Managed office space provider Smartworks claims to have crossed Rs 700 crore in revenue during FY23. The figure seems believable as many co-working space providers have rebounded strongly after the pandemic receded in the country.

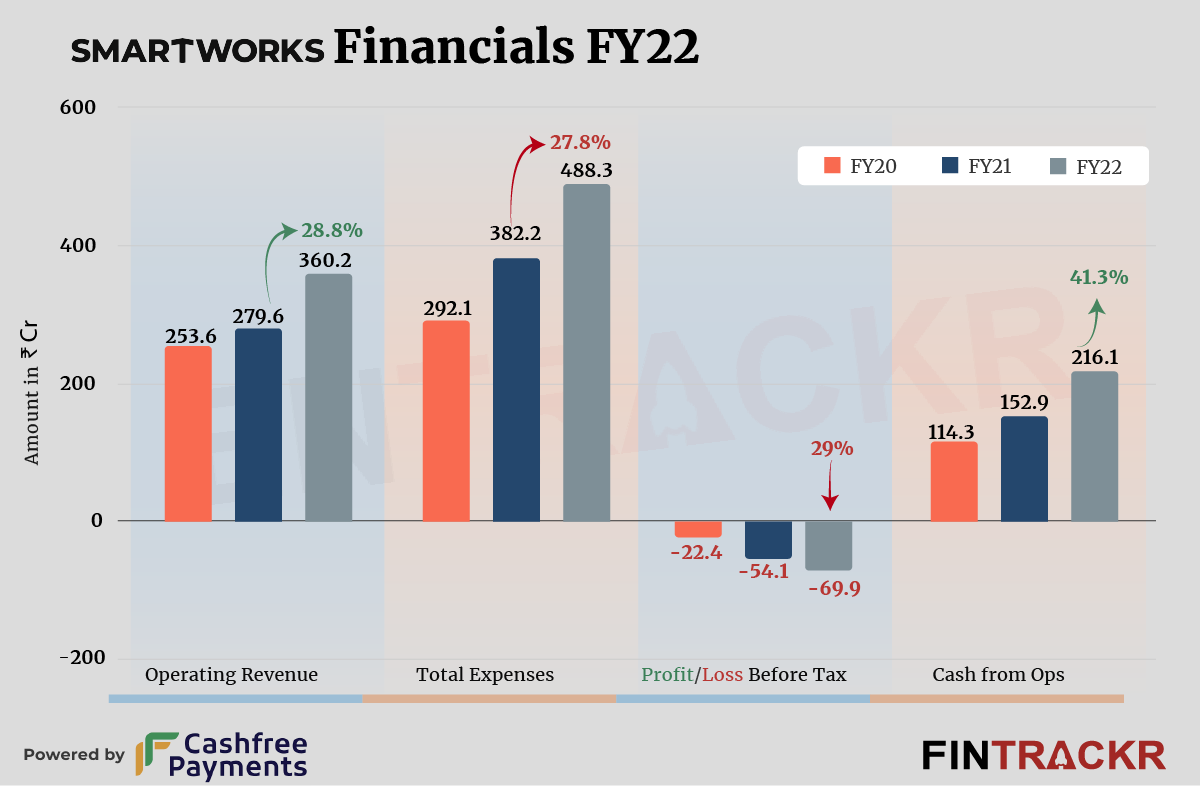

However, Smartworks has done to grow 28% in FY22 itself. Revenue grew 28.8% to Rs 360.2 crore in FY22 from Rs 279.6 crore in FY21, according to its consolidated financial statements filed with the Registrar of Companies.

The sale of services, which includes rental revenue for the use of co-working space and related ancillary services (such as parking charges, internet fees, electricity charges, etc.), was the key revenue driver for the Delhi-based company.

Smartworks also generated other income of Rs 33.96 crore from interest and miscellaneous sources in FY22.

Founded in April 2016 by Sarda and Harsh Binani, Smartworks currently has a real estate of 8-8.5 million square feet, of which 7 million square feet is operational, across 12 cities. The company has also set a target of increasing the space to 12-13 million square feet by March 2024, Sarda told news agency PTI.

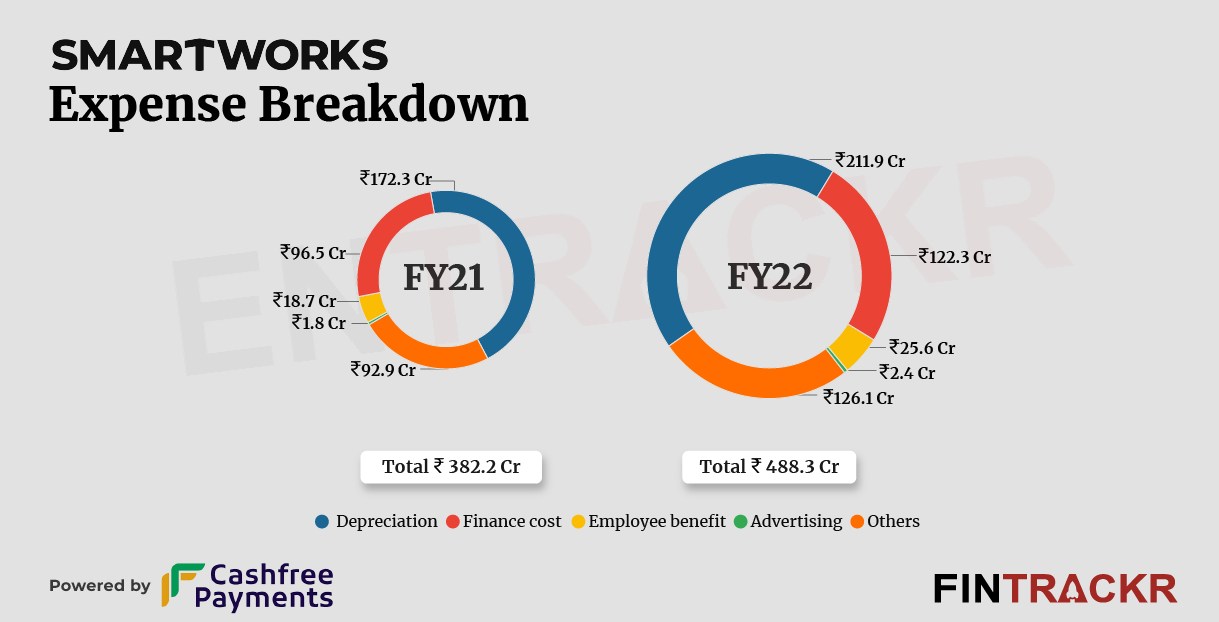

Breaking down the costs, depreciation formed 43.4% of the overall expenditure, indicating the asset heavy approach the firm has taken. This cost grew 23% to Rs 211.9 crore in FY22. Smartwoks has a total financial liability of Rs 2,730 crore (non-current and current), which led to finance costs surging by 26.7% to Rs 122.3 crore in FY22.

Its employee benefit and advertisement costs climbed 36.9% and 33.3% to Rs 25.6 crore and Rs 2.4 crore, respectively, pushing Smartwork’s overall cost by 27.8% to Rs 488.3 crore in FY22.

Smartworks’s losses widened by 29% to Rs 69.9 crore in FY22.

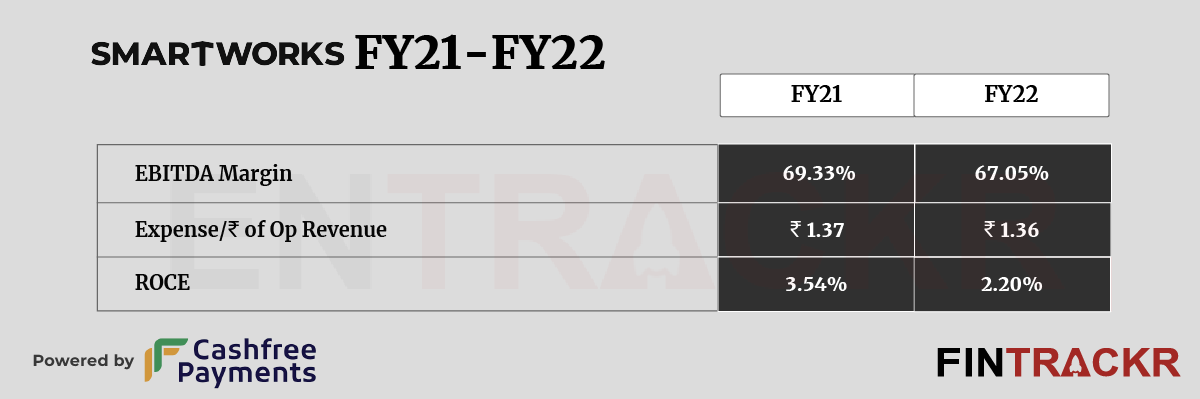

Its ROCE and EBITDA margin were registered at 2.20% and 67.05% during FY22. On a unit level, it spent Rs 1.36 to earn a rupee of operating revenue.

The company last raised $25 million from Singapore’s Keppel Land Ltd in 2019 and is currently in talks to raise $70-90 million.

Smartworks competes with the likes of Indiqube, which achieved a revenue of over Rs 350 crore in FY22. Another rival Awfis reported a revenue of Rs 257 crore in FY22. International co-working space firm WeWork is also quite active in India, and reportedly the valuation of the India unit may surpass the US counterpart.

Despite the competition, the likes of Smartworks have a big opportunity in India. The acceptance of remote and hybrid working models, soloprenuers, and small businesses looking to be asset light are some of the factors driving the surge in demand.

Reports suggest that the occupancy rates at coworking spaces have now shot up to 90-100%, compared with 45-60% a year ago. Co-working spaces had a 27% share in Indian office real estate, according to recent data shared by Anarock. In Q1 2019, its share was mere 14%.

In Q1 2019, its share was just 14%. Funding in co-working space is a testament to such reports as these startups managed to raise over $400 million since January 2021. Startups like Awfis, ABL Workspaces, BHIVE, Table Space, IndiQube, iSprout, and others raised handsome money as offices started reopening post-coronavirus-induced lockdown.

Interestingly, the asset-heavy business models of many Indian-owned co-working spaces, where the firms actually own the offices they run, might be scoffed at by some investors, but in the past two years, as commercial spaces have seen a strong surge in values, these firms are sitting pretty. Further, with commercial prices being more sticky in recent decades during slowdowns, as debt levels get pared down, these firms would be very well placed to weather any downturn.

Smartworks, having gone well past the stage where the business is finding a product market fit, has a long runaway of growth ahead of it, and seems well prepared to take full advantage too.

ALSO READ: The growth of proptech startups in India post covid: Entrackr Report