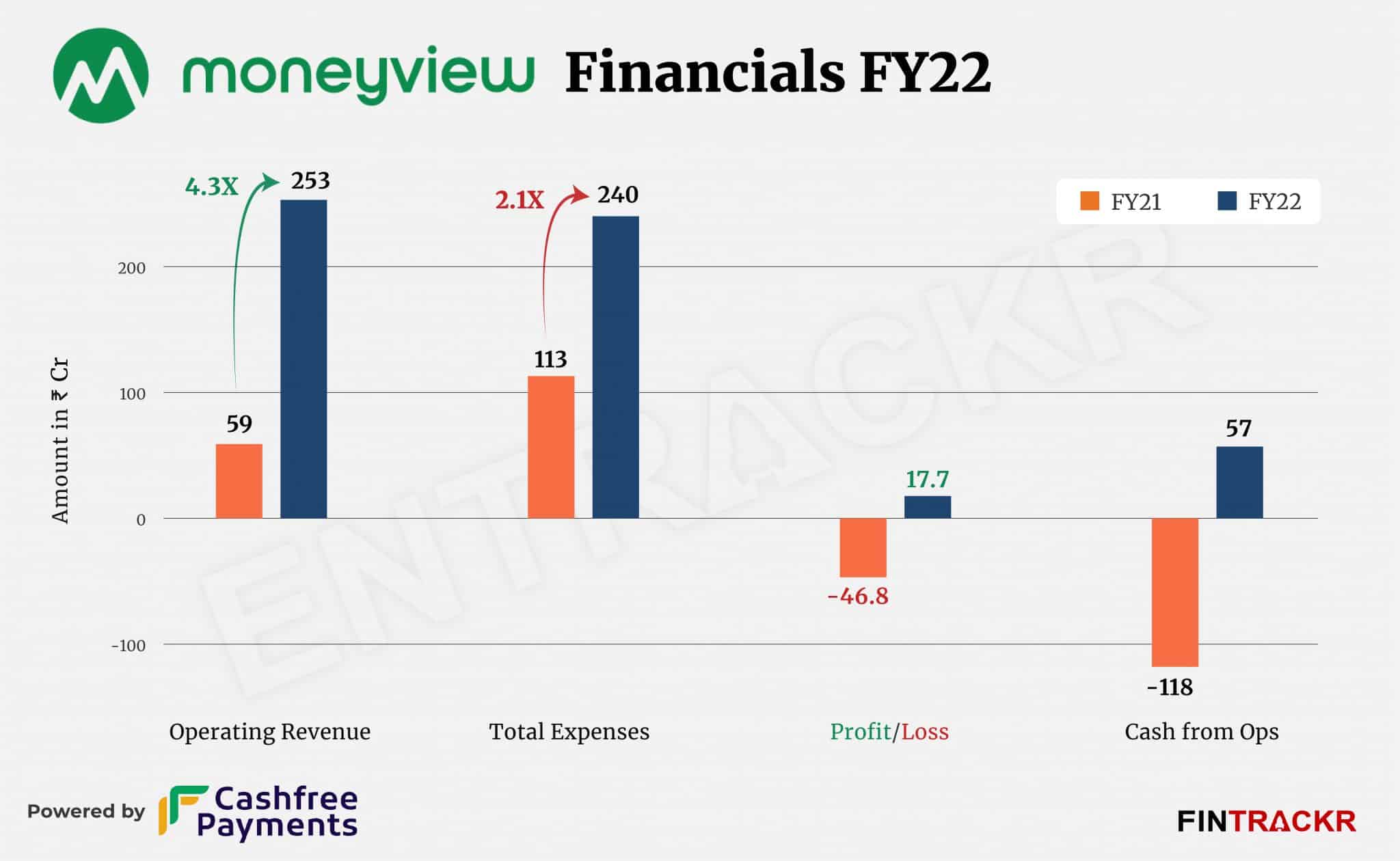

Online credit platform Money View demonstrated strong business growth during FY22 and this could be noticed from its scale which blew over 4X to Rs 253 crore, according to its annual financial report with the Registrar of Companies (ROC).

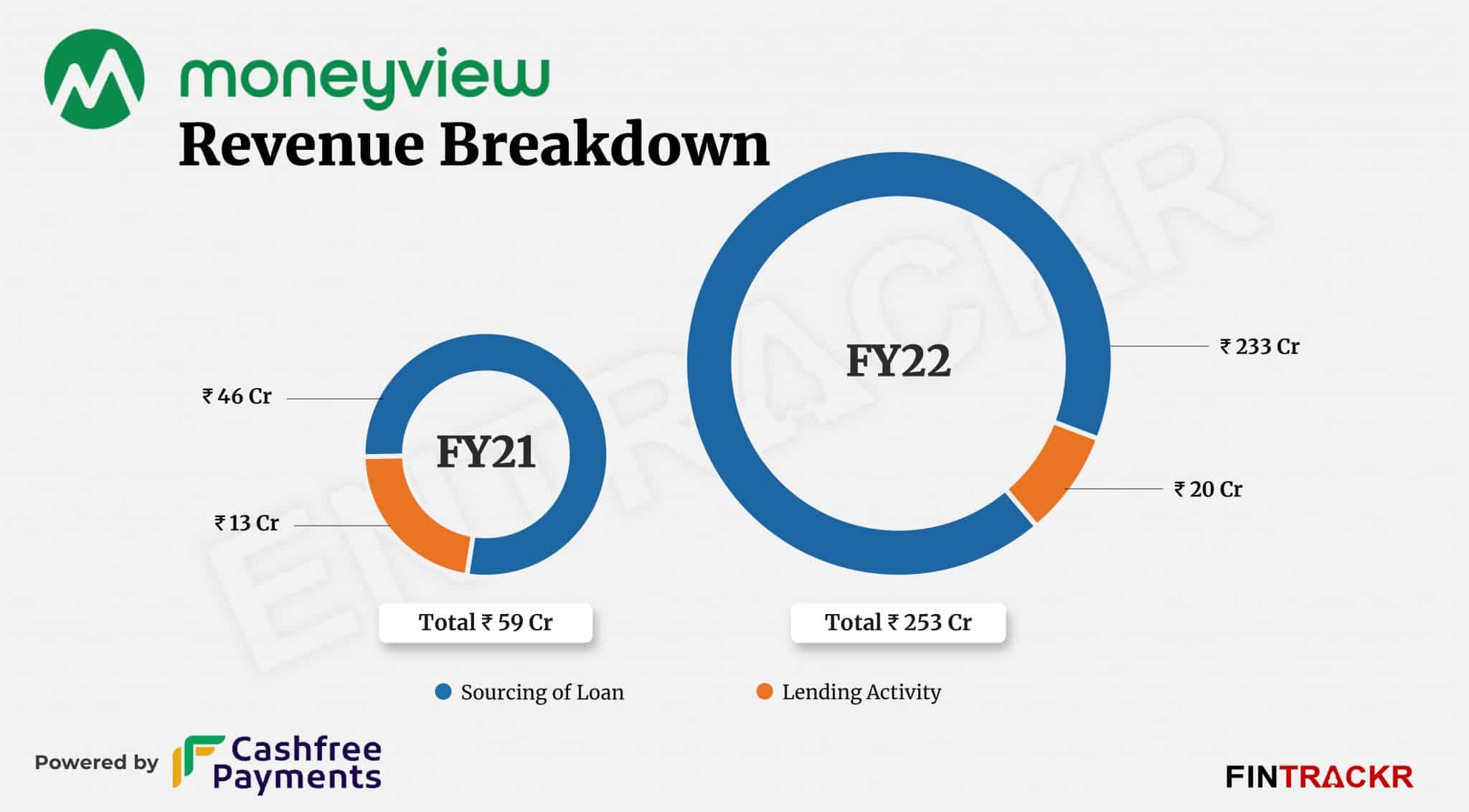

Money View offers personalized credit products like instant personal loans, cards, BNPL, and personal financial management solutions and has partnered with over 15 lenders. Sourcing and processing fees collected from the financing partners remained the largest source of revenue which accounted for 92% of the collections. This income grew 5X to Rs 233 crore in the fiscal year ending March 2022.

The eight-year-old company also enforces facilitation charges to the borrowers for the disbursement of loans. Income from this stream grew 54% to Rs 20 crore in FY22.

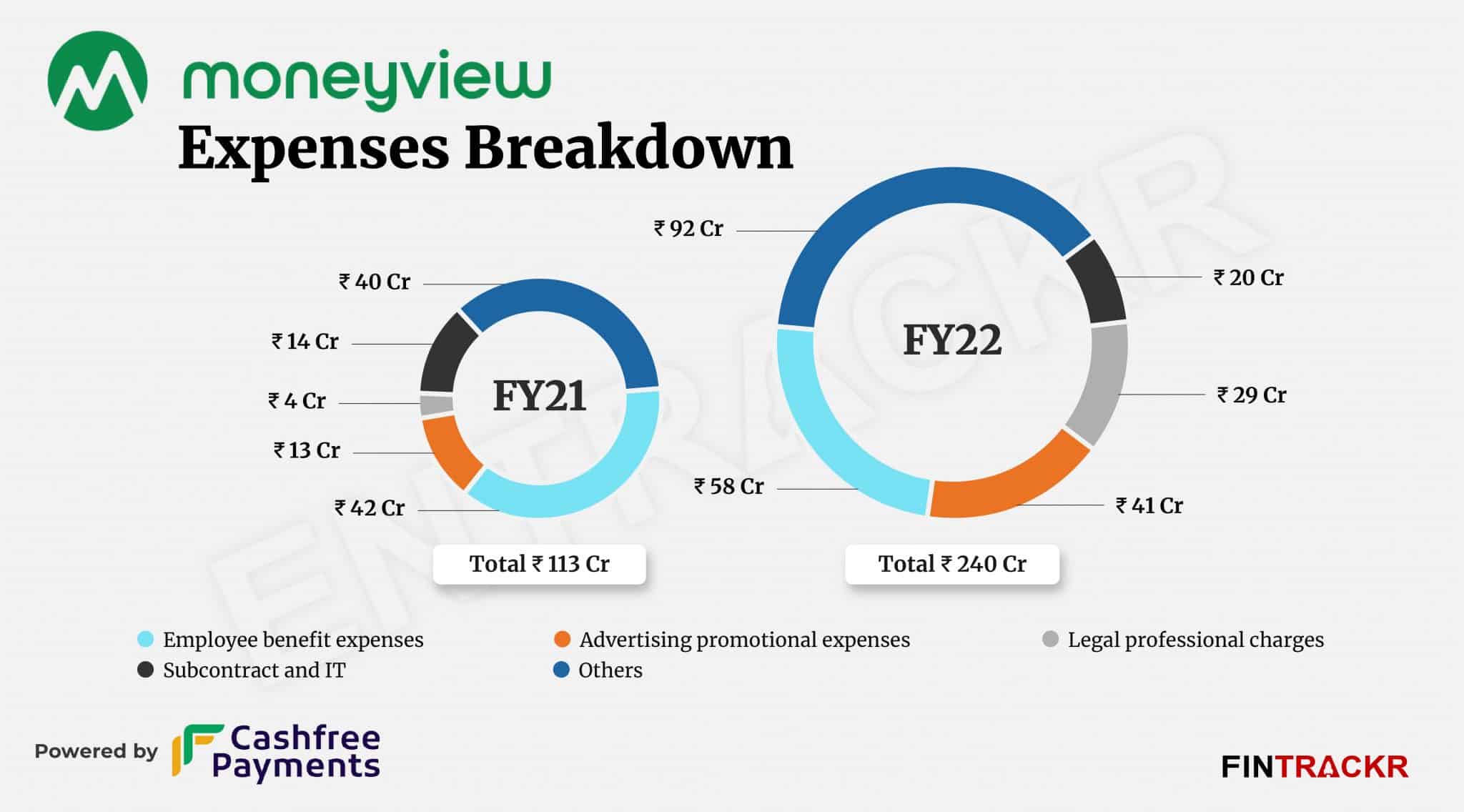

On the expense front, employee benefit expenses remained the largest cost center for Money View in FY22 and formed 24% of the overall cost. This expenditure surged 38% to Rs 58 crore in FY22 which also includes Rs 4.27 crore as ESOP expenses.

The cost of advertisement soared 3.1X to Rs 41 crore while legal and professional charges shot up 7X to Rs 29 crore during the last fiscal year. MoneyView added another Rs 20 crore as subcontract and information technology costs which pushed the total expenses by 112% to Rs 240 crore in FY22.

Even with over four-fold growth, the company managed to turn profitable in FY22. The Tiger-backed company posted a profit of Rs 17.7 crore in the last fiscal as compared to Rs 46.8 crore loss in FY21.

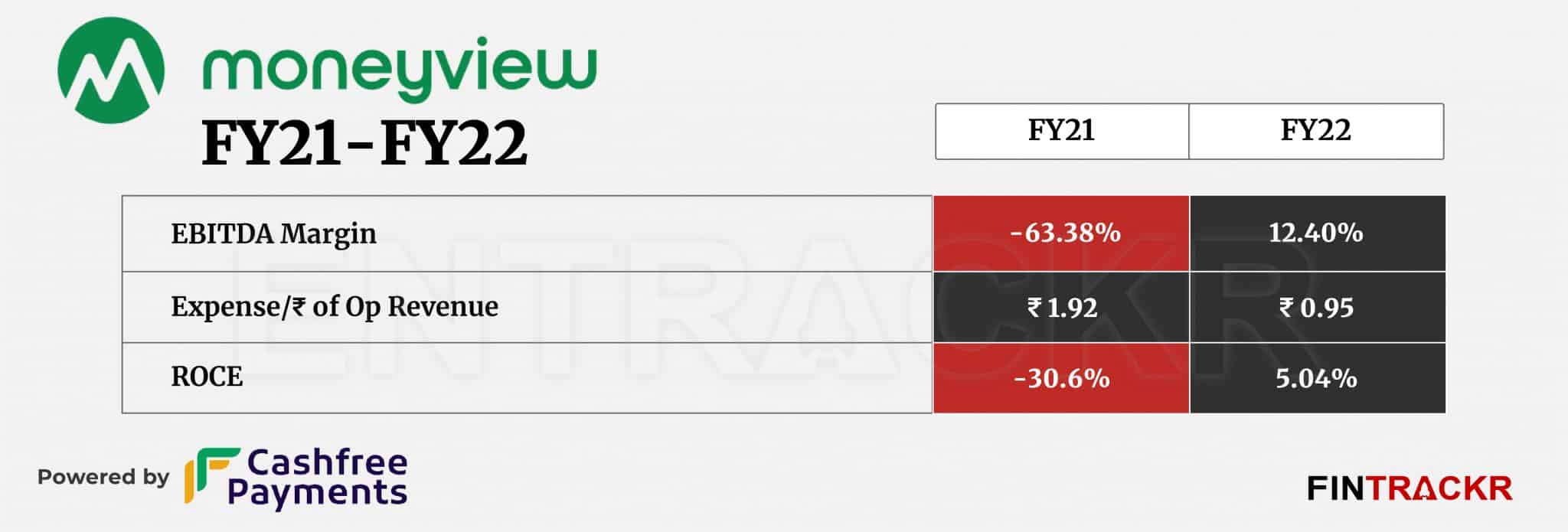

Coming over to the ratios, the return of capital employed (ROCE) and earnings before interest, taxes, depreciation, and amortisation (EBITDA) margin improved to positive with 5.05% and 12.40% respectively. On a unit level, Money View spent Rs 0.95 to earn a single rupee.

Founded by Puneet Agarwal and Sanjay Aggarwal, Money View scooped up $75 million in a Series D round led by Tiger Global in March and is reportedly in talks to raise around $150 million at a unicorn valuation. According to the company’s projections, it expects to end FY23 with more than Rs 1500 crore in revenue run rate.

The Money View story is a good indicator of the massive potential seen in the consumer finance space, where multiple banks and NBFC’s are already slogging it out for market share. The premise of a fast, paperless process from Money View is certainly not novel, but the firm has clearly done well to make it work.

With an NBFC heavy line up of lending partners, it seems safe to assume the firm does not even offer the best rates to borrowers. Other startups like CRED are already snapping away at the top end with their pre-approved loans (at 12%) that also promise paperless and quick disbursals.