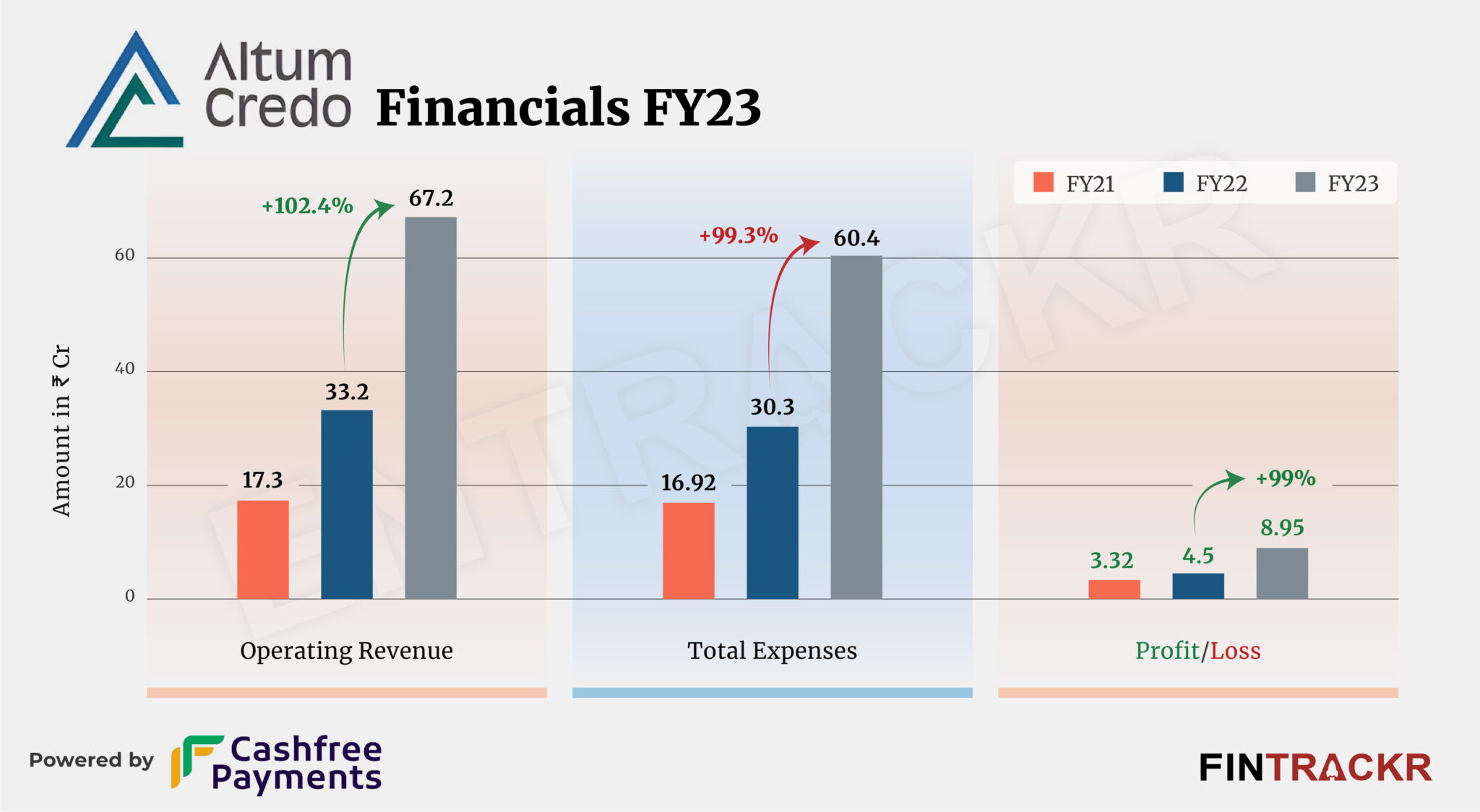

Housing finance company Altum Credo has grown over two-fold during the last fiscal year ending March 2023. The growth in scale has also helped the Amicus Capital-backed startup to register profits in two consecutive fiscal years.

Altum Credo’s revenue from operations scaled 102.4% to Rs 67.2 crore in FY23, according to its annual financial statements filed with the Registrar of Companies.

Altum Credo is a Housing Finance Company registered with the National Housing Bank (NHB) which provides financial accessibility for first home buyers across semi-urban and rural areas of India. It provides home loans in the range of Rs 4 lakh to Rs 40 lakh for a tenure of 5-20 years.

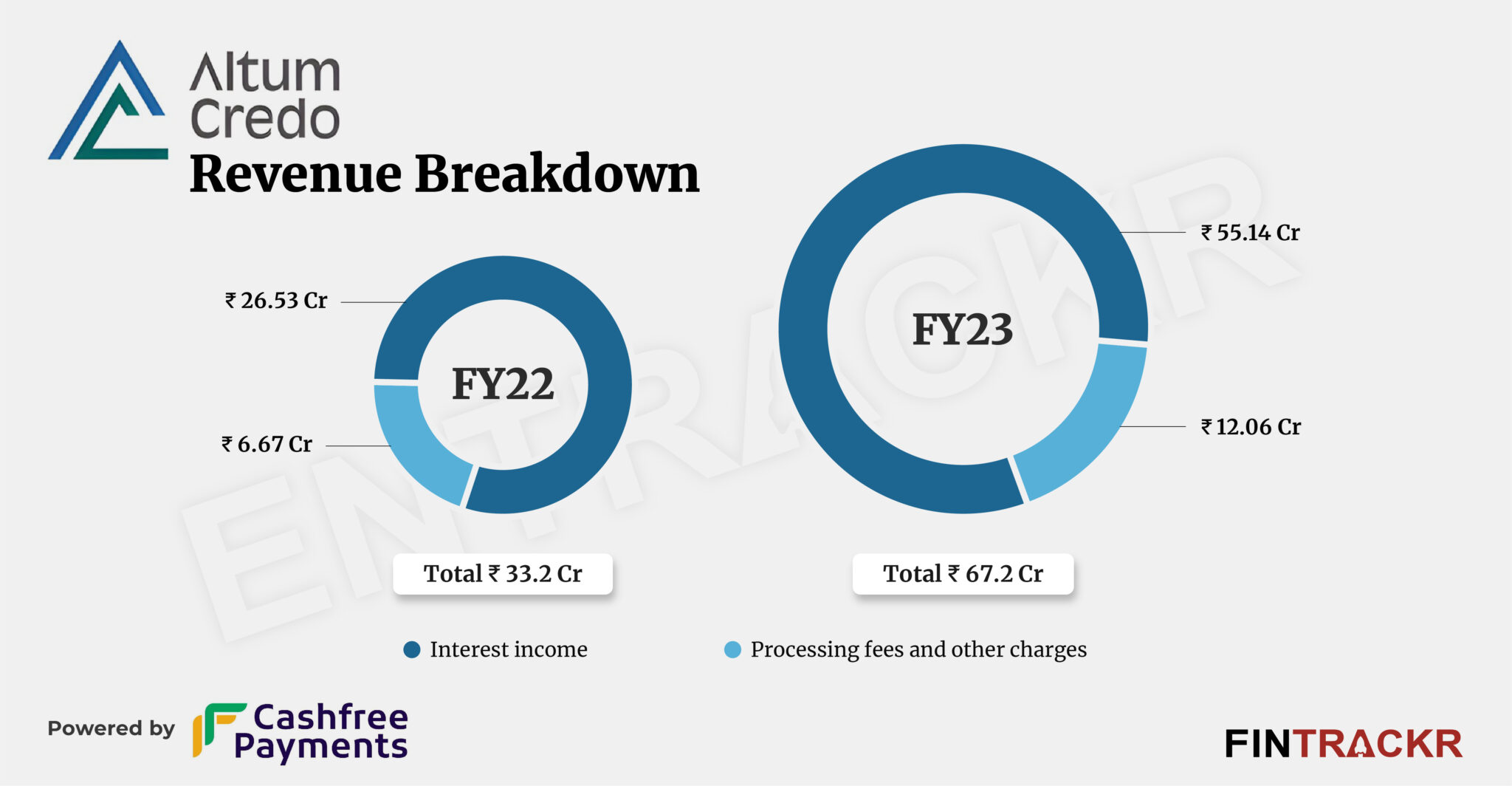

As per Fintrackr’s analysis, interest received from housing loans formed 82% of the collections which surged 2.1X to Rs 55.14 crore in FY23. The rest of the income came from processing fees and other charges which grew 80.8% to Rs 12 crore during the fiscal.

Alongwith its core-business, Altum Credo also has a non-operating income of Rs 5 crore from interest on fixed deposits with the bank during FY23.

Headquartered in Pune, the company currently has more than 40 branches and has a presence in the states of Maharashtra, Tamil Nadu, Karnataka, Rajasthan, Andhra Pradesh, and Telangana. It works with lending partners such as SBI, Vivriti Capital, Tata Capital, Northern Arc, and Federal Bank, among others.

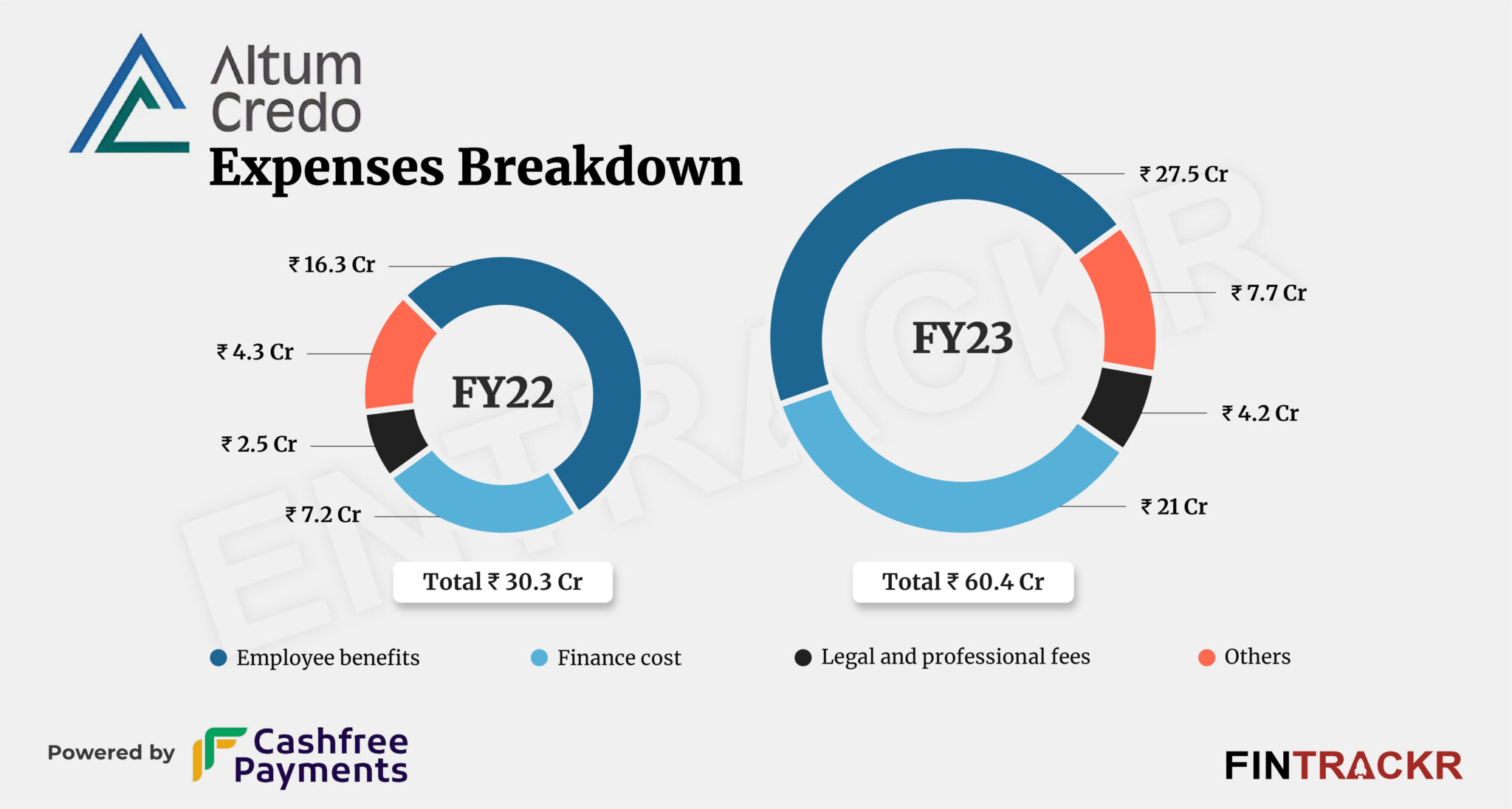

Employee benefits accounted for a major 45.5% chunk of total expenses. This cost grew 68.7% to Rs 27.5 crore in FY22. The finance costs for the company also surged 2.9X to Rs 21 crore in FY23.

Altum Credo added another Rs 4.2 crore towards legal and professional fees which steered its total cost around 2X to Rs 60.4 crore in FY23.

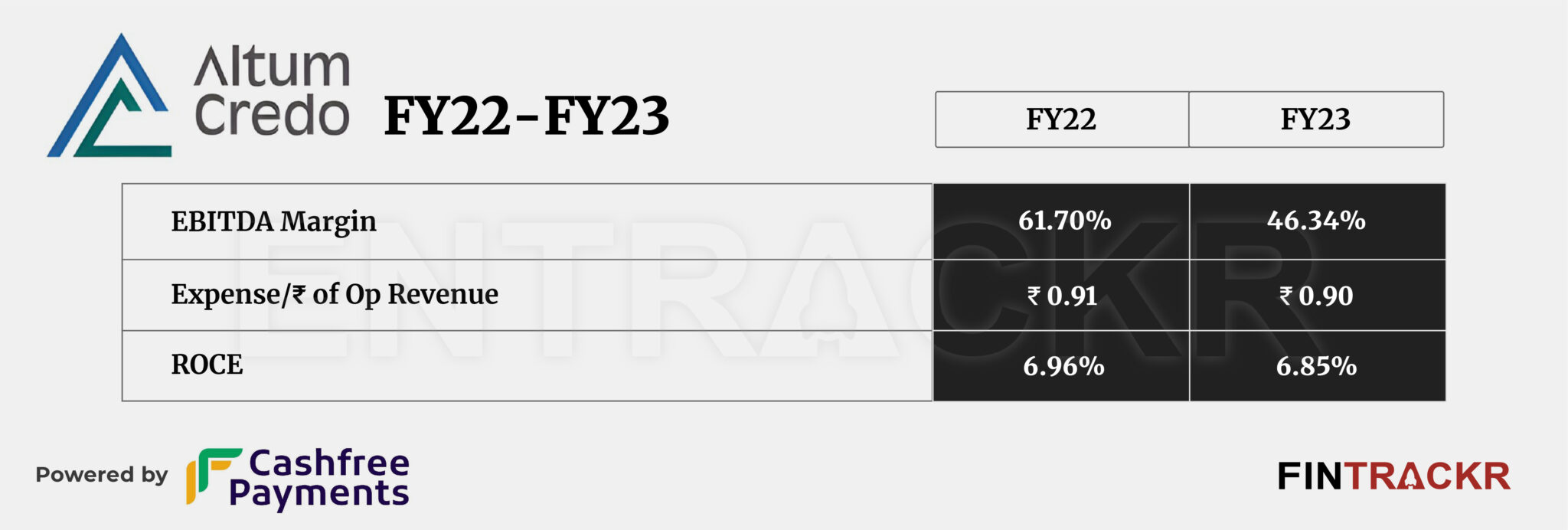

Continuous growth and a good control over its overheads helped Altum Credo register a 99% growth in profits to Rs 8.95 crore during FY23. Its profit after tax in FY22 and FY21 stood at Rs 4.5 crore and Rs 3.32 crore respectively. Its ROCE and EBITDA margin registered at 6.85% and 46.34% during the last fiscal year. The company spent Re 0.90 to earn a unit of operating revenue.

During FY22, the company claimed that its collection efficiency reached 98% with gross non-performing assets (NPA) at 0.7% and Net NPA at 0.4%. The company did not mention these numbers in its FY23 annual report.

While several proptech companies provide finance options for property buyers, a bunch of startups like Aviom, Easy Home Finance, Basic Home Loan, Andromeda operate focusing on this space only. According to an Entrackr’s report, proptech startups have mopped up nearly $2.4 billion between January 2021 and March 2023. Altum Credo has raised nearly $30 million to date. Last month, the company’s competitors Aviom and Basic Home Loan closed $30 million and $4.7 million round respectively.

With its south India focused approach in the budget segment of housing, Altum Credo has a long runway ahead of it, even as risks will be elevated with higher interest rates and the economic uncertainty that can accompany it. Maintaining asset quality remains key in the housing segment, something that can slip very quickly if a short term approach is taken to building it.