Women wellness direct-to-consumer brand BlissClub had recently raised $15 million in its Series A round led by Eight Roads Ventures and existing investor Elevation Capital. While the company did not provide details such as round break-up, valuation and shareholding pattern, Fintrackr has sifted through the company’s regulatory filings to decode these details.

The board at BlissClub had passed a special resolution to issue 10 equity shares and 4,253 Series A compulsory convertible preference shares (CCPS) at issue price of Rs 266,862.5 per share to raise around Rs 114 crore or $15 million, according to the company’s regulatory filing.

Eight Roads Ventures has spearheaded the Series A round with Rs 75.74 crore ($9.73 million) followed by Elevation Capital and Sarin Family which infused Rs 34.21 crore ($4.4 million) and Rs 80 lakh ($0.1 million) respectively. Licious’ co-founders Vivek Gupta & Abhay Hanjura via VIABL Smart Ventures, former Myntra’s CEO Amar Nagaram, SoftBank executives Sumer Juneja & Munish Varma and Paul Davidson invested Rs 37 lakh each.

Swiggy’s CEO Sriharsha Majety, Mamaearth’s co-founder Ghazal Alagh, Shopif’s executive Brennan Loh and global fashion influencer Masoom Minawala (Minawala Ventures) infused the remaining sum.

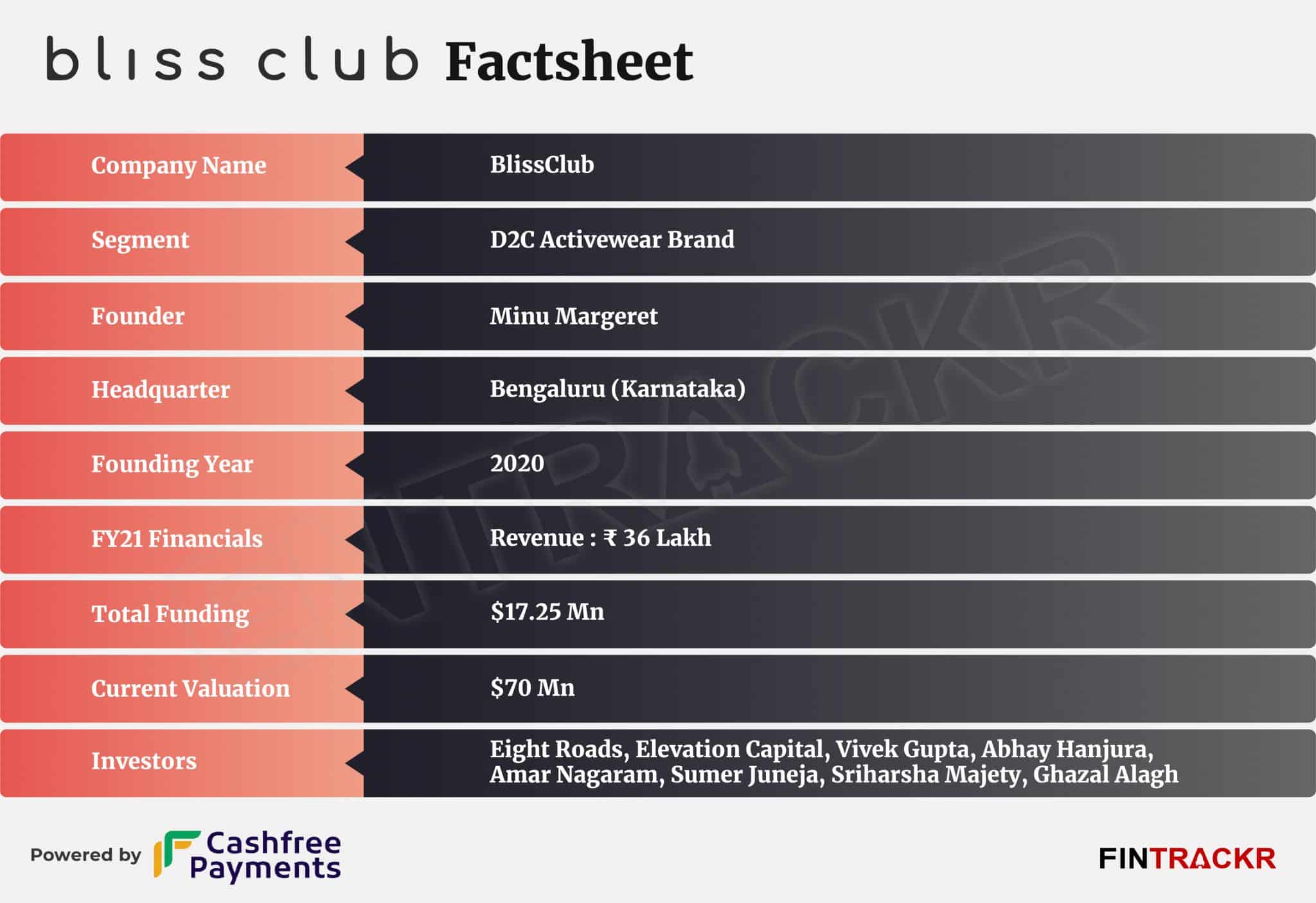

As per Fintrackr’s estimates, the company has been valued at around Rs 540 crore or $70 million (post-money).The company has raised nearly $17.25 million till date including a seed round of $2.25 million.

The Bengaluru-based startup is a homegrown activewear brand and creates fitness and wellness apparel for women. The brand does 90% of its sales through its website and rest from the third-party marketplaces.

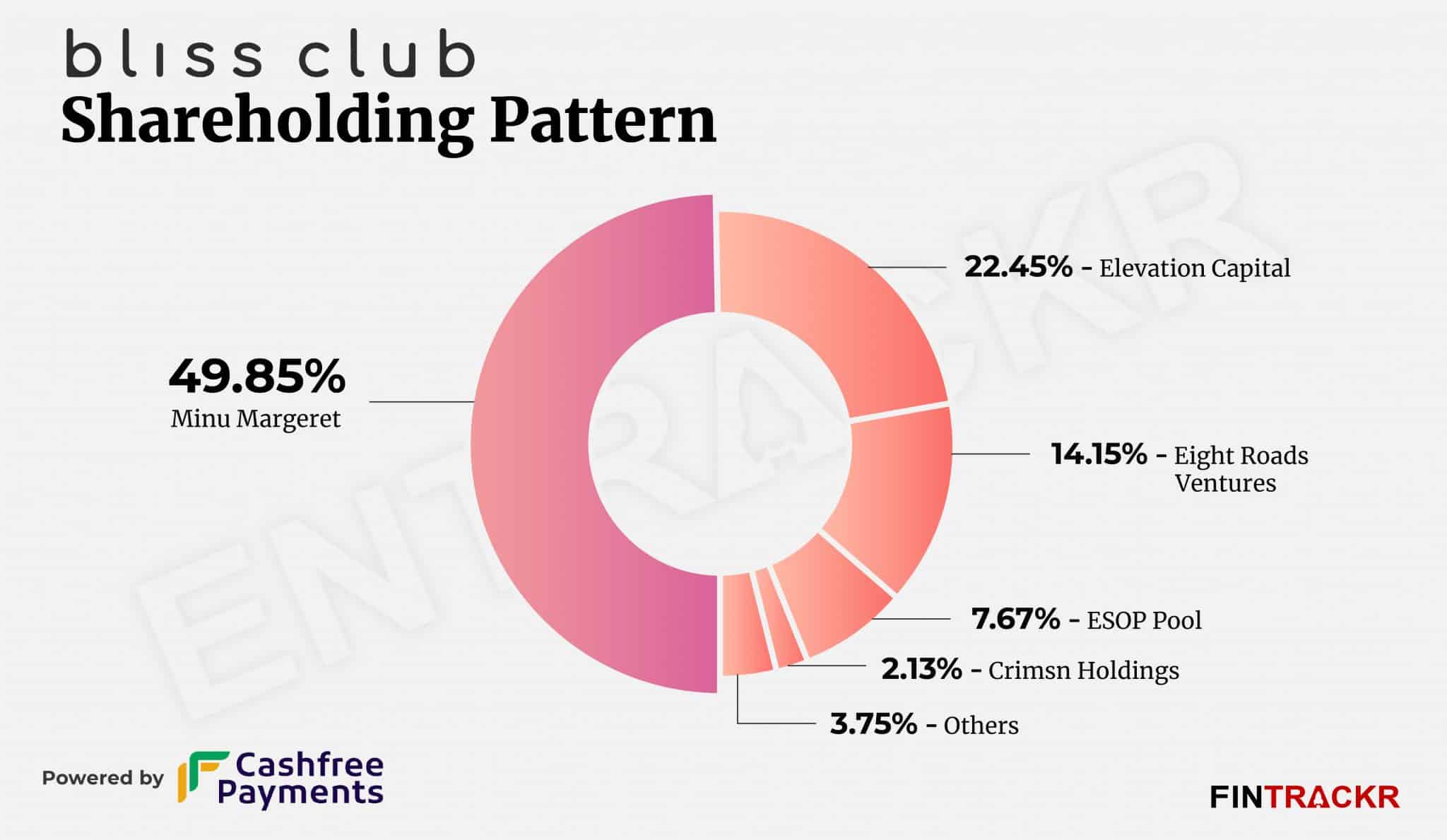

Post allotment of the Series A round, founder and CEO of the company Minu Margeret remains the largest stakeholder with 49.85% stake followed by Elevation Capital and Eight Roads Ventures who hold 22.45% and 14.15% stake respectively. The complete shareholding pattern of the company can be seen below:

While BlissClub is yet to file its financial numbers for FY22, it remained a pre-revenue stage company for the fiscal year ending March 2020 and booked revenue of Rs 36 lakh in FY21, as per the company’s annual financial statements with the RoC.

BlissClub competes with the likes of Playfiks, Kica Active, SilverTraq et al.

According to a report by Research and Markets, the activewear market in India has displayed a steady growth in the last decade — even outperforming fast fashion, ethnic wear and formal footwear since the onset of the pandemic — and is estimated to reach Rs 99,780 crore or $13 billion by 2024.