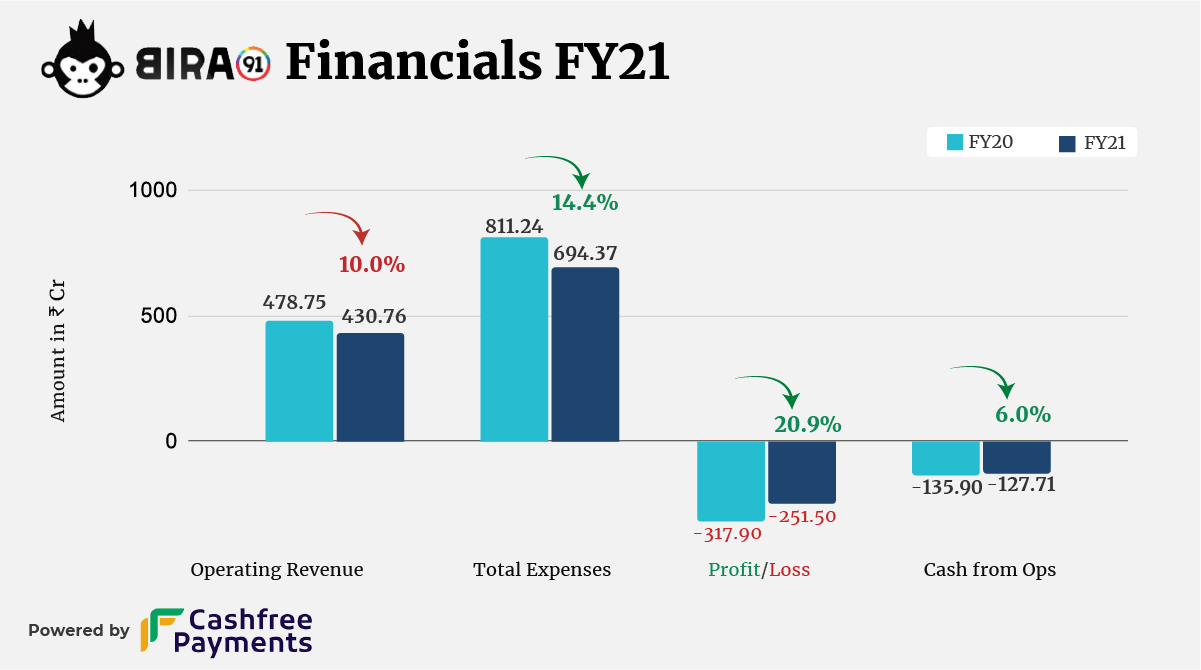

The pandemic hit the alcohol business, particularly brewers of beer who see the majority of their sales (40-60%) during summer. However, craft beer brand Bira 91 seems to have escaped relatively unscathed as evident from its topline which slipped 10% in FY21.

Bira 91 posted Rs 430.76 crore in operating revenue in the fiscal year ending March 2021, as per its annual financial statements filed recently with the RoC.

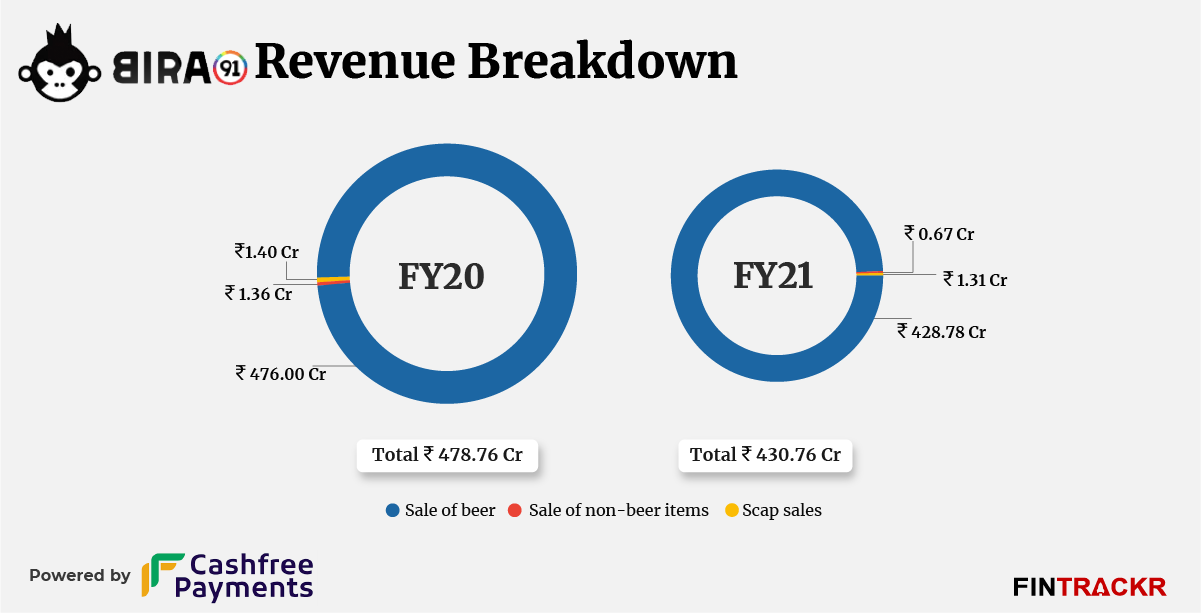

Revenue from sale of beer remains the largest contributor to the total operating revenue which dropped nearly 10% to Rs 428.8 crore during FY21 from Rs 476 crore in the previous fiscal year (FY20).

Bira 91 also offers a wide range of non-beer merchandise items such as t-shirts, masks, wallets, beer glasses and some other electronic and in house gaming products. Collection from sale of non-beer items shrank over 50% from Rs 1.36 crore in FY20 to Rs 67 lakh during FY21.

The Delhi-based company also booked Rs 1.31 crore revenue from scrap sales and generated Rs 430.76 crore operating revenue in total during FY21. Over 99% [Rs 426.6 crore] of its revenue originated in India.

Founded in 2015, Bira 91 makes various beer variants including Bira White, Bira Blonde, Bira91 Strong among others and has a presence in 18 countries. The company operates five breweries in India with the capacity to brew 2.5 million HLPA (Hectolitre per annum) of beer and has taprooms in Bengaluru.

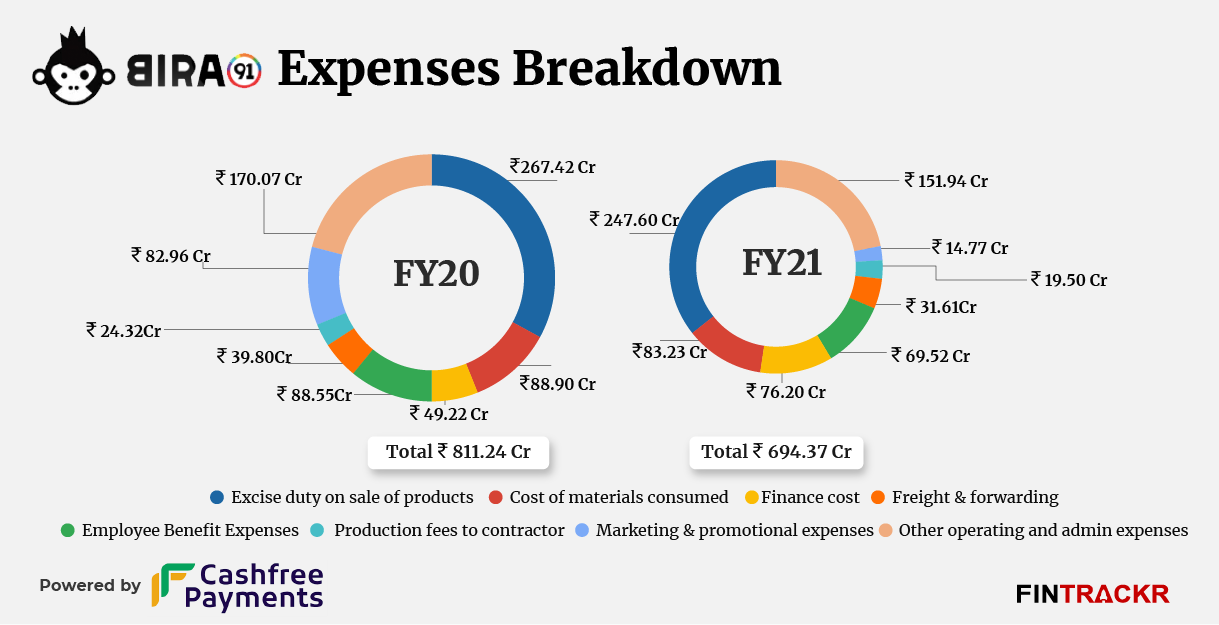

Excise duty on sale of products emerged as the largest burn for the company, contributing 35.7% to the total annual expenditure. This cost shrank 7.4% to Rs 247.6 crore in FY21 from Rs 267.42 crore in FY20.

Cost of materials consumed reduced 6.4% to Rs 83.23 crore during FY21, forming nearly 12% of the overall cost. The company spent Rs 76.2 crore as finance cost in FY21, 54.8% more than FY20.

The pandemic had driven the majority of companies to reduce their workforce for cost cutting. Bira 91 had also taken austerity measures that could be observed from its employee benefit expenses which reduced to Rs 69.52 crore in FY21 from Rs 88.55 crore in FY20. Moreover, marketing and promotional expenses were curtailed 82.2% to Rs 14.77 crore in FY21 from Rs 82.96 crore in FY20.

Moving further, the company also incurred production fees to contractor and freight & forwarding costs of Rs 19.5 crore and Rs 31.61 crore which shrank 19.8% and 20.6% during FY21 respectively. Bira 91 controlled its total expenses by 14.4% to Rs 694.37 crore in FY21 from Rs 811.24 crore in FY20.

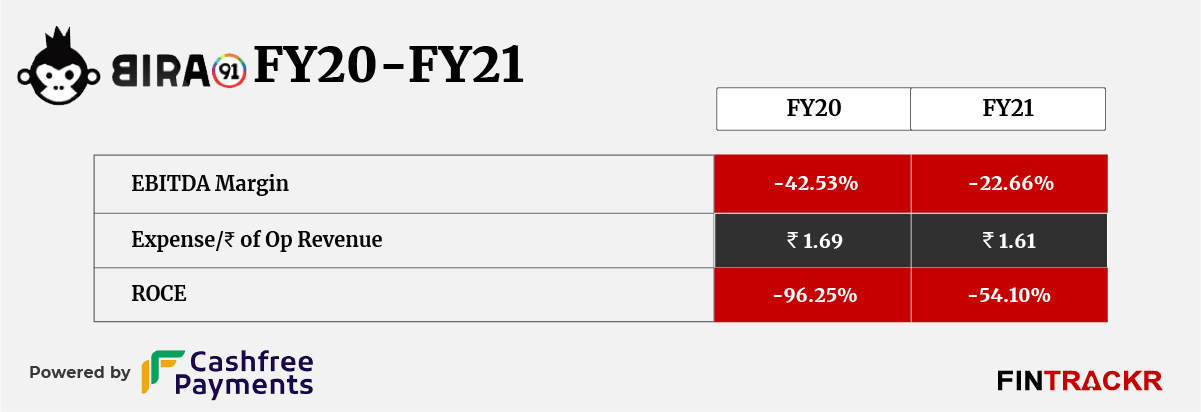

Though the operating revenue shrank 10%, the cost cutting helped the company to control its losses by nearly 21% to Rs 251.5 crore in FY21 from Rs 317.9 crore in the preceding fiscal year (FY20). On a unit level, the company spent Rs 1.61 to earn a rupee of operating revenue during FY21.

The controlled expenditure also helped the company to refine the ratios. EBITDA margin and ROCE improved to -22.66% and -54.10% during FY21 from -42.53% and -96.25% in FY20 respectively.

Bira 91’s FY22 should confirm a strong revival going by chief executive Ankur Jain’s claims that Bira 91 had doubled its volume and tripled its market share when compared to pre-covid peak. The company also forayed into the non-alcoholic beverages segment and the diversification may evolve Bira 91 into a full fledged beverage brand.

Clearly, the company has learned some tough lessons from the pandemic, especially on managing its costs better, which should hold it in good stead going ahead too. However, the relatively high finance costs are a worry in a rising interest rate environment, and will continue to put pressure on the firm to drive to a safer, more sustainable path soon.