High-speed fiber-optic broadband provider Atria Convergence Technologies (ACT) is set to be acquired by Partners Group at an estimated enterprise value of $1.2 billion. While the company was established in 2000, it was acquired by private equity players TA Associates and India Value Fund Advisors (IVFA) in 2015.

The acquisition of Atria Convergence Technologies is set to close, as per Entrackr’s sources. Let’s look at ACT’s FY21 balance sheet to make sense of the deal for the Swedish private equity firm acquiring a majority stake in the firm.

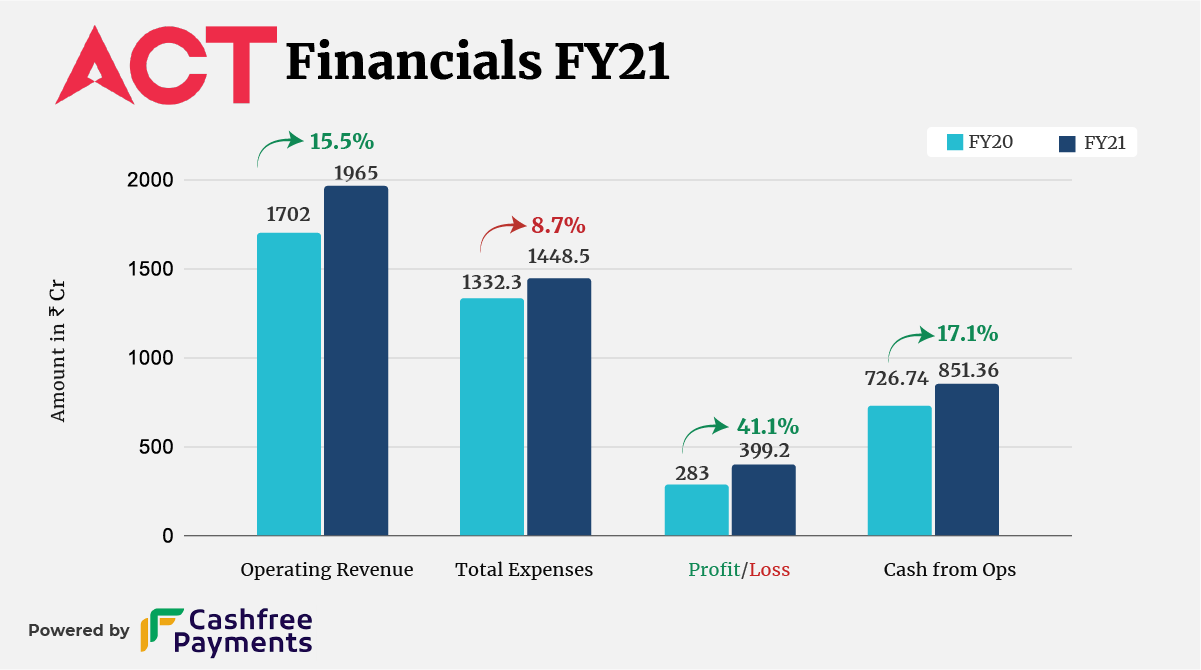

Despite the pandemic, ACT’s operating revenue scaled 15.5% to Rs 1,965 crore in FY21 from Rs 1,702 crore in FY20, according to its annual financial statements filed with the RoC. Employees working from home during the lockdown gave the momentum.

ACT is a multi-service operator offering a package of internet, TV, data, and other broadband services.

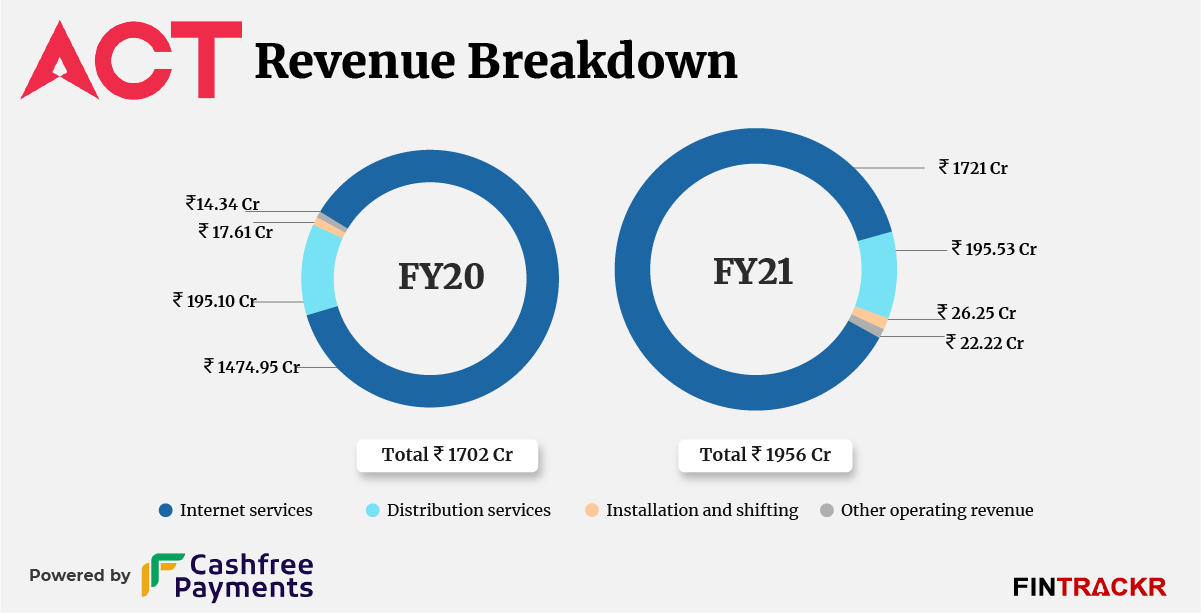

Collection from internet services contributed 87.6% of overall operating revenue and remains the main source in the company’s topline. This revenue surged 16.7% to Rs 1,721 crore during FY21.

Revenue from cable television distribution services remained stable at nearly Rs 195 crore during FY21 whereas installation and shifting services grew 49% to deliver Rs 26.25 crore in FY21 from Rs 17.61 crore in FY20.

The Bengaluru-based company also generated revenue of Rs 22.22 crore in FY21 from VAS (value-added service) and sale of products such as wifi routers, set-top boxes, edge cam et al. Collection from these sources surged 55% from Rs 14.34 crore in FY20.

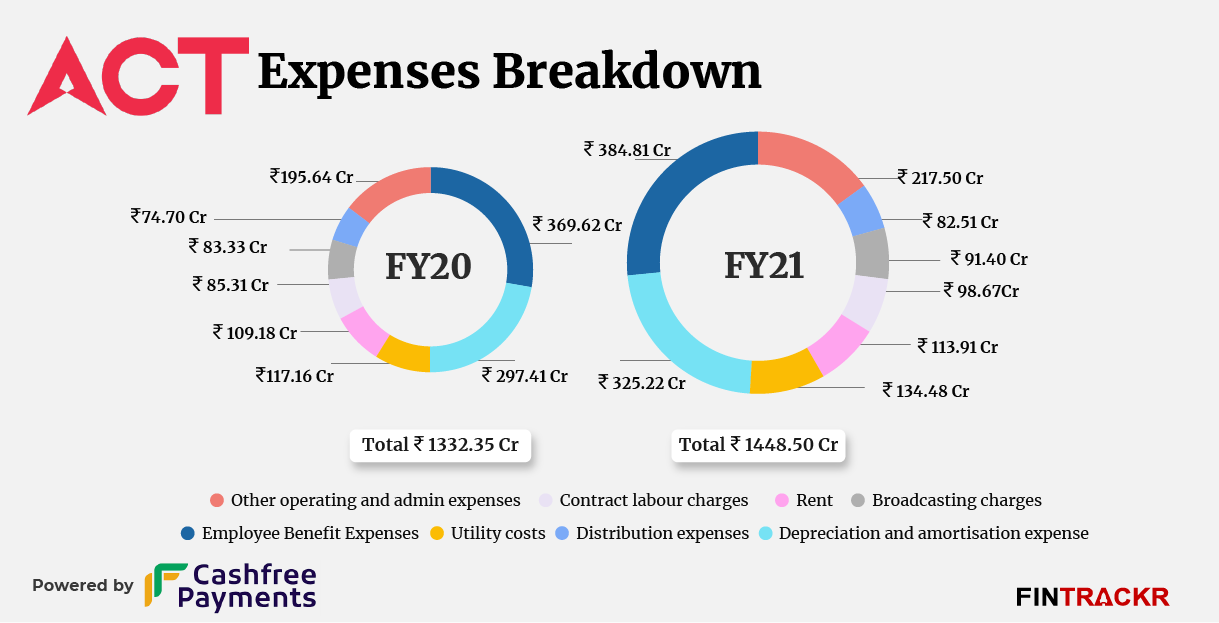

On the expenses front, employee benefit expenses formed the largest cost for the company contributing 26.6% of the annual expenditure. The expense saw a marginal increase from Rs 369.62 crore in FY20 to Rs 384.81 crore during the financial year 2021.

The company booked Rs 325.22 crore as depreciation and amortization expense (non-cash expenses) in FY21 contributing 22.5% of the overall cost. Contract labor charges including other support services surged 15.7% to Rs 98.67 crore in FY21 from Rs 85.31 crore in FY20.

Moreover, broadcasting charges and distribution expenses increased by 9.7% and 10.5% to Rs 91.4 crore and Rs 82.51 crore in FY21 respectively.

ACT also incurred Rs 48.6 crore expense on advertising & promotion in FY21 which pushed the company’s total expenditure to Rs 1,448.5 crore during the period from Rs 1332.35 crore in FY20.

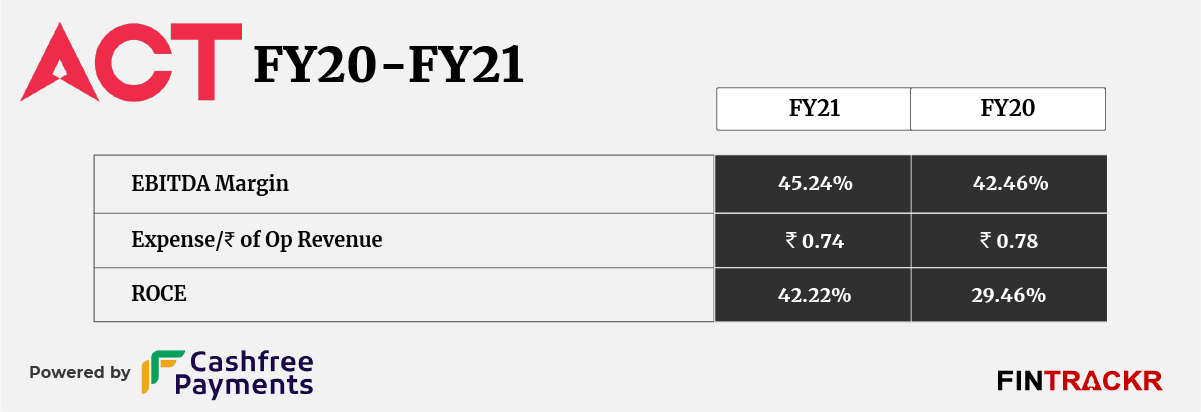

In line with revenue, the annual profits of the company also grew over 41% to Rs 399.2 crore in FY21 from Rs 283 crore in FY20. On a unit level, ACT spent Rs 0.74 to earn a rupee of operating revenue.

With control on cashburn, the company’s cash inflows increased nearly 17% to Rs 851.36 crore in FY21 from Rs 726.74 crore in FY20.

Growth in scale and profits helped the Sunder Raju-led company to refine the ratios. EBITDA margin and ROCE improved to 45.24% and 42.22% during FY21 from 42.46% and 29.46% in the preceding fiscal year (FY20).

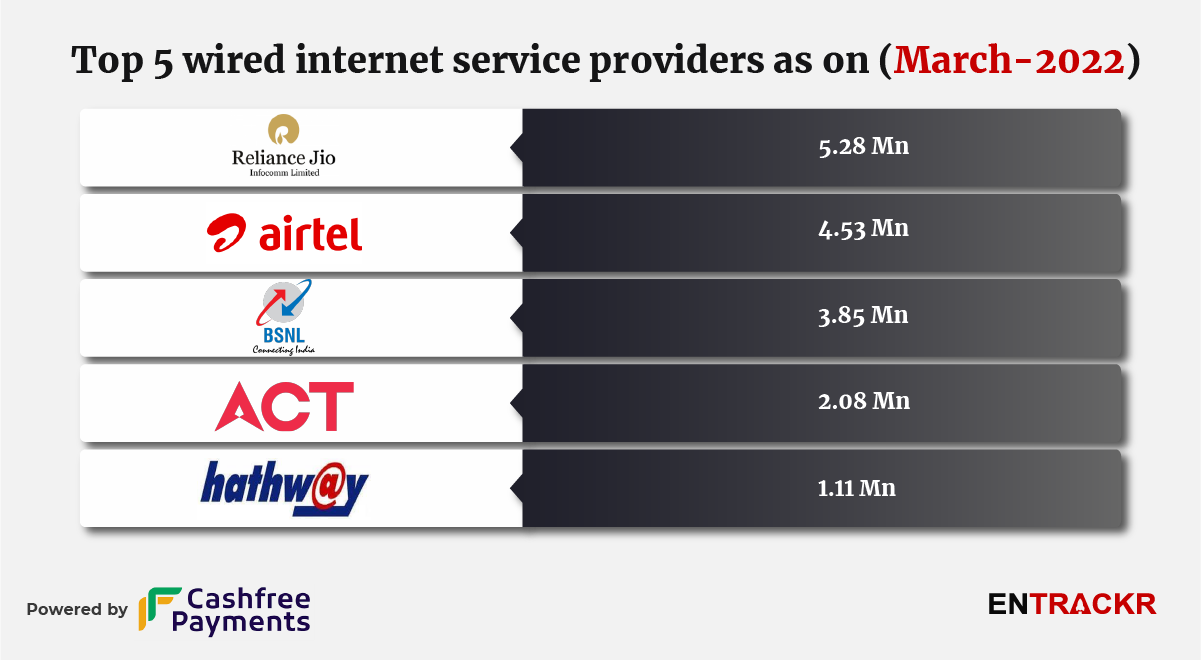

Jio GigaFiber, Airtel V-Fiber, Hathway, BSNL Bharat Fiber, and Tata Sky Broadband are the major competitors of ACT. According to the Telecom Regulatory Authority of India (TRAI), Reliance Jio Infocomm, Bharti Airtel, BSNL, ACT and Hathway (Reliance holds a majority stake in the company) were the top five wired broadband service providers as of March 2022. Jio, Airtel and BSNL have 5.28 million, 4.53 million and 3.85 million subscribers respectively. ACT is in the 4th spot with 2.08 million subscribers whereas Hathway had 1.11 million subscribers.

The move to Partners Group will hardly be the end of the ownership journey for the firm, considering the nature of the new owner. That, and the fact that the broadband market in India is still not quite at peak competition means that enough opportunities exist for ACT to ‘sweat’ its market presence and infrastructure for still higher returns, before a large player makes a pitch to its new owners. The high cash flows are a testimony to the rewards in the business for high-performing firms, and Partners Group will probably be doing very little to upset that applecart for now. Also, the deal will put ACT among the list of profitable unicorns.