Omnichannel jewellery brand BlueStone raised over $30 million led by Hero Enterprise at the end of the fiscal year ending March 2022. The fund infusion after a gap of six years had come with over 88% growth in its operating scale during FY22.

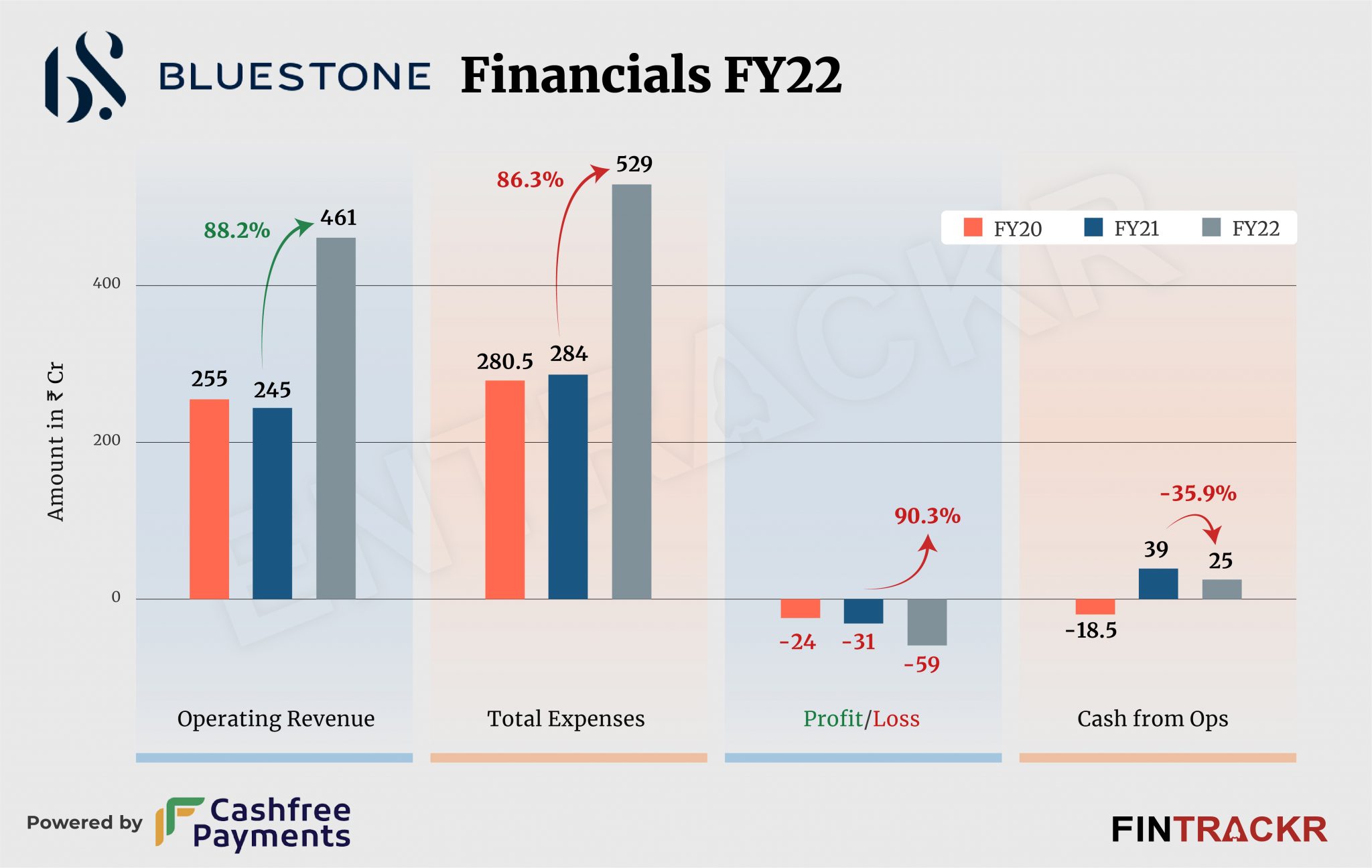

BlueStone offers rings, pendants, chains, and earrings made up of gold and diamonds through its retail outlets and website. The company made its entire operating revenue from the sale of the products which surged 88.2% to Rs 461 crore in FY22.

The firm also made Rs 15.3 crore from interest on current investments which took its total revenue to Rs 477 crore in FY22.

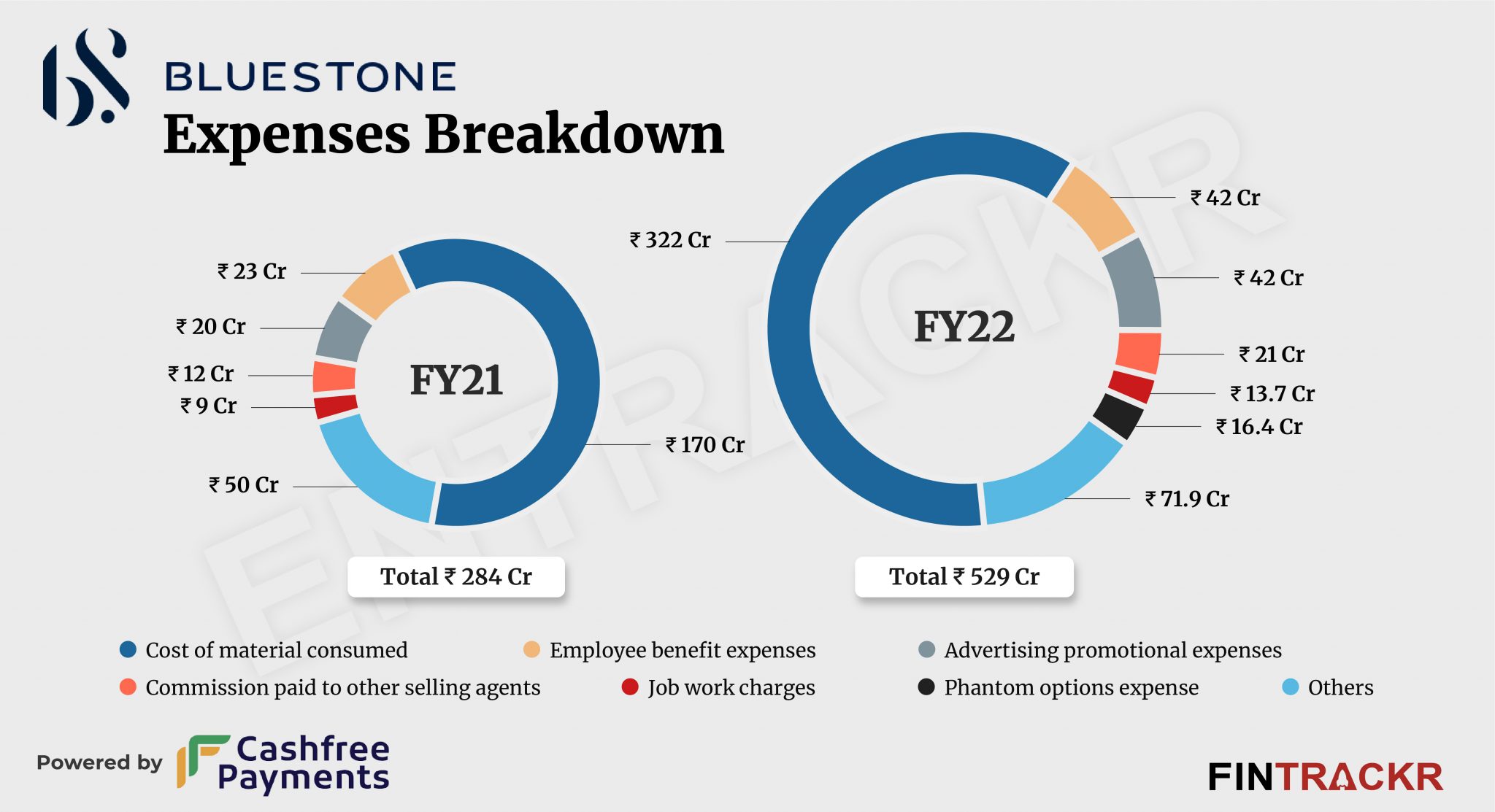

As BlueStone manufactures and retails high-value jewellery, the cost of material accounted for 61% of its overall cost. This expense shot up 89.4% to Rs 322 crore in FY22 from Rs 170 crore in FY21.

Its expenses on employee benefits spiked 82.6% to Rs 42 crore in FY22 while the cost of commission to agents grew 75% to Rs 21 crore. Advertising and promotion costs for BlueStone surged over 2X to Rs 42 crore in FY22. The firm also booked Rs 16.4 crore on phantom option expenses during FY22 which pushed its overall expenditure by 86.3% to Rs 529 crore in the last fiscal year.

BlueStone also registered a non-cash expenditure of Rs 1,209 crore in FY22 due to an accounting policy corresponding to the change in the fair valuation of compulsorily convertible preference shares. Considering the non-cash nature of these expenses, Entrackr has excluded these costs while calculating the total expenses, losses and ratios.

Outpacing its revenue growth, BlueStone’s losses rose around 90% to Rs 59 crore in FY22 from Rs 31 crore in FY21. The cash flow from operating activities also shrank 35.9% to Rs 25 crore.

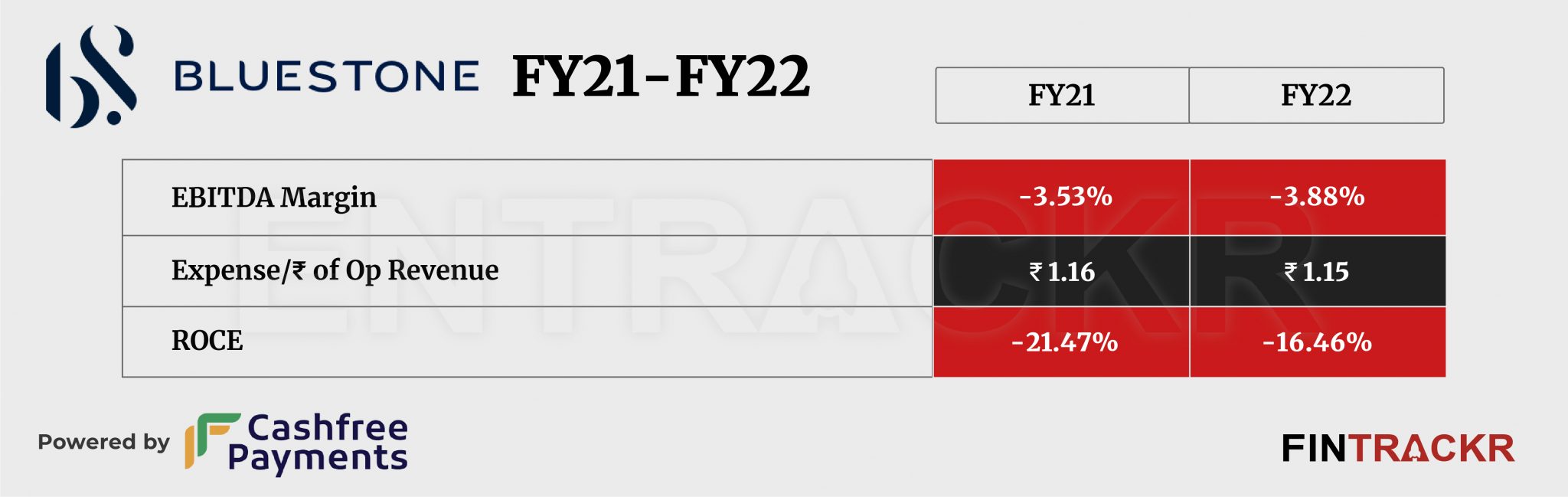

Its ROCE and EBITDA margin stood at -16.46% and -3.88% respectively in FY22. On a unit level, the company spent Rs 1.15 to earn a single rupee of operating revenue.

BlueStone directly competes with Melorra, Giva, and the Tata Group owned CaratLane. Venture Catalysts-backed Mellora posted an operational revenue of Rs 364.4 crore in FY22.

The market for jewellery as accessories, or lower carat gold ornaments is still evolving in India, and should only speed up as gold prices hit new highs in 2023. That should position BlueStone well with its offerings, except that legacy jewellery chains are also doing an impressive job of adapting to the new market needs.

This lower value but higher margin business of precious and semi precious stone dominated jewellery is also more susceptible to minor downturns in the economy, especially among the white collar class. That places BlueStone in a spot, to try and build on growth profitably. It has the momentum and backing to push anyway, and appears very likely to do so too.