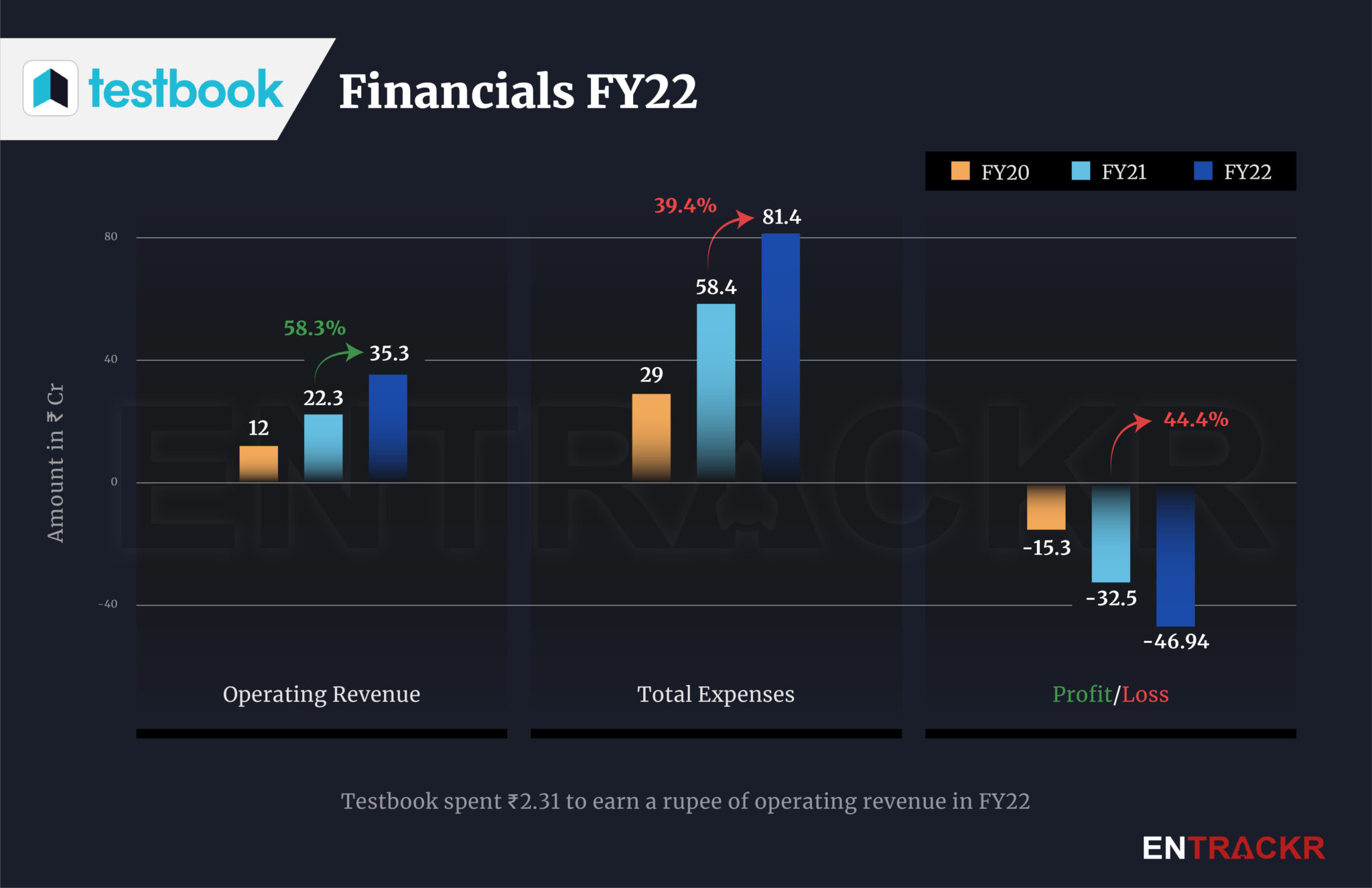

Competitive exam preparation platform Testbook has grown at a rapid clip during the last two fiscal years and crossed Rs 35 crore in revenue in FY22. However, its losses have gone up around three-fold in the last two fiscal years.

Mumbai-based Testbook’s revenue from operations grew 58.3% to Rs 35.3 crore during the fiscal year ending March 2022 as compared to Rs 22.3 crore in FY21, as per its financial statement with the Registrar of Companies (RoC).

Founded in 2014, Testbook helps students from smaller cities prepare for government exams through live classes, mock tests and quizzes. The firm primarily makes its money from selling online courses and mock test papers.

On the expense side, employee benefit cost accounted for nearly 39% of the total expenses. The cost ballooned 46% to Rs 31.7 crore in FY22 from Rs 21.73 crore in FY21. Payments to freelancers shot up 3.9X to Rs 10.81 crore during the year from Rs 2.74 crore in FY21.

Spending on advertising & promotional expenses shrank to Rs 14.91 crore during FY22 whereas IT costs (server & cloud storage and techtools charges) and legal professional fees spiked to Rs 4.83 crore and Rs 1.03 crore.

In the end, its total expenses surged 39.4% to Rs 81.4 crore in FY22 from Rs 58.4 crore in FY21. Along with the rising expenditure, annual losses of Testbook also soared 44.4% to Rs 46.94 crore during FY22 as compared to Rs 32.5 crore in FY21. Testbook spent Rs 2.31 to earn a rupee of operating income in FY22.

As per its balance sheet, Testbook’s current investments and cash & bank balances contracted around 99% and 60% respectively to Rs 24 lakh and Rs 4 crore during FY22.

Testbook has raised around $13 million or Rs 90 crore to date from Iron Pillar, Matrix and a clutch of angel investors. It was valued at around $37 million post-Series B round in January 2020.

In September 2022, B2B edtech firm Classplus bought a minority stake (34%) in Testbook via a secondary transaction. According to Entrackr sources, the investment is strategic in nature and Classplus may fold-up Testbook completely into the company in the future.