Cloud telephony platform Exotel has persevered through the years. The 11-year-old startup had struggled to raise funds and took eight years to raise its Series B round. And then between January 2020 and 2021, it cornered three funding rounds.

These funding rounds came on the back of a strong top and bottom line as the company saw a massive jump in profits in the financial year 2021. That said, even with an average revenue run rate of Rs 375 crore ($50 million), its growth remained flat in the pandemic-hit fiscal year ending March 2021.

Founded by Shivakumar Ganesan, Ishwar Sridharan, Vijay Sharma and Siddharth Ramesh, Exotel offers voice and SMS contact center capabilities to help its clients manage their customer engagement over the cloud. In 2014, Sharma quit the company to build a predictive outbound hiring solution Belong.

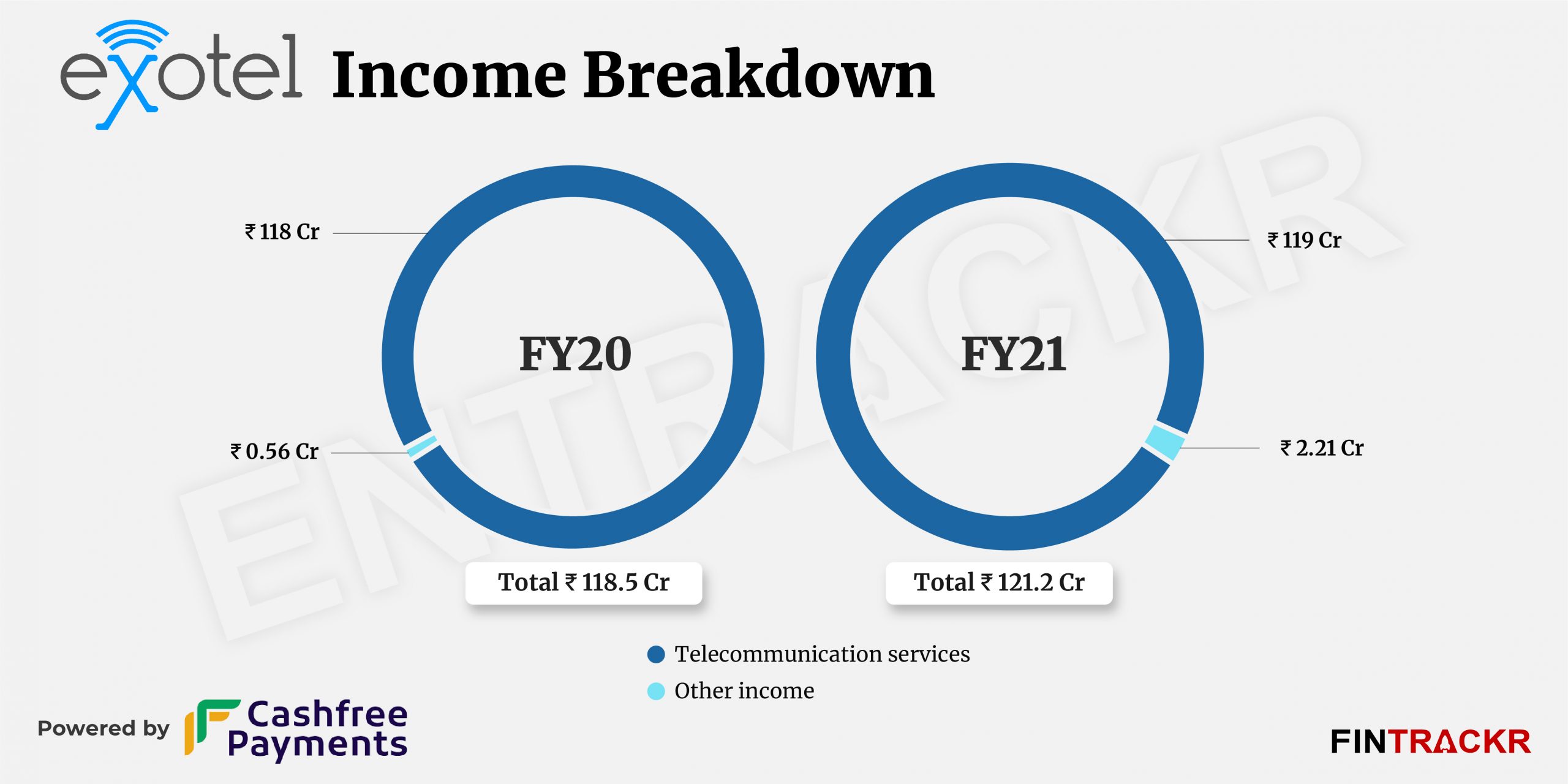

Telecommunication services were the major source of revenue for Exotel which stood at Rs 119 crore, as per the company’s annual financial statements with the RoC. The SaaS platform provides service to over 6,000 companies in India, SEA, the Middle East, and Africa.

Exotel generates 82% of the operating revenue from domestic services to Rs 97.75 crore while the rest of the operating revenue is from the companies having place of business outside India to Rs 21.29 crore.

The company also has its other income which soared almost 4X to Rs 2.21 crore in FY21 from Rs 56 lakh in the previous fiscal year (FY20).

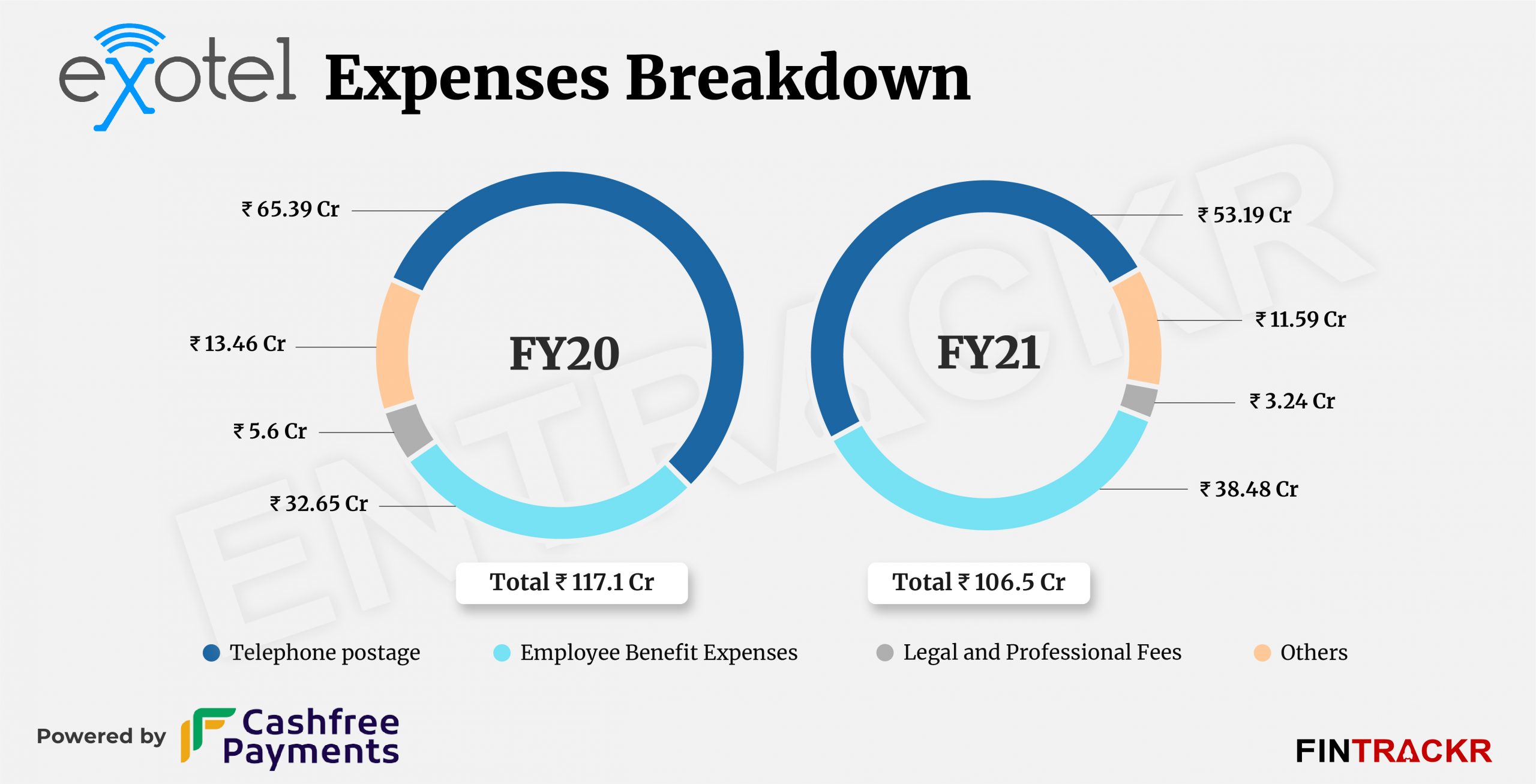

Being a full stack customer engagement platform, telephone postage became the largest cost center for Exotel contributing 50% of the overall expenses which shrinks 18.6% to Rs 53.19 crore in FY21 from Rs 65.39 crore in the preceding fiscal year (FY20).

The company spent 36.13% of the expenses on employee benefit costs. It is another major expenditure after telephone postage. This cost grew 17.85% to Rs 38.48 crore in FY21 from Rs 32.65 crore in FY20.

Exotel spent another Rs 3.24 crore on legal and professional fees pushing the total cost to Rs 106.5 crore in FY21 which stood at Rs 117.1 crore in the previous financial year (FY20).

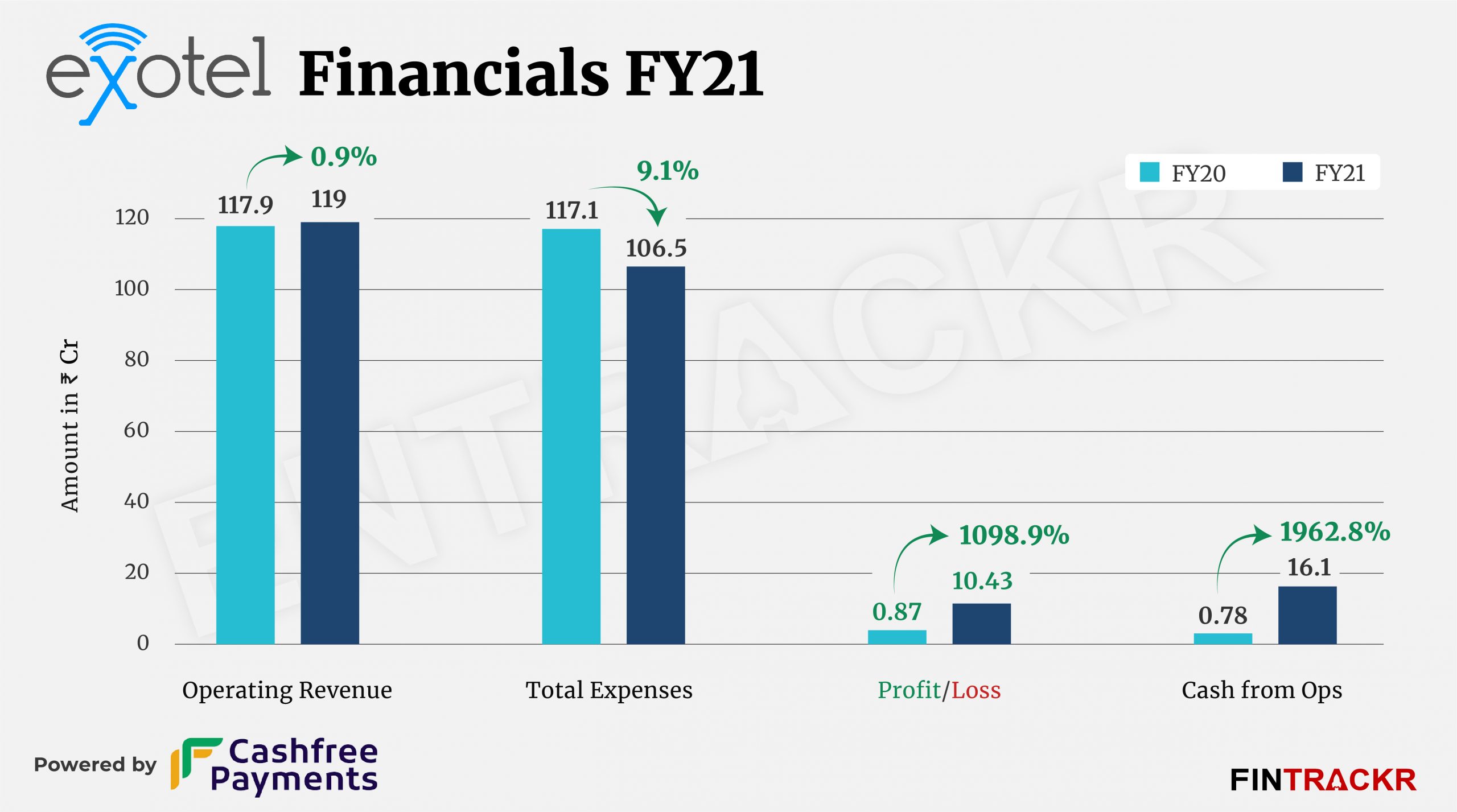

While Exotel’s revenue remained flat with 1% growth, the company managed to control its expenses by 9.1%, leading to profits of the startup spiking 12X to Rs 10.43 crore in FY21 where the figures stood at Rs 87 lakhs in FY20.

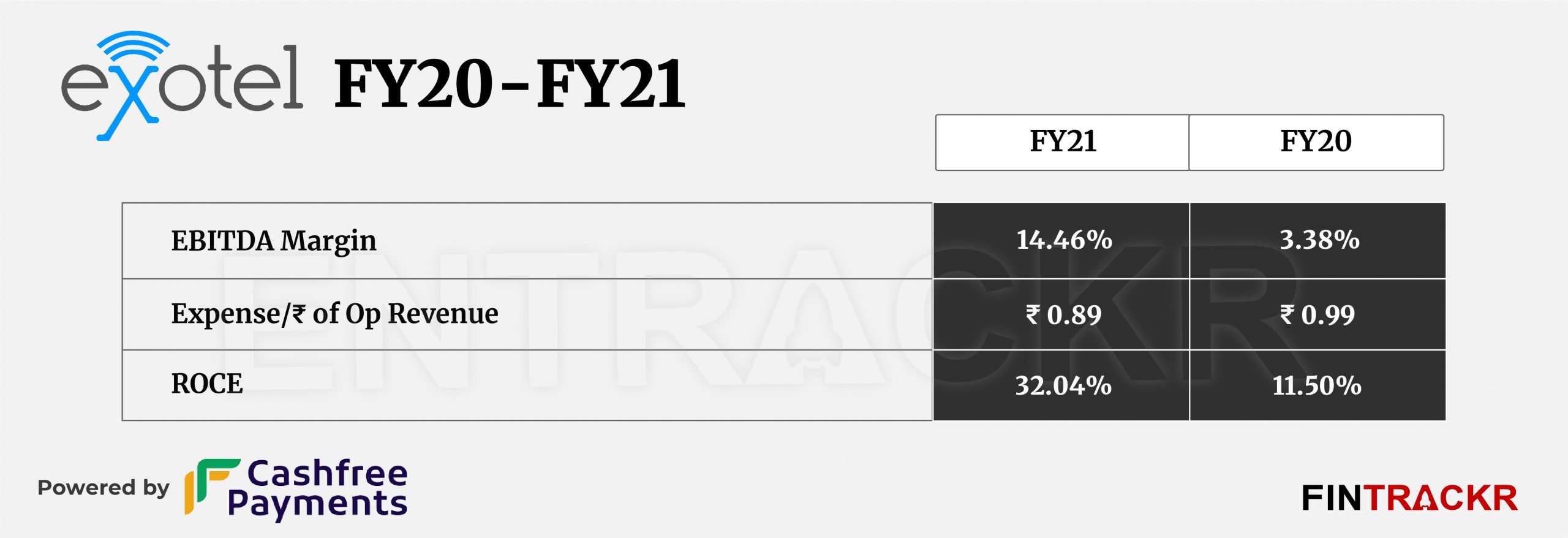

The control on expenses also impacted the cash inflow for the company. Cash inflow from operations grew 20X to Rs 16.1 crore in FY21 from Rs 78 lakhs in the previous year (FY20). Further, ROCE of the company improved to 32.04% in FY21 from 11.50% in FY20 while the EBITDA margin upgraded to 14.46% in FY21 from 3.38% in FY20.

With all these improvements, the Blume Ventures-backed company managed to improve its unit economics as well. Exotel spent Rs 0.89 to earn a single unit of operating revenue in FY21, whereas the spend for the same was Rs 0.99 in FY20.

Apart from the fundraising, there were few consolidations in the cloud telephony space in the past 12 months. In June 2021, Exotel announced its merger with Ameyo, a contact center platform and the company also acquired Cogno AI, a conversational AI platform in November. A similar startup called MyOperator acquired cloud communications startup Ziffy in October.

Earlier this year, Tiger Global-backed conversational messaging platform Gupshup acquired Sequoia Capital-backed cloud communications firm Knowlarity in a deal worth around $100 million.

Exotel directly competes with Knowlarity, MyOperator and a few others.

While one would imagine the large incumbent telecom operators would be interested in getting into the segment, perhaps what has kept them out has been the issue of valuations, as the telecom business itself had been re-rated down until recently. With both profitability and future outlook improving for the remaining players as a whole now, expect some action in the space soon.