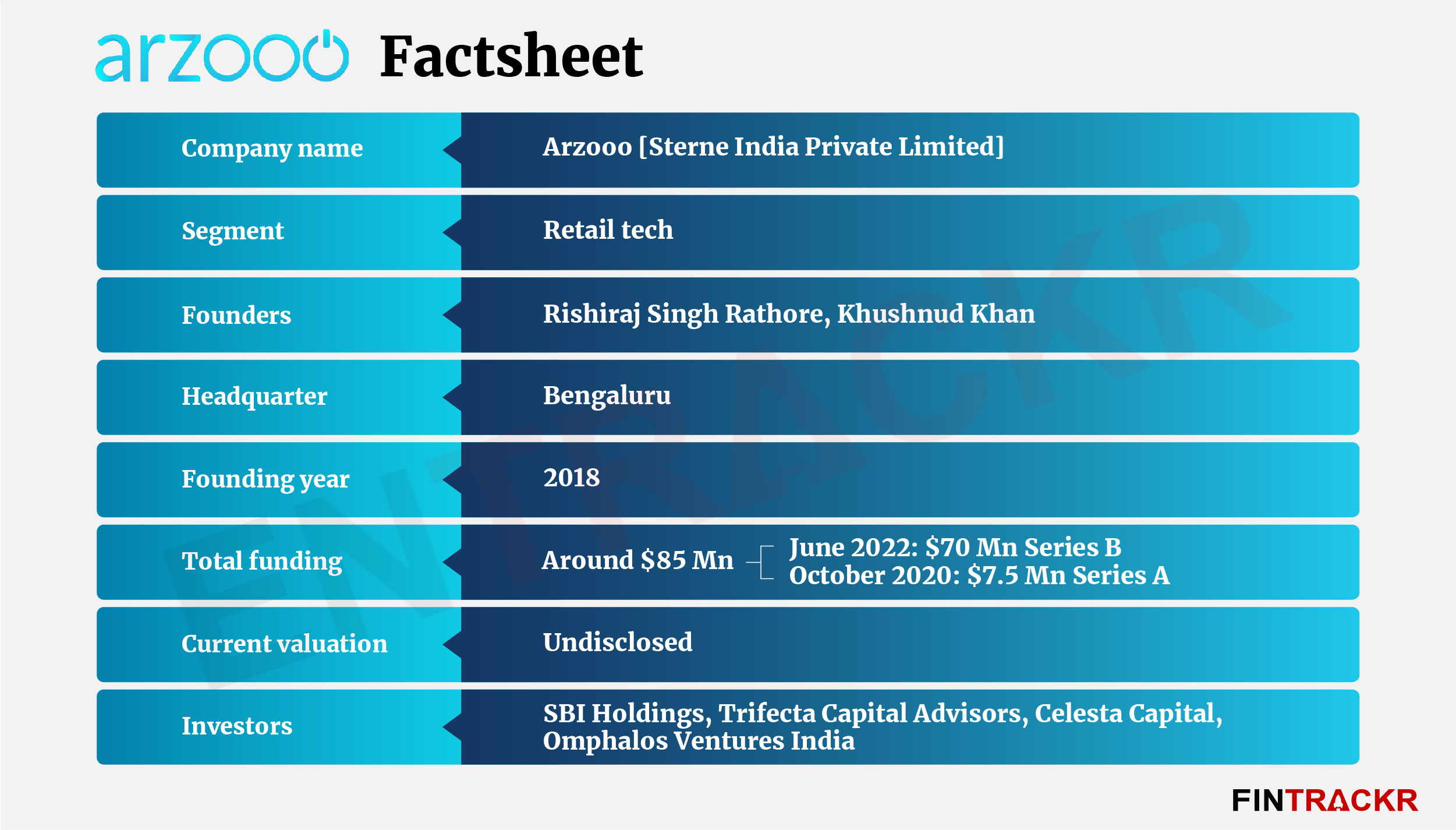

B2B retail technology platform Arzooo has raised $70 million in a Series B round from SBI Investment, an investment arm of Japan-based SBI Holdings and Trifecta Leaders Fund. Existing investors including Celesta Capital and 3 Lines VC also participated.

American food delivery major Doordash’s founder Tony Xu also joined the new round. This is Xu’s maiden investment in India. SBI Holdings had recently invested in Standard Chartered-backed Solv, a B2B digital marketplace for MSMEs.

The Bengaluru-based company had previously raised $7.5 million in Series A from Celesta and 3 Lines followed by an investment from Zoom founder Eric Yuan in October 2020 and a $6 million debt fund from Trifecta in February 2021.

While the company did not disclose its current valuation, it’s estimated to be valued at over $300 million. The company was valued at around $32 million during the last equity round as per Fintrackr’s estimates.

Arzooo will utilize its latest funding to ramp up its technology infrastructure, scaling stores’ growth and market expansion, said the company in a press release.

Founded by ex-Flipkart executives Khushnud Khan and Rishi Raj Rathore, four-year-old Arzooo is a real-time reverse auction-based e-commerce platform for high value branded goods such as refrigerators, air conditioners and televisions among others.

The platform provides retailers access to a wide variety of SKUs across leading and emerging home appliance brands. According to Arzooo, it has a pan-India presence and is already powering over 30,000 retailers allowing them to scale without the challenges of extensive inventory holding and access to pricing.

Arzooo also provides a digital credit lending product Arzooo Credit to offer up to 20 lakh loan to its partner stores for working capital purposes.

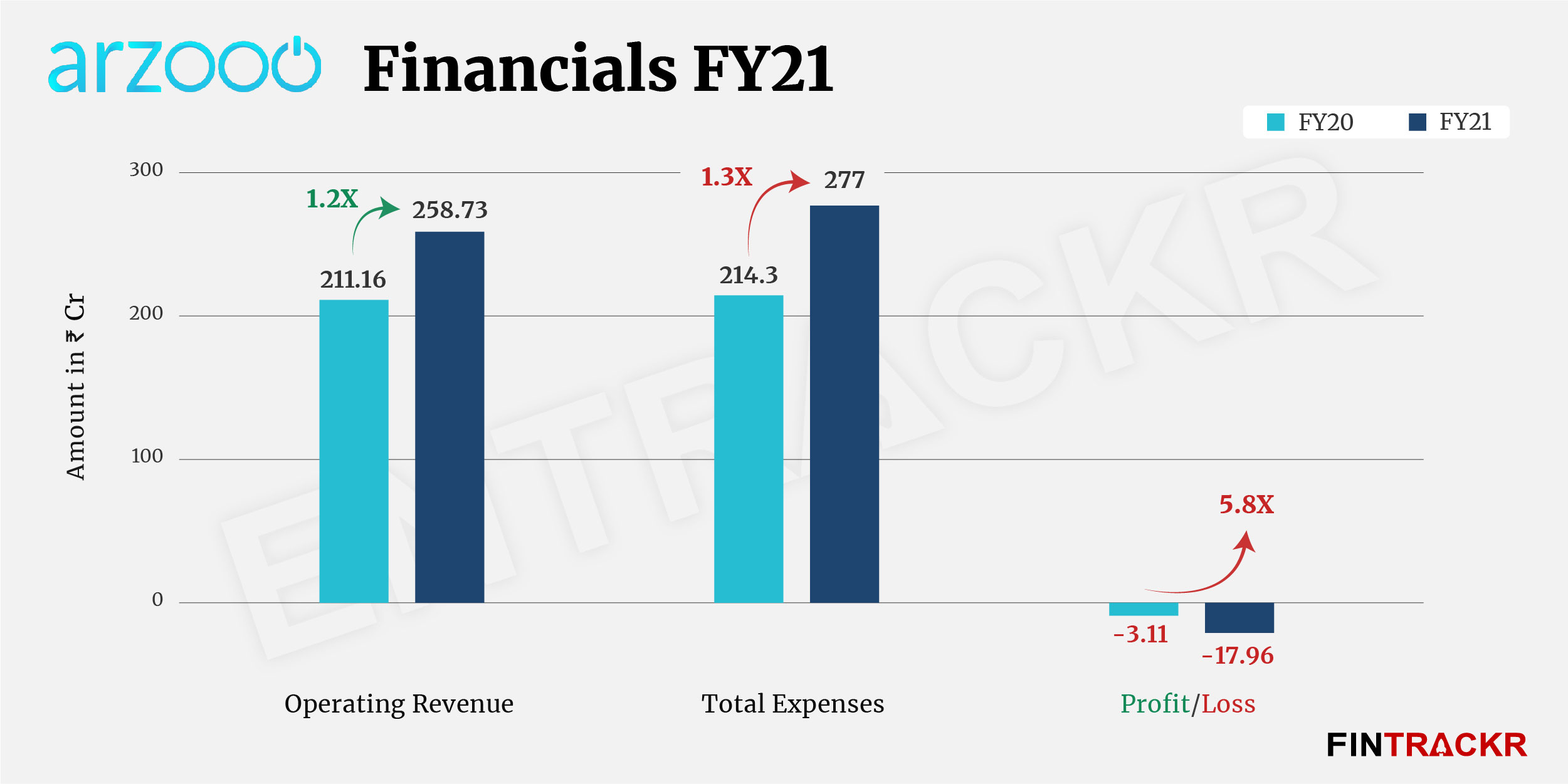

Arzooo has scaled up at a fast pace and this could be evident from its financial performance in the fiscal year ending March 2021. The company’s operating revenue grew 22.5% to Rs 258.73 crore during FY21 from Rs 211.16 crore in FY20, as per its annual financial statement filed with RoC.

While the company is yet to file its financials for FY22, its losses shot up 5.8X to Rs 17.96 crore FY21. It’s worth noting that Arzooo was close to breakeven in FY20.

Arzooo competes with large horizontal players such as Amazon, Flipkart, Udaan. Sequoia Capital-backed Zefo, one of Arzooo’s direct competitors, was acquired by Quikr in April 2019.