The story of proptech startups in India took shape in the mid-2000s after the entry of Info Edge-owned 99acres and Times Internet-owned Magicbricks, Quikr-owned CommonFloor and PropTiger (REA India)-owned Makaan.com. Following this, the story revolved around Housing.com, a once-celebrated startup which then faced a series of mishaps. In the past five years, the proptech segment has evolved manifold and has seen startups in brokerage tech led by Square Yards, construction tech led by Infra.Market, AI, AR, VR, IoT, SaaS, and other spaces. In this report, Entrackr analyzes the business model and fundraising trends of proptech startups in India, while also focusing on their revenue numbers, skyrocketing valuation and future prospects.

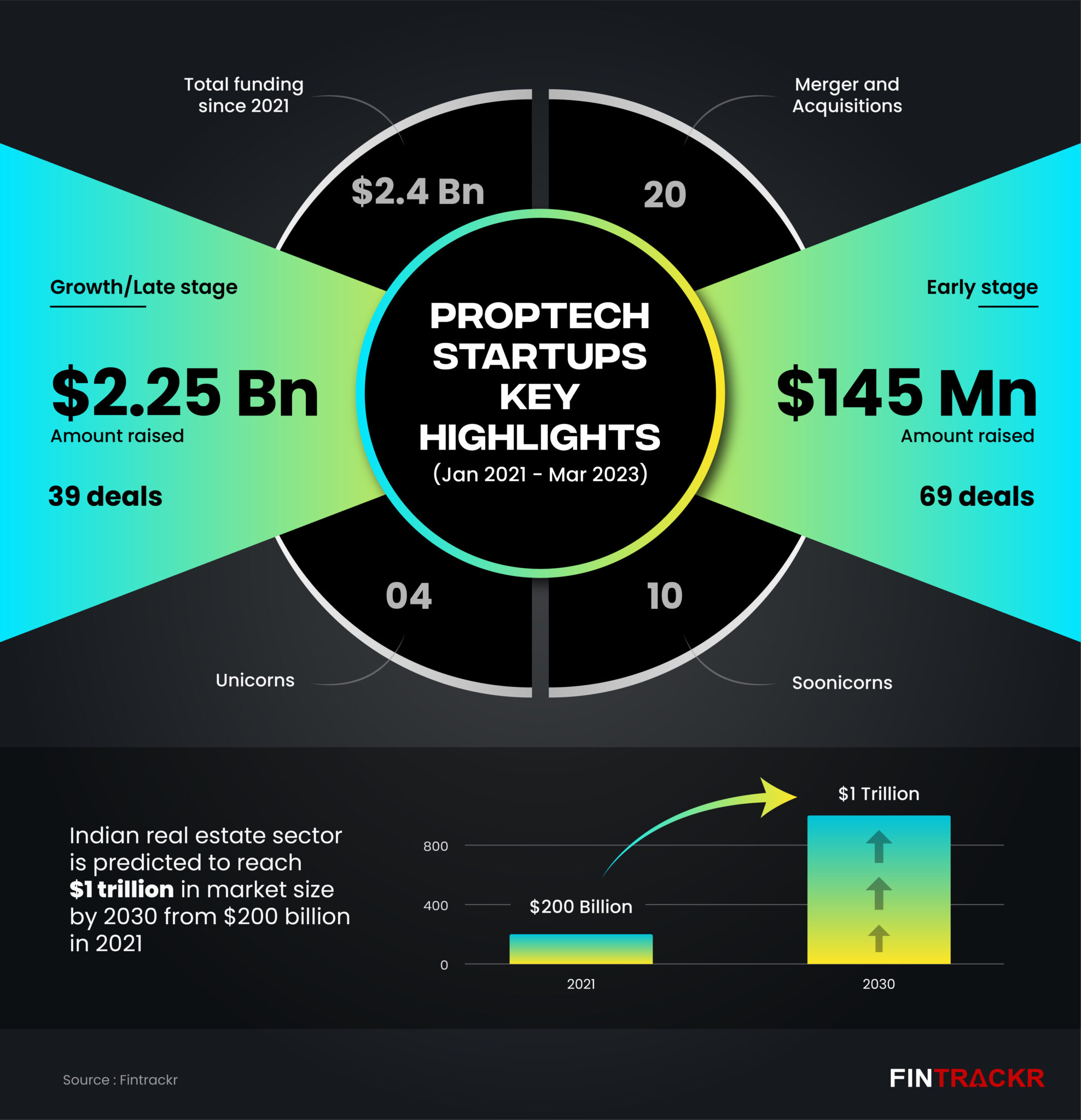

The Indian real estate sector is predicted to reach $1 trillion in market size by 2030, up from $200 billion in 2021, and contribute to 13% of the country’s GDP by 2025. And looks like tech companies in this space have a role to play as well. As per data compiled by Fintrackr, proptech startups have mopped up nearly $2.4 billion between January 2021 and March 2023. This comprises 39 growth stage companies raising $2.25 billion and 69 early stage startups raising $145 million. If we take previous data, then proptech startups have managed to raise $2.9 billion since January 2020.

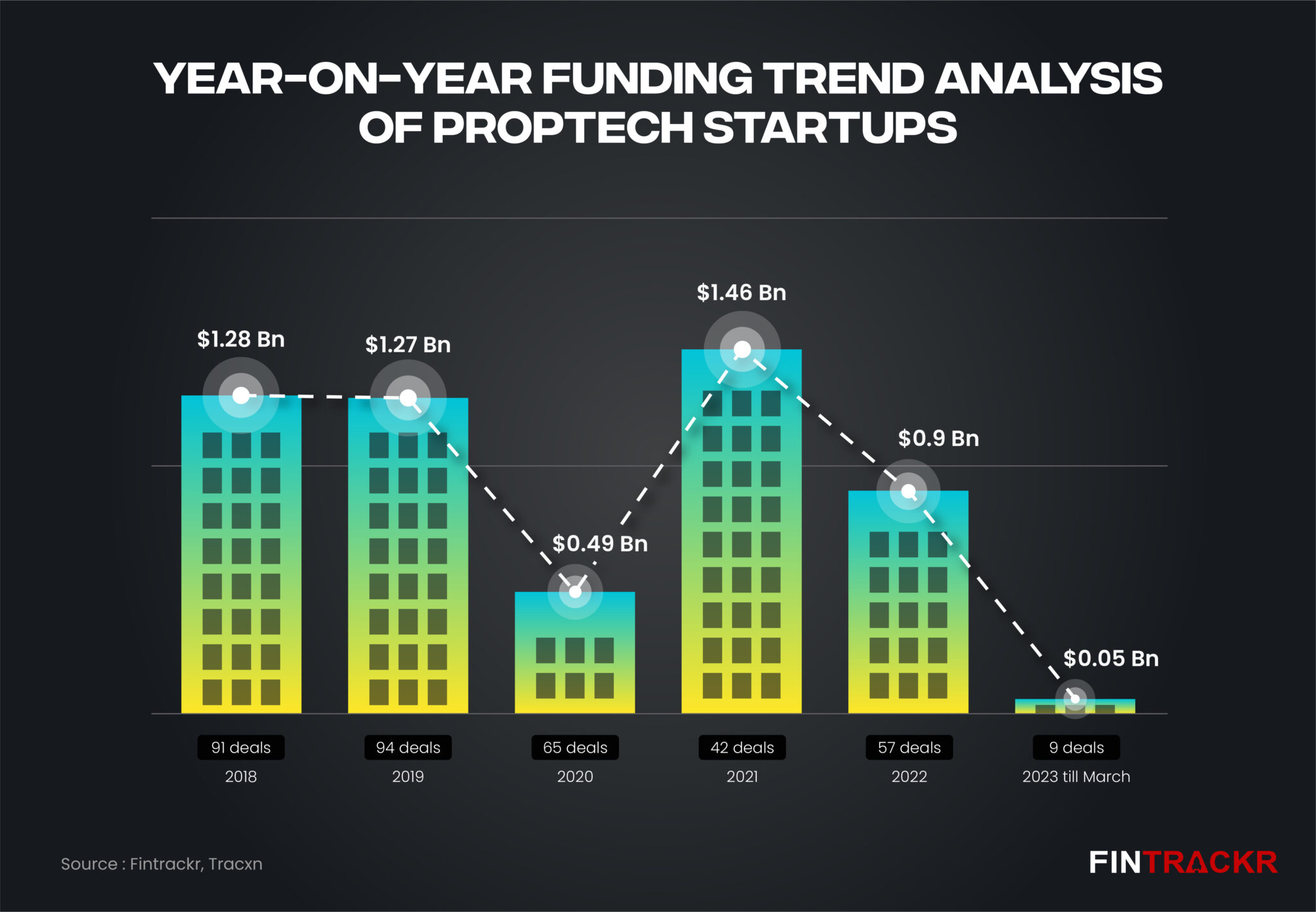

[Year-on-Year trend analysis]

Funding in proptech startups peaked in 2018 with $1.28 billion. Even as the trend continued in 2019, the impact of lockdown can be seen in 2020 when the fundraise plunged to less than $500 million. This again saw a revival in 2021, only soon to get impacted by an overall slowdown in the funding environment in 2022 and 2023. While pre-Covid era was dominated by the likes of OYO, co-working space providers, the post-Covid period saw massive funding in construction and building material focused startup such as Infra.Market, real estate rental startup NoBroker, home decor and interior startups Livspace and HomeLane.

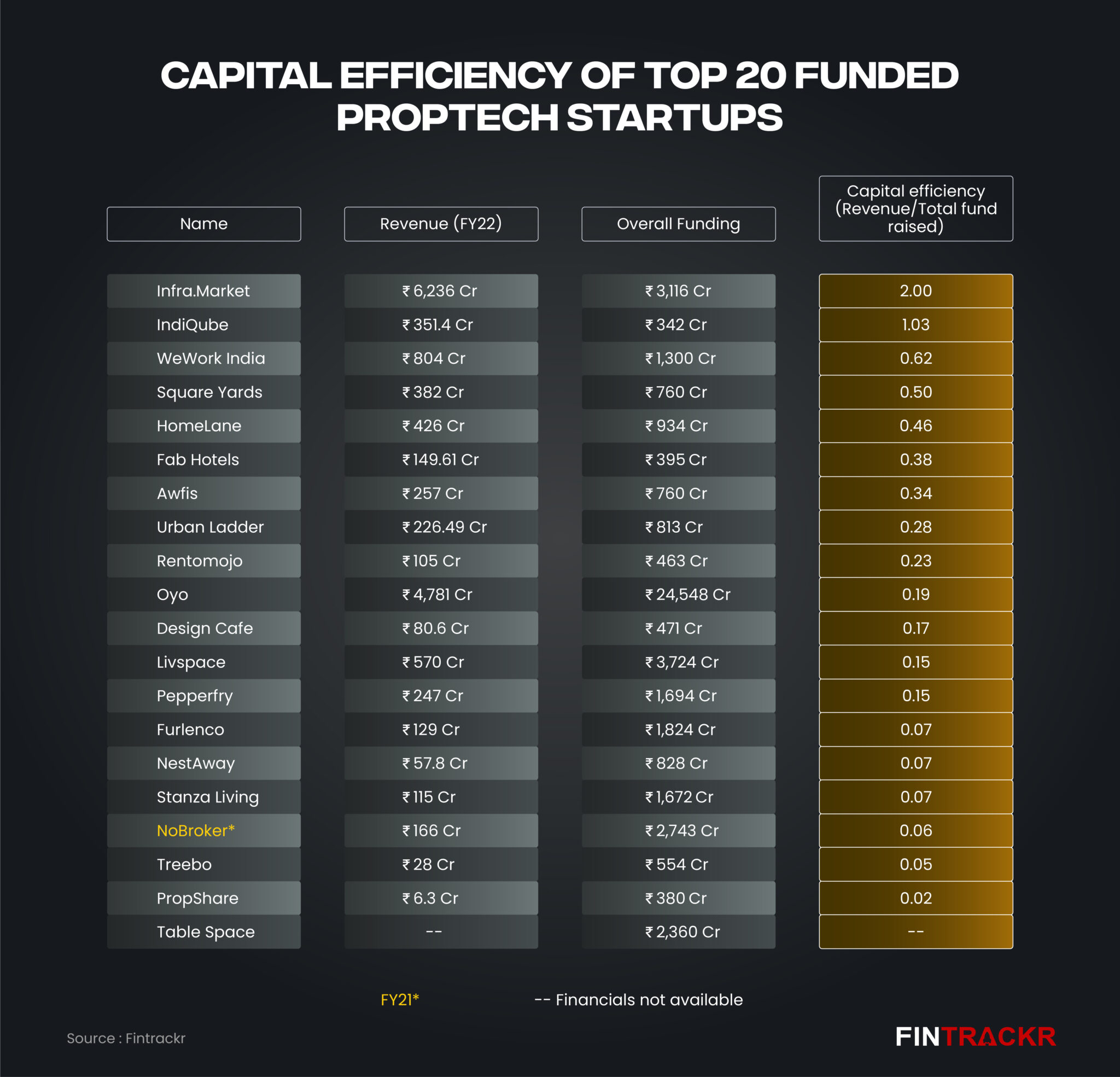

Entrackr has prepared a list of top 20 most funded proptech startups in India

[Top 20 funded proptech startups and their capital efficiency]

In this section, we have highlighted top 20 funded startups in proptech and their capital efficiency ratio based on their financial performance in FY22. Oyo, Livspace, Infra.Market, and NoBroker were the top funded companies with capital efficiency of 0.19, 0.15. 2 and 0.06 respectively. The capital efficiency of NoBroker is based on its FY21 numbers. While Table Space also did not disclose its FY22 numbers, Infra.Market has been the leader among its peers with revenue of more than Rs 6,000 crore.

The full report can be downloaded here.

Besides Infra.Market, IndiQube, Square Yards, WeWork India and HomeLane have better capital efficiency among the top 20 companies in the list.

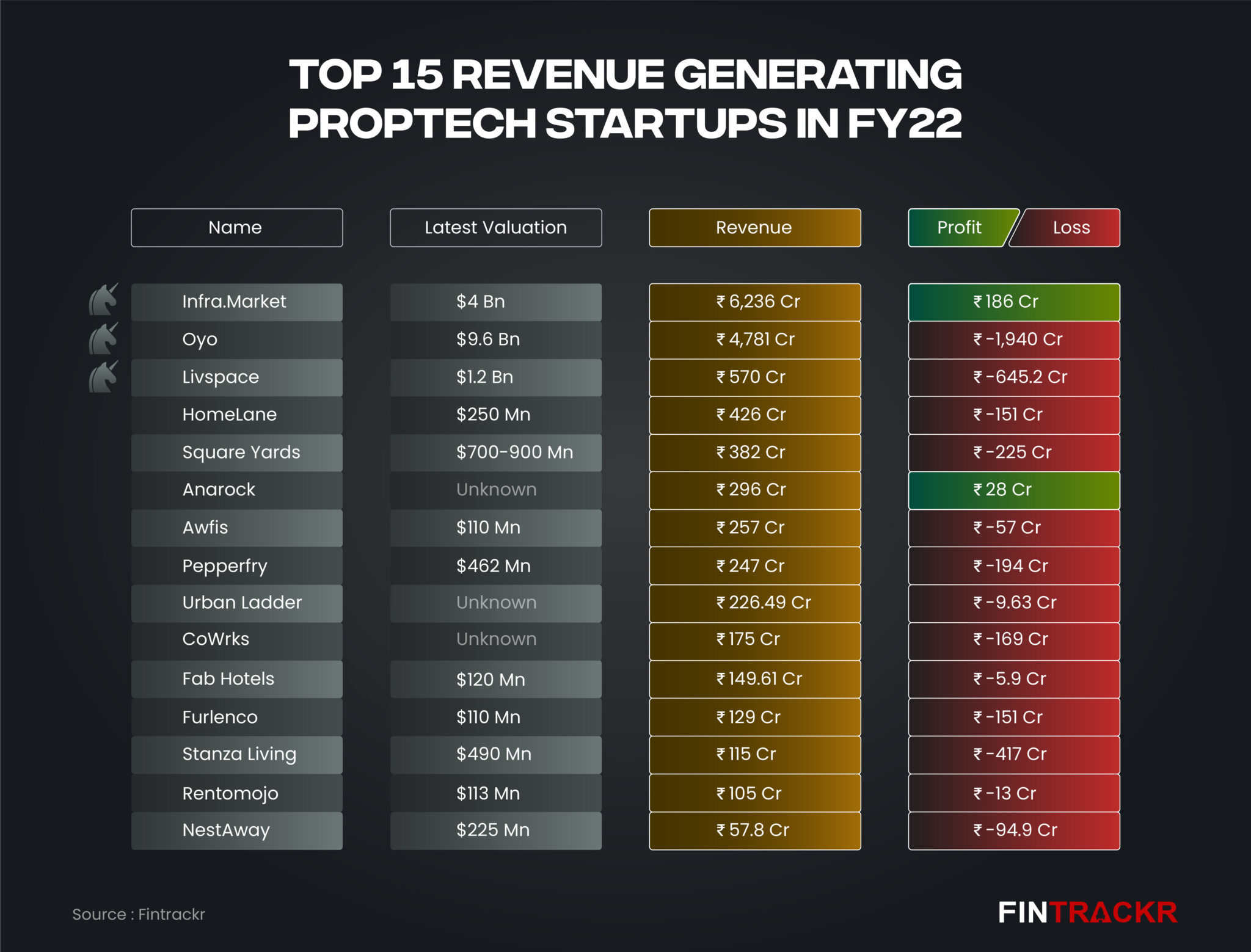

[Top 15 revenue generating proptech startups and their valuation]

Entrackr has prepared a list of top 15 new age and established proptech startups based on their revenue numbers and latest valuation. The table comprises all unlisted companies. Oyo’s peak valuation reached $9.6 billion after Microsoft’s backing in August 2021. The valuation was later marked down by its early backer SoftBank to $2.7 billion in an internal valuation report. Infra.Market is next on the list in terms of valuation. Interestingly, most of the top funded companies from the above lists have captured the top positioning in terms of revenue. There are a couple of exceptions. Housing brokerage firm Anarock, founded by industry veteran Anuj Puri, is one of the few firms that reported profit in FY22 without any external fundraise.

Sequoia-backed co-working solutions provider Awfis, and Cowrks are among the least funded companies since January 2021 but managed to post Rs 257 crore and Rs 175 crore revenue respectively in FY22.

Awfis claimed that it has doubled its revenue between FY22 and FY23 which is significant growth from pre-covid levels. “Going forward we are expecting 60-80% growth YoY. Pre-covid they had 50 centres, 24,000 seats in 9 cities. Today they have 150 centres, 88,000 seats in 17 cities,” said Sumit Lakhani, Deputy CEO of Awfis in a response to Entrackr’s queries.

Reliance-owned UrbanLadder reported Rs 226.49 crore in revenue during the fiscal year (FY22). The segment has produced four unicorns so far: Oyo, NoBroker, Infra.Market and Livspace. The latest valuation of Anarock, UrbanLadder, Cowrks, and Zolo Stays couldn’t be ascertained. Square Yards, Awfis, Pepperfry, Stanza Living, and Furlenco, among others are in the soonicorn list.

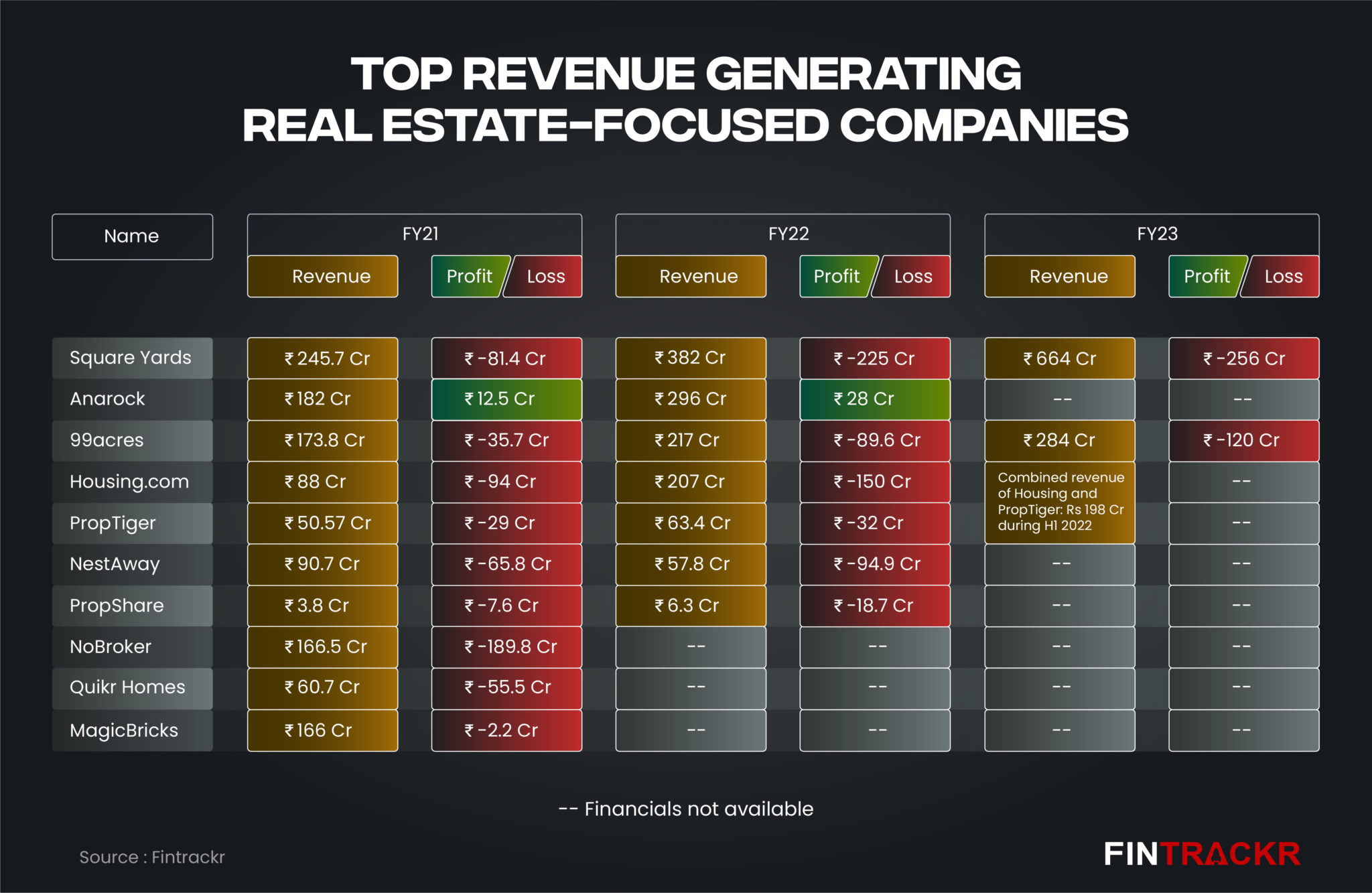

[Top revenue generating real estate-focused companies]

To compare financial performances better, Entrackr has prepared a list of companies dealing in real estate directly whether it is a new age company, legacy or listed one.

If we look at the financial performance of established companies (more than 15 years old) in the real estate segment, most of them have shown growth in revenue post covid. Square Yards is on top of the list with Rs 382 crore revenue in FY22 followed by Anarock at Rs 296 Cr. Square Yards scale further grew 73.7% to Rs 664 crore in FY23 while its losses grew only 13.8% to Rs 256.17 crore in FY23 from Rs 225.1 crore in FY22. InfoEdge-owned 99acres was in third position with Rs 217 crore revenue in FY22 while losses of the company stood at close to Rs 90 crore. Housing and PropTiger recorded Rs 207 crore revenue and Rs 63.4 crore revenue in FY22. Both announced their merger in 2017. Makaan.com also became a part of PropTiger group in 2015.

Overall REA India, which is a part of Australia’s REA Group and owns Housing.com, PropTiger, and Makaan.com, grew 92% to nearly Rs 300 crore in FY22.

Magicbricks, NoBroker and Quikr Homes did not disclose their FY22 numbers.

“We are typically growing by 100 percentage to 150 percentage every year in terms of revenue. Companies like us got a disadvantage because of COVID because customers were not able to venture out [to] see properties. So for us, life is better after COVID and hence the transactions as a transaction volume, revenue, everything is going massively up post COVID,” said Amit Agarwal, CEO of NoBroker. The firm targets profitability in the next couple of years.

“We had a sensational finish to the year FY23 with INR 670 cr of revenue & 70% growth. Our focus on providing integrated solutions across the real estate ecosystem and our investments in expanding our capacity should continue to drive operating leverage over the next couple of years. As we rejoice a phenomenal year, we are buckling up for an ambitious target of INR1000+ Cr revenue and full FY profitability in FY24” said Tanuj Shori, Founder and CEO, Square Yards.

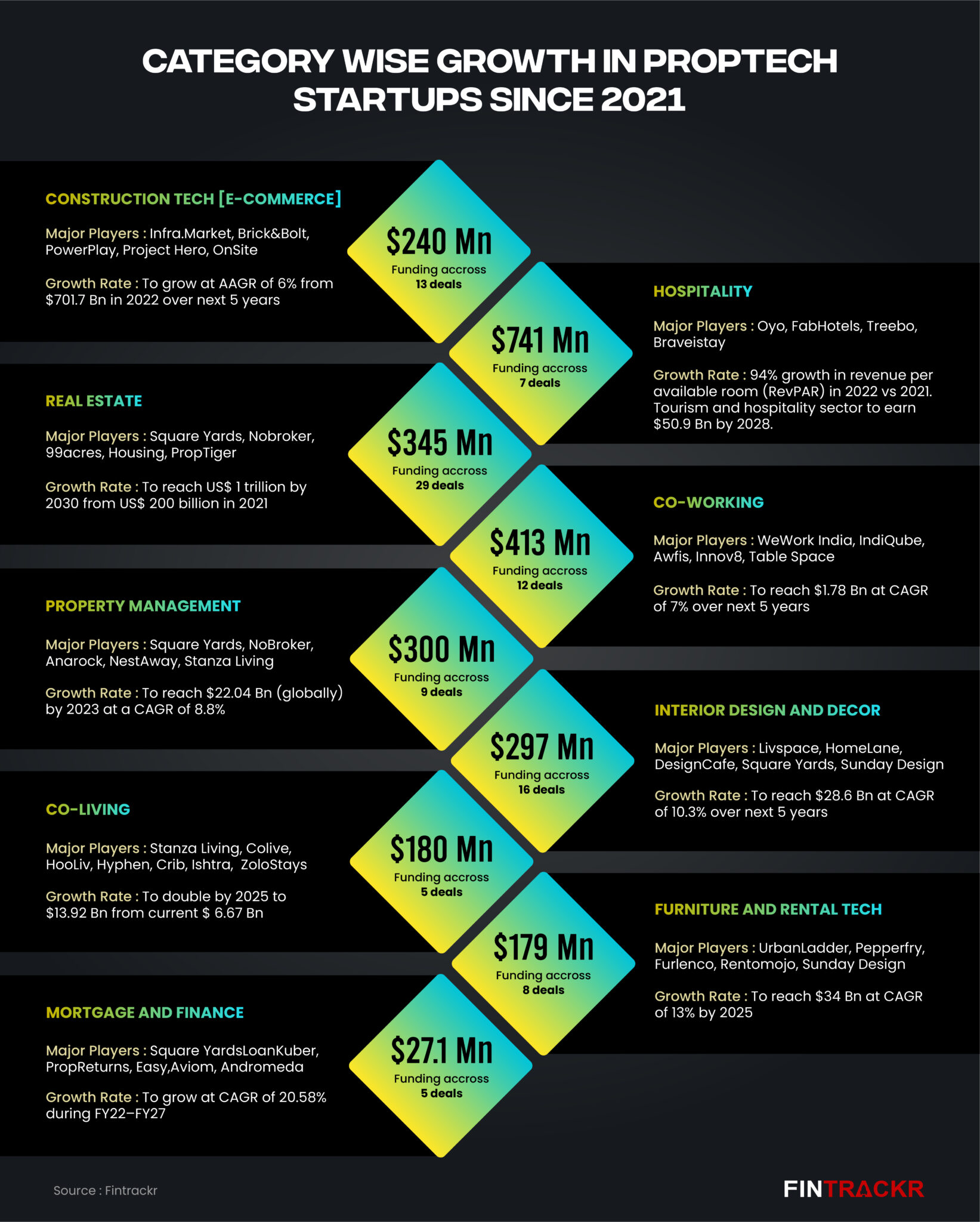

[Growth in major segments]

Escalating demand for properties including housing, office, retail, warehouse, co-working, and co-living can be witnessed post covid. A report by PropTiger also suggested that residential real estate sales in top cities of India saw 50% year on year growth in 2022. According to the report, a total of 3,08,940 units were sold in 2022 as compared to 2,05,940 units sold in 2021. Entrackr has done a separate analysis on top segments of proptech startups to see their growth since covid.

Real Estate and brokerage tech: As per Fintrackr’s analysis, more than 29 startups that deal in real estate mopped up nearly $345 million out of the total $2.4 billion funding between January 2021 to March 2023. NoBroker, and Square Yards were some of the top funded companies in the list. The list also includes the likes of Anarock and NestAway which did not raise any capital during the 27-month period but registered decent revenue in FY22.

“The last decade was not very great for real estate residential appreciation, but that has changed from the 2020. So, there has been very good appreciation from COVID to today,” said Amit Agarwal. “And the demand for properties specially in Metro is very, very robust. And now that RBI has given a pause on the rates, home loan rates, this is in addition positive for real estate.”

“On a starting basis, we are not we are pretty reasonable in terms of the home loan. In fact, in March 2023, we have seen a massive jump in the property deals and in the home loan closures on our own platform, we have seen 100 percentage increase in home loans that no broker has processed compared to the year before,”added Agarwal.

Construction tech [e-commerce]: Construction materials-focused startups raised $240 million in total funding between January 2021 and March 2023. Infra.Market topped with $175 million in funding. The list also counts several e-commerce platforms such as Brick&Bolt, ZippMat, Powerplay, Project Hero and Mistry.Store. Infra.Market’s competitor OfBusiness mopped up nearly $800 million in 2021 and was valued at $5 billion during its last funding round. Since the firm also deals in products beyond building and construction such as industrial goods, chemicals, and agro produce, it is not included in the proptech list.

Hospitality: Oyo alone led the list of funded companies in the hospitality segment during 2021-2023 (till March). The company’s competitors FabHotels and Treebo are far behind in terms of revenue and funding . While Treebo raised $16 million as a part of Series D round in June 2021, Fab Hotels couldn’t manage to raise external money in the past couple of years. Revenue wise, Oyo was close to Rs 4,781 crore in FY22 whereas FabHotels and Treebo reported Rs 150 crore and Rs 28 crore revenue respectively. It’s worth highlighting that FabHotels controlled its losses to Rs 5.9 crore in FY22.

Co-working: Reports suggest that the occupancy rates at coworking spaces have now shot up to 90-100%, compared with 45-60% a year ago. Co-working spaces had a 27% share in Indian office real estate, according to recent data shared by Anarock. In Q1 2019, its share was just 14%. Funding in co-working space is a testament to such reports as these startups managed to raise over $400 million since January 2021. Startups like Awfis, ABL Workspaces, BHIVE, Table Space, IndiQube, iSprout, and others raised handsome money as offices started reopening post coronavirus-induced lockdown. The Indian arm of WeWork also raised funding to operate in the country. The firm claimed that its revenue grew by 70% to around Rs 1,300 crore in calendar year 2022. Cowrks and Oyo-owned Innov8 also compete in the segment.

Interior design and decor: In the past few years, a flurry of home interior design and decor-focused startups raised VC money. Livspace leads the list and is currently the only unicorn from this space. HomeLane, Arrivae, Flipspaces, Infurnia, Design Cafe, Nestroots, KraftInn, Sunday Design are other notable companies in this space which raised nearly $300 million in total during the above mentioned period (January 2021 to March 2023). Square Yards, NoBroker also operated in the segment. While most of the companies are in their early stage, revenue and funding analysis of growth stage companies can be seen in the chart.

Livspace and HomeLane did not comment on Entrackr’s queries.

Furniture and rentaltech: Furniture and rental tech startups raised $179 million since January 2021. Rentomojo, Furlenco, CityFurnish, Sunday Design, and Cinnamon Homes were notable companies in the list. Furlenco was on the top in terms of revenue and funding followed by Rentomojo.

Mortgage and finance: While several proptech companies provide mortgage and finance options for property buyers, a few startups operate focusing on this space only. PropReturns, LoanKuber, Easy, and Aviom managed to close their new funding rounds.

Coliving: Like co-working, the demand for co-living or managed rental accommodations in metropolitan cities like Mumbai, Delhi, Kolkata and Bengaluru also increased post covid. Startups like Stanza Living, Colive, HooLiv, Hyphen, Crib, and Ishtra managed to raise $180 million since January 2021.

Property management: The global property management software market is expected to reach $22.04 billion by 2023 at a CAGR of 8.8%. Square Yards, NoBroker, Anarock, NestAway, Stanza Living have emerged as the top companies in the space, raising over $300 million across nine deals since January 2021.

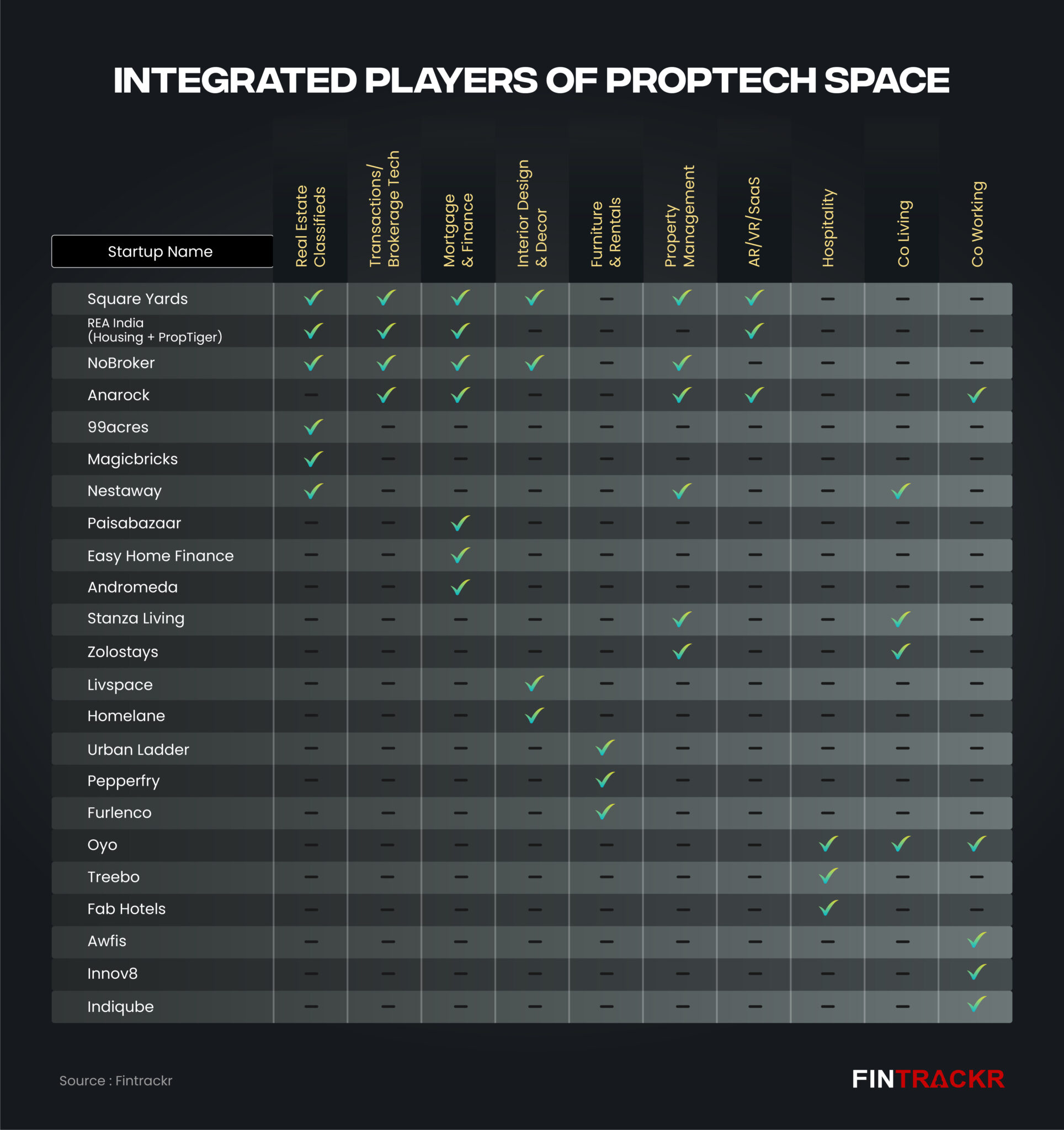

[Integrated players of proptech space]

After a deep dive into the business models of all proptech startups, we found a clutch of companies operate beyond their core verticals. In this list, Square Yards has emerged as the most integrated player across the real estate value chain. This is followed by NoBroker, Anarock, and REA (Housing+PropTiger) which are covering at least four different verticals.

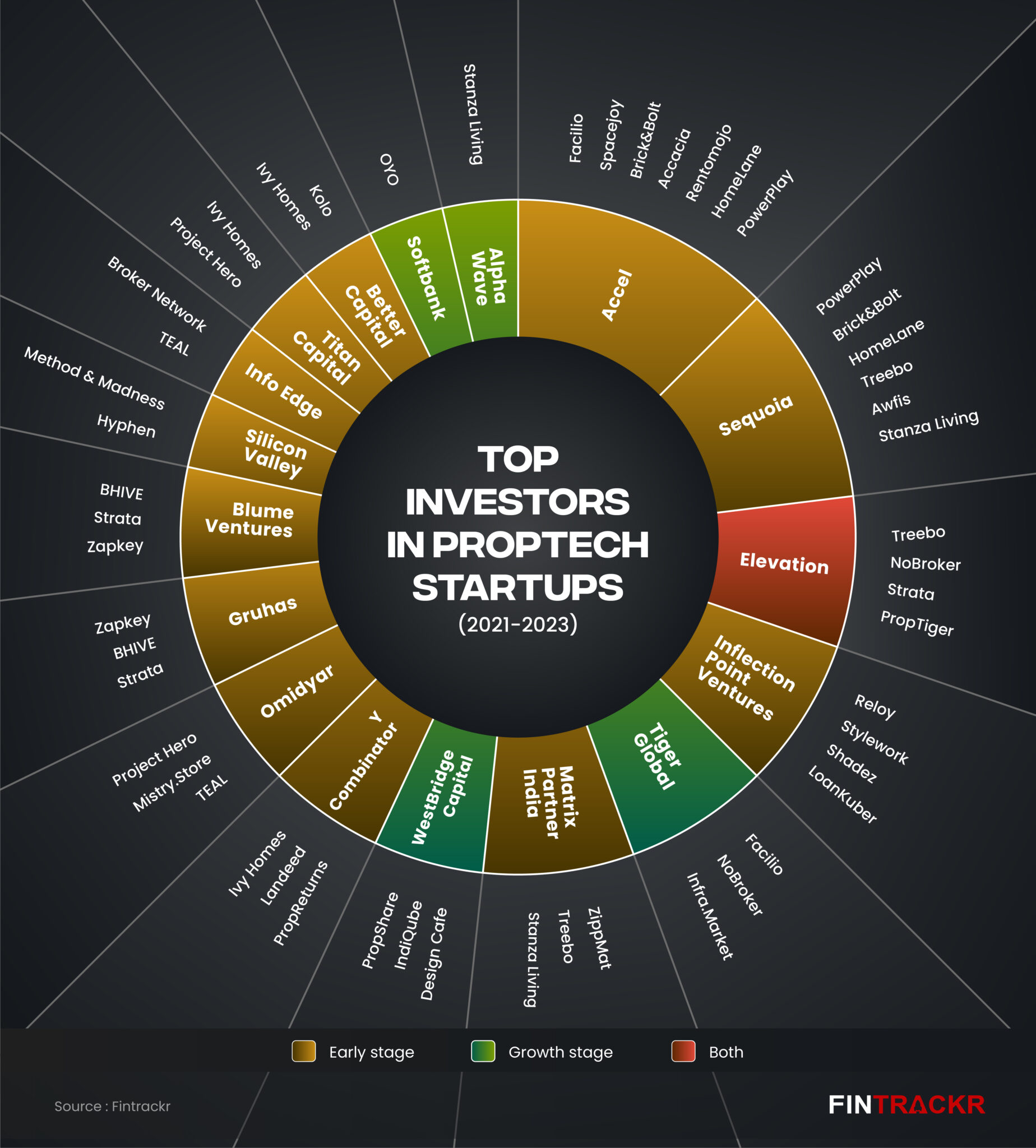

[Most active investors]

In the past couple of years, SoftBank, Alpha Wave, WestBridge Capital, and Tiger Global have emerged as top investors focusing on growth stage proptech startups in the country. This followed by Matrix, Sequoia, Omidyar Network, Accel, Gruhas, Y Combinator, Inflection Point Ventures, and Info Edge have majorly invested in early stage companies. Elevation Capital has backed early as well as growth startups in the list. Their investment pattern can be seen in the graph below.

Meanwhile, InfoEdge has written off its entire investment in 4B Networks: a proptech startup led by Rahul Yadav, who formerly co-founded Housing.com. The reasons for the write-off are the challenging funding environment.

Apart from VC funding, private equity investment in real estate also saw a stable growth in the last fiscal year. According to a report published by real estate consultant Anarock, Private equity investments in real estate remained flat and stood at $4.2 billion in FY23.

Commenting on investment trends, Lakhani said ,“With the business showing robust growth, the segment maturing, and good unit economics from some of the players, the sector will see growing interest from growth-stage PE firms. There may be a bit less action in early-stage deal-making in this sector but it will attract interest from growth capital firms. Over the last 12 months, there have been few successful equity, credit & quasi-equity transaction closures in the sector.”

[Industry initiatives]

Last year, the Confederation of Real Estate Developers’ Associations of India (Credai) and Venture Catalysts partnered to set up a $100 million fund to invest in proptech startups. Recently, Gruhas Proptech, DLF Family Office, and Anthill Ventures announced the launch of the second edition of Gruhas ASPIRE, a six-month scaling program for early-stage proptech startups.

In March, Housing announced the launch of the Rent Now Pay Later (RNPL) service in partnership with embedded finance startup Niro. According to the company, this solution will bring genuine empowerment to millions of customers who desire to rent properties using credit but are often hindered by the lack of traditional instruments. Most recently, Real estate consultant CBRE partnered with tech industry body Nasscom to launch a proptech challenge programme to support and mentor startups in the real estate industry.

[Entrackr’s take]

For a category whose basic, distinct feature is high ticket sizes and the role of financing, the proptech segment has been remarkably difficult to find profits in, for most startups. Most of that challenge can be blamed on the nature of the largest part of the market, the housing and commercial property segments. Both are heavily regulated, frequently with arbitrary and illogical rules, and ability to manage in such an environment can sap energies at the most ‘professional’ firms.

Then there is the apparent mismatch in the balance of power, with builders dominating, despite a terrible record of delivery and quality in many cases. What that has meant is that despite their best intentions at the start, almost no proptechs in these segments have been able to prioritise the interests of their end customers, finding themselves instead, relegated to a role that is, at worst, an extended marketing arm of most builders, big or small. Depending on their ability to bring in money, be it in the form of project equity at one end or lower commissions at the other, they manage their relationships with the builders.

The entry of large private equity firms like Blackstone or innovative instruments like REITs (Real Estate Investment Trusts) or even InVITs (Infrastructure Investment Trusts) has not yet had the kind of impact one would have hoped for, except in a few commercial pockets.

These issues, so apparent from the outside, are one reason one cannot blame many of the new players for not trying. Many models have been tried, in an effort to bring an element of order and predictability for the end customer in this wild west of a category. It is the Indian economy’s tragedy that despite every effort, change has been extremely tough on the ground, and that will continue to cast a shadow on the prospects of startups in this segment too.

The one bright ray of hope is the emerging boom (for real) in tier 2 cities for all segments of the proptech world, and progressive moves to clean up land ownership rules and processes including digitisation in key states, which could sustain growth in the sector at above usual levels in times to come.