Online debt platform Yubi (formerly CredAvenue) emerged as one of the fastest fintech companies to become a unicorn in India, taking just 18 months from its inception to touch $1.3 billion in valuation. The 3X jump in its valuation within six months has come on the back of a solid 6X plus surge in its operating revenue in the fiscal year ending March 2021.

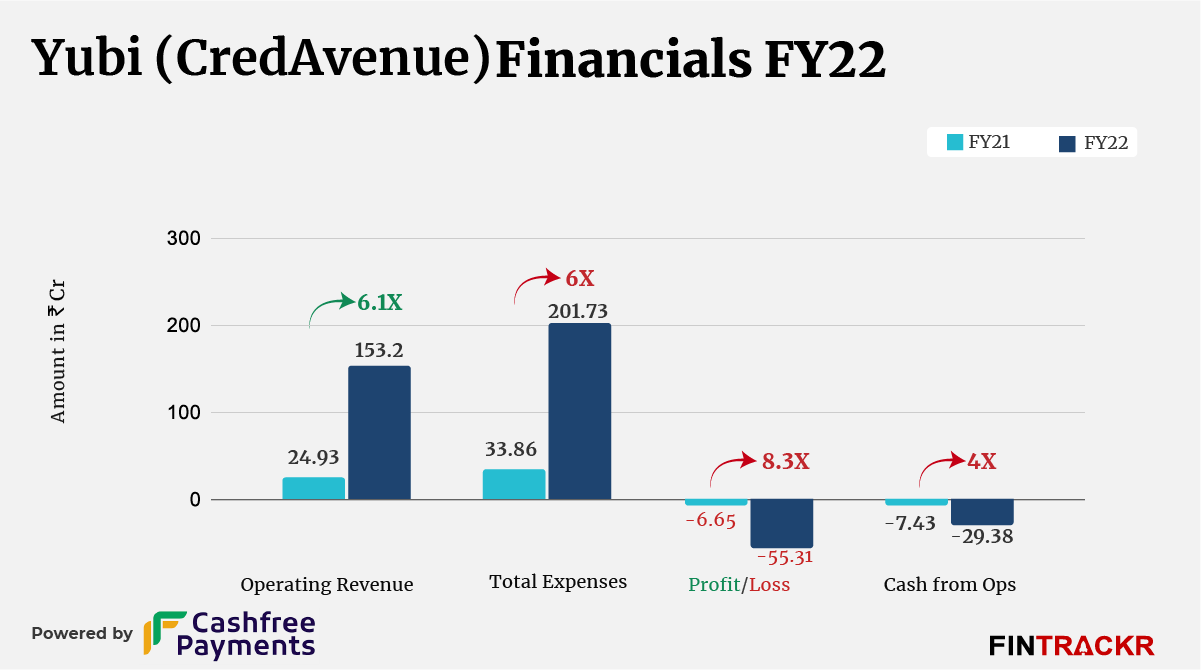

The Insight Partner-backed Yubi’s operational income grew 6.1X to Rs 153.2 crore in FY22 from Rs 24.93 crore in the previous fiscal year (FY21), according to the firm’s annual financial statements filed with the RoC.

Owned by Vivriti India, Yubi is a debt marketplace which connects businesses seeking loans with financial institutions, banks and other investors. The company has six products which include a lending marketplace, supply chain financing marketplace, digital lending platform and a dedicated real estate and infrastructure financing solution.

It’s worth noting that these are standalone numbers of Yubi.

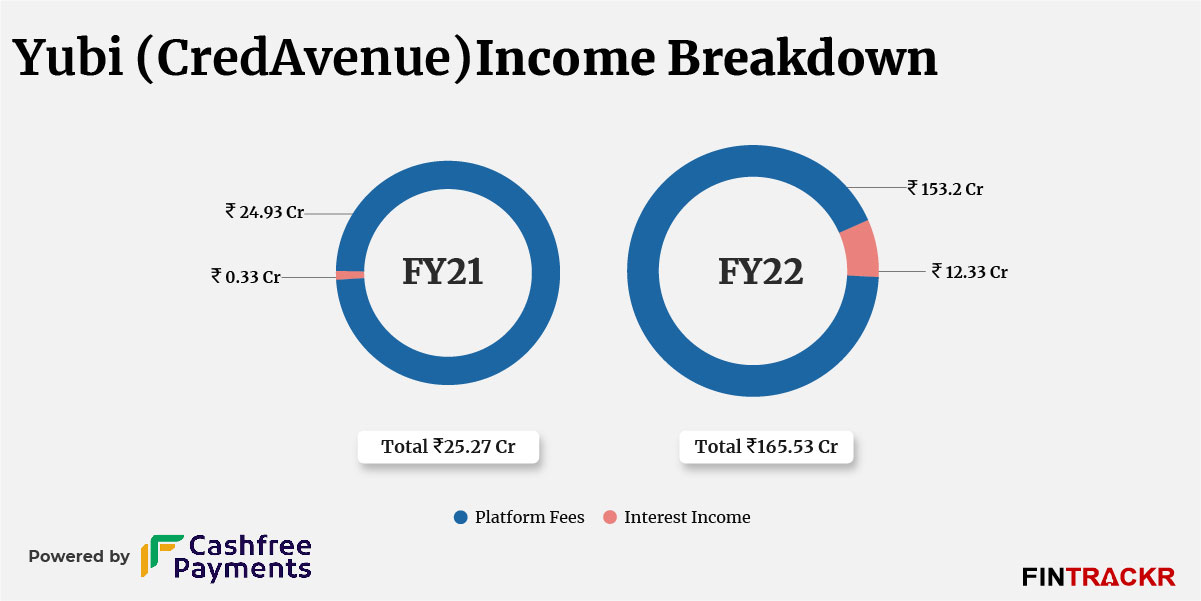

Platform fees collected for facilitating the loans remain the major source of income for Yubi accounting for 92.5% of the total operating revenue. This income grew 6.1X to Rs 153.2 crore in FY22 as compared to Rs 24.93 crore in FY21.

Yubi also made Rs 12.33 crore, mostly from interest on fixed deposits and the sale of current investments which pushed its total income to Rs 165.53 crore in FY22.

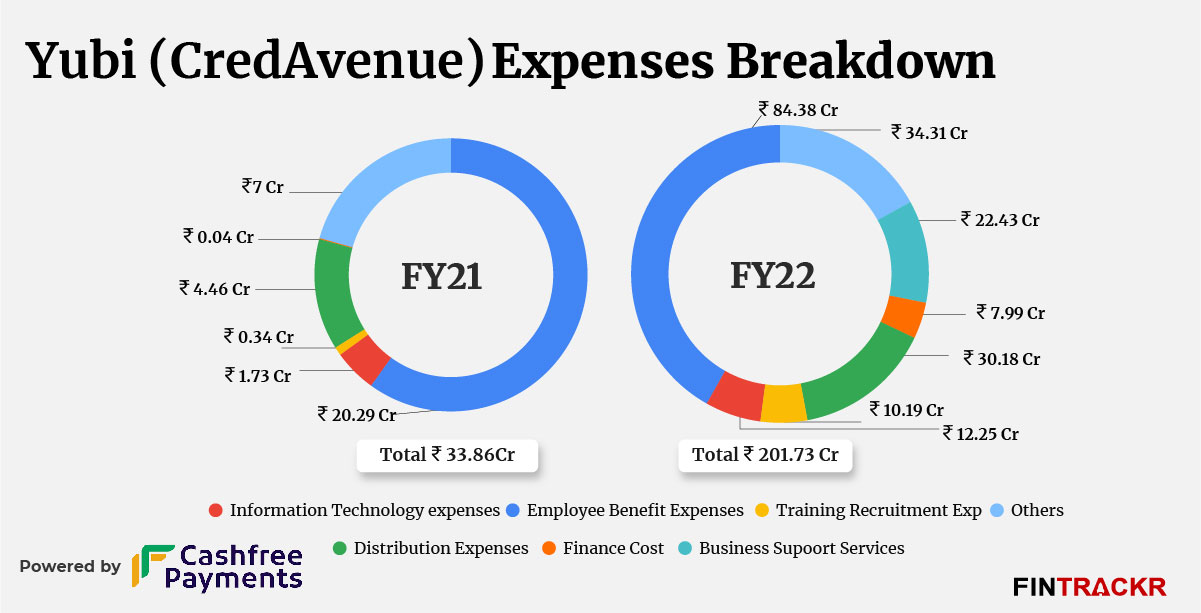

Mirroring the growth in scale, overall costs at the company shot up around 6X to Rs 201.73 crore in FY22 from Rs 33.86 crore in FY21. Employee benefit expenses were the major cost center for Yubi which constituted 41.80% of the overall cost and soared 4.15X to Rs 84.38 crore in FY22 from Rs 20.29 crore in FY21.

As the company grew at a scorching pace, its distribution cost jumped 6.7X to Rs 30.18 crore in FY22 from Rs 4.46 crore in FY21. Yubi also spent Rs 22.43 crore on business support services which include legal costs et al in FY22.

Information technology and training & recruitment expenses were other major costs for Yubi which soared 7X and 30X respectively to Rs 12.25 and Rs 10.19 crore in FY22.

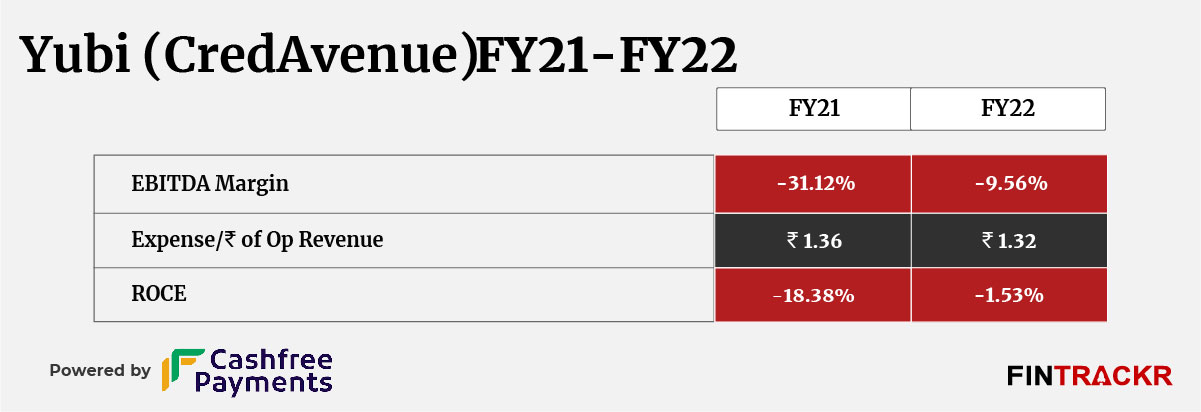

With the multi-fold increase in scale, Yubi’s expenses also shot up, resulting in a sharp 8.3X surge in losses to Rs 55.31 crore in FY22 from Rs 6.65 crore in FY21. As the company managed to expand its business brilliantly in FY22, its EBITDA and ROCE also improved.

On a unit level, Yubi spent Rs 1.32 to earn a rupee of operating revenue in FY22.

Yubi (CredAvenue) has demonstrated stellar financial performance in FY22 and the solid track record of its co-founders Gaurav Kumar and Vineet Sukumar seems to have worked well in scaling up the lending marketplace platform. According to its website, the company has managed to onboard 2500 corporates, 750 lenders and facilitate debt volumes of over Rs 100,000 crore.

Kumar has been a veteran in the Indian lending and investing ecosystem. He was a founding member and chief business officer (CBO) at Northern Arch Capital between 2008 and 2017. Sukumar had a close to eight-year-long stint at IFMR Capital Finance. The duo have been running Vivriti capital for about 20 months which owns a majority stake in Yubi (CredAvenue).

Yubi is also foraying into global markets starting with West Asia and North Africa with results expected to be visible by the end of FY23.