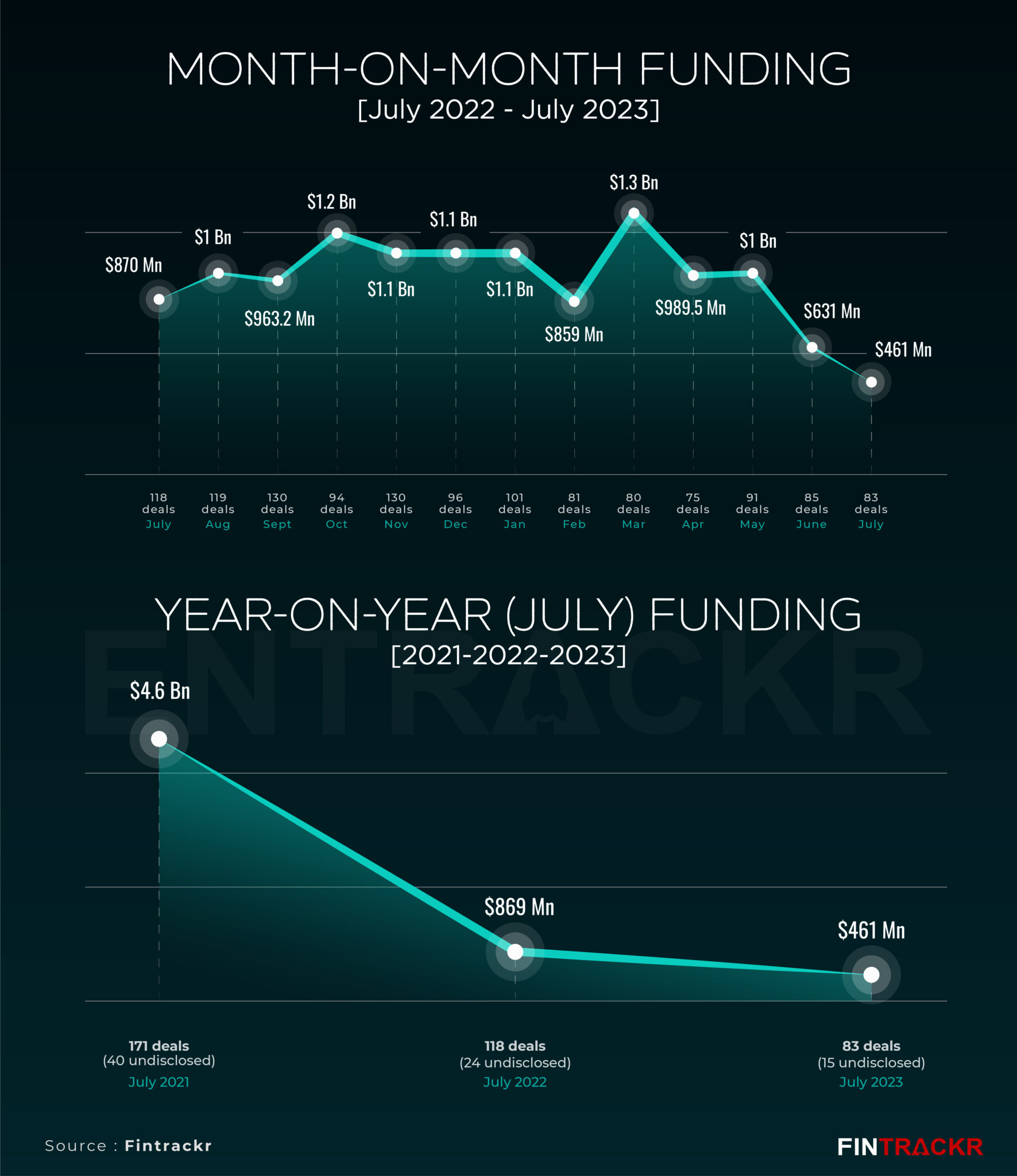

[Top 10 growth stage deals]

For the first time during this year, no growth stage startup managed to go past the $50 million funding mark. In the chart, insurtech company RenewBuy and edtech company LeverageEdu raised $40 million each and were in top position. Online furniture retailer Furlenco raised $36.5 million from Sleepwell-parent Sheela Foam as a part of the strategic deal that is nowhere close to its peak valuation.

D2C jewelry brand GIVA and battery swapping network Battery Smart were in the top five list whereas digital transformation consulting company KaarTech, trucking aggregator LetsTransport, High end computing solutions provider Netweb Technologies and Enterprise SaaS management platform Zluri made it to the top 10 list. Spacetech Pixxel and SaaS company Viniculum were two growth stage companies that did not disclose their transaction details. Like previous months, unicorns remained true to their name, with no sightings in July.

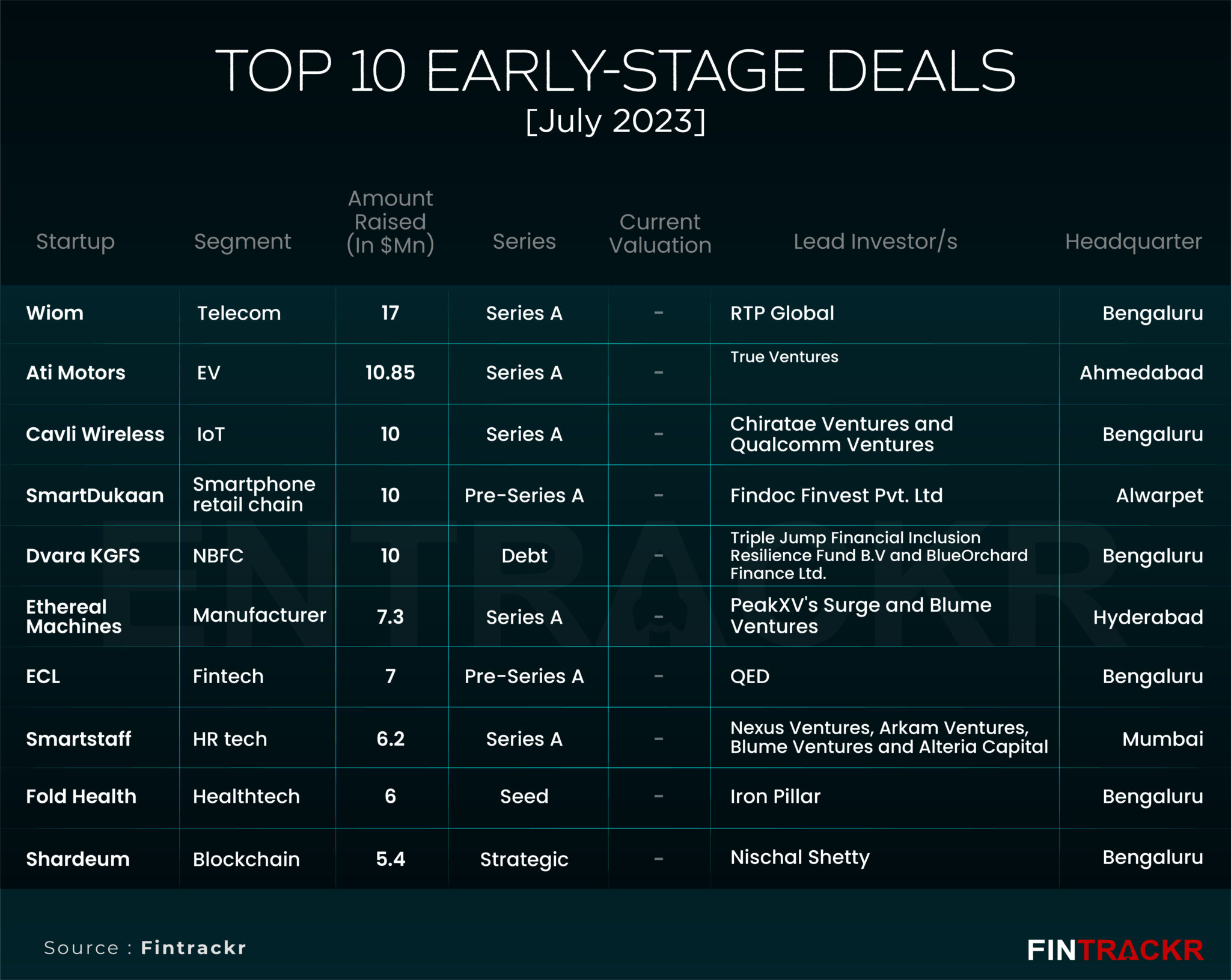

[Top 10 early stage deals]

The impact of low funding can also be seen in early stage deals where 56 startups raised around $180 million, averaging a $3 million check size. Telecom company WIOM topped the list with $17 million funding, followed by industrial robotics startup Ati Motors which raised $10.85 million. In the top five list, IoT startup Cavli Wireless, Smartphone retail chain Smart Dukaan and NBFC startup Dvara KGFS raised $10 million each.

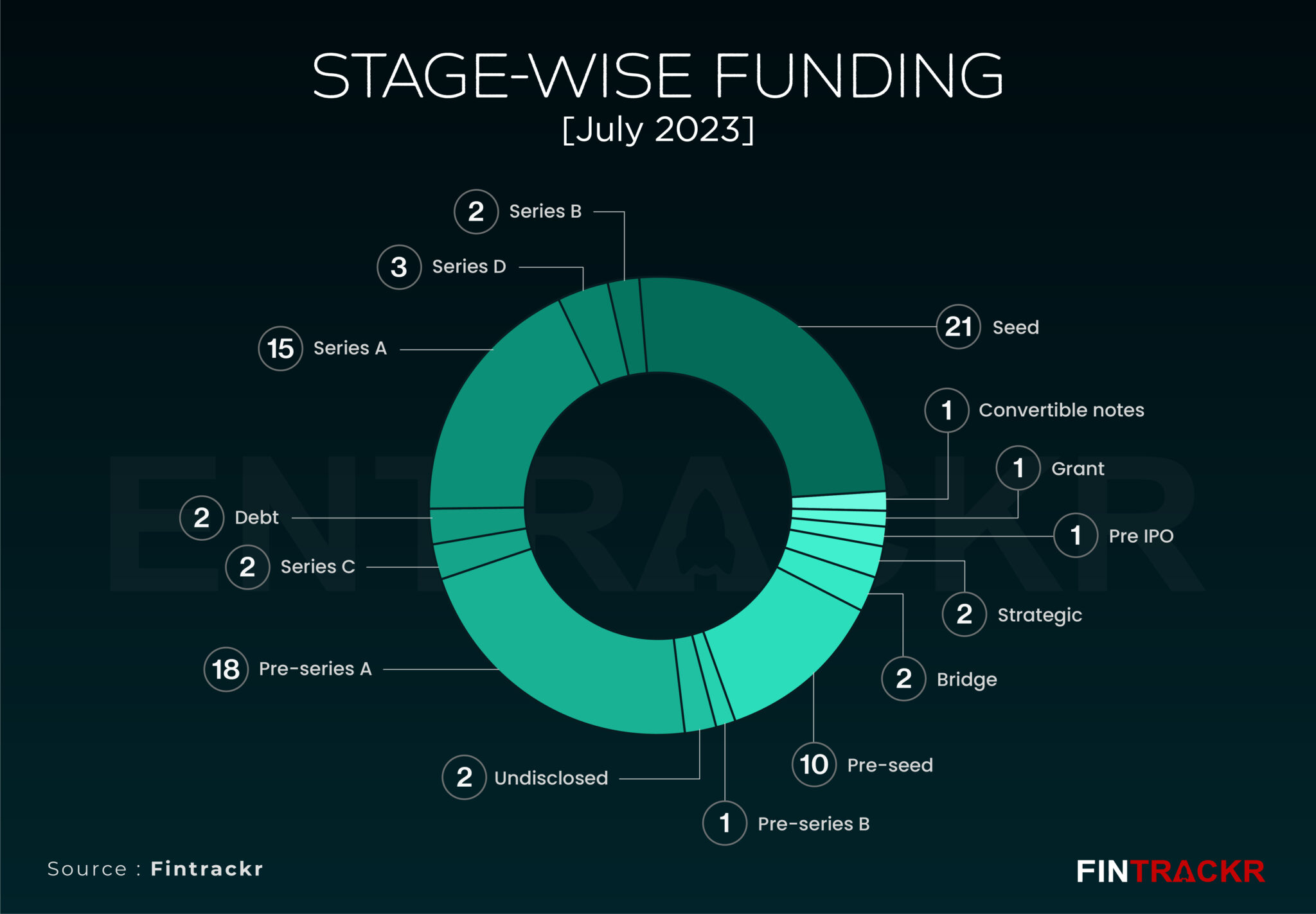

[Stage wise deals]

With 21 deals, seed stage startups were on top followed by pre-Series A, Series A and pre-Seed. In the growth stage, Series B, Series C and Series D saw 2, 3 and 2 deals respectively.

In terms of amount, Series A stage startups alone scooped up more than 19% of the total deal. Series B and Series D accounted for 15% and 11.5% of the total funding during the month respectively.

[City and segment]

Bengaluru, once again became hub of startups as 50 startups from the city scooped up nearly $270 million in funding in July. This is close to 58% of the total funding during the last month. Delhi-NCR-based startups were the next with 20 deals amounting to $140 million. Chennai, Mumbai, and Kerala were next on the list.

E-commerce dominated in terms of segment wise deals followed by SaaS, fintech, logistics and EV. Healthtech, edtech and security focused startups saw 3 deals each but remained out of the top five list. Value wise, e-commerce startups scooped up more than $95 million whereas SaaS and Fintech raised $86 million and $74 million respectively.

[Mergers and acquisitions]

In July, around a dozen startups got acquired or initiated the process of mergers and acquisitions. While most of the deals were undisclosed, a clutch of companies grabbed the headlines. Reliance Brands, a part of Reliance Retail Ventures, is reportedly acquiring Alia Bhatt’s kidswear brand Ed-a-Mamma at a valuation of around Rs 300-350 crore. Meanwhile, Swiggy has entered into a definitive agreement to acquire retail distribution company LYNK Logistics Limited.

In notable deals, automobile classifieds portal CarTrade announced that it will acquire OLX India’s auto and classifieds business in a deal worth Rs 537 crore.

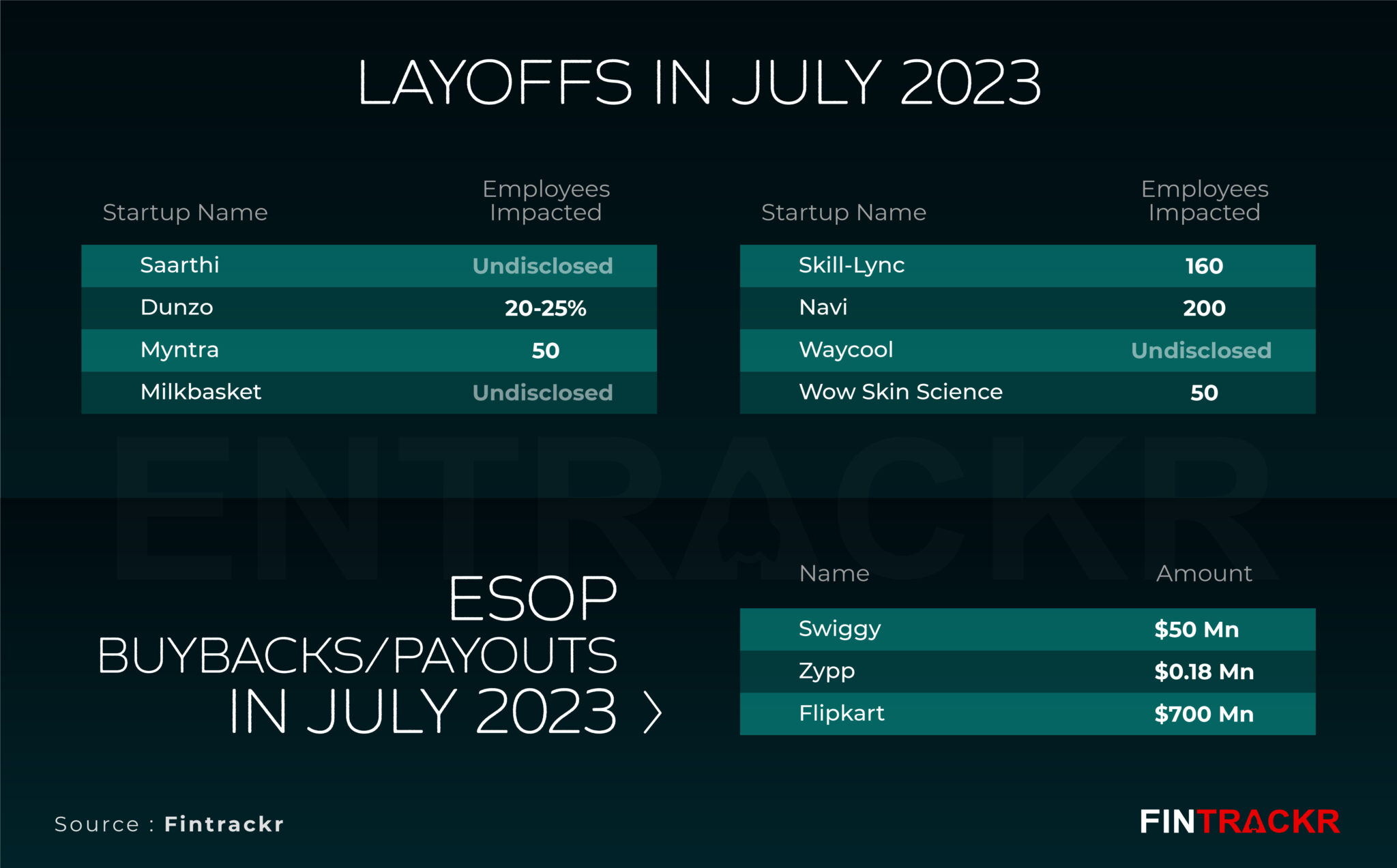

[Layoffs]

Mass layoffs have derailed all the future plans of startups where even established, well funded and profit making companies could not control the firing of employees. For instance, NAVI, an IPO-bound profitable company, fired 150-200 employees across tech, product and analytics among others. Milkbasket, which was acquired by Reliance Retail, also resorted to layoffs as it looks to revamp its business model. Dunzo, another Reliance-backed startup, saw mass layoffs in the past couple of months. The list counts Myntra, Waycool and Wow Skin Science.

[ESOP buyback]

Amid all the gloom and doom, a couple of positive developments happened in July too. For instance, Tiger Global and Accel completely exited e-commerce marketplace Flipkart and a bunch of startups announced ESOP buyback and payouts.

Walmart-owned Flipkart announced $700 million worth ESOP payout for its employees. Recently, foodtech major Swiggy also started rolling out the second tranche of its committed ESOP liquidity program worth $50 million. In 2023, data analytics company Tredence, edtech company Sunstone, logistics startup Porter, hygiene company Sirona, gaming company WinZo and EV startup Zypp Electric also announced their stock buyback plan. As per data compiled by Fintrackr, more than 80 startups have bought back ESOPs worth $1.5 billion since 2020.

[Conclusion]

Numbers don’t lie, and the numbers are unambiguously sending a message to the Indian startup ecosystem. It’s time to shape up or hunker down for what could be a long wait before the tide turns. With the overall economy going well enough, expect bargain hunting in the space from established firms to continue as the slowdown in the startup space gets extended. Even as VCs and other investors have aimed to line up funds worth upwards of $4.5 billion for the next phase of their plans, those funds will take at least 1-3 quarters before they come in, possibly with a new perspective on valuations. That explains the rush to layoffs people and extend runways by many startups. Expect more to follow. Corrections will follow not just in valuations, but in salaries, ESOPs, hiring and expansions. However, don’t expect any let off in the pace of new startups, or investor pitches, as the idea of entrepreneurship has truly taken root in India now.