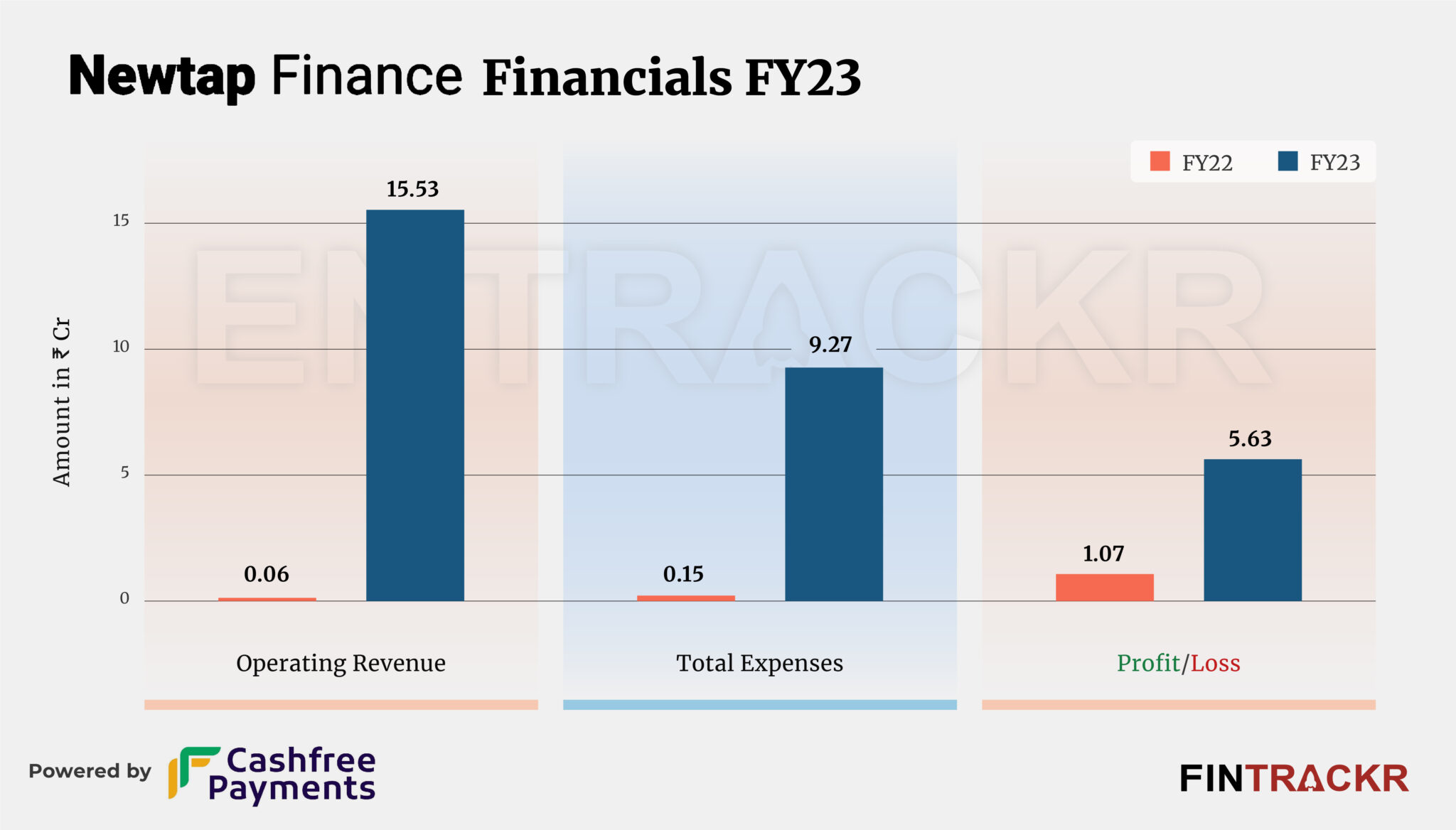

Non banking financial company Newtap Finance has demonstrated good growth in the financial year 2022-23 (FY23). The company, in which CRED founder Kunal Shah’s new entity Newtap Technologies is a majority shareholder, saw its revenue from operations flourish multifold to Rs 15.53 crore during FY23, in contrast to Rs 6.74 lakh in FY22, per the company’s financial statements reviewed by Entrackr.

This growth is despite the company being fully functional for only half of the financial year ending March 2023, say sources.

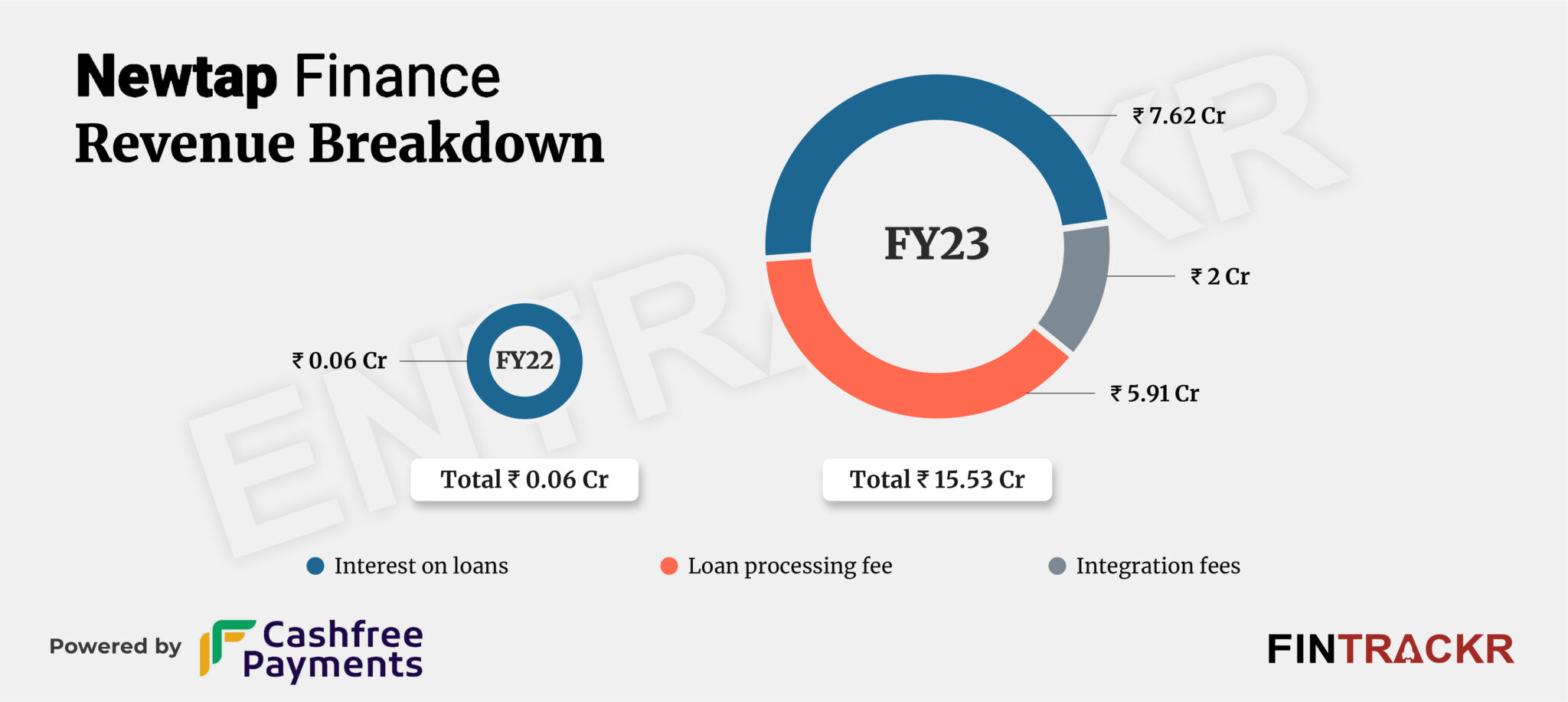

Newtap Finance collects majority of its operating revenue from interest on loans and this formed 49% of the total revenue during FY23. Collections from this vertical ballooned to Rs 7.62 crore during the year from Rs 6.74 lakh in FY22. It’s worth noting that during FY22, Newtap had only interest on loans as the source of revenue.

However in FY23, the company also collected loan processing fees of Rs 5.91 crore and integration fees of Rs 2 crore. Besides this, Newtap earned interest and gain on financial assets (non-operating revenue) of Rs 1.53 crore in FY23 which took its overall revenue to Rs 17.06 crore during the period.

CRED facilitates distribution of its loan products – CRED Cash and CRED Flash through a bunch of NBFC platforms including Newtap Finance.

In November 2021, Shah’s Newtap Technologies acquired Parfait Finance & Investment and later renamed it to Newtap Finance. Shah holds 77% in Newtap Finance via Newtap Technologies and CRED has remaining stake, as per filings.

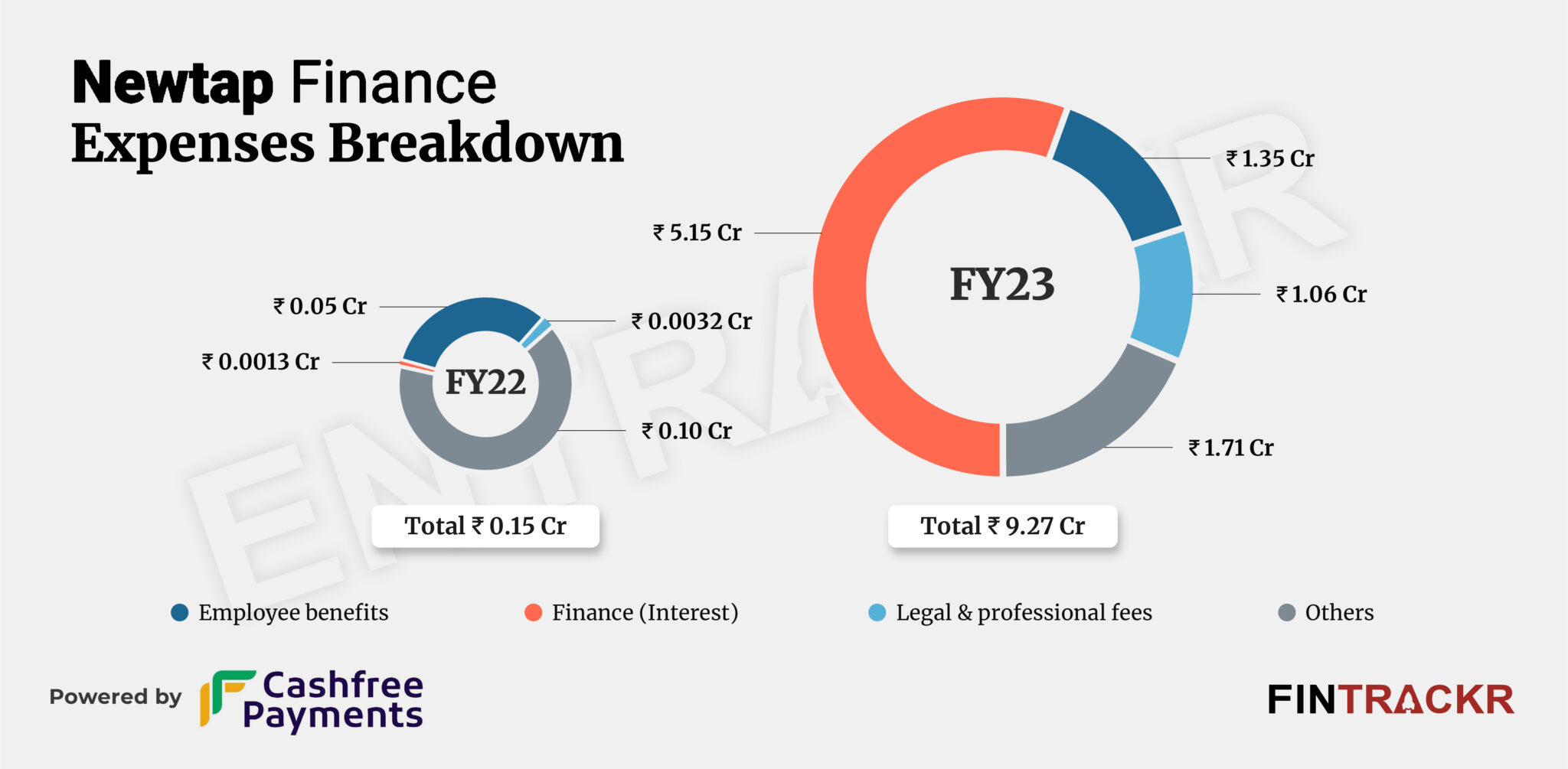

Heading towards expenses, Newtap recorded 55.6% of the total expenditure as finance costs (interest) during the year. This cost shot up to Rs 5.15 crore during FY23 from Rs 13k in the previous fiscal year.

Employee benefits expense soared to Rs 1.35 crore during FY23 from Rs 5 lakh in FY22. According to the company, it is operating with a small team now which can also be observed from its employee cost which seems too low as compared to other players in the space. Further, legal and professional fees jumped to Rs 1.06 crore during the year from only Rs 32k in FY22.

Moreover, the company also incurred expenses related to commission for loan sourcing, membership, subscription et al. which dragged its total expenses to Rs 9.27 crore during FY23. The total expenditure of the company in FY22 was registered at Rs 15 lakh.

Unlike other NBFCs, Newtap has not provided details of non-performing assets (NPAs) under its financial statement.

With a remarkable performance during FY23, the company’s profits grew 5.3X to Rs 5.63 crore during the period as compared to Rs 1.07 crore in FY22.

As per Fintrackr’s analysis, the company has advanced long-term loans of Rs 161.6 crore and short-term loans of Rs 111.3 crore during FY22. As a result, the company’s operating cash flows turned negative to Rs 264 crore in FY23 against Rs 3.11 crore (positive) in FY22.

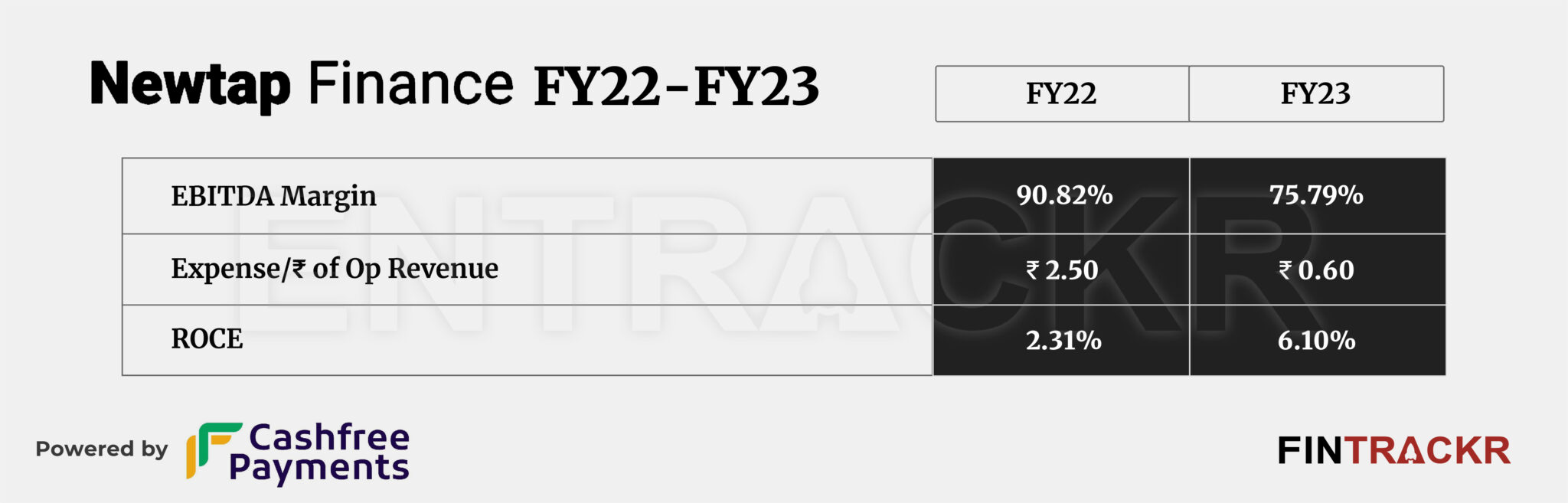

Coming to ratios, EBITDA margin and ROCE of the company stood at 75.79% and 6.10% respectively in FY23. On a unit level, Newtap Finance spent Re 0.6 to earn a rupee of operating revenue.

According to a source privy to the matter, Newtap Finance’s current loan book size stands at around Rs 270 crore.

Newtap Technologies, the holding entity of Newtap Finance, was in talks to raise $50-70 million in its maiden funding round to ramp up its lending business. As per sources, the company is likely to close the deal by this fiscal year (FY24).