Digital healthcare platform Practo is one of few notable growth stage startups which failed to report its financial numbers on time for the last three fiscal years: FY20, FY21 and FY22. The company filed its FY20 financial report in July 2022 whereas FY21 and FY22 numbers were reported in March and June 2023.

This is the background on its timeline of financial reporting. Now, let’s look at its FY22 financial numbers.

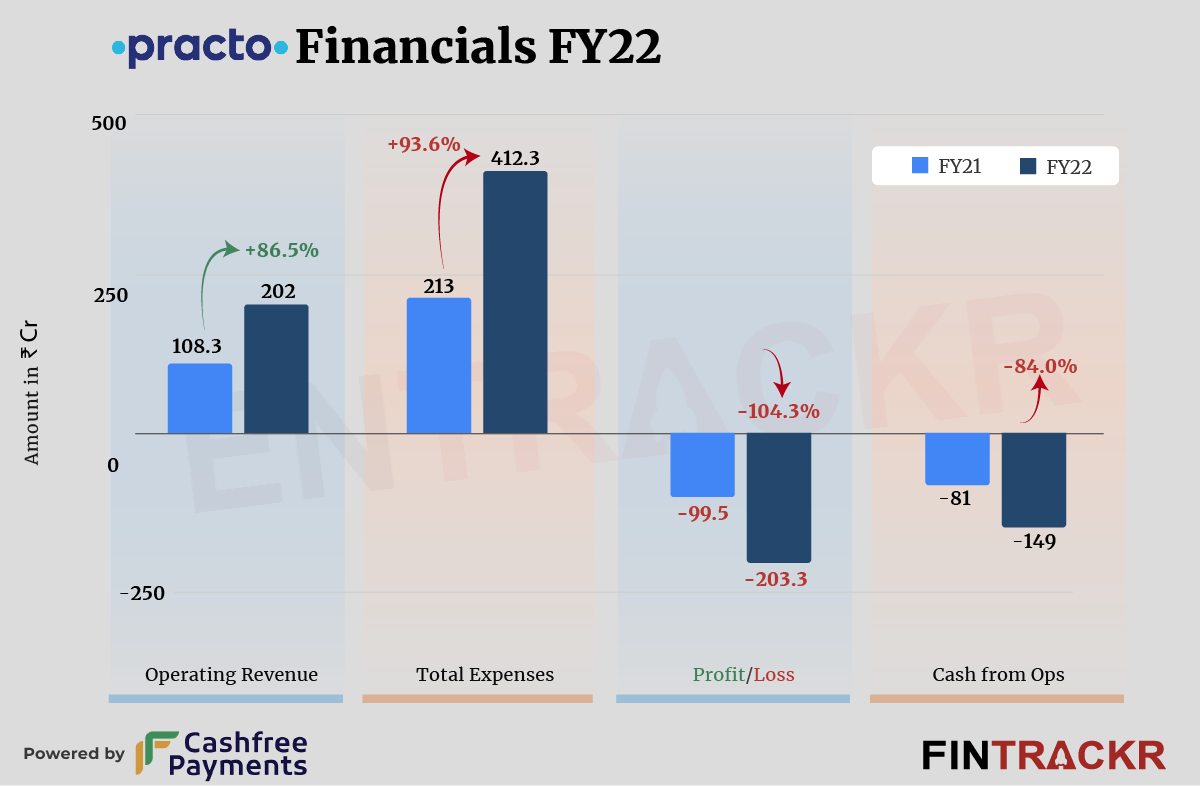

Practo Pte, which owns and runs Practo India, registered 86.5% growth in operating revenue to Rs 202 crore in FY22, according to its consolidated financial statements filed by the group company (Practo Pte Ltd) in Singapore.

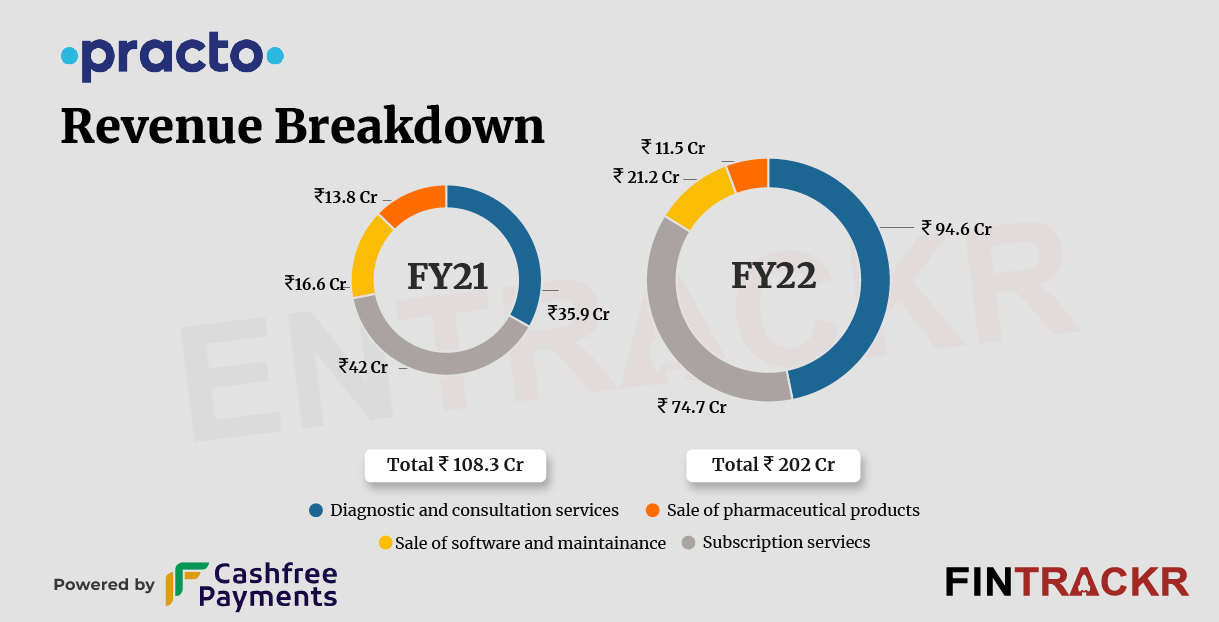

Founded in 2008, Practo connects doctors with patients and offers several ancillary services such as telemedicine, pathology, and medicines. Income from diagnostic and consulting services formed 47% of the total operating revenue. This collection surged 2.6X to Rs 94.6 crore in the fiscal year ending March 2022.

Its subscription services, sale of software and maintenance offered to doctors and clinics contributed Rs 74.7 crore and Rs 21.2 crore respectively in FY22. Practo also acts as an online medicine ordering platform and its collection from this service stood at Rs 11.5 crore.

Significantly, the company recorded Rs 127 crore under ‘other income’ head during FY21, which it made from the change of foreign exchange gain and conversion of convertible notes to preference shares. We have ignored this income during the analysis.

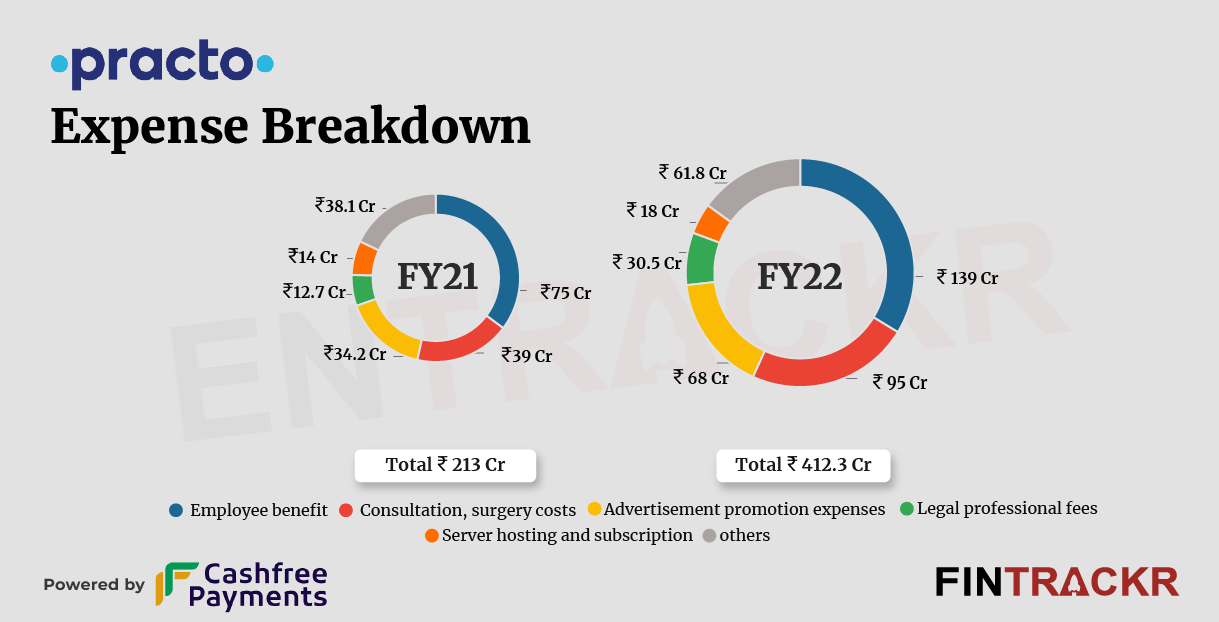

On the cost side, employee benefit was the largest cost center for Practo which accounted for 33.7% of the overall expenses. This cost increased 85.3% to Rs 139 crore during FY22 that includes Rs 23 crore on ESOP expenses (non-cash).

Its expenses on consultation and surgery verticals swelled 2.4X to Rs 95 crore in FY22 while the advertisement cost and legal/professional expenses saw a jump of 2X and 2.4X to Rs 68 crore and 30.5 crores respectively. The company spent Rs 18 crore towards server hosting and subscription which pushed its overall cost by 93.6% to Rs 412.3 crore in FY22.

Caveat: In the finance cost, the company booked an amount of Rs 352 crore against net change in the fair value of redeemable optionally convertible preference shares and Rs 19.7 crore towards impairment loss on trade and receivables. We have ignored both expenses as they are non-cash in nature.

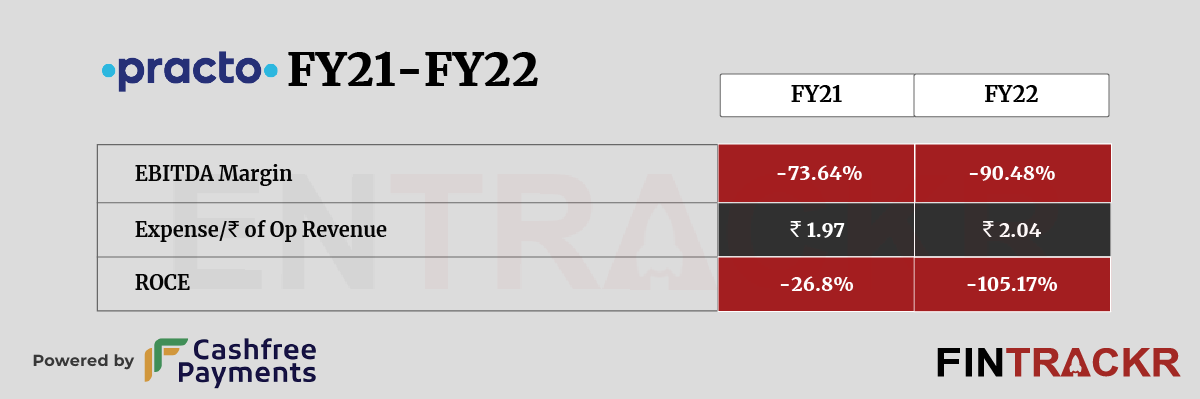

Even as the expenses outpaced its revenue growth, Practo’s losses spiked by 104% to Rs 203.3 crore in FY22 from Rs 99.5 crore in FY21. Its ROCE and EBITDA margin stood at -105.17% and -90.48% during FY22. Practo spent Rs 2.04 to earn a single unit of operating revenue.

Practo has raised a total of $179 million to date including its $55 million Series D round led by China’s Tencent and other existing investors at around $600-650 million valuation.

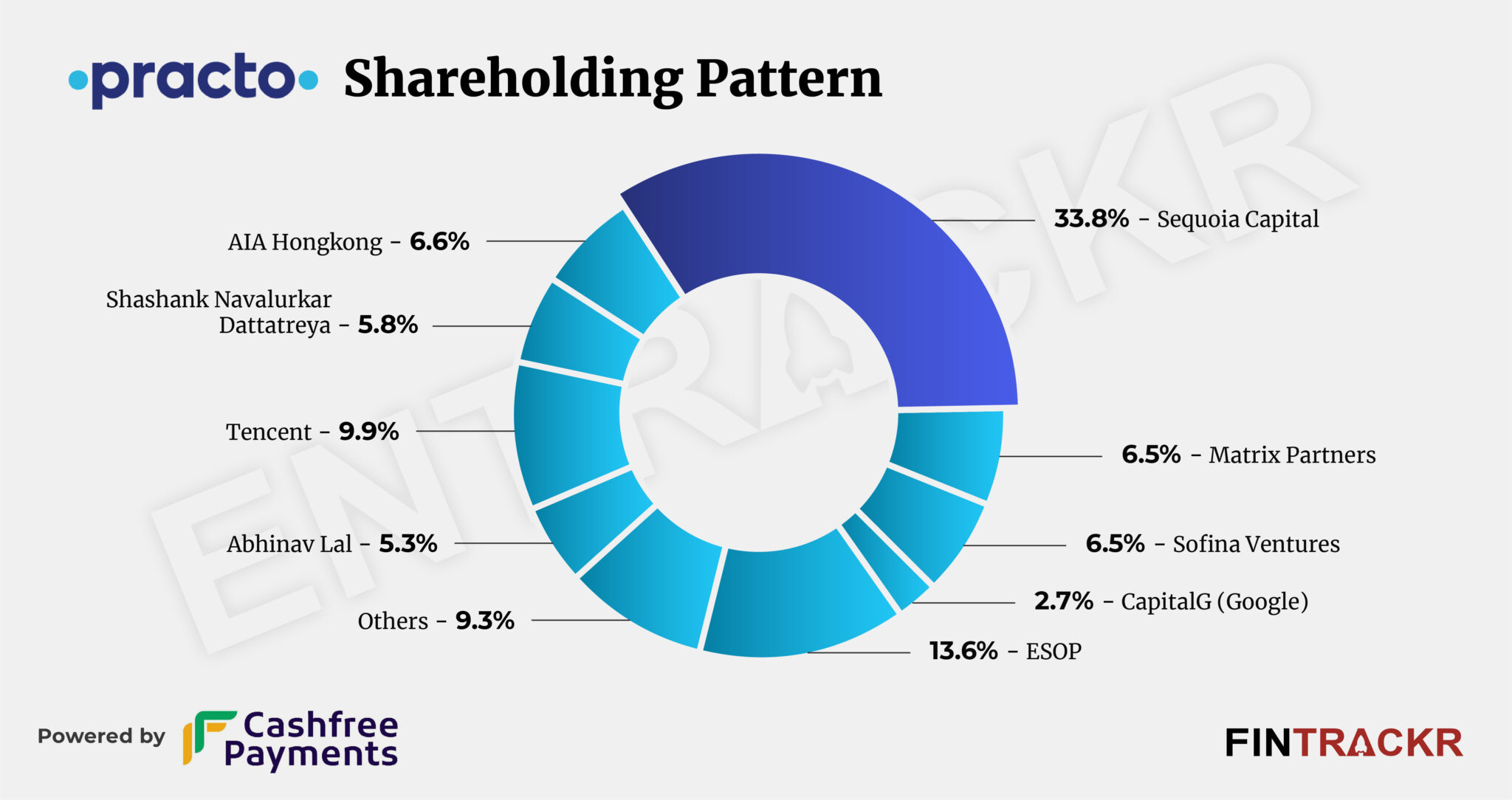

Sequoia Capital is the largest stakeholder in Practo with 33.8% followed by Tencent and AIA Hong Kong which own 9.9% and 6.6% stake in the company. Full shareholding pattern can be seen here:

Practo directly comepets with Tata 1Mg which scale over 2X to Rs 627 crore in FY22 while the losses of the firm jumped over Rs 500 crore in FY22. Mfine is another competitor which spent Rs 258 crore to make Rs 50 crore of revenue in FY22.

As one of the early movers in the space, Practo certainly hasn’t had the sort of journey its founders or investors would have hoped for.

The delays in filing financial returns is but one symptom of a firm that has been unable to deliver anything substantive on its promises. Even the topline it has built up after all this time is going to be heavily under threat, considering the scale and backing behind its newer competitors, which effectively includes the Reliance group and the Tatas. The high share of revenue from billing its parent firm for software services has been a consistent issue with Practo, and will hardly wash with industry watchers.