Online trucking platform Blackbuck turned a unicorn last year after raising $67 million led by Tribe Capital, IFC Emerging Asia Fund, and VEF. The firm’s entry into the unicorn club was no small feat as it came after the pandemic stricken fiscal (FY21) which eroded 60% of its scale.

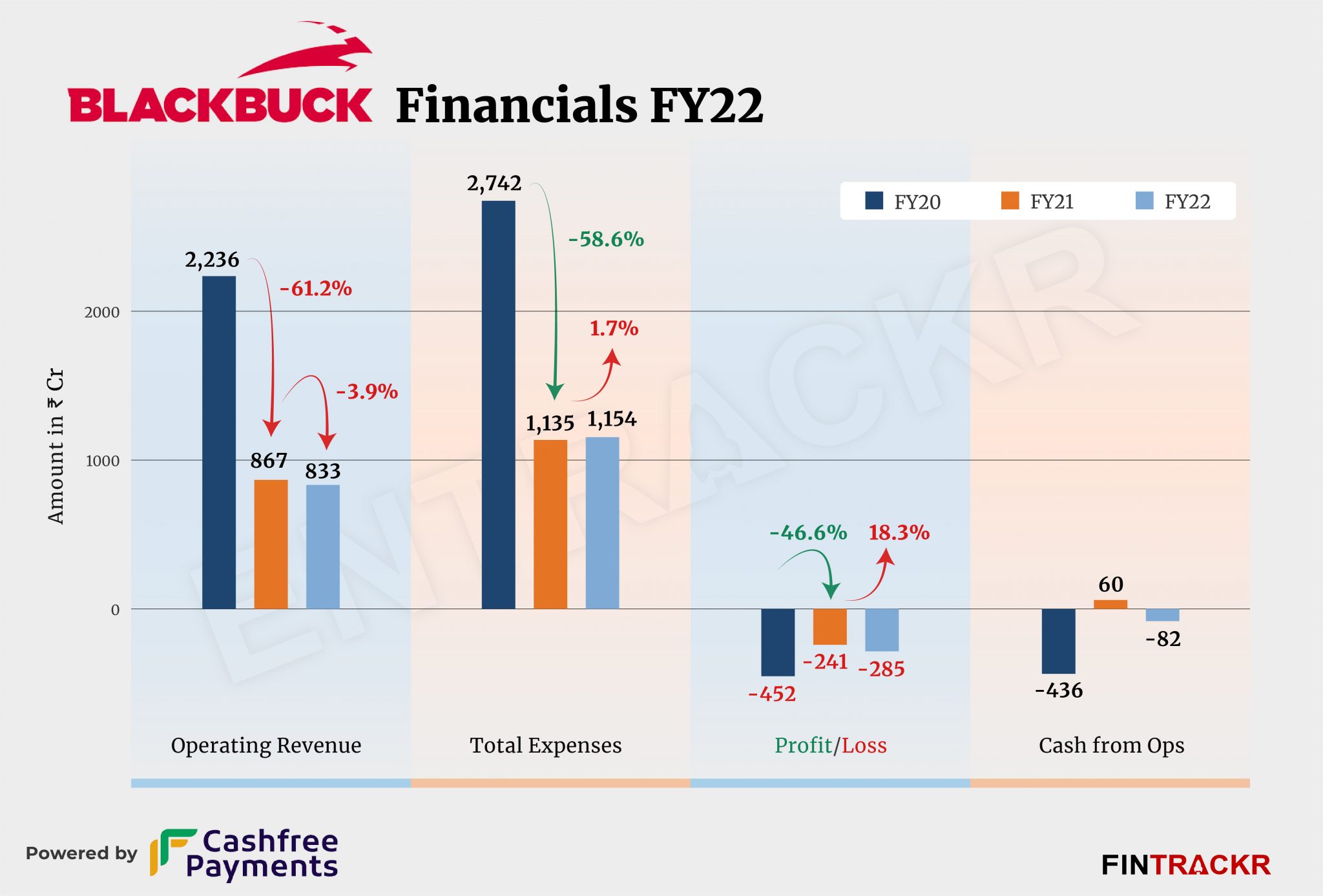

While the majority of growth and late stage startups witnessed negative growth in FY21 due to Covid-19, they bounced back in FY22 with a significant spike in their scale. That’s not the case with Blackbuck, however, which reported an almost 4% decline in its topline in the last fiscal year as compared to FY21, according to the company’s annual financial statement with the Registrar of Companies (RoC).

If we compare Blackbuck’s FY22 revenue with its pre Covid-19 fiscal (FY20), the firm’s scale shrank a whopping 62.7%. It posted Rs 2,236 crore in operating revenue in FY2o which had slumped to Rs 833 crore in FY22.

The seven-year-old firm offers B2B logistics solutions for long-haul trucking and provides intercity logistics services to large companies including medium and small medium enterprises (MSMEs).

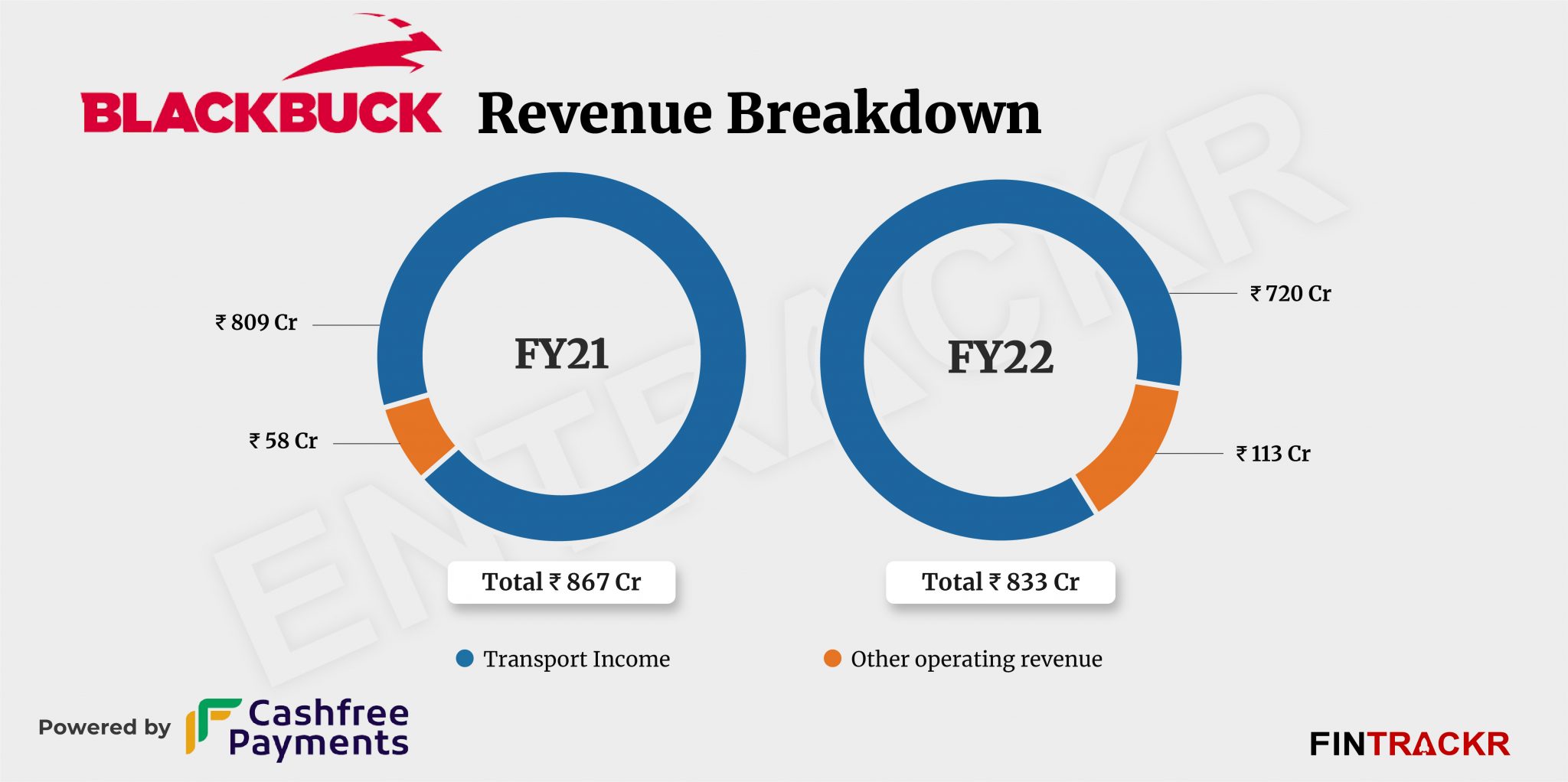

Logistics services formed 86% of the company’s collections which reduced to Rs 720 crore in FY22 from Rs 809 crore in FY21. Blackbuck’s telematics services and tip incentives contributed 14% of the total operating revenue, charging ahead by 94.8% to Rs 113 crore in FY22.

On the back of its sizable Series E round, the company’s income from interest on non-current investments increased 39% to Rs 36.8 crore.

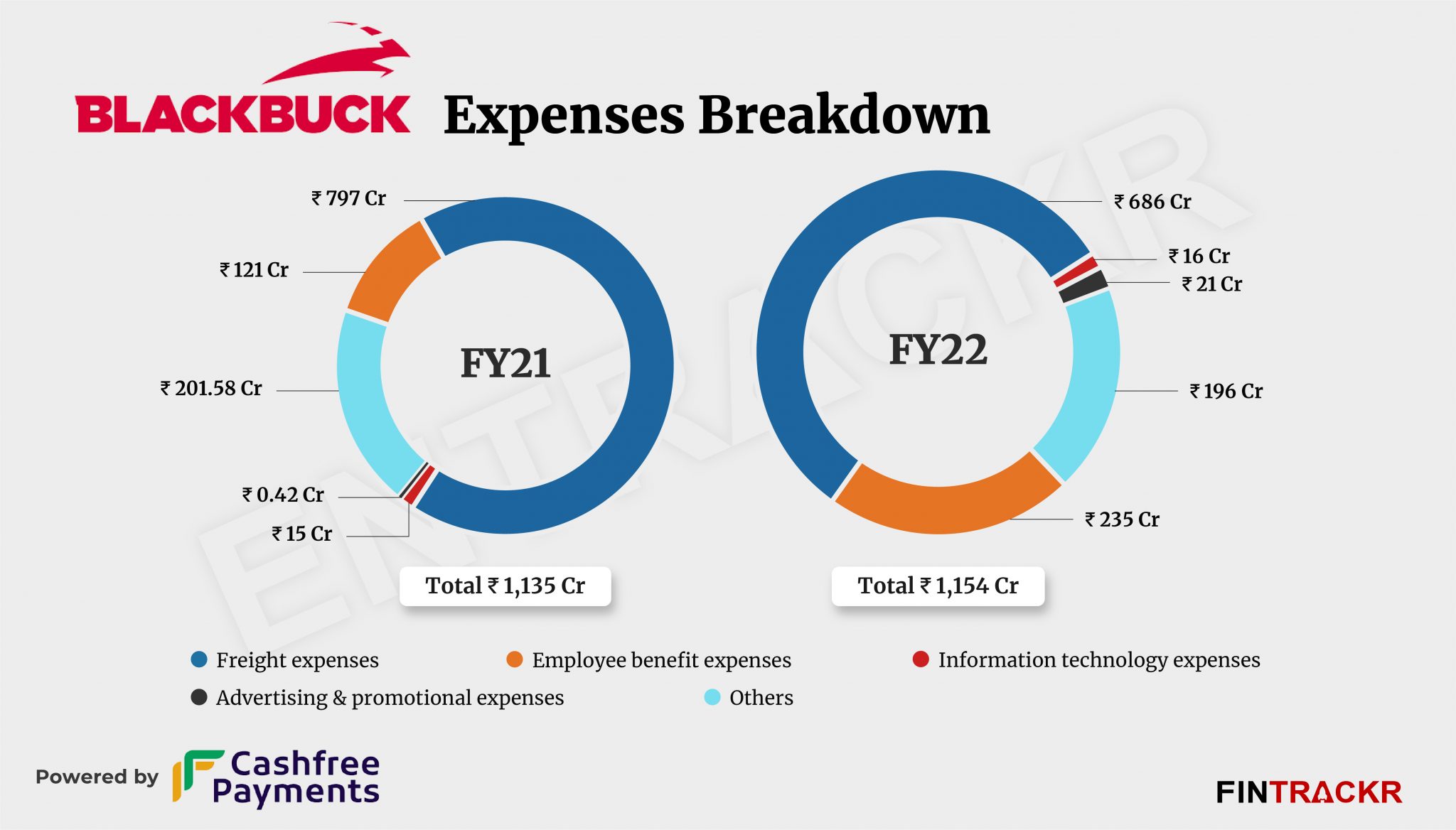

Blackbuck renders the transport service to its customers and pays truck owners itself. These payments were the largest cost for Blackbuck accounting for 59% of annual expenses. Going beyond the drop in topline, this cost dipped 13.9% to Rs 686 crore during the last fiscal year (FY22).

Employee benefit was the second largest cost which increased by 94.2% to Rs 235 crore in FY22. It also included Rs 90.65 crore as ESOP expenses (non cash expenditure). Information technology costs remained flat at Rs 16 crore while the advertisement and promotion costs stood at Rs 21 crore. All that ensured Blackbuck’s overall cost increased marginally to Rs 1,154 crore in FY22 from Rs 1135 crore in the previous fiscal year (FY21).

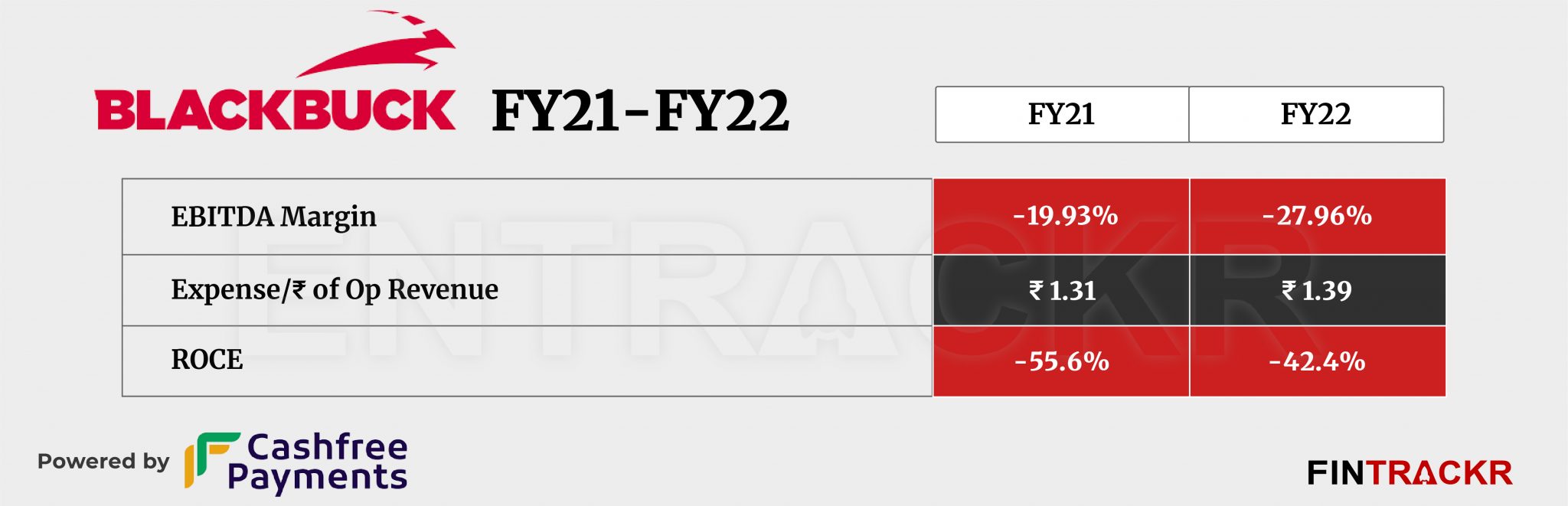

With the stagnant revenue and marginal increase in cost, its losses grew 18.3% to Rs 285 crore in FY22. On the ratios side, ROCE and EBITDA margins were registered at -42.4% and -55.6% respectively. On a unit level, Blackbuck spent Rs 1.39 to earn a single rupee in FY22.

The huge spike in employee costs in the face of stagnating revenues indicates a struggle to find its feet in a market that has been influenced massively by investor funds in the past few years. That has taken costs way higher than many of these firms had expected or projected. The worst part of the whole experience is that for the end customer, benefits in terms of lower costs have not really turned up in most cases. Rising fuel costs and related costs in the business have only complicated the market further for emerging logistics firms like Blackbuck, as they struggle to carve out a distinct identity and loyalty in the market. Next stop might just be some much needed consolidation for the industry.