While Shiprocket had entered into the coveted unicorn club after raising $33.5 million from Temasek and LightRock in FY23, FY22 turned out to be the best fiscal year so far for Shiprocket as the company raised its largest $185 million round in December last year which valued it at $930 million.

Back to back financing rounds in FY22 also supported Shiprocket as it sailed past the Rs 600 crore revenue mark during the financial year ending March 2022.

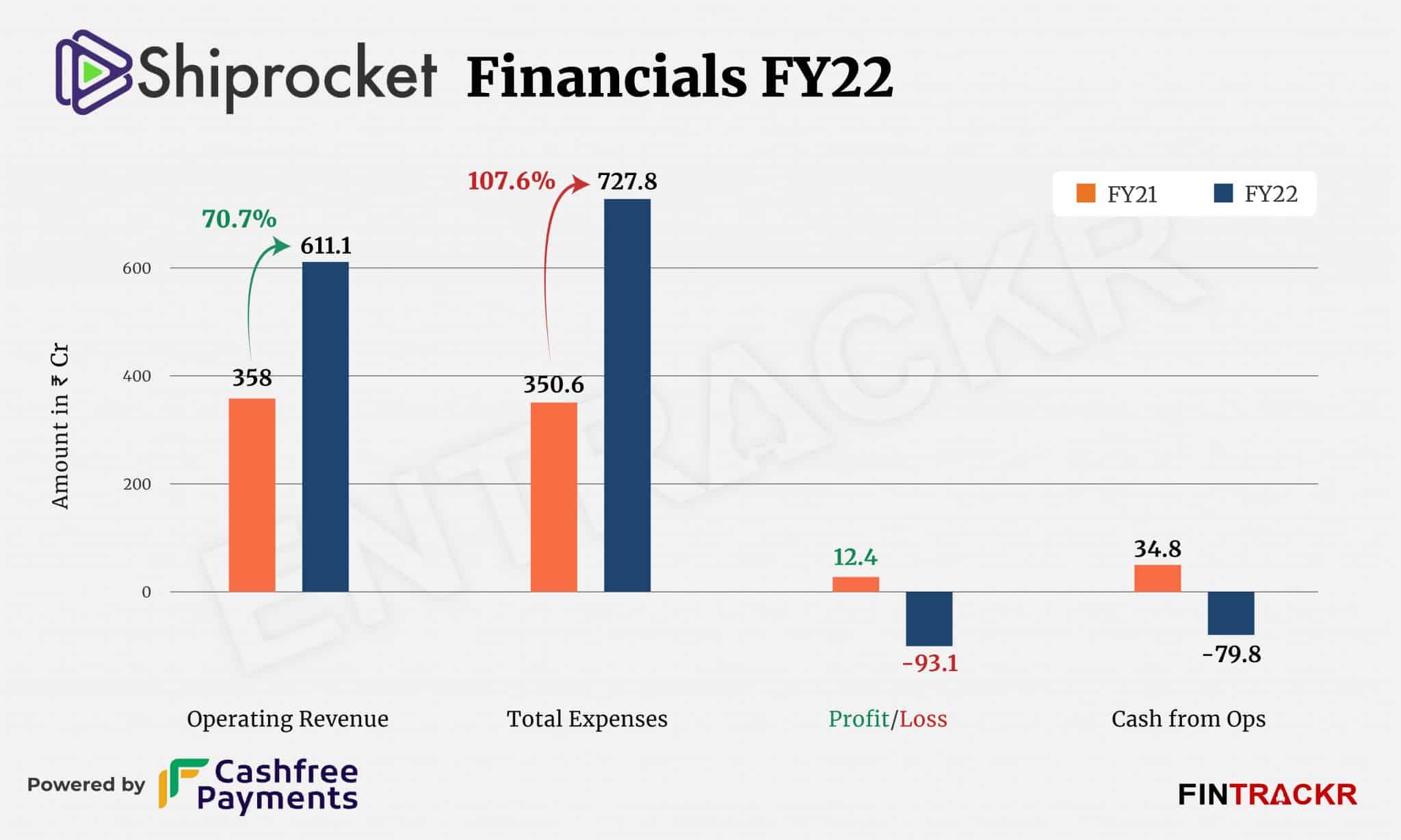

Shiprocket’s operating revenue grew around 71% to Rs 611 crore in FY22, as per the annual financial statements filed with the Registrar of Companies (RoC).

The Delhi-based company offers shipping, technology services including one-time setup and fulfillment solutions which include warehousing, catalog, and inventory management. Collection from these services was the sole source of revenues for Shiprocket in FY22.

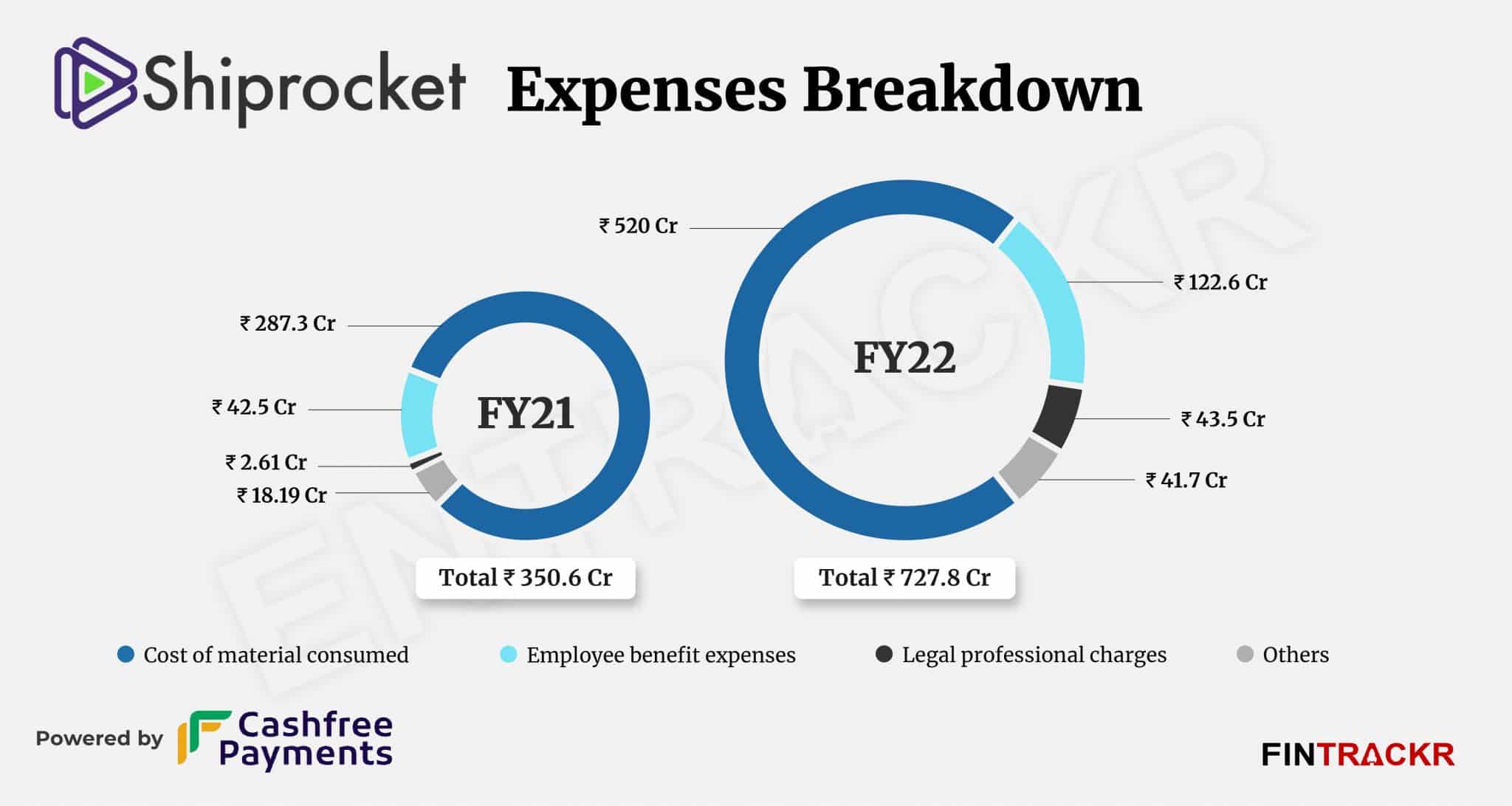

Cost of material consumed was the largest cost for Shiprocket, forming 71.4% of the overall cost. This cost includes packaging material like flyers, packaging boxes, corrugated boxes, et al which surged 81% to Rs 520 crore in FY22 from Rs 287.3 crore in FY21.

Employee benefits expense was the second largest cost center for the company which grew 2.8X to Rs 122.6 crore and accounted for nearly 17% of Shiprocket’s total expenses in FY22. This expense also includes Rs 31.7 crore on ESOPs.

Shiprocket had acquired three companies: Glaucus, Rocketbox, and Wigzo in FY22 and raised two financing rounds. These transactions lifted its legal and professional costs by 16.6X to Rs 43.5 crore and pushed its total expenses to the tune of 107% to Rs 727.8 crore in FY22.

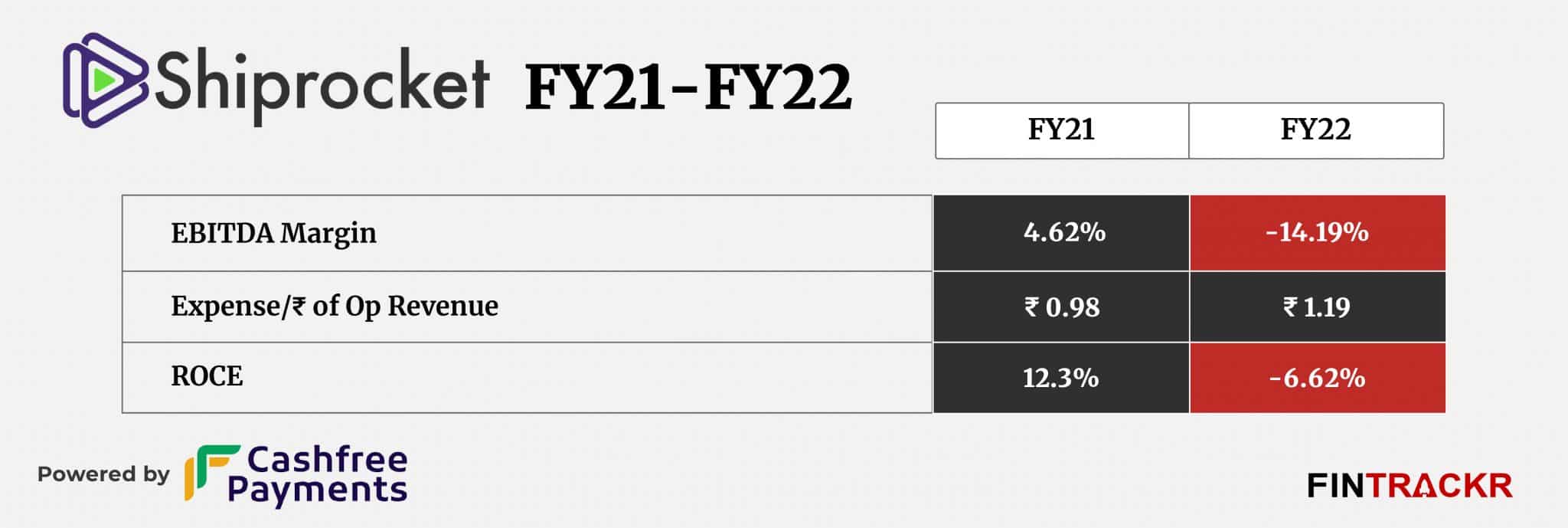

The Zomato-backed company had prioritized growth at all costs in FY22 and this is evident from its bottom line which slipped into the red. Shiprocket posted a loss of Rs 93 crore in FY22 against a profit of Rs 12.4 crore during FY21. On a unit level, the company spent Rs 1.19 to earn a single rupee.

The firm will be hoping that the end of one-time costs on acquisitions, fundraising and the elevated cost of packaging for most of FY22 will finally lead to a return to profitability in FY23 or early in FY24. The funding market also, while not exactly souring for logistics firms, is no longer as forgiving, as we have seen in the hammering for the Delhivery stock price in the past week or so.