The B2B e-commerce space has been growing at a rapid clip in the past five years and Zetwerk has been right up there among those leading the charge. The company’s scale has grown 292X in the past four fiscal years to Rs 4,961 crore in FY22 from Rs 17 crore in its first full fiscal year of operations (FY18).

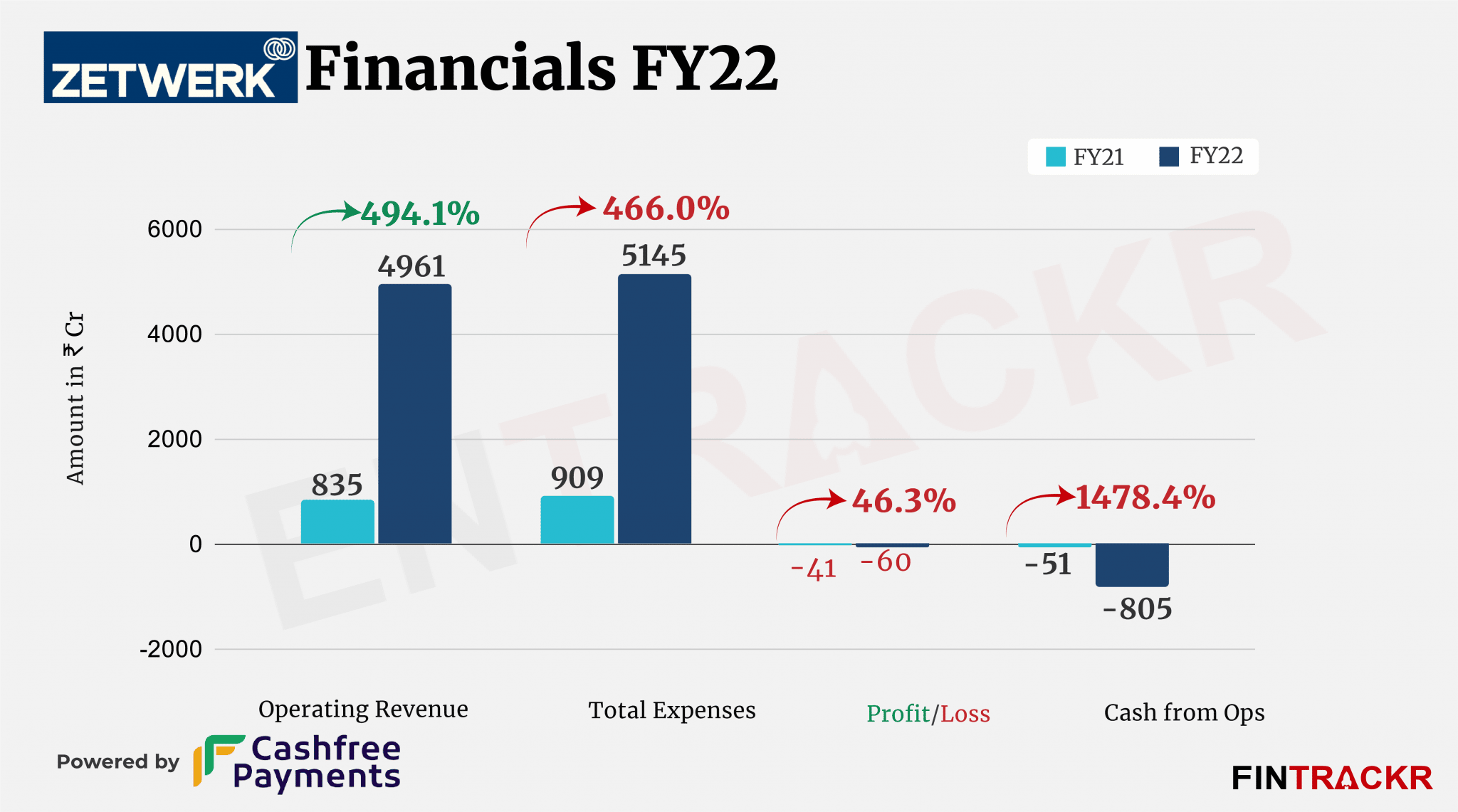

Zetwerk offers a bouquet of B2B services and products including inputs and machinery for manufacturing plants boasting 8,000 active suppliers and 1,800 customers including manufacturing and contracting giants like Bhel, Tata Steel, and Larsen & Toubro. Revenue from these services surged around 6X to Rs 4,961 crore in FY22 from Rs 835 crore in FY21, as per its annual financial statement.

Collection from domestic operations formed 83.7% of the total collections and stood at Rs 4,154 crore whereas the remaining 16% of income came from overseas operations. Importantly, the United States Contributed 60% of the total export volume.

Zetwerk had raised $210 million led by Greenoaks Capital in December last year at a valuation of $2.68 billion. The huge fundraising and subsequent inflow also helped the company to make Rs 101 crore in FY22 from interest on fixed deposits and other financial instruments.

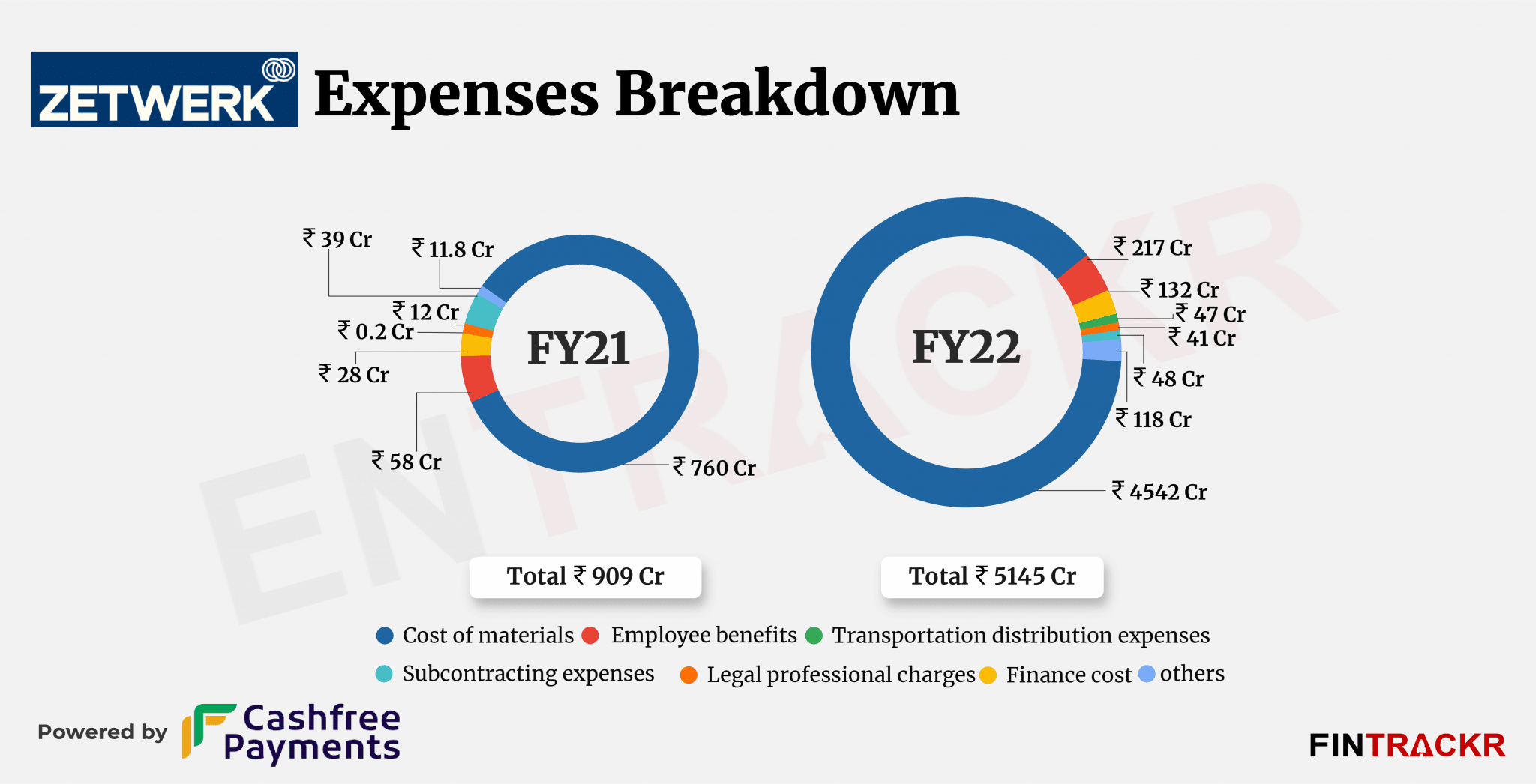

When it comes to expenses, the cost of procuring the materials from its network i.e vendors and suppliers formed around 88% of the overall cost which grew around 6X to Rs 4,542 crore in the fiscal year ending March 31, 2022.

Expenditure on employee benefits was the second largest cost element and increased 3.7X to Rs 217 crore during the last fiscal year. The company’s cost of finance shot up 4.7X to Rs 132 crore while subcontracting and legal and professional expenses increased 1.2X and 3.4X respectively to Rs 48 crore and Rs 41 crore in FY22.

The Amrit Acharya-led firm added another Rs 47 crore as transportation and distribution expenses pushing the total cost by 5.6X to Rs 5145 crore in FY22. Despite the spike in expenses, Zetwerk has managed to control losses thanks to overall growth outpacing losses. That means losses barely grew to Rs 60 Crore in FY22.

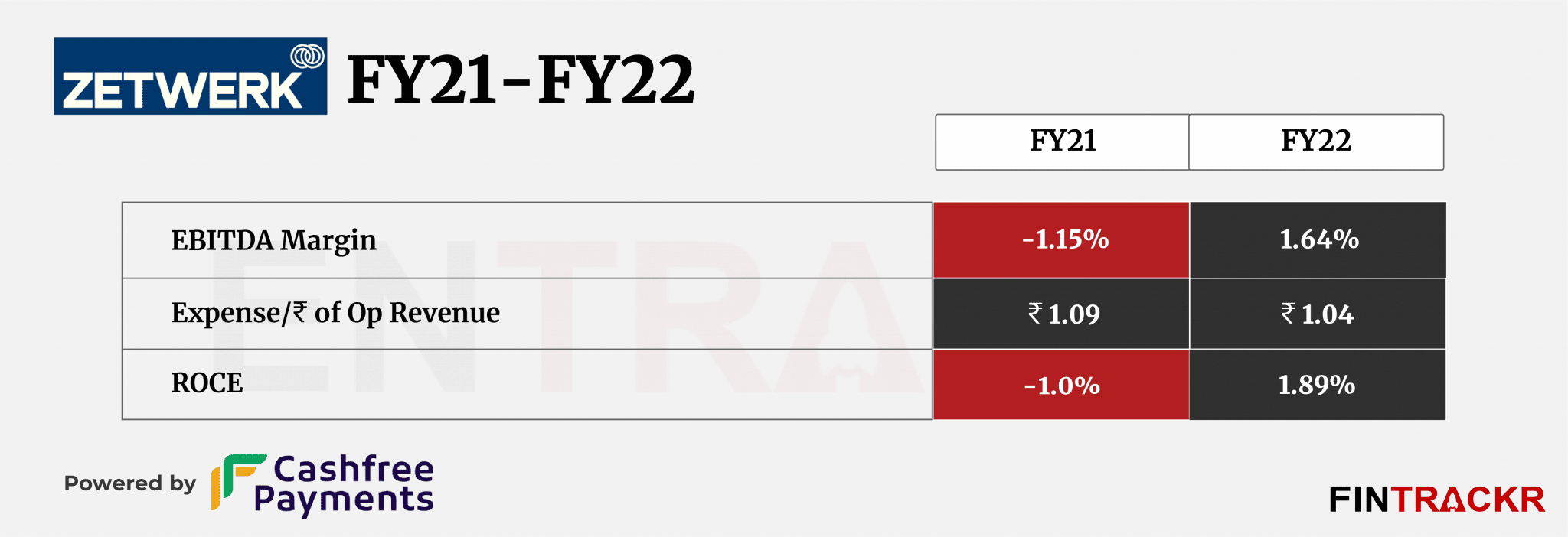

With nearly 6X jump in revenue in FY22 as compared to FY21, ratios like, ROCE and EBITDA margin turned positive and registered 1.89% and 1.64% growth respectively in FY22. On a unit level, the company spent 1.04 to earn a single unit of operating revenue.

Zetwerk competes with OfBusiness which is the largest player in this space and crossed the Rs 7,000 crore revenue mark in FY22 with a hefty profit of over Rs 200 crore. Infra.Market is the second largest company with over Rs 6,000 crore topline in the last fiscal year.

In a category where topline growth is the relatively easy part, it is the strategies players employ to improve margins that matter. Be it financing, turning manufacturers themselves, or adding other services for their network of buyers and sellers, these firms have been running through the whole gamut of possibilities in trying to arrive at an optimum growth model. Zetwerk, with its focus on solving the manufacturing challenges in core sectors with a ‘supply chain’ of owned, operated, and partnered manufacturing plants, has placed its bets on manufacturing like no one else. It’s a bet that is expected to pay off big as India aligns its economy towards a higher share of manufacturing, but the risk factories that stifled manufacturing until now have not completely gone away, be it on the policy, labour, or other key input resource front. How it navigates those will decide how long it can maintain its scorching growth.