WhatsApp’s transaction data for unified payments interface or UPI in July is a worrisome figure for the Meta-owned company as it saw a steep decline in payment users during the last month as compared to the previous month or June this year.

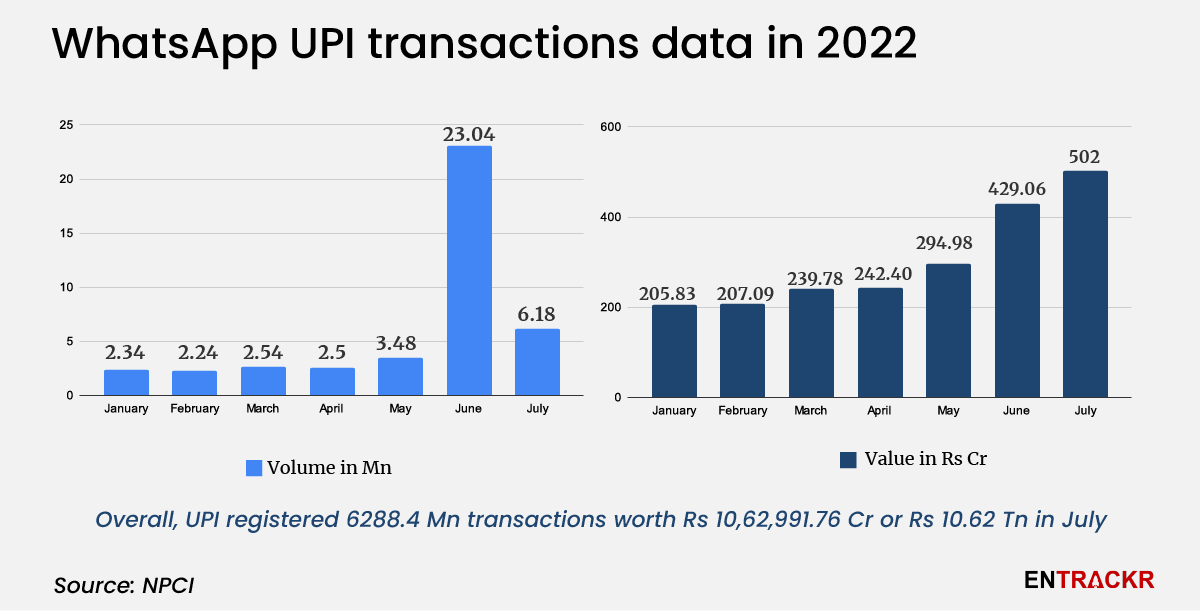

According to National Payments Corporation of India (NPCI) data, WhatsApp registered 23.08 million transactions in June, up from 3.48 million in May. However, the transaction number declined by 74% to 6.18 million in July.

Although the transaction volume for WhatsApp declined, it managed to increase its value from Rs 429 crore in June to Rs 502 crore in July. It means the average transaction value jumped more than 4X from Rs 18.65 to Rs 83.6 during the same period.

According to experts tracking the UPI ecosystem, the primary reason for the decline in number is the removal of cashback offers by WhatsApp which pulled discount hunters to the app. WhatsApp was offering users Rs 35 cashback for the next three payments or a total of Rs 105 cashback. Interestingly, there was no limit to the amount initially but the firm later clarified that the offer was limited and available only for select users.

In April, NPCI also allowed WhatsApp to onboard an additional 60 million users on UPI. With this approval, WhatsApp will be able to expand the service to its first 100 million users.

Overall, UPI registered 6288.4 million or 6.2 billion transactions amounting to Rs 10,62,991.76 crore in July.

PhonePe, Google Pay and Paytm continue to lead the pack with 2,993 million, 2,130 million and 828 million transactions respectively. Volume wise, PhonePe has 47.6% market share followed by GooglePay and Paytm with 33.88% and 13% share respectively. The trio control nearly 95% share against the remaining apps in the UPI ecosystem.

Value wise, PhonePe controls nearly 50% market share while Google Pay has 34%.

Besides cashbacks and various offers through promo codes, PhonePe, Google Pay and Paytm have better use cases such as ticket booking, and utility payments like electricity, water and bill payments. Additionally, PhonePe and Paytm also have a wallet feature which helps them to maintain their pole position on the UPI bandwagon.

While NPCI has already advocated capping UPI’s market share for third-party apps, which comprises PhonePe and Google Pay, to 30%, the rule has not been formalised yet, allowing the apps to continue without any issues so far.

Recently, an ET report highlighted that multiple Members of Parliament (MPs) are planning to raise the issue of the duopoly of UPI apps in the house during the upcoming monsoon session.