The rise of healthcare space is set to be another big India story. Since 2016, the healthcare industry has grown at a CAGR of 22% to hit $372 billion in 2022. Backed by various government initiatives, including Ayushman Bharat, and rise of several VC-funded startups, healthcare space has become more democratic than ever.

Though there’s an appetite for healthcare services across India, at macro-level, many corporates are yet to fix the complexities of providing comprehensive healthcare coverage, depriving a large number of modern workforces of its benefits. This is where Alyve Health is trying to make an impact.

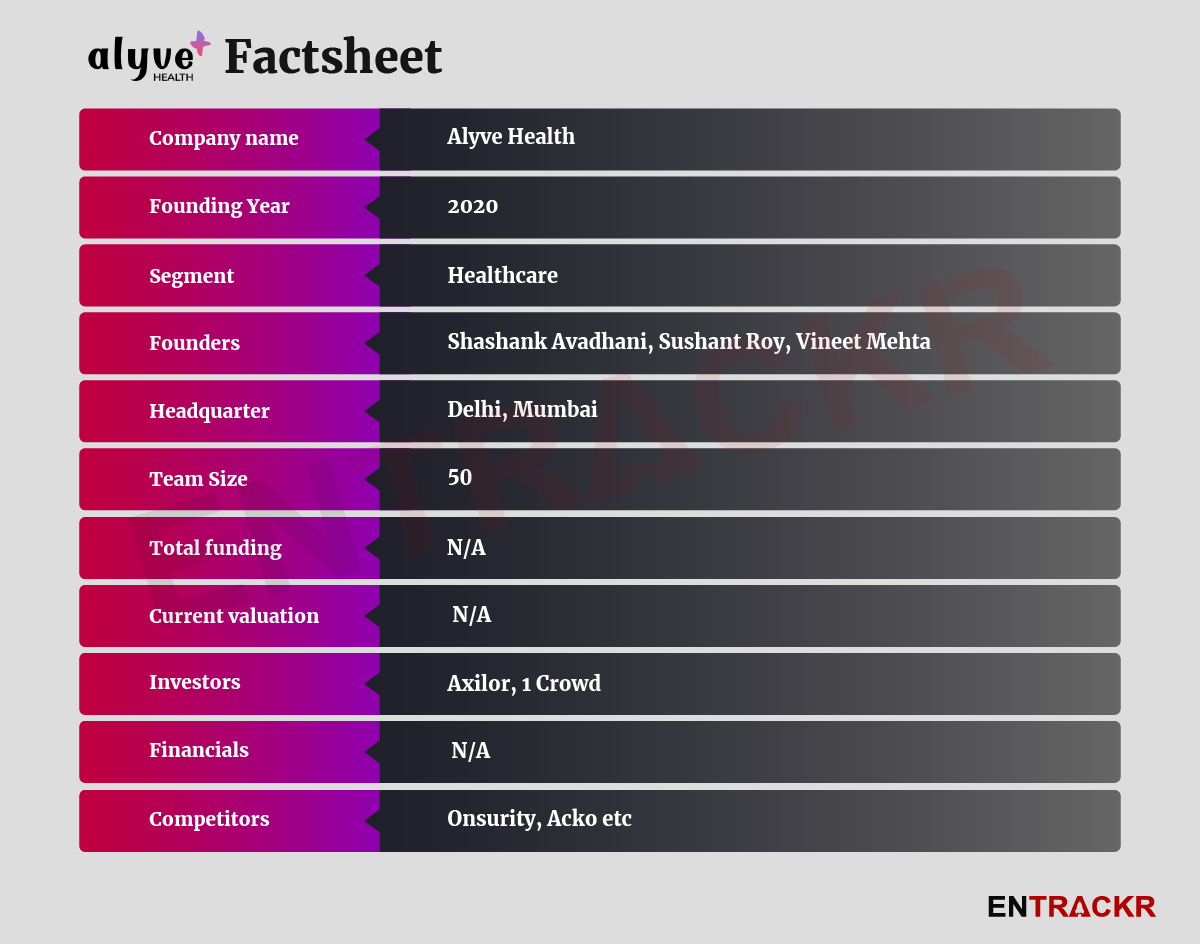

Founded in 2020 by Shashank Avadhani and Sushant Roy, Alyve Health offers a range of healthcare services, including insurance, health check-ups, out-patient care, fitness, and preventive care, all on one integrated platform. This provides greater accessibility and convenience for members, allowing them to access all their coverage in one place and eliminate the complexity of pillar-to-post healthcare journeys. Members can also track and monitor their progress towards their health goals and outcomes with the help of the platform.

For groups, Alyve Health offers the ability to configure multiple coverages and benefits on one platform, rather than negotiating with multiple vendors. This is aimed at allowing secure financial benefits of scale of supply and helps fight the rising costs of healthcare by shifting spending towards prevention. Communities can be of multiple types like corporate, educational institutions, alumni, shared goals, housing Society, and more.

“Our primary unique selling point is the rapid configuration and launch of plans and programs, accomplished in just minutes. This is made possible by our integration with over 25 insurance and healthcare networks, as well as our capacity for tailoring services to each group’s needs,” founders told Entrackr.

Alyve Health has raised an undisclosed funding in a seed round. Founders said they are in the market to raise a series A round, which they expect to close in the next few weeks. Founders did not reveal financials and other related information.

That said, group insurance as a concept is becoming increasingly popular in India. It’s also reflected by the popularity of startups leveraging technology to democratize health insurance in India, such as Acko, Digit Insurance, Plum, and Onsurity. As mentioned above, the healthcare insurance market is really huge in India and more startups with unique propositions can make a mark. In conclusion, the growing popularity of group insurance and the emergence of innovative startups in the healthcare insurance market in India demonstrate the potential for continued growth and transformation in the industry.