YouTube acquired vernacular social commerce startup Simsim for an undisclosed sum during FY22. But, despite being under the hood of Google, the Delhi-based startup’s growth during FY22 was not high-paced.

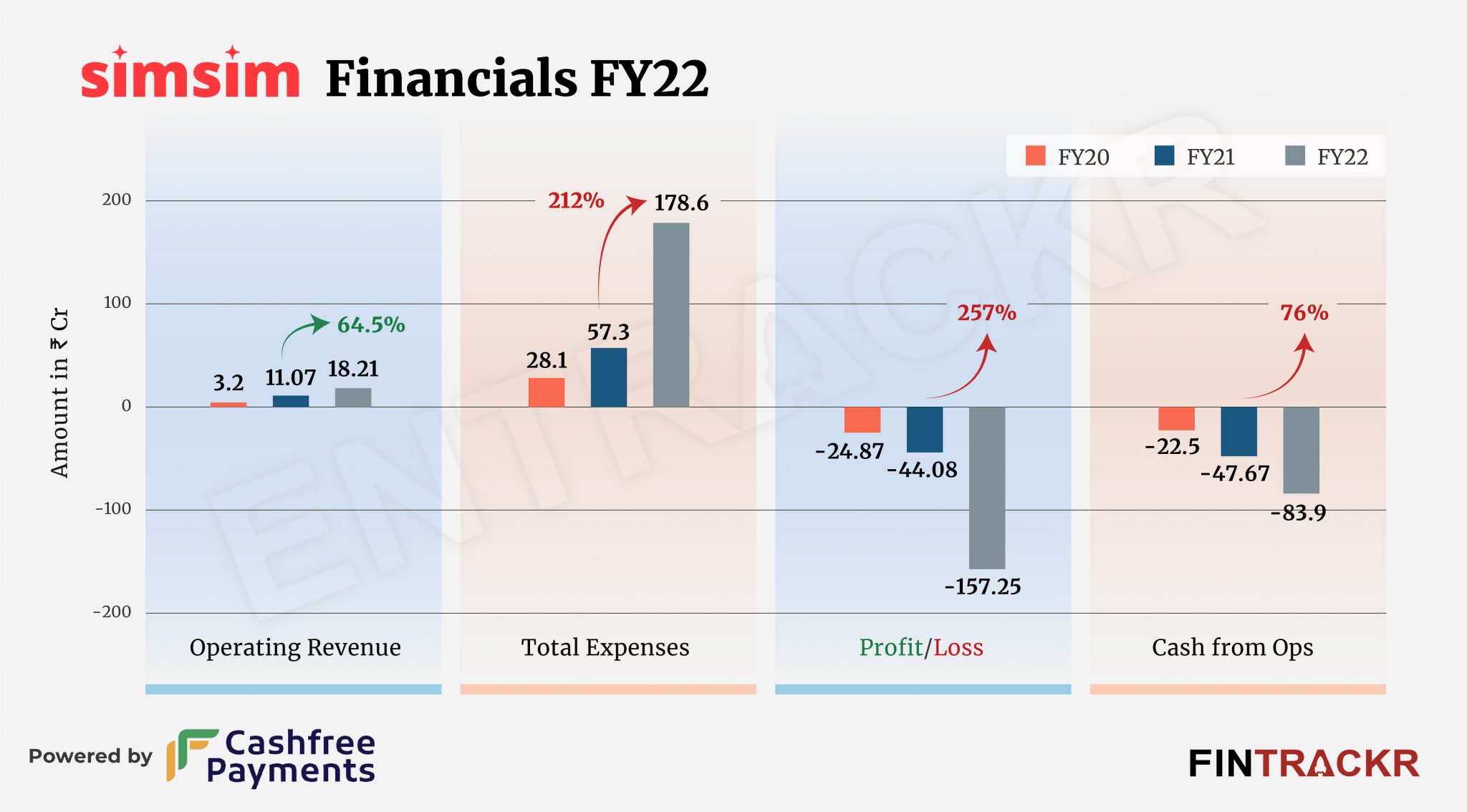

Simsim’s revenue from operations grew 64.5% to Rs 18.21 crore during the fiscal year ending March 2022 as opposed to Rs 11.07 crore in FY21, as per its annual financial statement with the Registrar of Companies (RoC).

Meanwhile, its losses crossed a whopping Rs 155 crore during the same period.

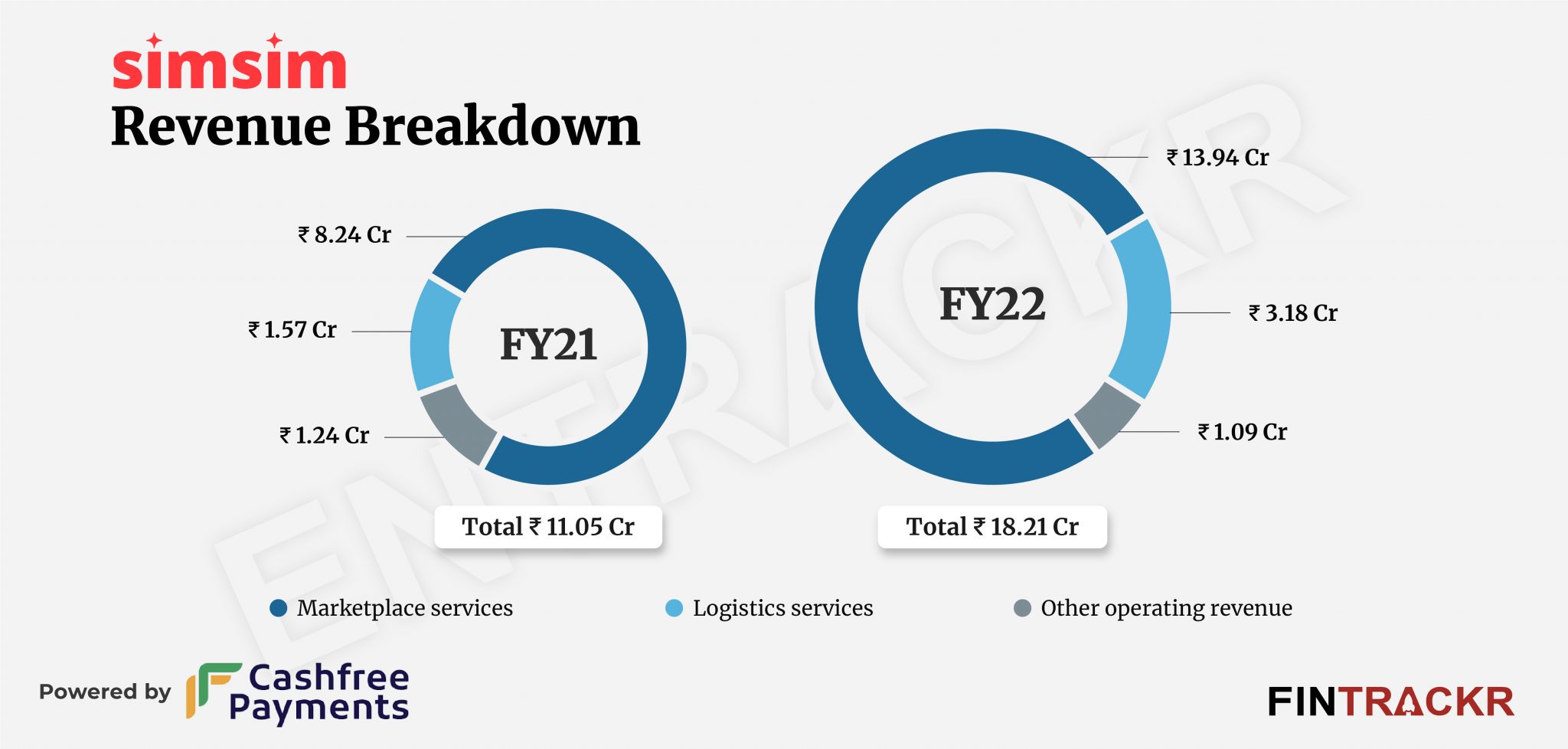

Simsim provides a technology platform to merchants and influencers to retail fashion, household, and consumer products. It majorly makes money from marketplace services such as transaction fees. Collections from these services surged 69% to Rs 13.94 crore during the last fiscal from Rs 8.24 crore in FY21.

The company also provides logistics services and collections from this vertical spiked over 2X to Rs 3.18 crore in FY22 while it made Rs 1.09 crore from promotional activities and other support services.

Simsim also earned non-operating revenue of Rs 3.13 crore which took its overall topline to Rs 21.34 crore during FY22.

Founded by Amit Bagaria, Kunal Suri and Saurabh Vashishtha, Simsim enables retailers of all sizes to reach buyers through video in three local languages: Hindi, Tamil and Bengali.

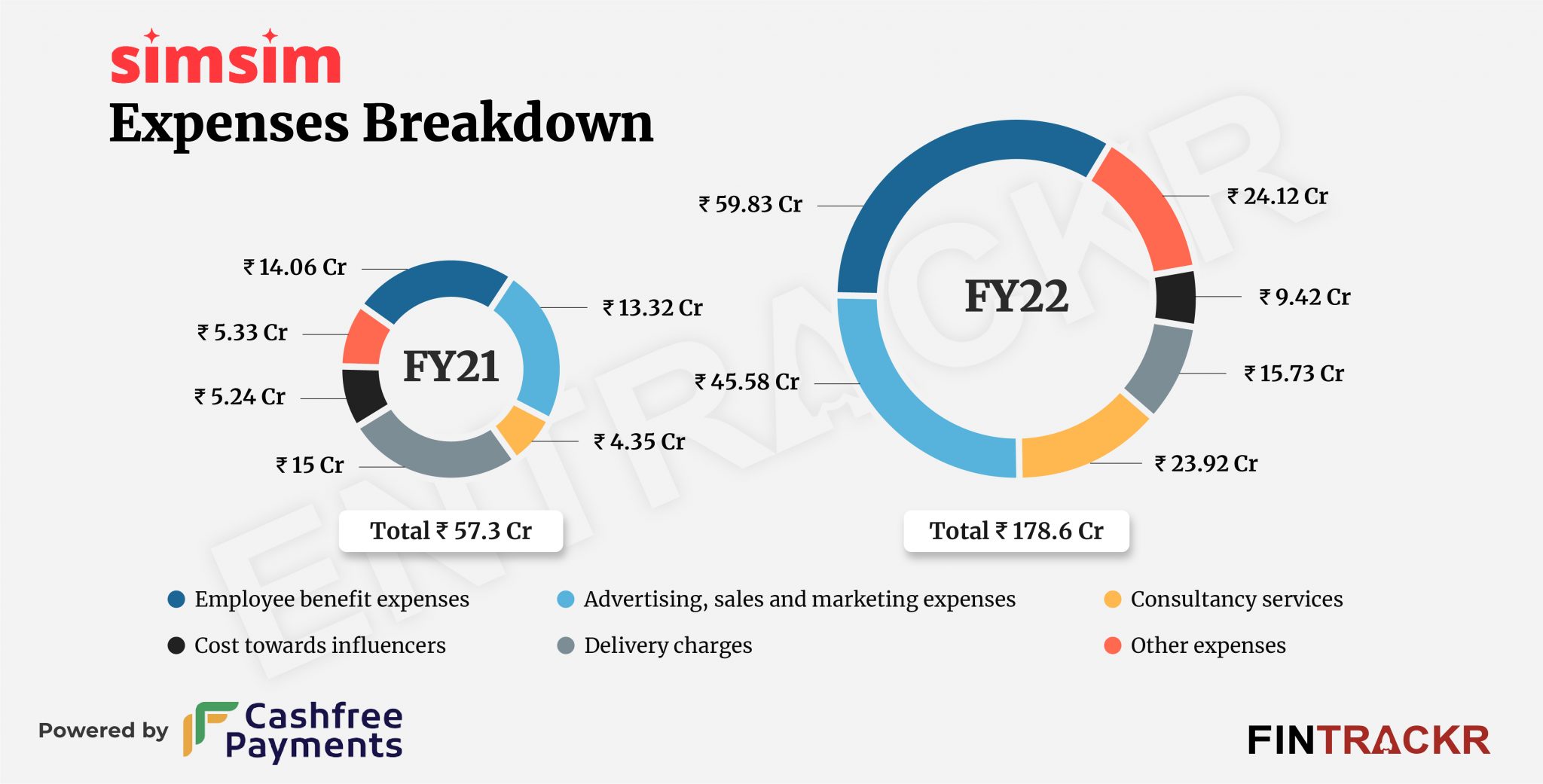

Heading towards expenses, employee benefits formed 33.5% of the total expenses which exploded over 4X to Rs 59.83 crore in FY22 from Rs 14.06 crore in FY21. Importantly, these expenses also include Rs 7.28 crore worth of ESOP cost.

To fuel up its growth and acquire more customers, Simsim spent aggressively on advertising and promotional activities. This cost shot up 3.4X to Rs 45.58 crore in FY22 while its expenses towards influencers grew around 80% to Rs 9.42 crore.

Spends on consultancy services spiked 5.5X to Rs 23.92 crore in FY22 from Rs 4.35 crore in FY21. It also incurred Rs 15.73 crore and Rs 6.31 crore on delivery and cloud server charges respectively.

Following the rising cash burn, its total expenses soared over three fold growth to Rs 178.6 crore in FY22 as compared to Rs 57.3 crore in FY21. Simsim’s cash outflows from operations also went up 76% to Rs 83.9 crore in the last fiscal year.

In line with expenses, the company’s losses also mounted 3.5X to Rs 157.25 crore during FY22. Moreover, its outstanding losses climbed 3.2X to Rs 226 crore during the same period.

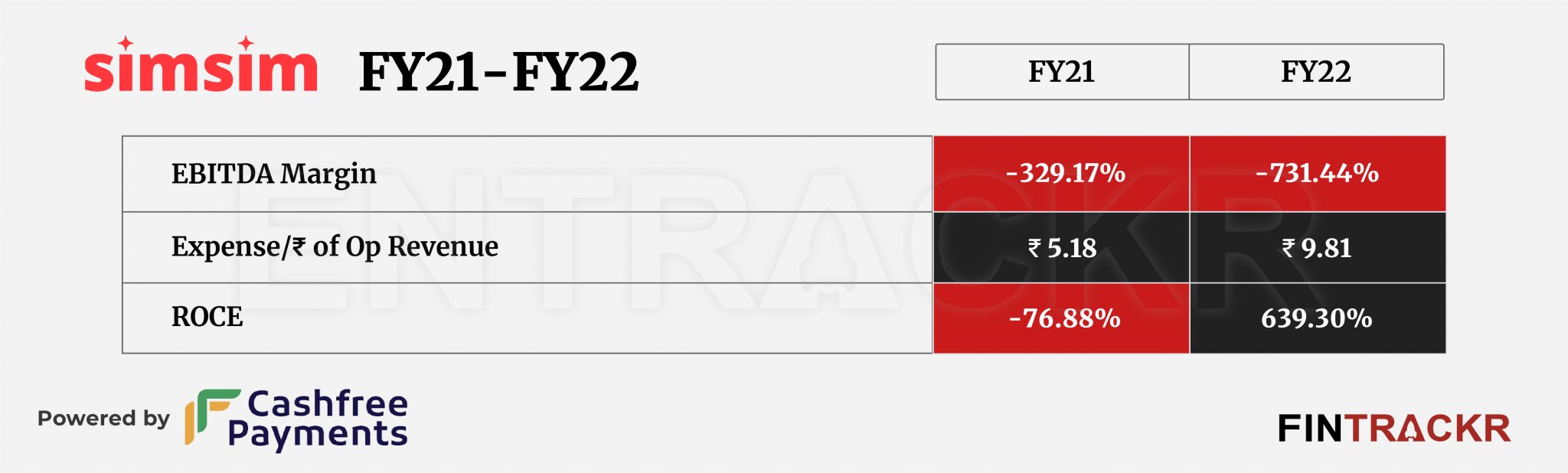

As per Fintrackr’s analysis, its EBITDA margin weakened to -731.44% during the year which could be attributed to rise in employees and customer acquisition costs. On a unit level, Simsim spent Rs 9.81 to earn a rupee of operating income during FY22.

Simsim has raised around $17 million to date and was last valued at around $50 million following its Series B round of $8 million during February 2020. In July 2021, YouTube acquired Simsim to help its viewers discover and buy products from Indian retailers. The size of the deal remained undisclosed and was reportedly valued at over $70 million.

Google has recently laid off over 450 employees as a part of its global plan to reduce its workforce by 6% or around 12,000 employees. According to a media report, the lay off also includes around 70% of the workforce of Simsim.

In the video commerce space, Simsim directly competes with EkAnek and BulBul. Alpha wave-backed EkAnek’s operating scale surged 2.8X to Rs 9.16 crore in FY22 while its losses surged 70% to Rs 25.85 crore. BulBul was acquired by Good Creator Co (GCC), a subsidiary of The Good Glamm Group.

Simsim is one of the few startups that managed to score a Series B round of funding within six months of launch. The numbers definitely make you wonder about the pitch the firm made to score so well. Were losses projected for the next 2-5 years? Or a P&L that would be completely unviable without the funding in the bank?

We checked out some of the videos on the site, and it left us distinctly nonplussed. Be as it may, one has to wonder about the business model when perfectly acceptable videos are being made for next to nothing by thousands of ecommerce entrepreneurs today. The only model which seems feasible here is an end-to-end model of discovery and sales for its customers, with video being just a potential feature to be used, or in YouTube’s case, the hero as part of a larger offering.