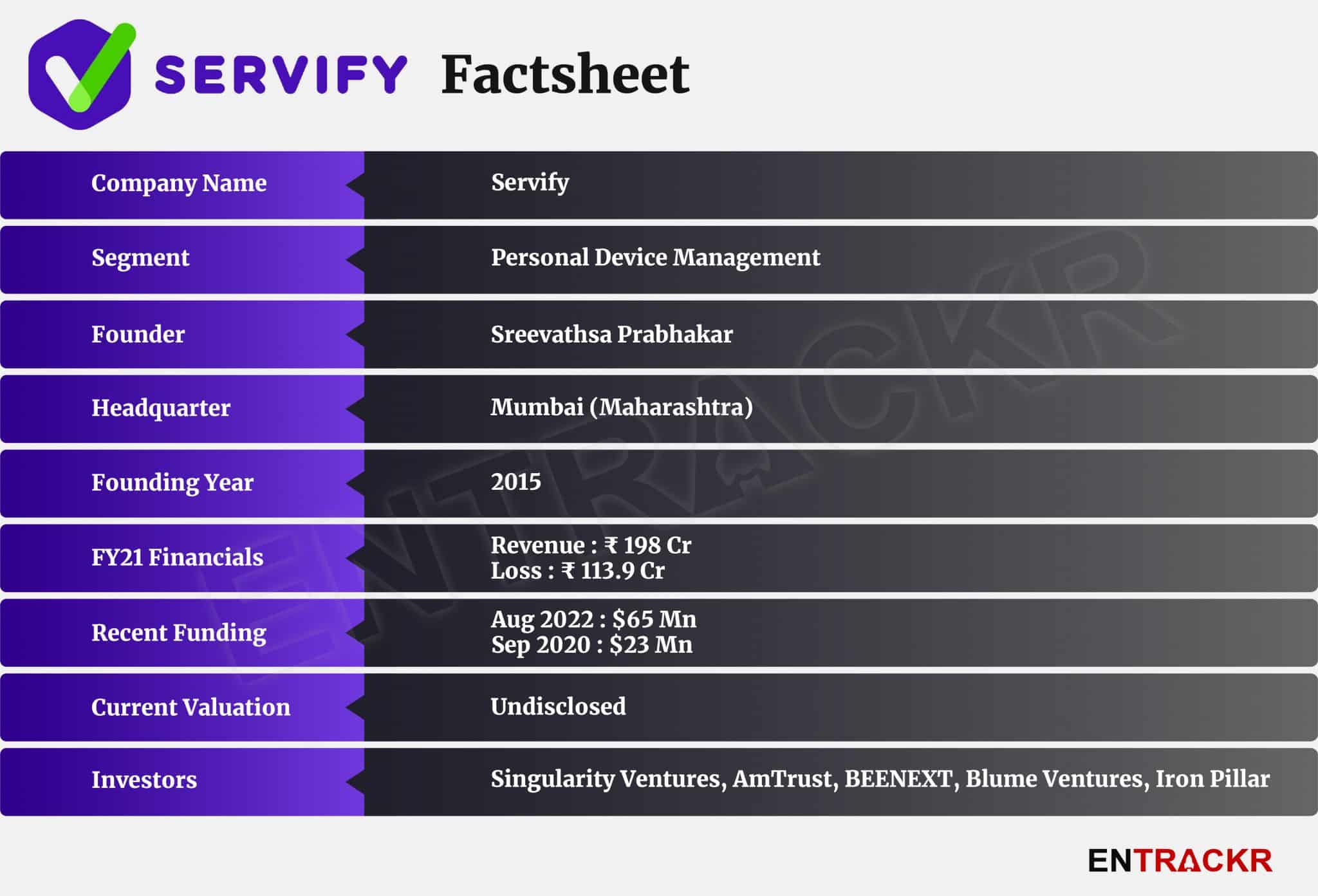

Servify, personal device management and after-sale services for electronic gadgets company, has secured $65 million as part of its ongoing Series D funding round led by Singularity Growth Opportunity Fund.

Several strategic investors like AmTrust, family offices including Pidilite, and existing investors including Iron Pillar, BEENEXT, Blume Ventures, and DMI Sparkle Fund also participated in the round.

The fresh round has come after a gap of almost two years for the Mumbai-based startup. It raised $23 million in Series C round in September 2020 and $15 million Series B in August 2018. Growth stage fund Iron Pillar led both rounds. The company has scooped up around $110 million since its inception in 2015.

Servify will use the latest proceeds to grow its business in international markets and strengthen the technology platform. Recently, the company extended its platform to enable affordable product purchases such as No Cost EMI, instant discounts, and will also scale these offerings with the raised capital.

Servify offers brand-authorized after-sales support for mobile phones, personal gadgets, electronics and home appliances. The platform allows consumers to add their household electronic gadgets onto the platform, store the bills, and access authentic brand authorized service during or beyond the warranty period.

Servify currently works with over 75 top device brands, retailers, distributors, insurers, service providers and carriers such as Apple, Samsung, OnePlus, Xiaomi, HP, Vivo, Realme and Nokia amongst others.

According to Servify, it’s trying to make a dent in an addressable market of over $100 billion with global presence which include North America, Europe, Middle East, Turkey, and Asia. It has a presence in about 40 countries and employs more than 700 people globally.

Sreevathsa Prabhakar, founder of Servify, claims that the company is clocking an annual revenue rate of $130 million (more than Rs 1,000 crore) and is on the verge of turning profitable. Prabhakar also added that the company is planning to go public in 18 to 24 months.

While the company’s latest financials has not been filed yet, it reported a 2.8X jump in operating revenue to nearly Rs 198 crore in FY21. As per its regulatory filings with RoC, losses of the company also surged by 34% to Rs 113.9 crore during the fiscal year.