Tax filing and compliance company Clear (formerly Cleartax) was in the news when it started charging for income tax returns (ITR) after ten years of free services. The move was inevitable as the company has been struggling to grow its topline for the past two fiscal years.

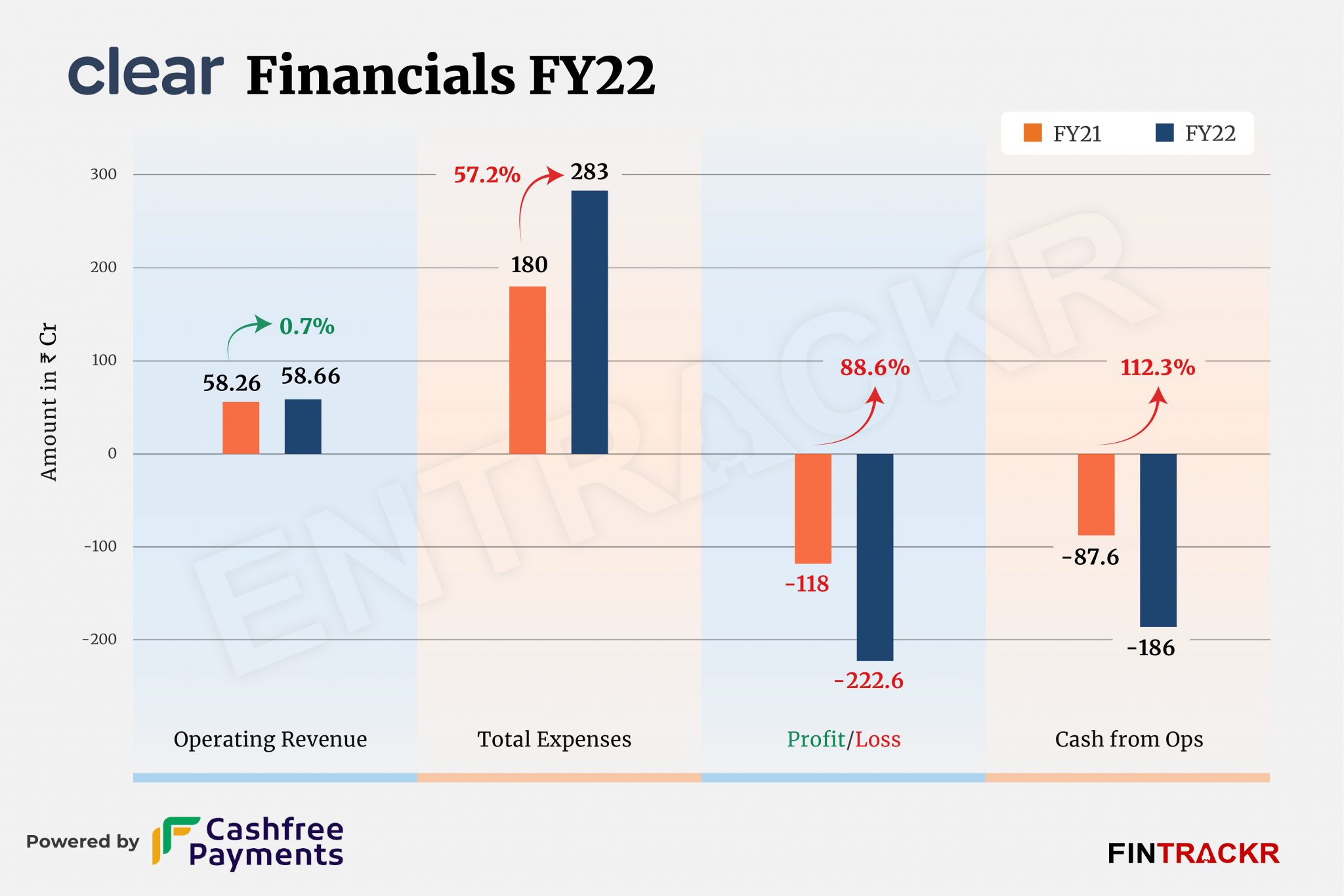

Clear posted Rs 58.26 crore in revenue in FY21 which grew less than 1% to Rs 58.66 crore in FY22, according to the company’s standalone annual financial statement with the Registrar of Companies.

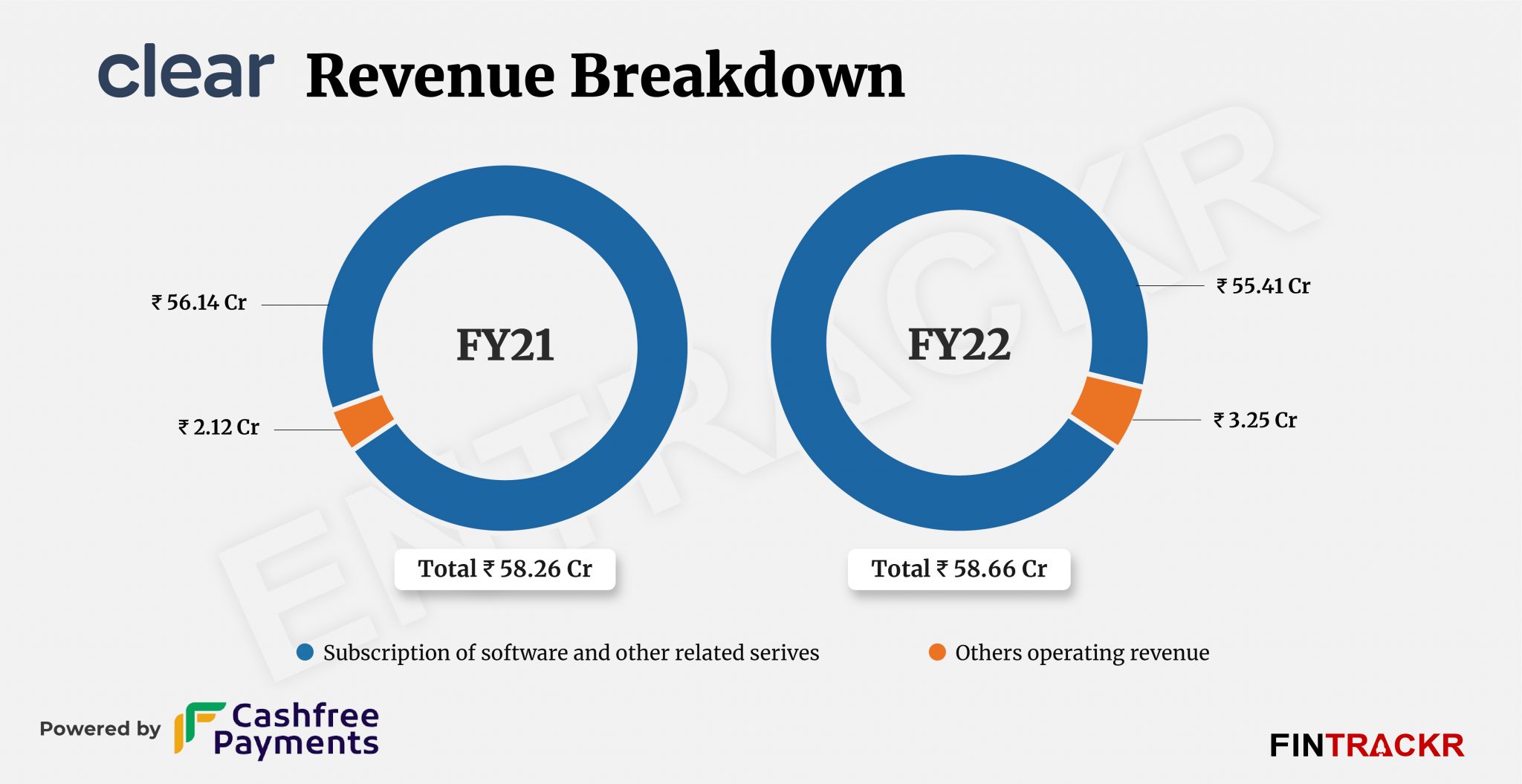

The company derives almost all of its revenue from subscriptions to hosted software and other one-time services which accounted for 94.5% of its total operating revenue. Collection from these services dipped 1.3% to Rs 55.41 crore in FY22 from Rs 56.14 crore in FY21.

Collection from rendering other services (undisclosed) surged 53.3% to Rs 3.25 crore during the year whereas the company also booked interest and gain on investments and other non-operating revenue of Rs 1.7 crore in FY22 which drove Clear’s total income to Rs 60.36 crore.

Clear is a tax and financial services software platform, which facilitates GST filing, e-invoicing, TDS, ITC (input tax credit) et al. As per its website, its services are used by over 600K small businesses, 1,200 enterprises, and 60,000 tax professionals. As of now, Clear has acquired six startups: Cimplyfive, Xpedize, yBANQ, Karvy, Dose FM, and Tootl.

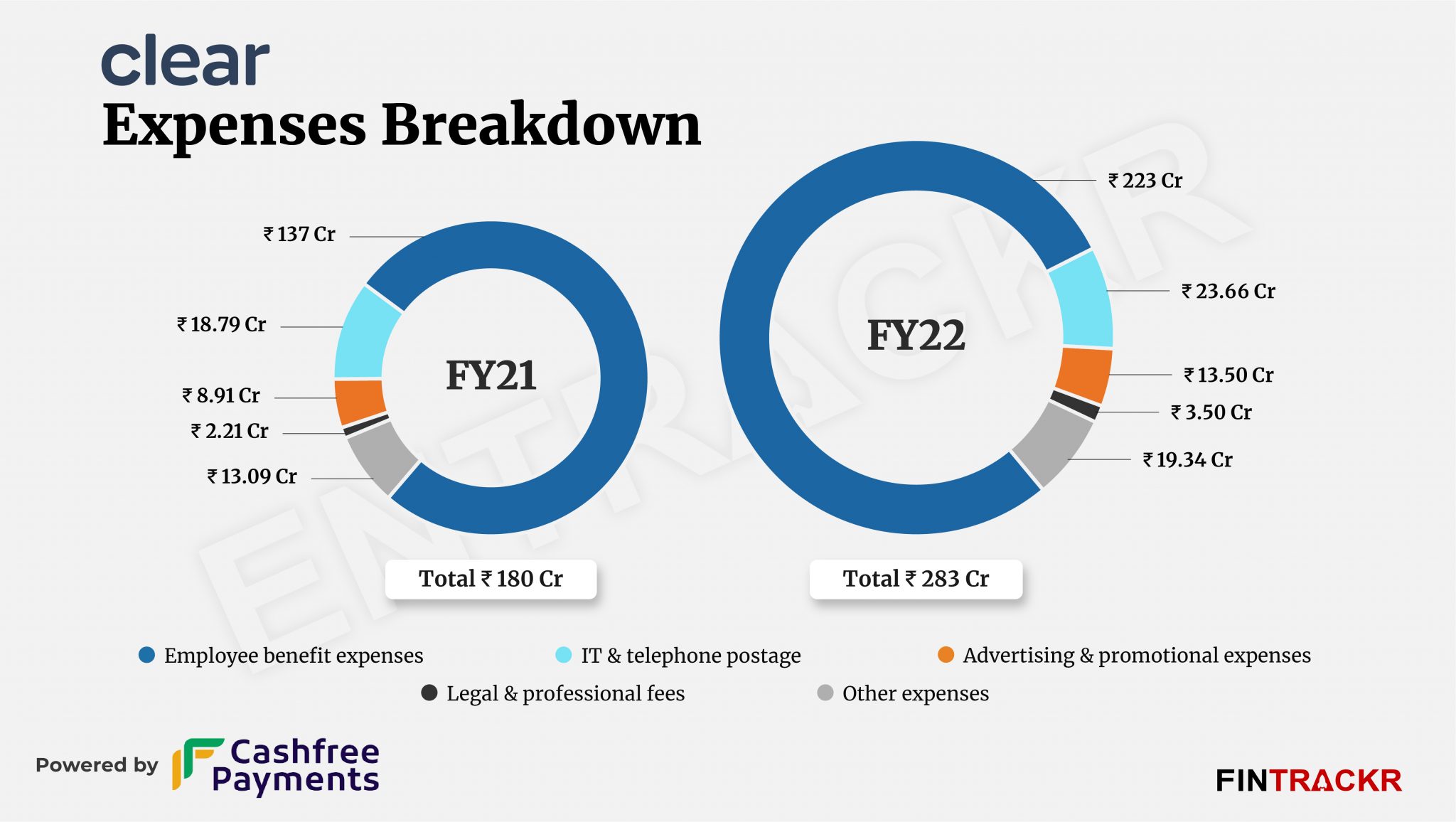

Moving towards expenses, employee benefits stood out as the largest cost element which formed around 79% of overall expenses. This cost flew 62.8% to Rs 223 crore in FY22 from Rs 137 crore in FY21.

Information technology (IT) and telephone postage expenses went up 26% to Rs 23.66 crore during the last fiscal year. Spends on advertising cum promotional expenses and legal-professional fees inclined 51.5% and 58.4% respectively to Rs 13.5 crore and Rs 3.5 crore in FY22.

Clear also booked commission, brokerage, outsourced manpower, payment gateway, and other expenses of Rs 9.1 crore in FY22 which inflated its total expenditure by 57.2% to Rs 283 crore during FY22 as compared to Rs 180 crore in FY21.

Following the stagnant scale and over 57% hike in expenses, Clear’s losses ballooned 88.6% to Rs 222.6 crore in FY22. Its cash outflows from operating activities soared 2.1X to Rs 186 crore in FY22 from Rs 87.6 crore in FY21.

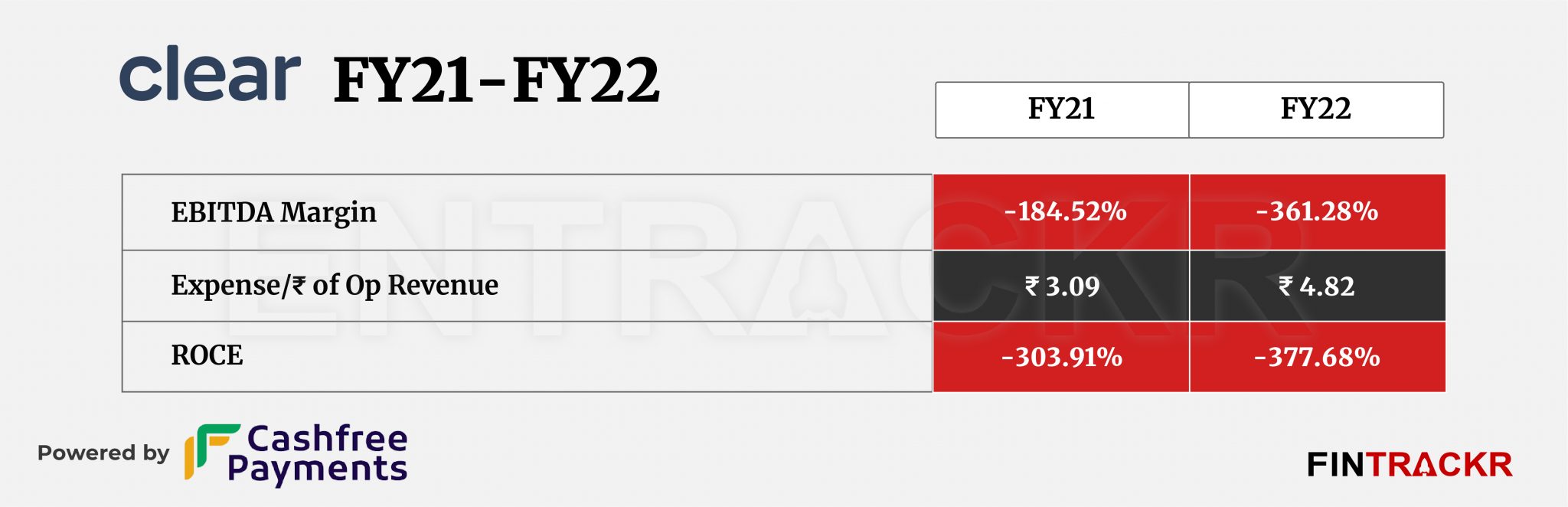

Its EBITDA margin and ROCE worsened to -361.28% and -377.68% during the year which could be attributed to flat scale and high cash burn. On a unit level, Cleartax spent Rs 4.82 to earn a rupee in FY22.

Clear has raised around $140 million to date and it was valued in the range of $700-800 million following its latest fundraising of $75 million.

Looking at the numbers, one would have to wonder if Clear took too long to start charging, and whether its cost base justifies the scale of the opportunity it has. Tax returns, even as it has been simplified over the years, remains an attractive market to target, but Clear’s cost structure militates against any significant upside for the firm in that segment anymore. Clear is at serious risk of losing out on years of goodwill and investments without getting a handle on its costs and figuring out better ways to promote and get traction on the services it offers besides tax filing.