Grocery and essentials-focused social commerce startup DealShare has become one of the fastest growing unicorns in terms of revenue in FY22. The Bengaluru-based company’s topline grew over eight fold in the last fiscal year. However, the company also bled heavily to achieve the scale.

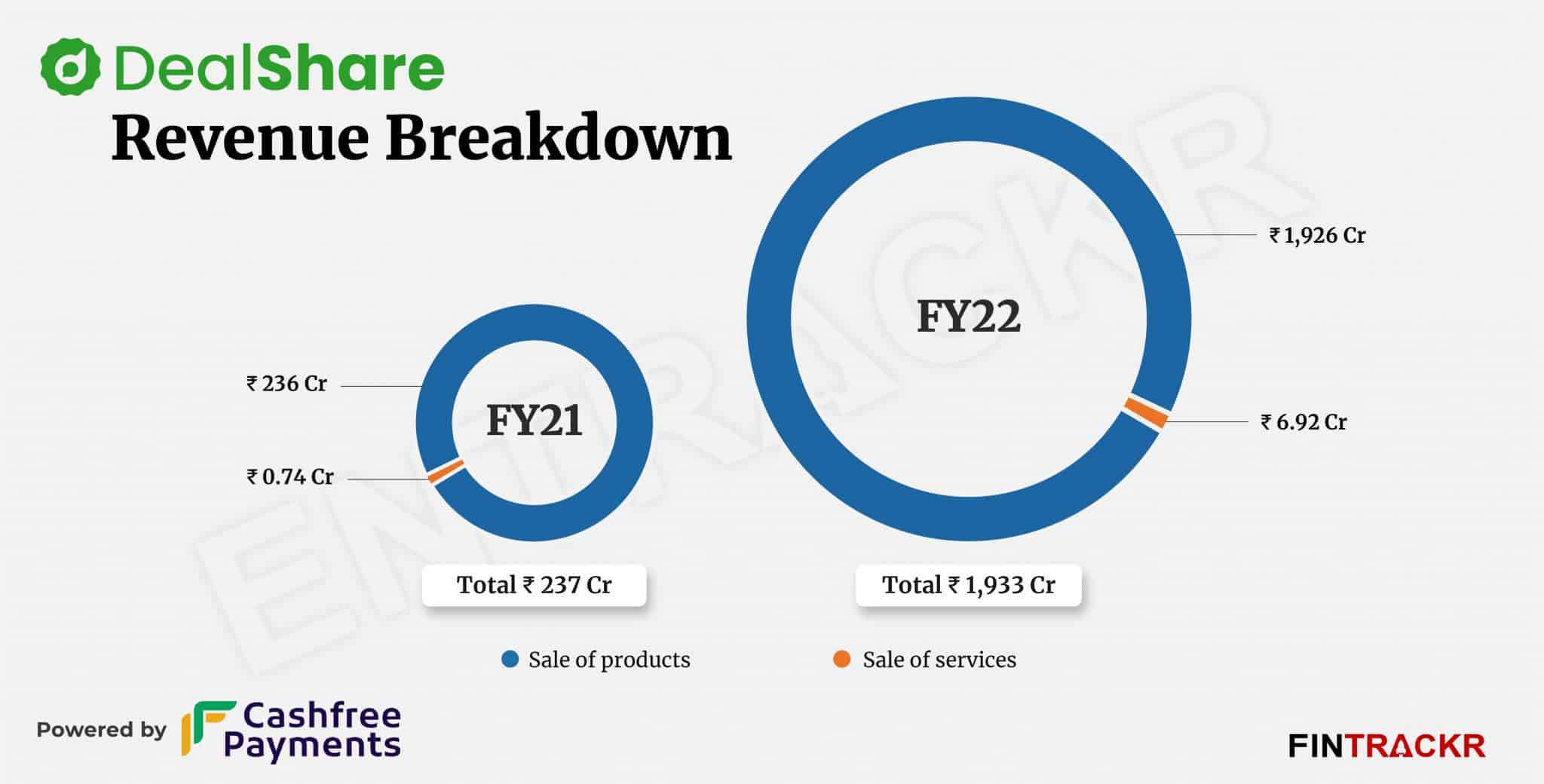

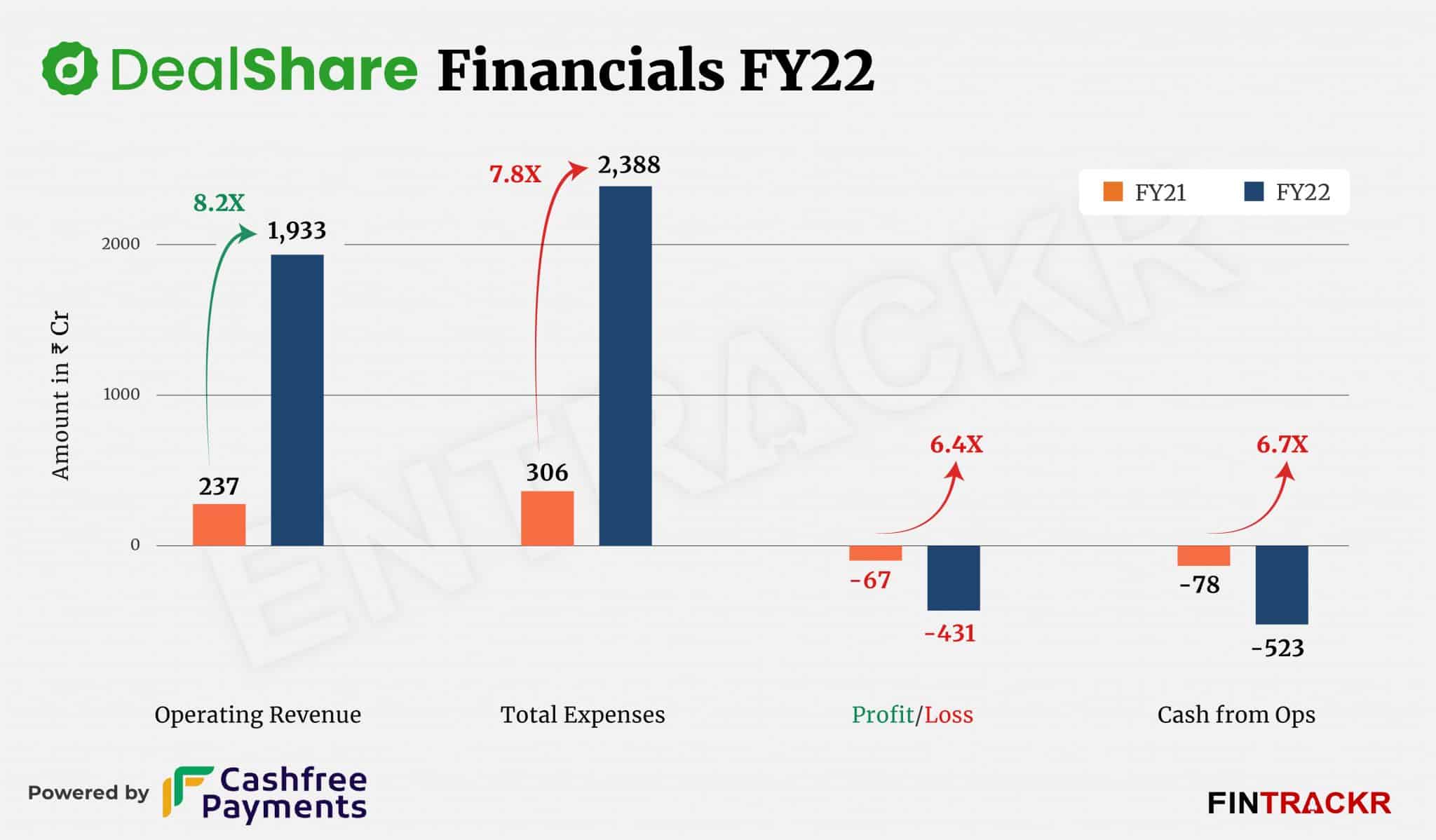

DealShare’s revenue from operations (gross revenue) skyrocketed 8.2X to Rs 1,933 crore during the fiscal year ending March 2022 from Rs 237 crore in FY21, as per annual financial statement with the Registrar of Companies (RoC). The Tiger Global-backed company generates revenue mostly from sale of grocery items such as snacks & drinks, fruits & veggies and personal care products and the same ballooned over 8X to Rs 1,926 crore in FY22 from Rs 236 crore during the last fiscal.

The company booked Rs 6.92 crore from sale of services which consists of marketing income from vendors. It also reported a non-operating income of Rs 24 crore majorly from interest on bank deposits, bonds and other current investments, driving the total income to Rs 1,957 crore during FY22.

DealShare is an inventory-led platform that manages the supply chain and logistics in bigger cities. It operates in over 150 cities across 10 states and claims to have on-boarded over 1,000 local brands and catered to over 20 million (2 crore) customers with its B2B2C platforms.

DealShare recently said that it has created over 1,000 small scale businesses in tier II and III cities in the past couple of years with the help of its community leader network (DealShare Dost). As per the company, the network is helping it to avoid brand marketing expenses and the vertical contributes close to 40% of the overall revenue.

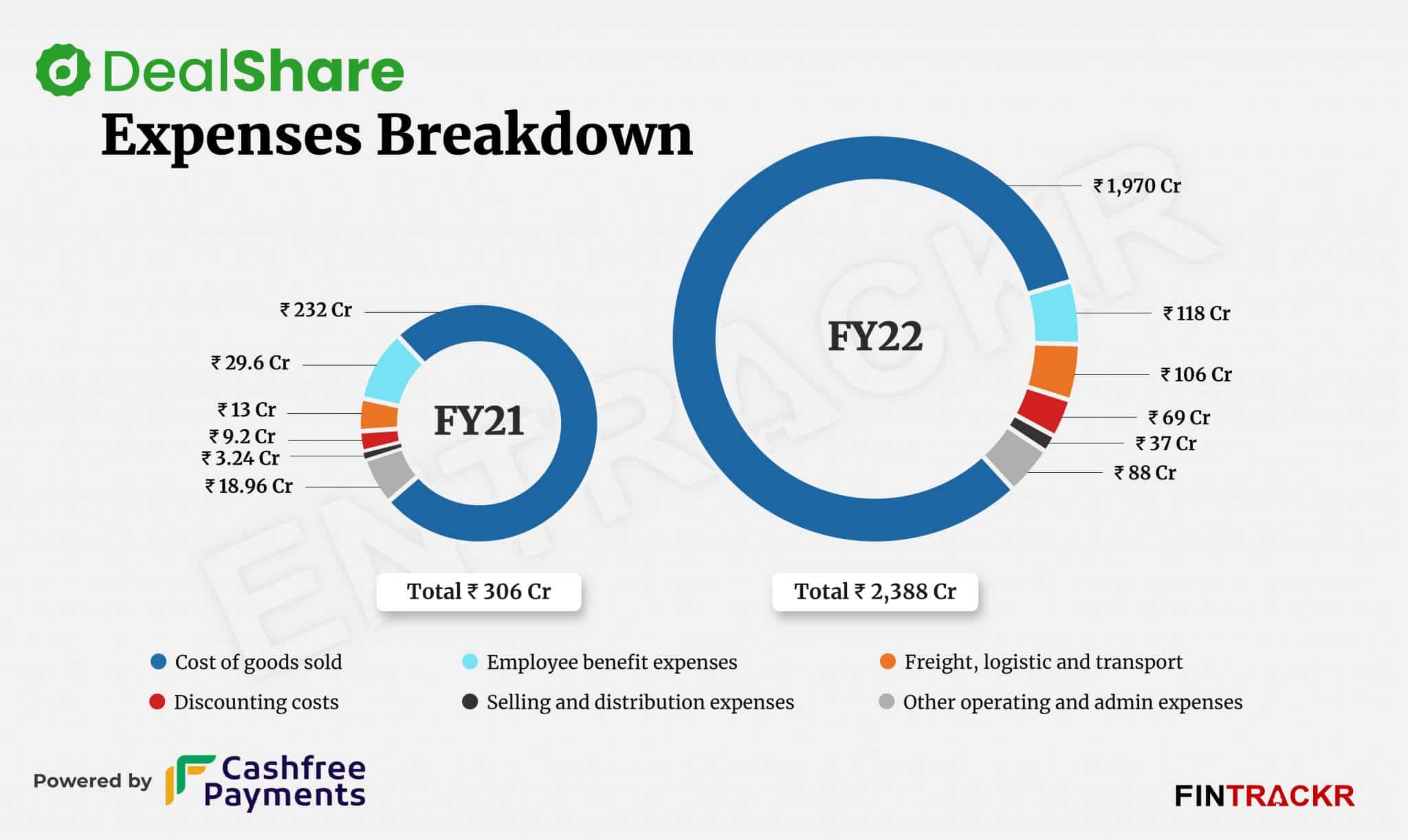

On the expense front, DealShare primarily engages in wholesale trade of FMCG goods, and procurement of goods accounted as the single largest cost center forming 82.5% of the overall expenditure. This cost spiked 8.5X to Rs 1,970 crore in FY22 from Rs 232 crore in FY21.

As the scale grew, the company hired more resources due to which expenses on employee’s benefits and logistics surged 4X and 8.2X to Rs 118 crore and Rs 106 crore respectively in FY22. Importantly, employee benefit cost also includes expenses on the employee stock option scheme and employee stock purchase plan of nearly Rs 23 crore.

DealShare offers discounts to customers to drive sales on its platform meanwhile discounting costs inclined 7.5X to Rs 69 crore in FY22. The firm also incurred selling and distribution expenses of Rs 37 crore which surged over 11X during the last fiscal year.

During FY22, the total expenditure of the company soared 7.8X to Rs 2,388 crore as compared to Rs 306 crore in FY21. In line with scale, losses of the company also deepened by 6.4X to Rs 431 crore in FY22 against Rs 67 crore booked in the preceding fiscal year.

Due to high cash burn on the cost of goods sold, cash outflows from operating activities shot up 6.7X to Rs 523 crore during the year from Rs 78 crore booked in FY21.

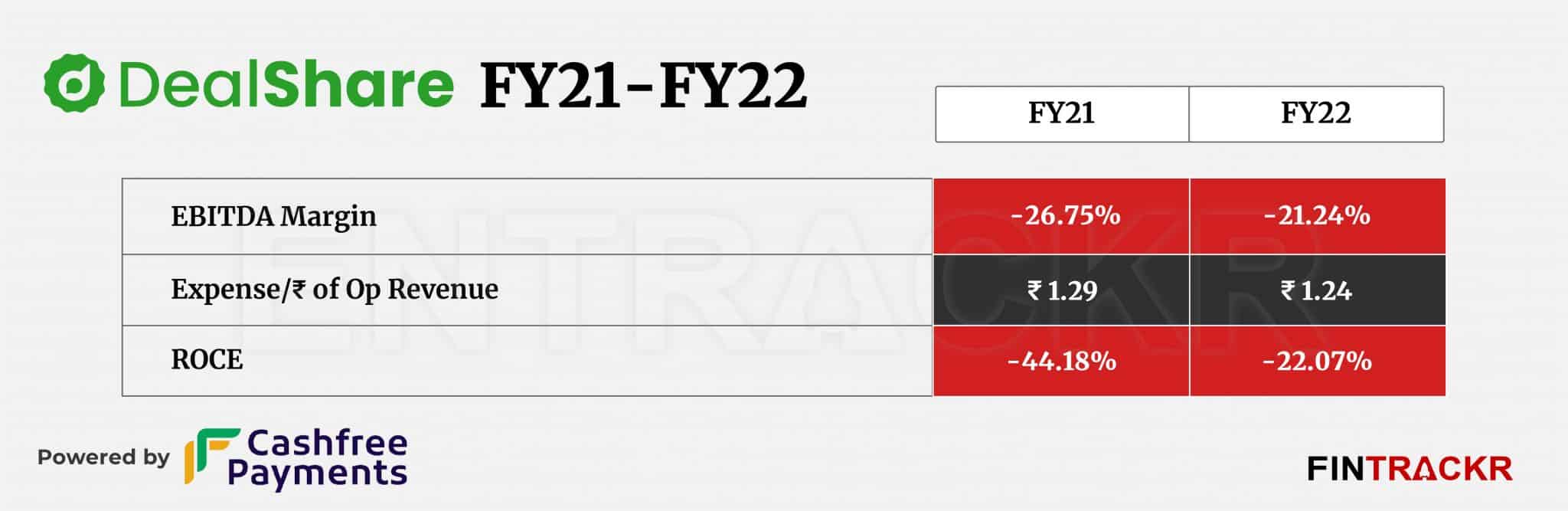

Coming to ratios, EBITDA margin and ROCE improved by 551 and 2,211 BPS to -21.24% and -22.07% during the year. On a unit level, the Jaipur-based company spent Rs 1.24 to earn a single rupee of operating revenue in FY22.

DealShare recently launched private brands on its platform and plans to invest Rs 500 crore over the next 2-3 years in its new business. According to a report, the Indian grocery market has a potential to reach a revenue of $38.9 billion by 2028 at a CAGR of 37.1%. DealShare managed to raise close to $400 million since its inception and more than 95% of the total funding came in the last 24 months.

While the unicorn status and high funding indicates a story well sold to investors, DealShare does face the reality of a market with sticky costs and high competition. Building own label brands or working with smaller brands seems an obvious answer to improve margins but is tougher than it seems. Missteps in areas like logistics can easily lead to long term damage, even as these costs will bite. Expanding the portfolio will also be a drain, even if the pressure to do so will always be there. Dealshare’s move into the safety of a cash positive zone will be keenly watched.