Indian startups failed to cross the $1 billion mark in funding during a month that was mired with layoffs and lack of large rounds. Moreover, funding in a couple of late stage companies contributed to more than half of the total funding.

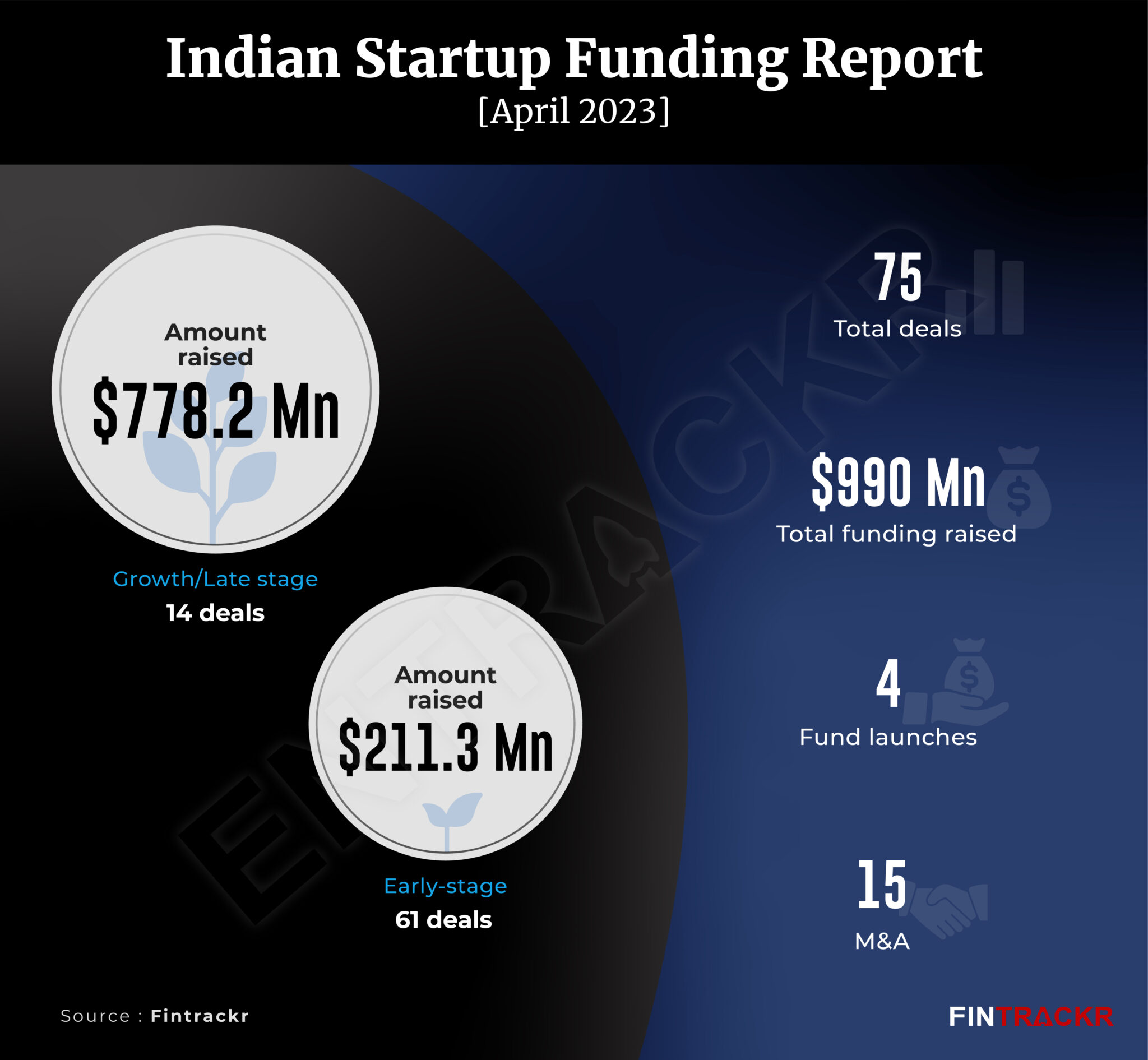

Data compiled by Fintrackr shows that 75 startups managed to raise nearly $990 million in April. This is a sharp decline of nearly 24% from $1.3 billion during the previous month. Growth and late stage startups managed to mop up $778 million across 14 deals while early stage startups bagged $211 million across 61 deals; whereas 11 startups did not disclose their transaction details.

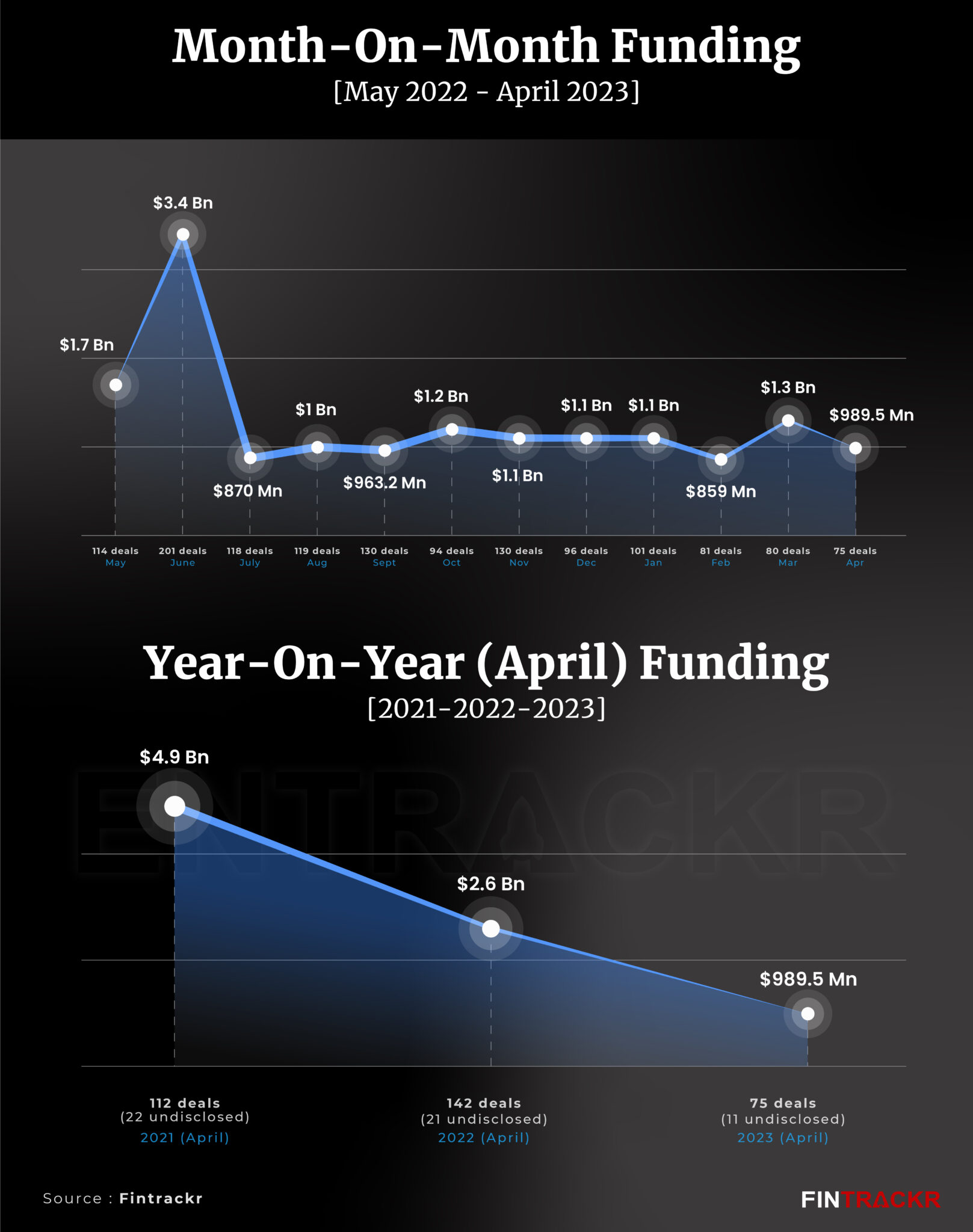

[Month-on-Month trend]

January saw 101 deals amounting to $1.1 billion which fell to $859 million in February and ended the first quarter with an up tick to $1.3 billion in March. Even during last year, Indian startups saw a 33.75% decline in funding from $4 billion in March to $2.65 billion in April. There was also a continuous drop in funding in April in the last three years.

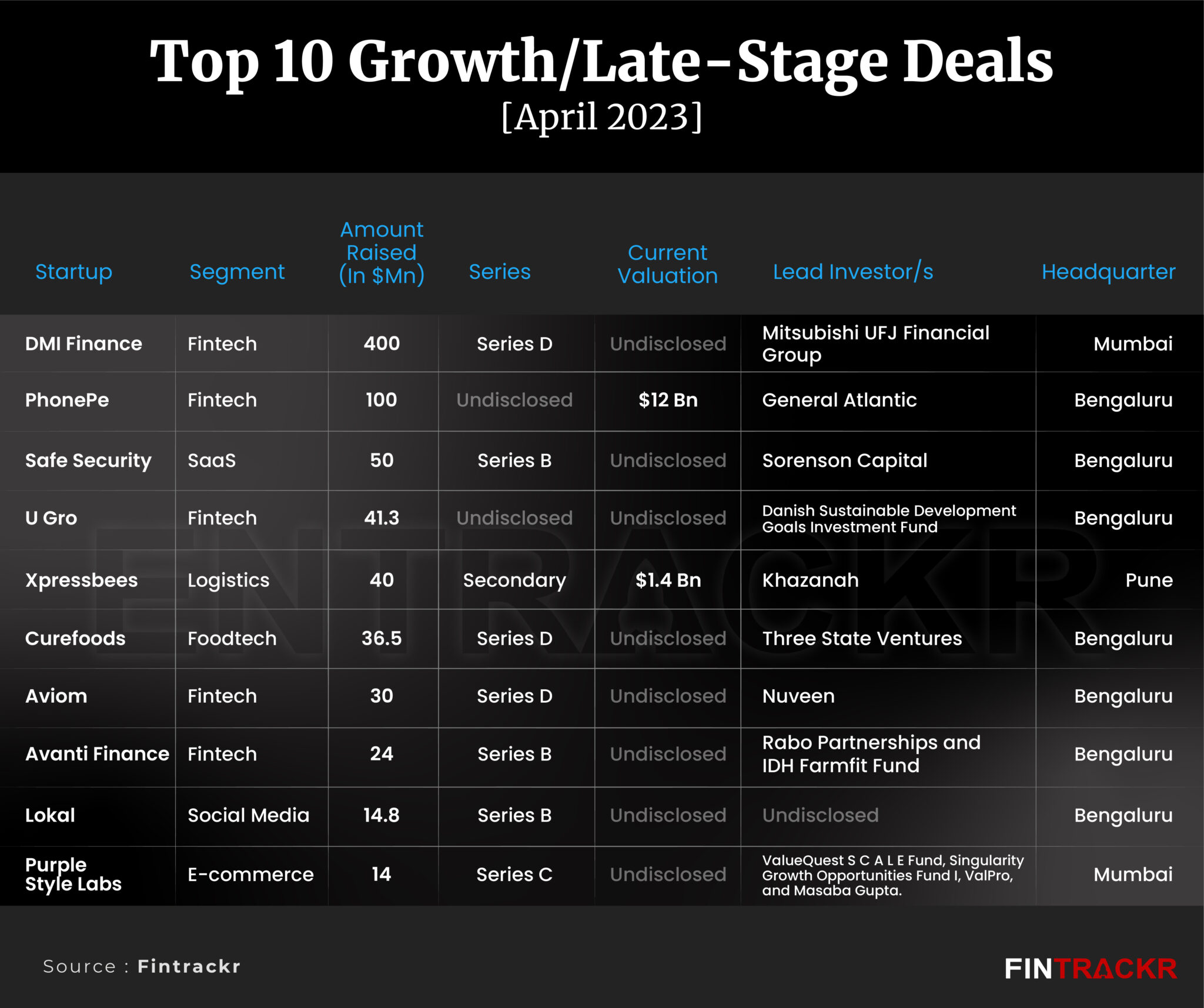

[Top 10 growth stage deals]

In the top 10 growth stage deals, DMI Finance (NBFC) and PhonePe grabbed $400 million and $100 million respectively. Except these two, no startup managed to cross $100 million in funding in the last month.

Cyber risk quantification company Safe Security, fintech company U Gro and cloud kitchen brand Curefoods were next on the list with $50 million, $41.3 million and $36.5 million funding respectively. Third-party end-to-end logistics provider XpressBees saw $40 million in funding via secondary transaction. For the last seven months, no startup has been able to go past the unicorn valuation ($1 billion) mark. India saw its last unicorn in September 2022 when Molbio Diagnostics achieved the milestone with $85 million round led by Temasek.

Also Read: Profit-loss index: Decoding latest financials of 100 unicorns of India

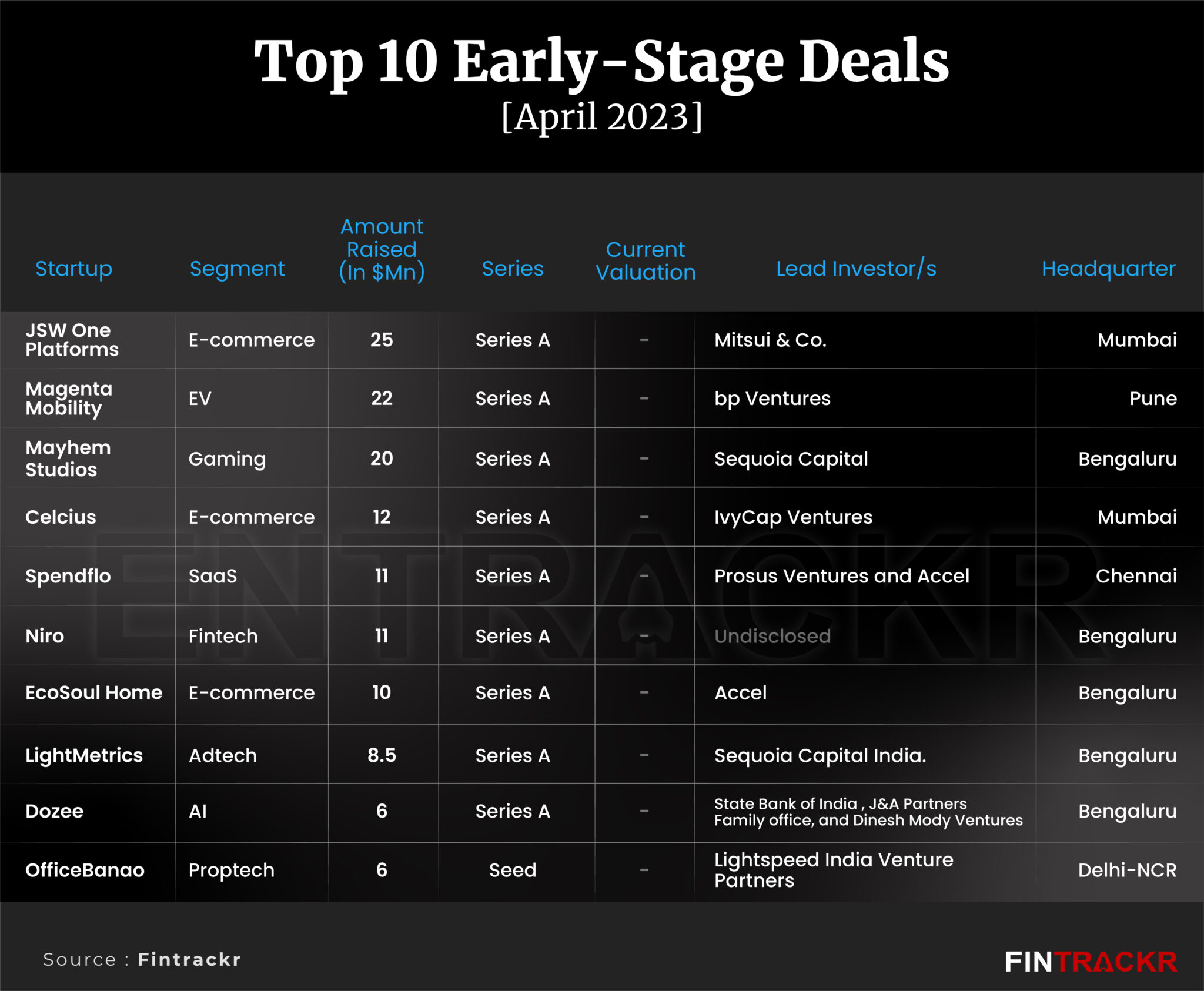

[Top 10 early stage deals]

In the early stage deals, B2B e-commerce firm JSW One Platforms scooped up $25 million in Series A round and stood at top position. Electric mobility solutions provider Magenta Mobility and Mobile game development studio Mayhem Studios are the other two early stage startups to go past the $20 million funding mark in the last month.

Besides the above three, B2B cold chain marketplace Celcius, SaaS buying and management platform Spendflo, consumer-lending platform Niro and D2C eco-friendly products maker EcoSoul Home were notable deals in the list.

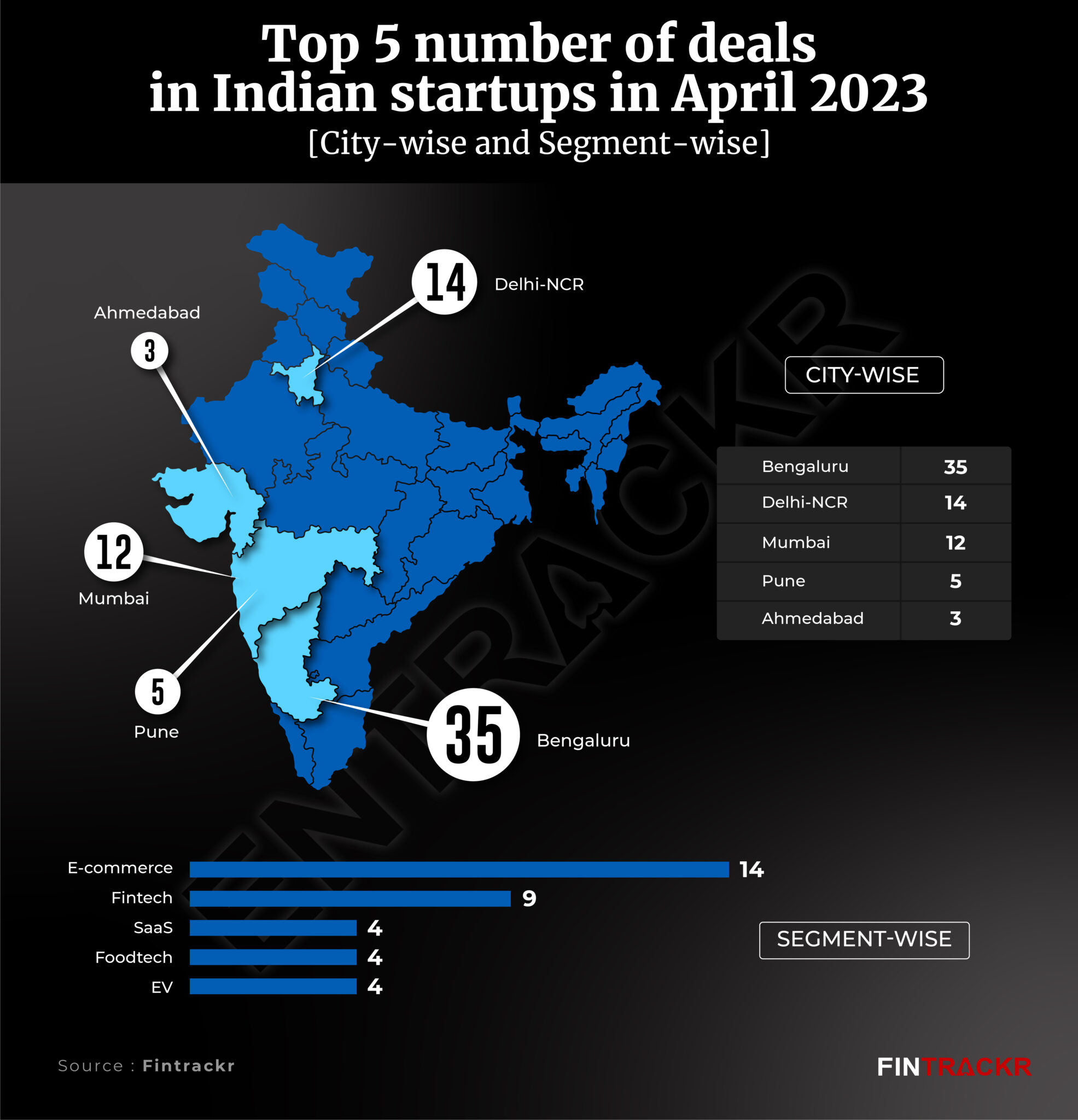

[Segment and city wise deals]

E-commerce leads the pack in terms of number of deals in April. These companies raised over $68 million across 14 deals. However, fintech remained on top when it came to the amount raised. Last month, 9 fintech companies mopped up $615 million in total and accounted for more than 60% of the overall funding. SaaS, foodtech, EV and AI were next on the list. Edtech and agritech were on the 10th and 11th spot respectively.

City wise, Bengaluru retained its numero uno position with 35 deals (more than 40% of overall funding) followed by Delhi NCR which saw 14 deals. Mumbai was on third spot in terms of number of deals but it surpassed Delhi NCR by a huge margin when it comes to value of deals. Pune and Ahmedabad managed to be in the top 5 list.

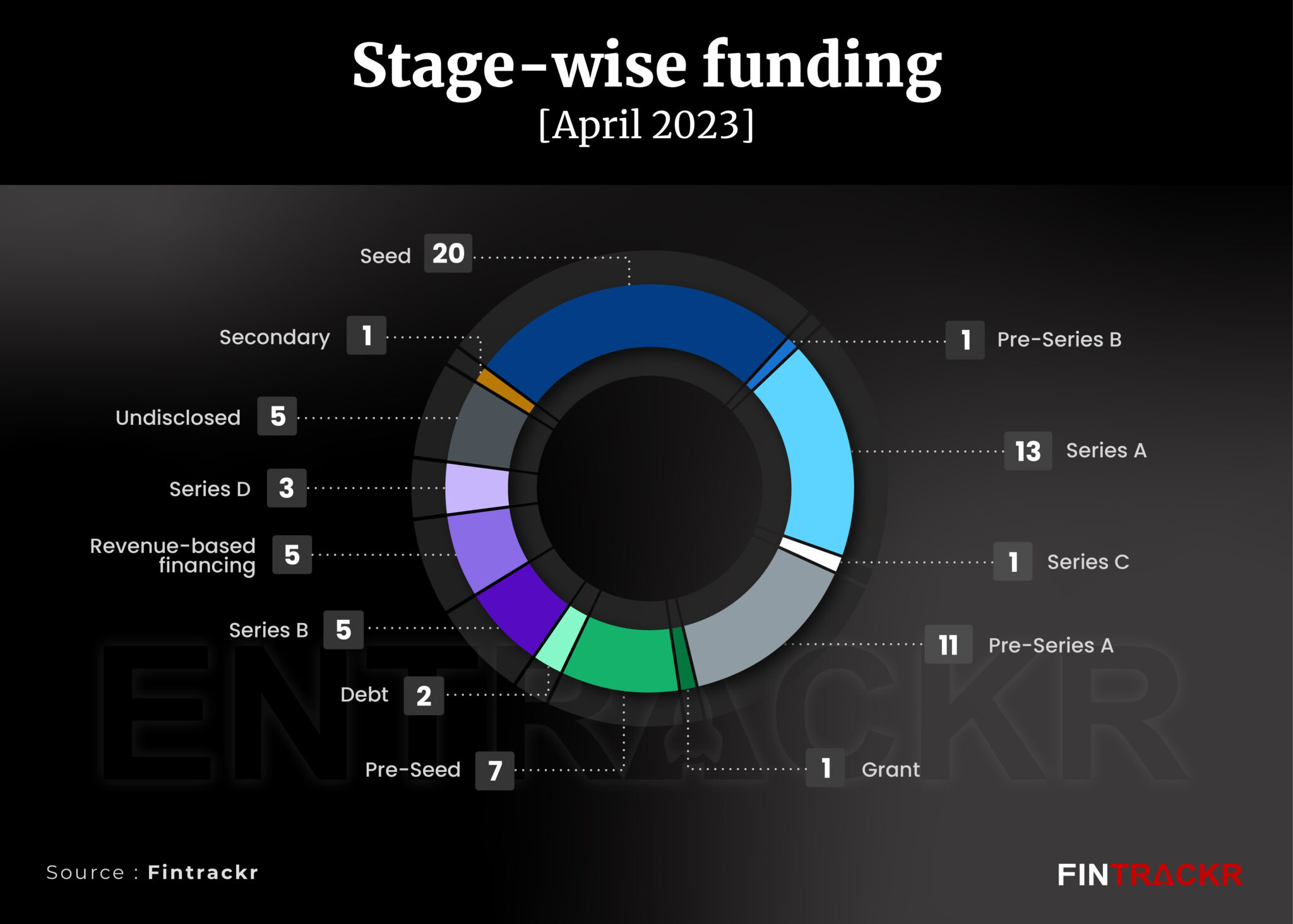

[Stage wise deals]

April saw 20 seed funding whereas 7 deals were in the pre-seed stage. This was followed by Series A and pre-Series A where 13 and 11 startups got funded respectively. In growth and late stage deals, Series B, Series C and Series D saw 5, 1 and 3 deals respectively. It’s worth highlighting that 5 startups funded through revenue-based financing during the last month.

[Mergers and Acquisitions]

There were 15 mergers and acquisition deals in April. While deal size of most of the acquisitions remains undisclosed, there were few notable deals in the last month. The acquisition of Verak by InsuranceDekho, Metamorphosis Edu by BrightCHAMPS, TROOPERS by Betterplace were in the spotlight.

[Layoffs]

As per data compiled by Fintrackr citing various media reports, 12 startups laid off part of their staff in April. More than 1700 employees were impacted by this move. During the first quarter of 2023 (January-March), more than 6,000 employees were fired. Byju’s, Unacademy, upGrad Campus, ShareChat, GoMechanic and Swiggy saw the most number of layoffs during Q1. At this rate, the layoffs number may surpass or get closer to previous year’s record. For context, the layoff numbers were more than 20,000 in 2022.

[Conclusion]

Even as the funding slowdown drags on for startups, it is clear that spaces like e-commerce, SaaS and IT are well out of the priority lists of investors. Scarcely believable investments into quick commerce, Kirana tech and the likes that have hurt investor pockets and credibility should also be a thing of the past, as reality takes hold.

While the opportunities in fintech remain, and will continue to attract both new startups and investors, what is long overdue is the beginning of stronger investor interest in areas like climate tech and renewables, where policy changes are creating space for new startups to step in. Be it carbon markets, or renewable energy, these will be more considered opportunities where long term financing will be welcomed.

Even as some of the largest fund backed startups in edtech or fintech seem to be struggling, don’t rule out a strong revival in these segments at some stage, as an ongoing consolidation eases out inefficiencies. These remain massive sectors that will inevitably attract capital, as we have seen with even agritech, where, despite many hurdles, capital has found a way to incubate increasingly large firms.