Covid-19 might have eroded the scale of the majority of the businesses during FY21 but for healthcare diagnostic firms, it also threw up an unprecedented opportunity. One such company is Goa-based Molbio Diagnostics which spearheaded India’s Covid-19 screening with portable and battery-operated real-time RT PCR point of care (PoC) testing system, which recorded a 25X jump in its revenue during FY21.

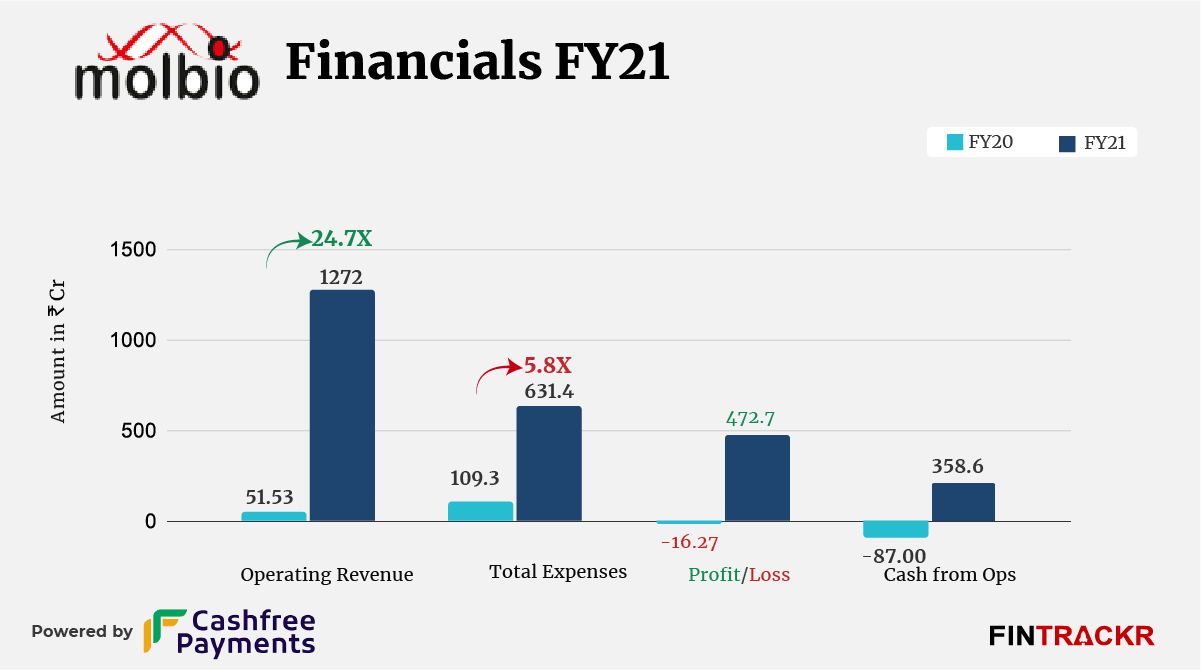

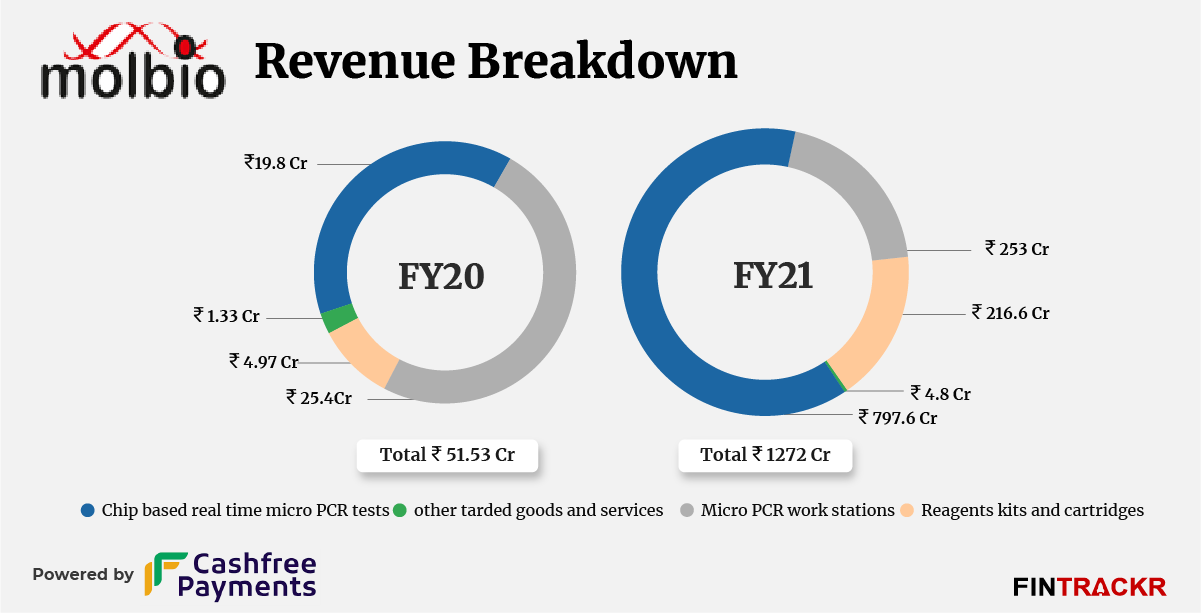

The company’s total topline stood at Rs 1,272 crore in the fiscal year ending March 2021 as compared to Rs 51.53 crore in FY20, according to its annual financial statements with the Registrar of Companies (Roc).

Truenat is a flagship product of Molbio Diagnostics which provides a real-time IoT-enabled testing kit for over 30 diseases. Collection from Truenat alone soared 40X to Rs 797.6 crore in FY21 from mere Rs 19.8 crore in FY20.

Micro PCR workstation, reagents kits and cartridges were another major revenue driver for the Sriram Natarajan and Chandrasekhar Nair-led firm which surged 10X and 43X to Rs 253 crore and 216.6 crore in FY21 respectively. It also made Rs 4.8 crore from sale of cotton linter, matrix and other services.

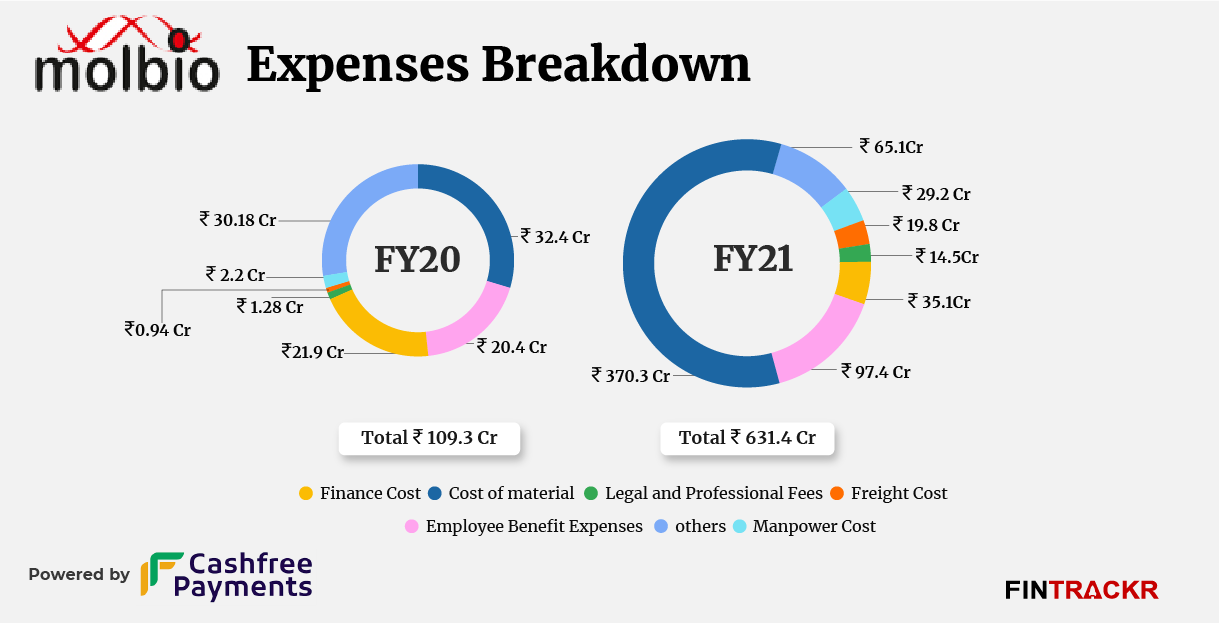

Interestingly, Molbio Diagnostics’ total cost grew only 5.7X to Rs 631.4 crore in FY21 from Rs 109.3 crore in the preceding fiscal year (FY20). Cost of raw materials and components turned out to be the largest burn for the company constituting 59% of the overall cost which grew 11.4X to Rs 370 crore in FY21 from Rs 32.4 crore in FY20.

Also read: Adar Poonawalla-backed Mylab’s revenue rockets 100X in FY21

Molbio Diagnostics’ expenditure on employee benefits grew 4.7X to Rs 97.4 crore in FY21 from Rs 20.4 crore in FY20. The company also spent Rs 29.2 crore and Rs 19.8 crore on manpower cost and freight in FY21 respectively. Professional fees and finance cost also soared 11X and 5.6X to Rs 14.5 crore and R 35 crore respectively.

While the company posted a loss of Rs 16.27 crore in FY20, Molbio Diagnostics booked a whopping profit of Rs 472.7 crore in FY21. As the scale grew at a scorching pace in FY21, cash flows from operations made a turnaround and stood at Rs 358.6 crore in FY21 from a negative cash flow of Rs 87 crore in FY20.

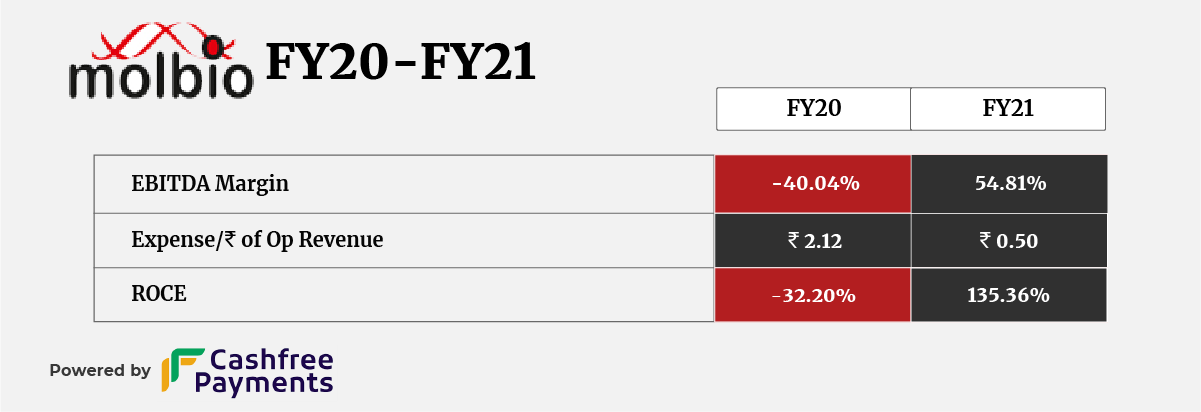

EBITDA margin and return on capital employed (ROCE) of Molbio Diagnostics improved to 54.81% and 135.36% respectively. On a unit level, the company spent Rs 0.50 to earn a single unit of operating revenue in FY21.

The company aims to become a one-billion-dollar revenue company in the next 3-5 years, by globally selling surveillance platforms for various diseases.

In March, the Indian government had deployed Molbio Diagnostics’ Truenat platform as a frontline tool in the special door-to-door TB (Tuberculosis) screening initiative. In addition to TB, the platform can test for over 30 other diseases including hepatitis, HIV, dengue, and malaria. Recently, the company claims that more than 4,000 Truenat machines are being used across the private and public sectors for testing across the country.

Backed by Motilal Oswal group, Molbio Diagnostics was reportedly in talks with Singapore state-owned fund Temasek to raise fresh capital.

Repeating its FY21 performance will not be easy going ahead, and not just because of the larger base and the retreat of Covid. It is also because the diagnostics field has attracted some of the biggest names in the corporate sector, with many more expected to join in. Be it the Tata’s, the Ambanis, or even the Adanis, it looks set to become perhaps the only sector where these three, and more will be competing. That sets the stage for some significant challenges, and the firms that are really good and globally competitive will no doubt look beyond India soon.