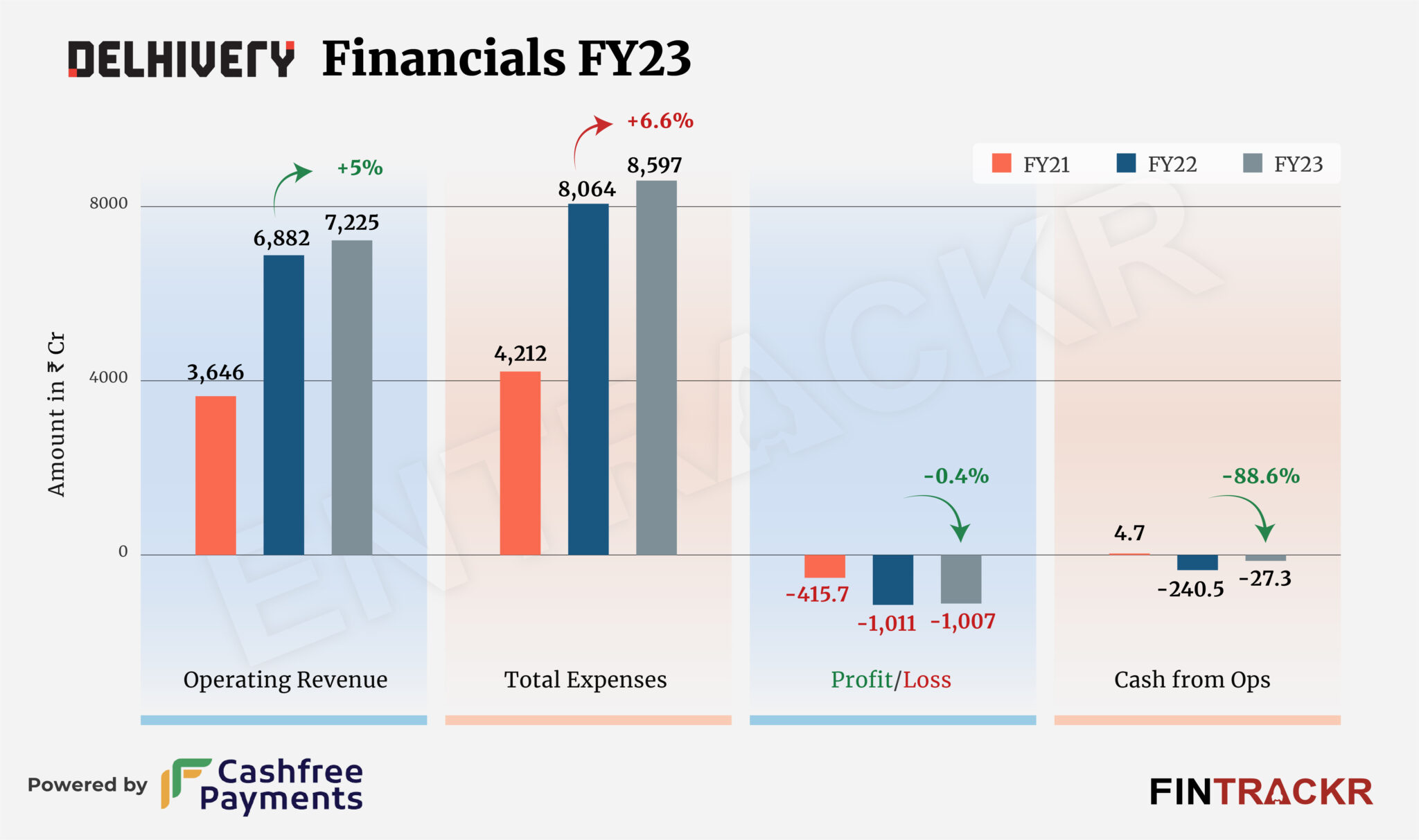

Delhivery’s revenue from operations barely grew 5% to Rs 7,225 crore during the fiscal year ending March 2023 as compared to Rs 6,882 crore in FY22, according to its consolidated annual financial statements sourced from National Stock Exchange (NSE).

On a quarterly basis, Delhivery’s scale went up only 1.9% to Rs 1,860 crore during the Q4 of FY23 from Rs 1,824 crore in Q3 of the same fiscal year. While losses of the company reduced by 18.9% to Rs 158.6 crore in Q4 as compared to Rs 195.6 crore during the third quarter of FY23.

Coming back to the annual results, Delhivery collected around 99% of its operating revenue from India while the remaining came from the rest of the world during FY23. For context, Delhivery has nine subsidiaries including Delhivery USA LLC, Delhivery Corp Limited, and Orion Supply Chain Private Limited among others.

Other than its operating revenue, Delhivery’s non-operating income (majorly interest on financial assets) surged 95.5% to Rs 305 crore during the fiscal, which took its overall revenue to Rs 7,530 crore at the end of FY23.

Delhivery offers a comprehensive range of logistics services encompassing express parcel transportation, PTL freight, TL freight, cross-border operations, supply chain management, and technology solutions. Covering over 18,500 pin codes, it has fulfilled over 2 billion shipments since inception and today works with over 27,000 customers, including large & small e-commerce participants, SMEs, and other enterprises & brands.

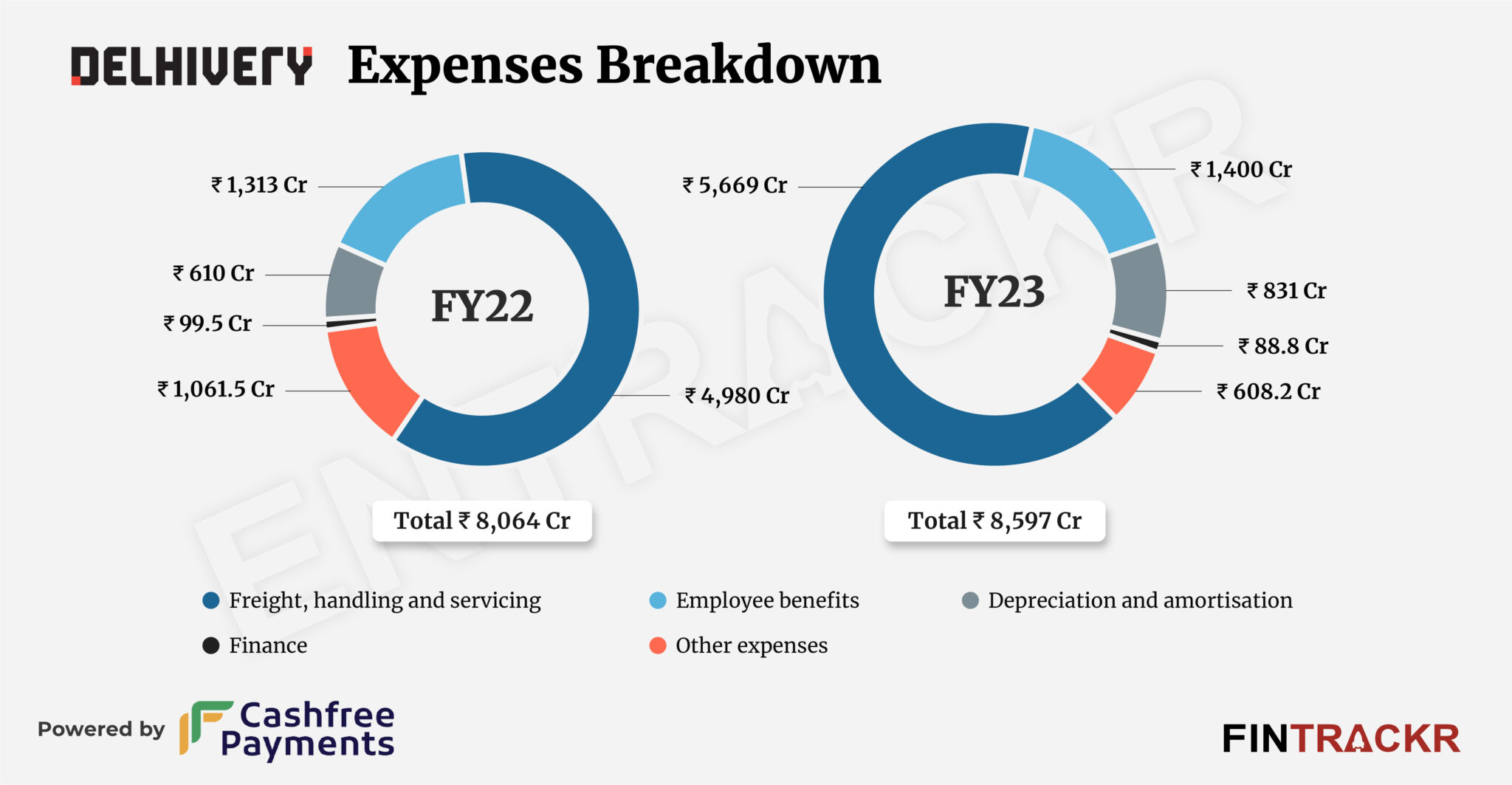

On the expenditure side, freight, handling and servicing formed 66% of the total expenses which increased 13.8% to Rs 5,669 crore in FY23 from Rs 4,980 crore in FY22.

Employee benefit expenses grew 6.6% to Rs 1,400 crore on yearly basis whereas the company also incurred depreciation-amortization and finance costs of Rs 831 crore and Rs 88.8 crore respectively during FY23.

In total, Delhivery’s expenses went up 6.6% to Rs 8,597 crore in FY23 from Rs 8,064 crore in FY22. With the stagnant scale, its losses remained stable at Rs 1,007 crore during FY23 as compared to Rs 1,011 crore in the previous fiscal year.

Following the control over cash burn, operating cash outflows of Delhivery went down 88.6% to Rs 27.3 crore during the last fiscal year.

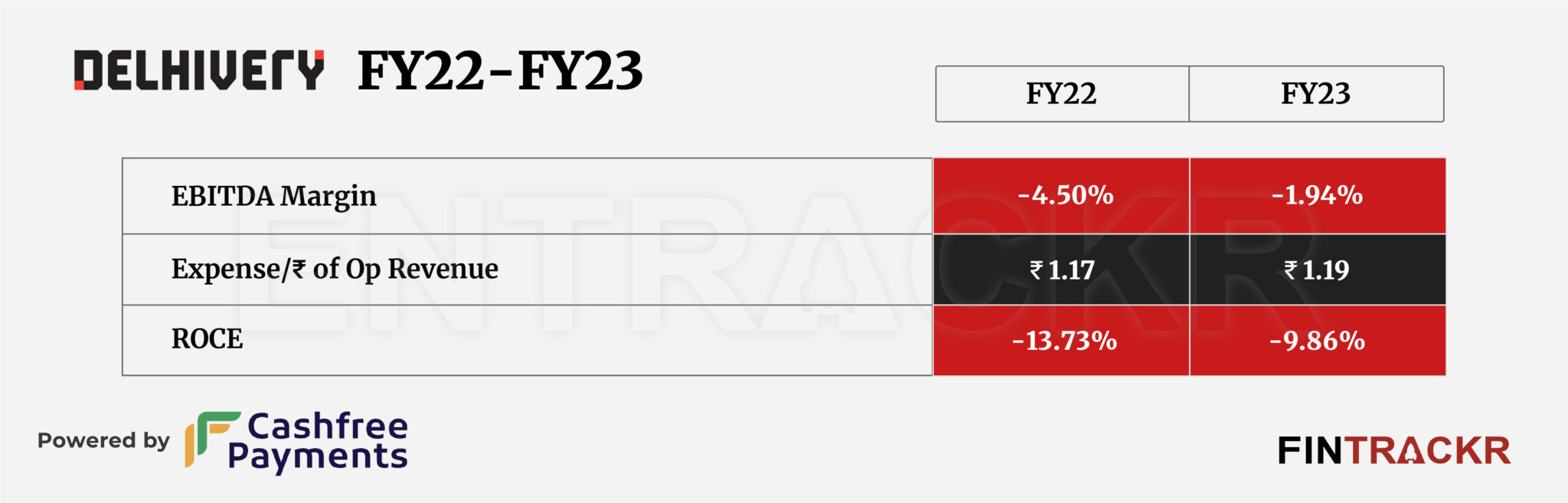

As per Fintrackr’s analysis, EBITDA margin and ROCE of the company bettered to -1.94% and -9.86% during FY23. On a unit level, Delhivery spent Rs 1.19 to earn a rupee of operating income.

On the face of it, the stagnation in growth would seem to indicate just how tough it has been to gain market share over the past year for Delhivery. Whether that would make the firm hostage to overall industry and economy growth rates or it will find a higher gear, we should know soon enough. But there is no doubt that the deceleration will not go down well in the stock market for the listed firm. It will need to justify its premium valuation sooner than later to keep it that way.