BluSmart Mobility, an EV ride-hailing service, and EV charging operator, claims to turn profitable by the end of the calendar year 2023. This confidence likely comes from consistent VC support (read large funding rounds), increasing demand for sustainable mobility options, and customer dissatisfaction with platforms like Uber and Ola.

The target of becoming profitable, however, appears to be quite ambitious if we closely review the company’s bottom line in the fiscal year ending March 2022.

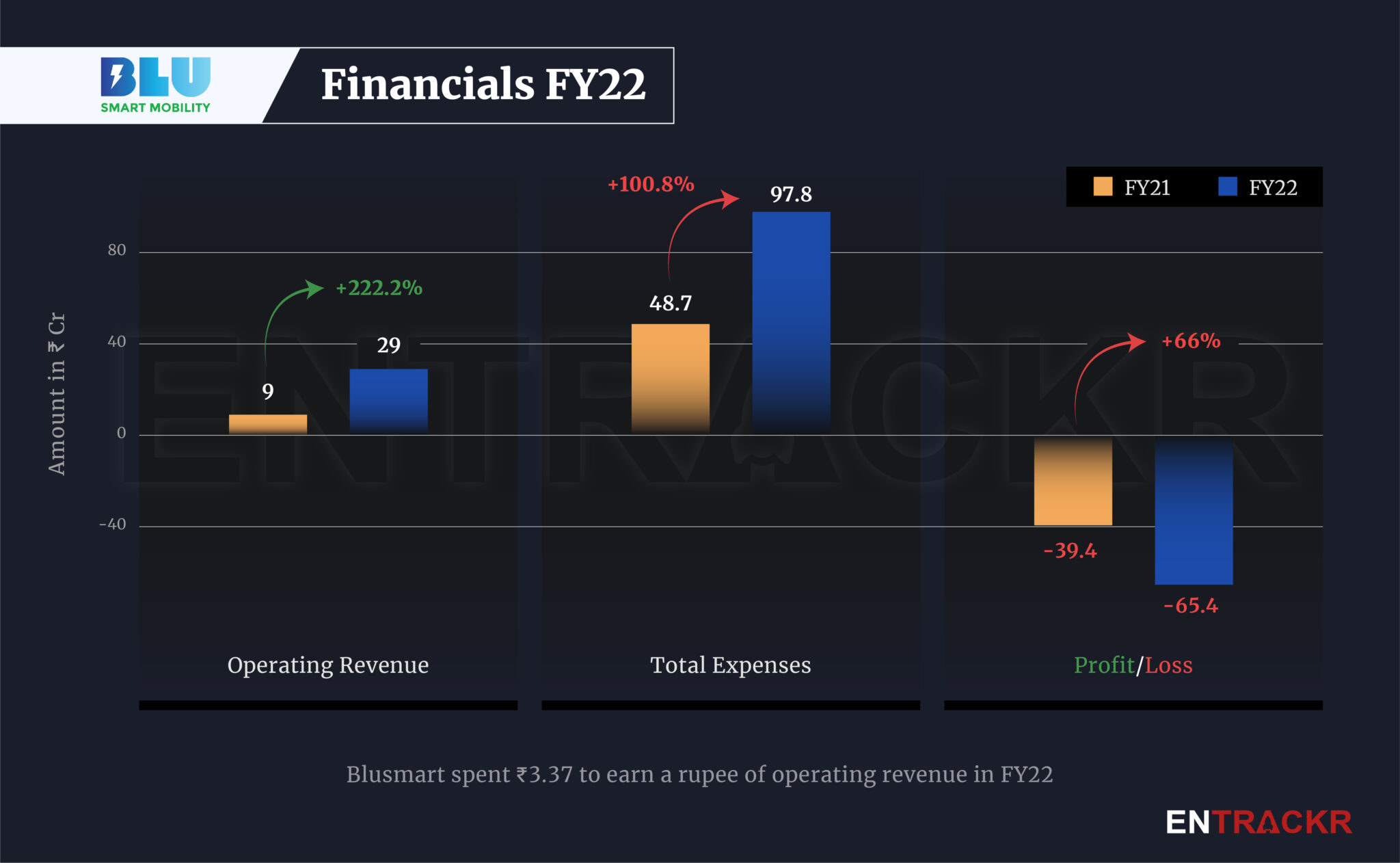

Even as the Gurugram-based firm’s scale jumped 222% to Rs 29 crore in FY22, its losses also grew 66% to Rs 65.4 crore, according to its consolidated financial statements with the RoC.

Founded in 2019 by Anmol Jaggi, Puneet Jaggi and Punit Goyal, BluSmart provides electric cabs in parts of Delhi-NCR and Bengaluru.

Unlike Uber and Ola, it is not a conventional on-demand cab-hailing app and offers pre-scheduled cab services. Cabs and charging facilities were two sources of revenue for BluSmart in FY22. The firm did not disclose revenue break-ups across the two verticals.

Driver related cost formed 24.3% of the total expenditure, which surged 2.18X to Rs 23.8 crore in FY22. The lease rent expenses were another prime cost for BluSmart which grew by 91.3% to Rs 19.9 crore in FY22.

Its employee benefit costs increased 23% to Rs 10.1 crore while legal professional fees and cab charging expenses were recorded at Rs 11.1 crore and Rs 4.6 crore, respectively, during FY22. Ultimately, the company’s burn spiked 100% to Rs 97.8 crore in FY22.

With over two-folds growth in the total cost, its losses grew 66% to Rs 65.4 crore in FY22. Its ROCE and EBITDA margin were registered at -28.18% and -179.57% whereas the company spent Rs 3.37 to earn a unit of operating revenue in FY22.

BluSmart has raised over $109 million so far, including $85 million in an extended Series A round in multiple tranches. As per the company, it has also received an EV asset leasing loan of $150 million (Rs 1,200 crore) backed by Development Financial Institution.

BluSmart claims it does not really compete with Uber and Ola, focusing instead on a few high-value routes with its limited fleet size of EVs. In fact, in the long term, the firm sees Uber, Ola, and many other commercial operators as customers for its EV charging network. The firm has focused on grabbing prime slots across the city with a high-quality charging network, which positions it very well to take advantage of a market when EVs take center stage in numbers.

Considering moves like the Delhi EV policy which pushes cab aggregators to convert to EV fleets by 2030, that strategy holds a lot of promise, and by many accounts, is what convinced many investors of the potential in the business too. On the matter of achieving profitability, it is possible the firm may have come close to operating breakeven, and we should know soon enough once they file their FY23 numbers. But expect a lot of action from this firm, basis their approach so far that has been refreshingly different.