The pandemic impacted the country’s fourth-largest valued fintech company Pine Labs adversely, as seen by a dip in its collections in FY21.

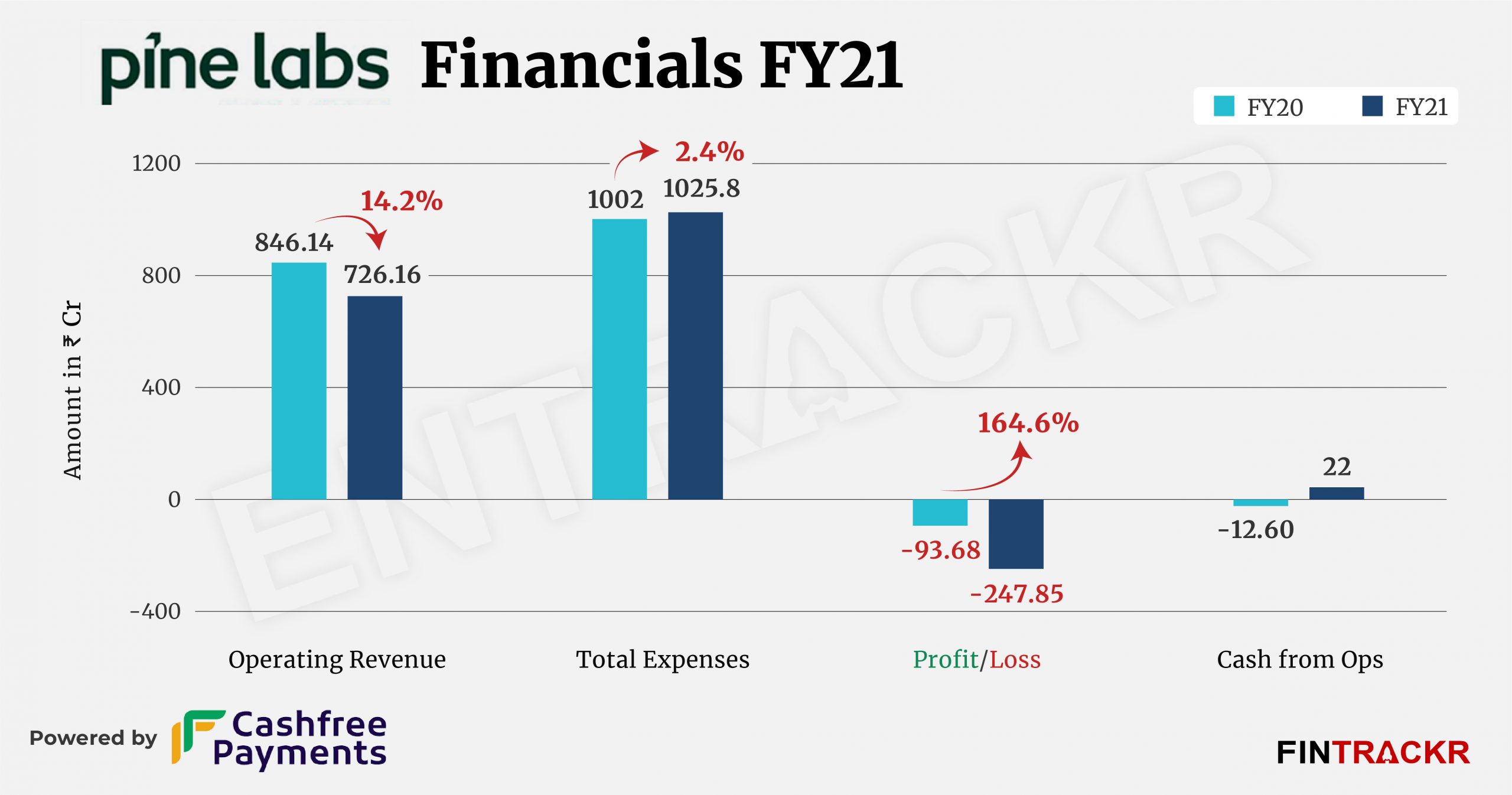

During the fiscal year ended 2021, merchant commerce Pine Labs’ revenue reduced 14.2% to Rs 726.16 crore from Rs 846.14 crore in FY20, as per the financial statements filed by its holding company Pine Labs Pte Ltd in Singapore recently.

Pine Labs has twelve subsidiaries in different countries including Singapore, India, Thailand, Indonesia, Dubai, Malaysia and Australia. India was the largest market for Pine Labs and formed 88.6% of its total collection in FY21 whereas Singapore and the remaining markets contributed 8.2% and 3.2% respectively.

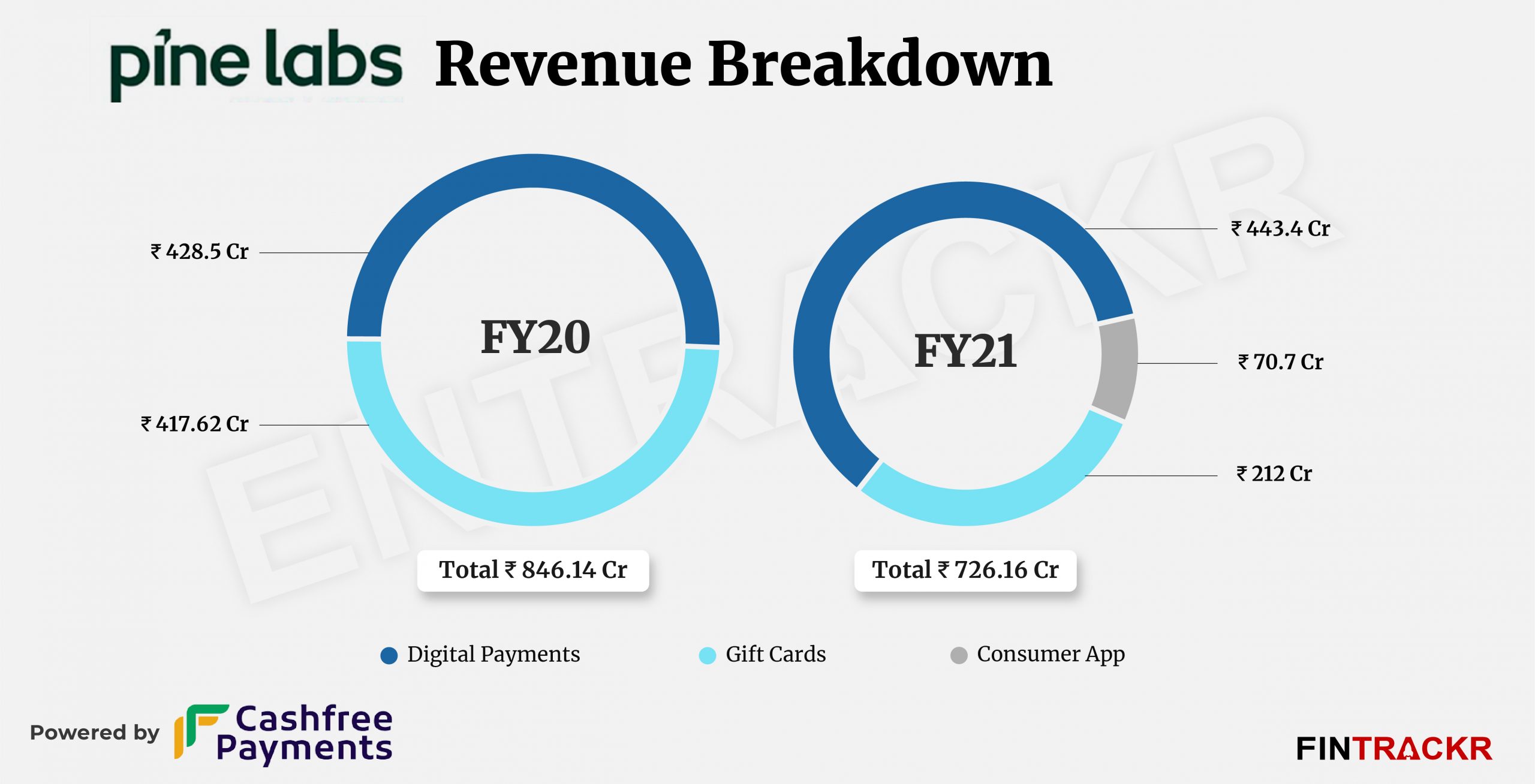

Pine Labs provides point of sales devices (PoS) terminals for merchants to accept plastic cards and QR-based payments in their stores. The company charges fixed or variable fees from merchants, banks and brands against these services. This income emerged as the largest one for Pine Labs and constitutes 61% of its total operating revenue in FY21.

The Delhi-headquartered company also entered into the corporate gifting space in 2019 with acquisition of QwikCilver, the fulfilment firm for Amex rewards till then. It charges processing fees on the value of gift cards/vouchers activated or reloaded as per the agreement with the merchants which forms 29.2% of the company’s operating income. This vertical suffered the worst during the pandemic-laden fiscal year and its collection contracted 49.2% to Rs 212 crore in FY21 from Rs 417.6 crore in FY20.

In July 2020, the company added Southeast Asian consumer fintech firm Fave which provides deals, vouchers and e-cards to customers. Pine Labs generated a revenue of Rs 70.7 crore in FY21 as a commission fee for all payments made using the Fave application which operates in Malaysia, Singapore and Indonesia.

Pine Labs’ income from interest on security and bank deposits reduced 45.8% to Rs 20.7 crore in FY21 from Rs 38.16 crore in FY20.

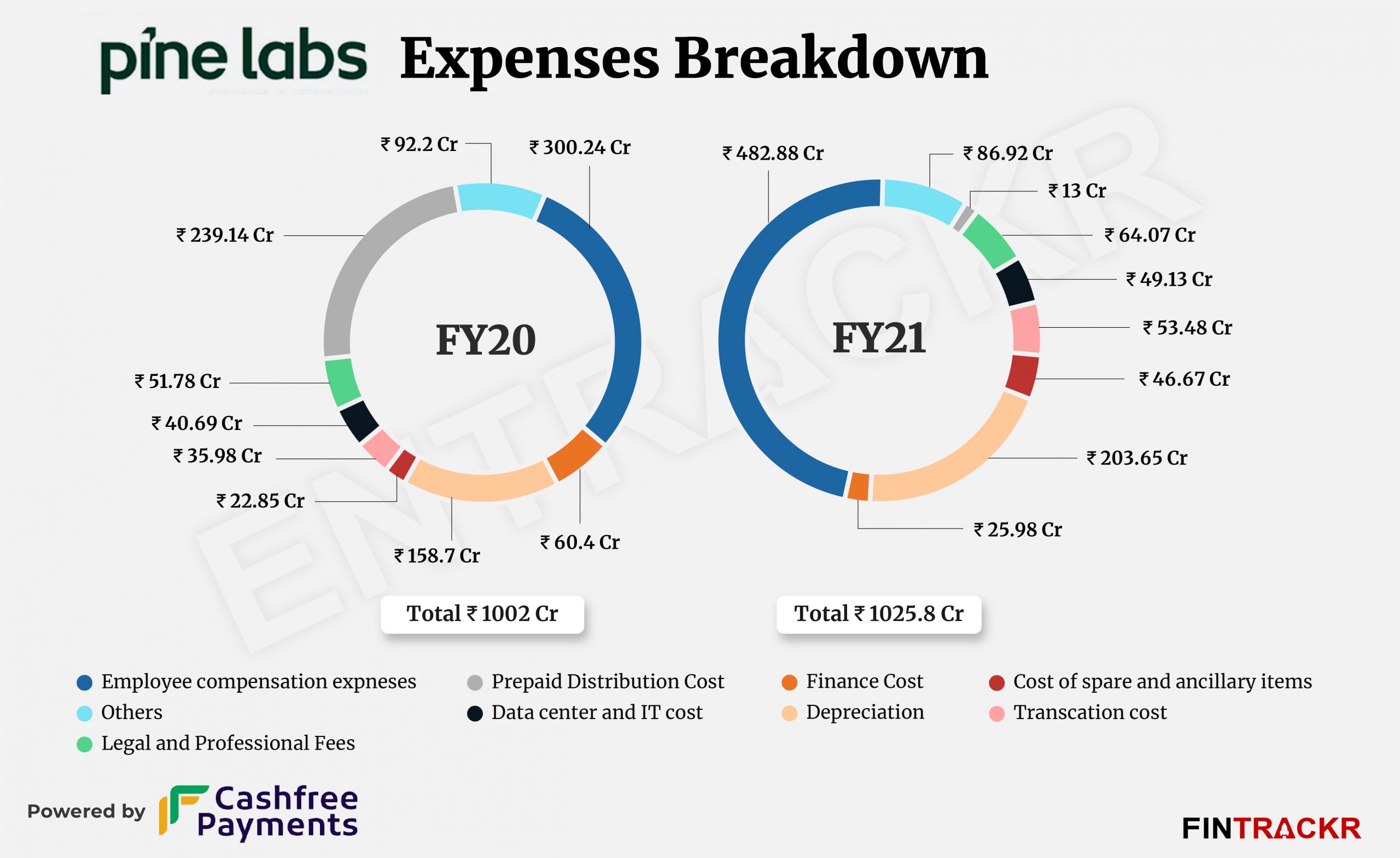

Moving over to the cost sheet, employee benefits cost was the largest cost center for the company, constituting 47% of the annual cost. This cost grew 61% to Rs 482.88 crore in FY21 from Rs 300 crore in the preceding fiscal year (FY20). This also includes Rs 131.63 crore as ESOP expenses (Non-cash).

Cost of spares and ancillary items which includes the cost of paper rolls used in merchant equipment, cost of equipment sold and consumables jumped 2X to Rs 46.67 crore in FY21 from Rs 22.85 crore in FY20.

Transaction cost for the company includes switch fees paid to service providers, listing fees to merchants, payment gateway charges and support charges for the deployment of POS machines. This cost increased 48.6% to Rs 53.48 crore in FY21.

Expenditure on data and information technology (IT) ballooned 20% to Rs 49.1 crore in FY21 from Rs 40.69 crore in FY20 while the cost for repair and maintenance remain constant at Rs 24 crore in FY21.

Moving further, Pine Labs booked Rs 13 crore as prepaid distribution cost in FY21 which shrank 94% from Rs 239 in FY20. This cost includes the cost of gift cards, and vouchers, which pine labs maintain as an inventory. It booked another Rs 64 crore as legal and professional fees in FY21 pushing total expenditure to Rs 1,025 crore in FY21 from Rs 1,001.98 crore in the previous fiscal year (FY20)

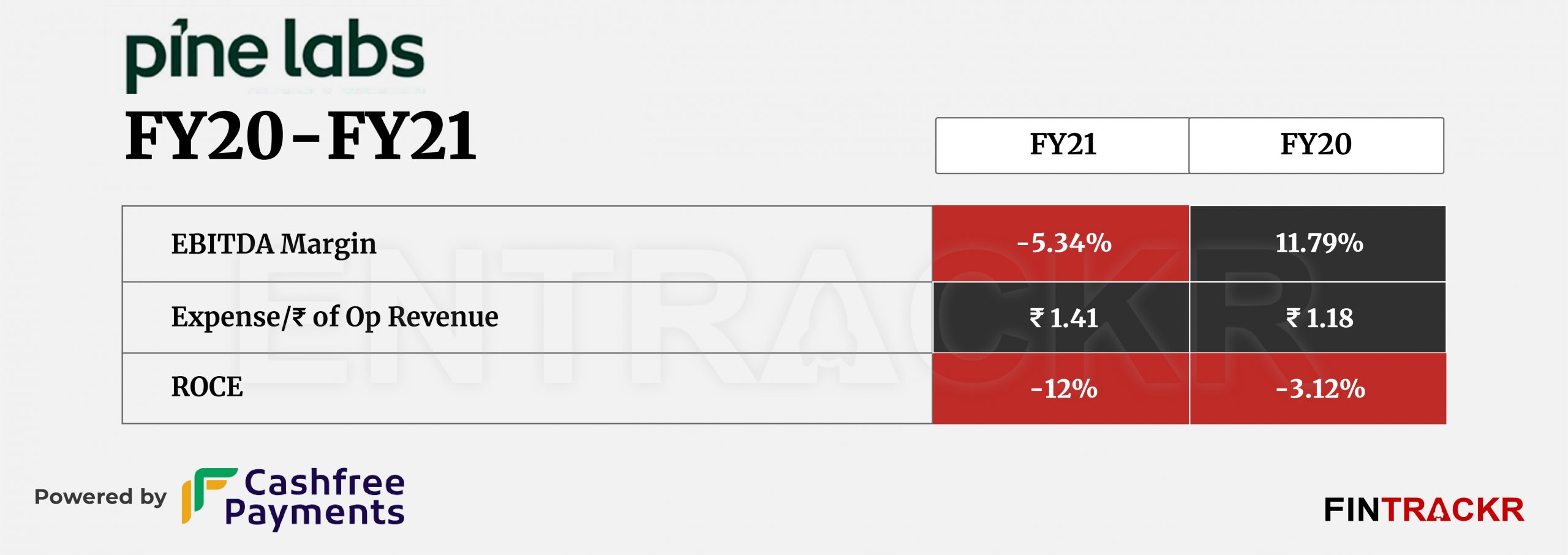

As its scale shrunk, Pine Labs’ losses surged 164% to Rs 247.85 crore in FY21 from Rs 93.68 crore in FY20 which resulted in a worsening of ROCE and EBITDA margin in FY21. On a unit level, the company spent Rs 1.41 to earn a rupee.

While the company is yet to file its financial results for FY22, its collections are likely to have improved during the last fiscal year. The company was also planning an initial public offering (IPO) in the US this year but our sources are indicating that it has delayed its public listing in the wake of poor market conditions. Ahead of the listing on the bourses, Pine Labs has acquired a majority stake or made three back-to-back acquisitions. This includes Mumbai-based online payments startup Qfix in February, payments solution provider Mosambee in April and most recently it took over fintech infrastructure company Setu.

Looking ahead, profitability could remain elusive for the firm in a highly competitive Indian market in its core payments business. The rewards and vouchers business should offer succour, though a faster ramp up even there will not be easy. Pine Labs will need to pull out more than just the odd acquisition to justify that $5 billion valuation.