Grocery focussed Social Commerce startup DealShare caught a lot of attention in the Indian startup ecosystem after scaling its valuation over 10X within a fiscal to $1.6 billion and achieving unicorn status in Feb 2022. While the company’s valuation will be evaluated and justified in the long haul, DealShare has managed to grow its scale over 4X in FY21.

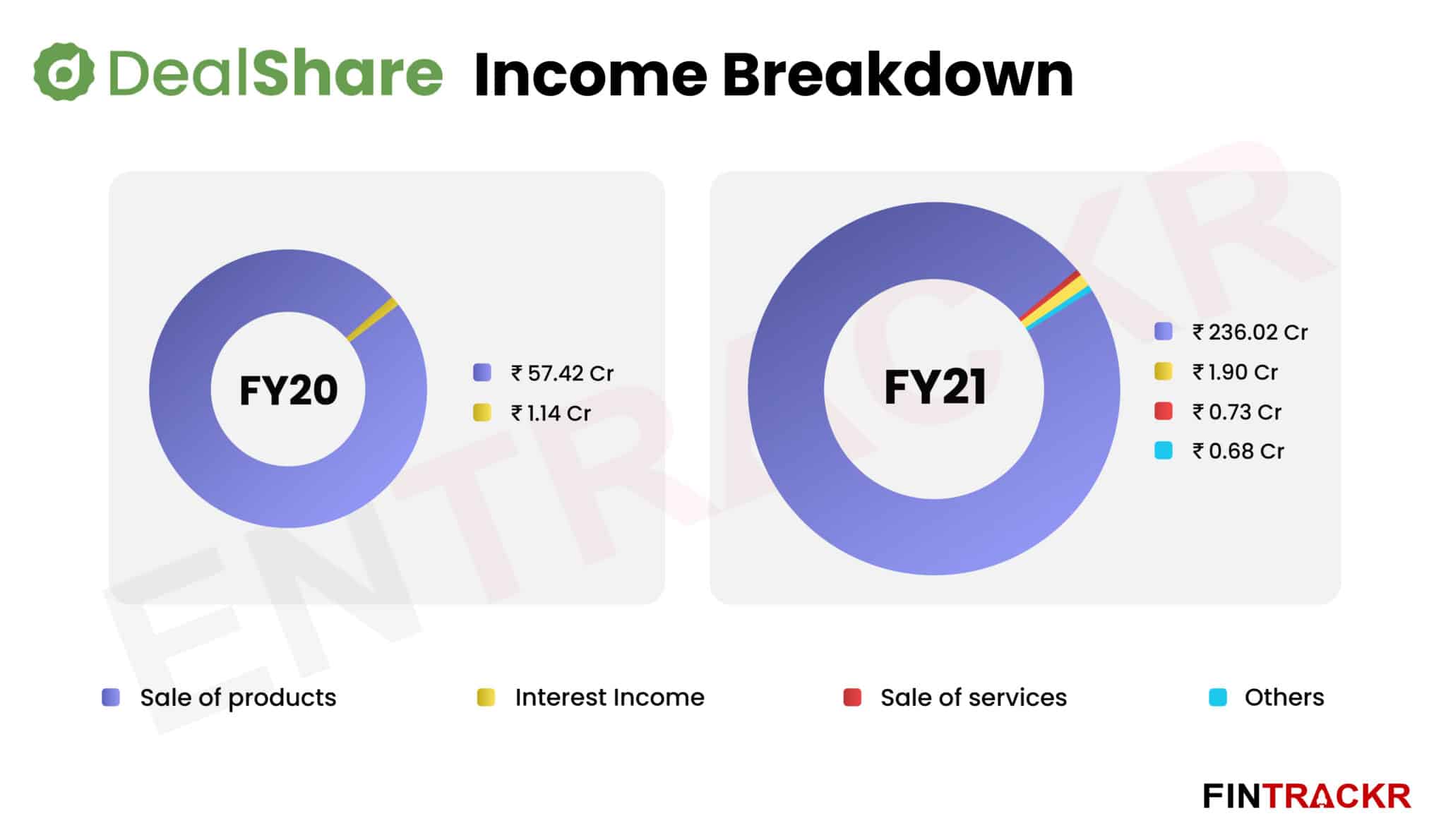

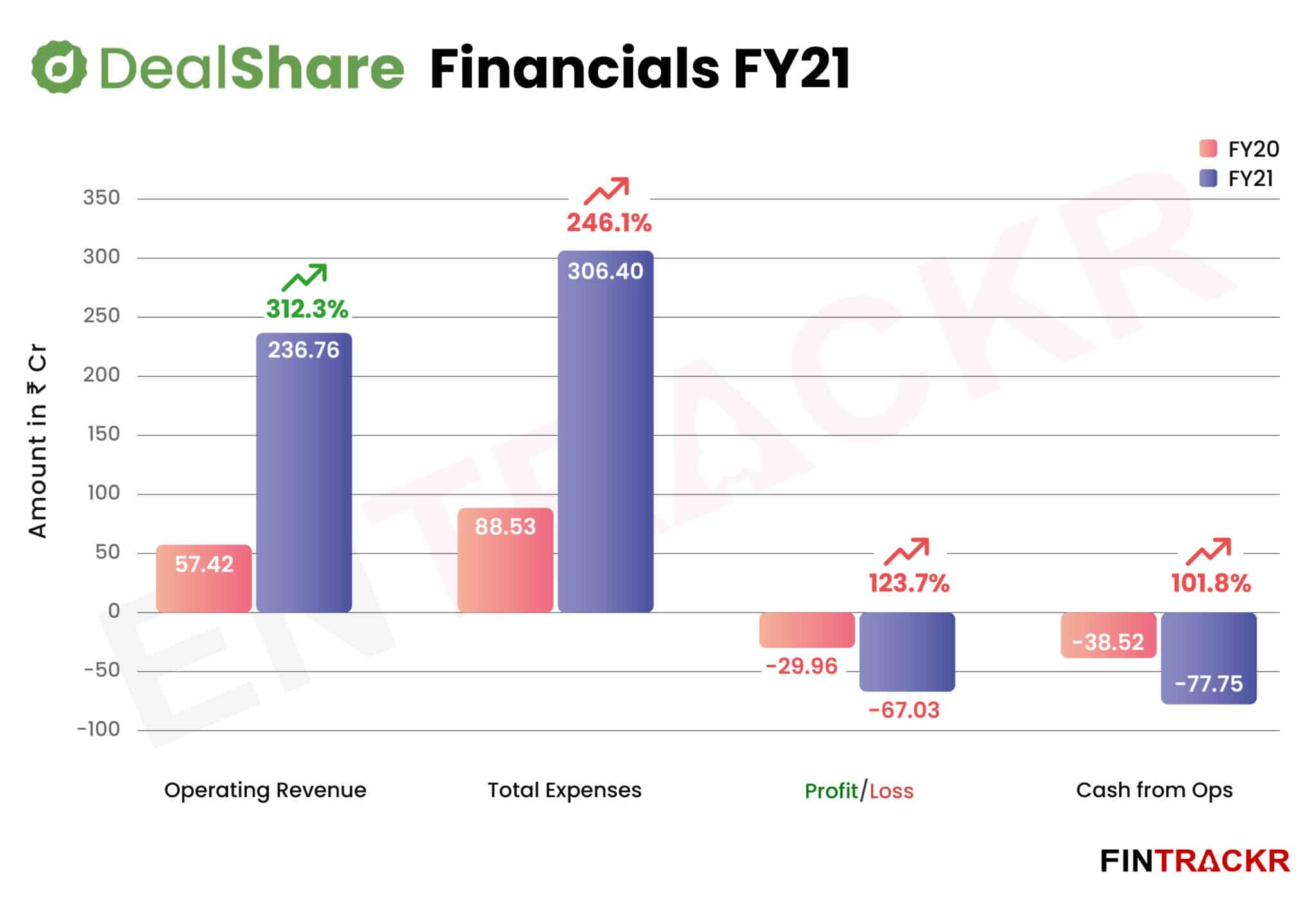

The Tiger Global-backed company’s revenue from operations surged by 312% to Rs 236.8 crore during FY21 from Rs 57.4 crore in FY20, its annual statements for FY21 with RoC shows.

DealShare currently operates in over 100 cities and claims to have catered to over 1.5 crore customers with its B2B2C hyperlocal e-retail business model. The startup offers over 20,000 SKUs on its platform and its application has over 20 million downloads as of now.

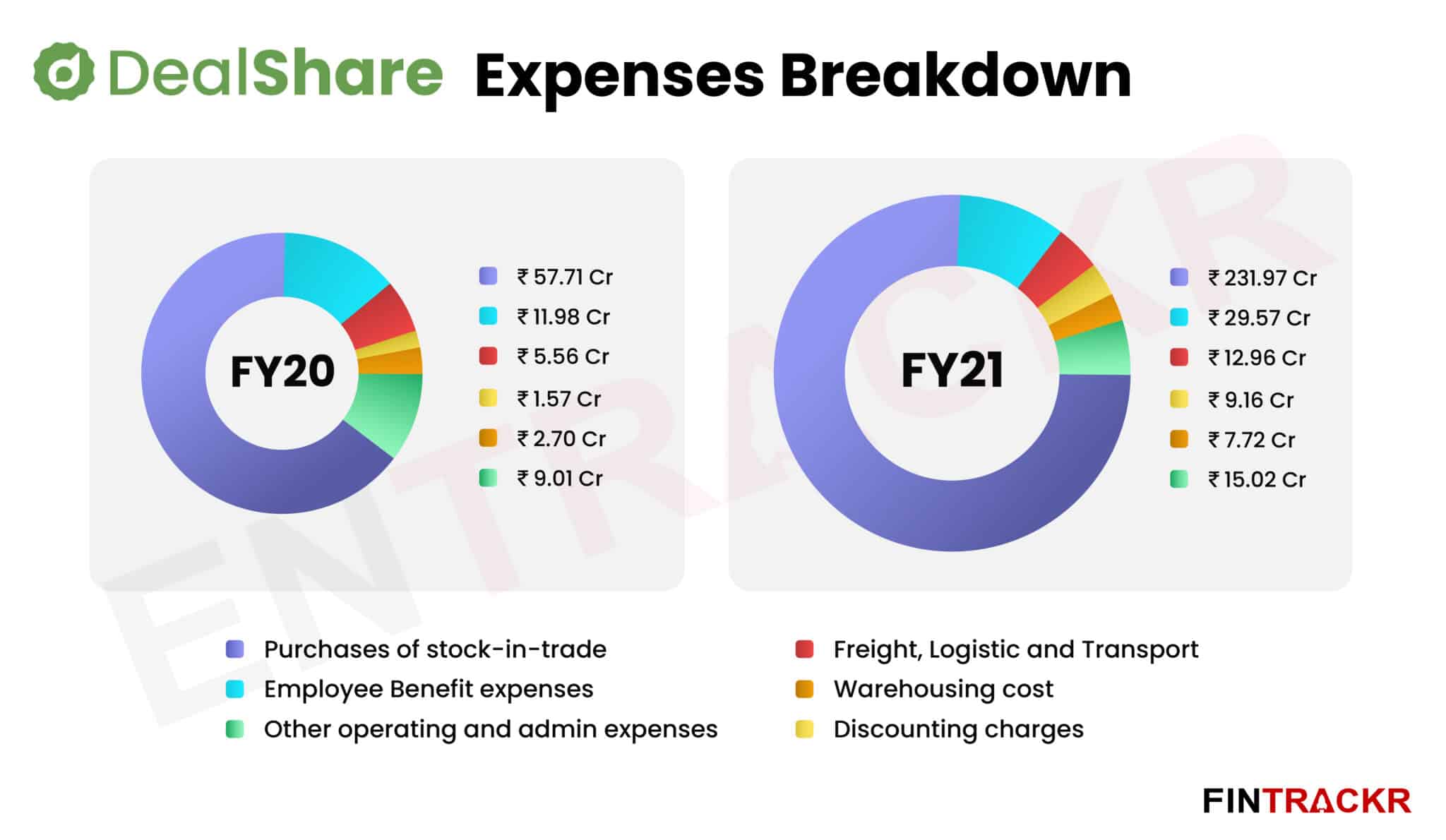

The Jaipur-based company primarily engages in wholesale trade of FMCG goods and procurement of stock in trade is the largest cost incurred by the company, accounting for 75.7% of its annual costs.

This cost has grown by 302% from Rs 57.71 crore in FY20 to around Rs 232 crore during FY21 on account of increased order volumes. As economies of scale kicked in, Dealshare’s gross margins improved from -0.5% in FY20 to 1.72% during the last fiscal year.

The surge in order volume was also evident in the company’s transportation and logistics expenditure which grew by 133.1% to nearly Rs 13 crore in FY21 from Rs 5.56 crore incurred in FY20. DealShare also expanded its warehousing operations to keep up with inflated demand and related costs surged by 186% YoY to Rs 7.72 crore during FY21.

Employee benefits is the second largest cost center for the social commerce company, making up 9.7% of its annual costs. These payments surged by 147% to Rs 29.6 crore in FY21 from Rs 11.98 crore paid in FY20 as the company grew its employee base to meet demand. Importantly, around 21% of employee benefits i.e Rs 6.22 crore, were paid in the form of ESOPs.

DealShare also offers discounts to customers to drive sales on its platform and these discounting costs ballooned by 483.4% to Rs 9.16 crore during FY21 from Rs 1.57 crore worth of discounts handed out in FY20.

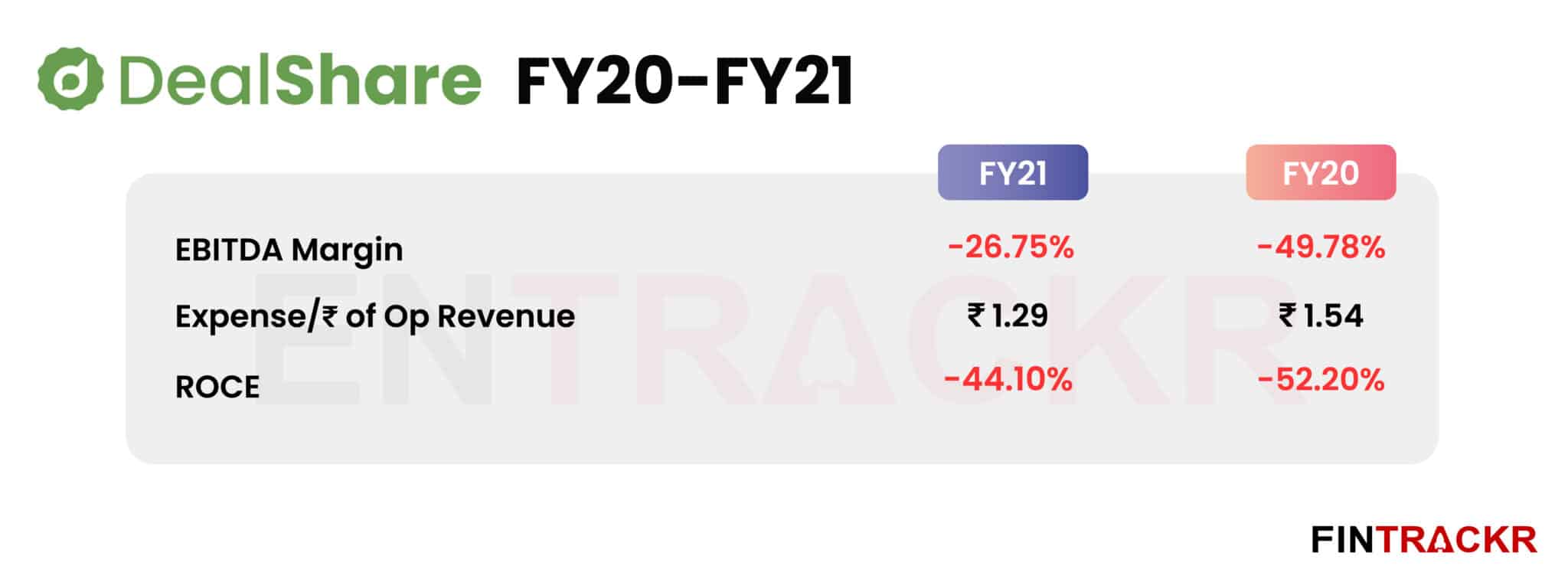

Another Rs 1.14 crore were paid as rent pushing the annual expenditure to Rs 306.4 crore in FY21, which grew by 246.1% from Rs 88.53 crore spent in total during FY20. DealShare spent Rs 1.29 to earn a single rupee of revenue during FY21.

The exponential growth in revenue also resulted in increased cashburn albeit on improved margins. Its EBITDA margin improved from -49.78% in FY20 to -26.75% in FY21 while annual losses grew by 101.8% YoY to Rs 67.03 crore during the same period.

Operating in a segment that is seeing increasing competition, even as it remains a low margin business, Dealshare’s growth and profitability will depend to a large extent on the efficiencies it can wring out, and the segments it targets. Right now, it seems to be managing by picking many, relatively smaller brands where margins could be higher. But to keep the growth momentum going, it will surely go up against more established players soon. It remains to be seen if DealShare will be able to keep the growth momentum going without any further drop in margins.