Surgery focused hospital chain Pristyn Care has been growing at a rapid clip in the past two years and this could be noticed from its scale. The company has expanded its reach to 22 cities and managed to onboard over 100 hospitals since its inception in 2018.

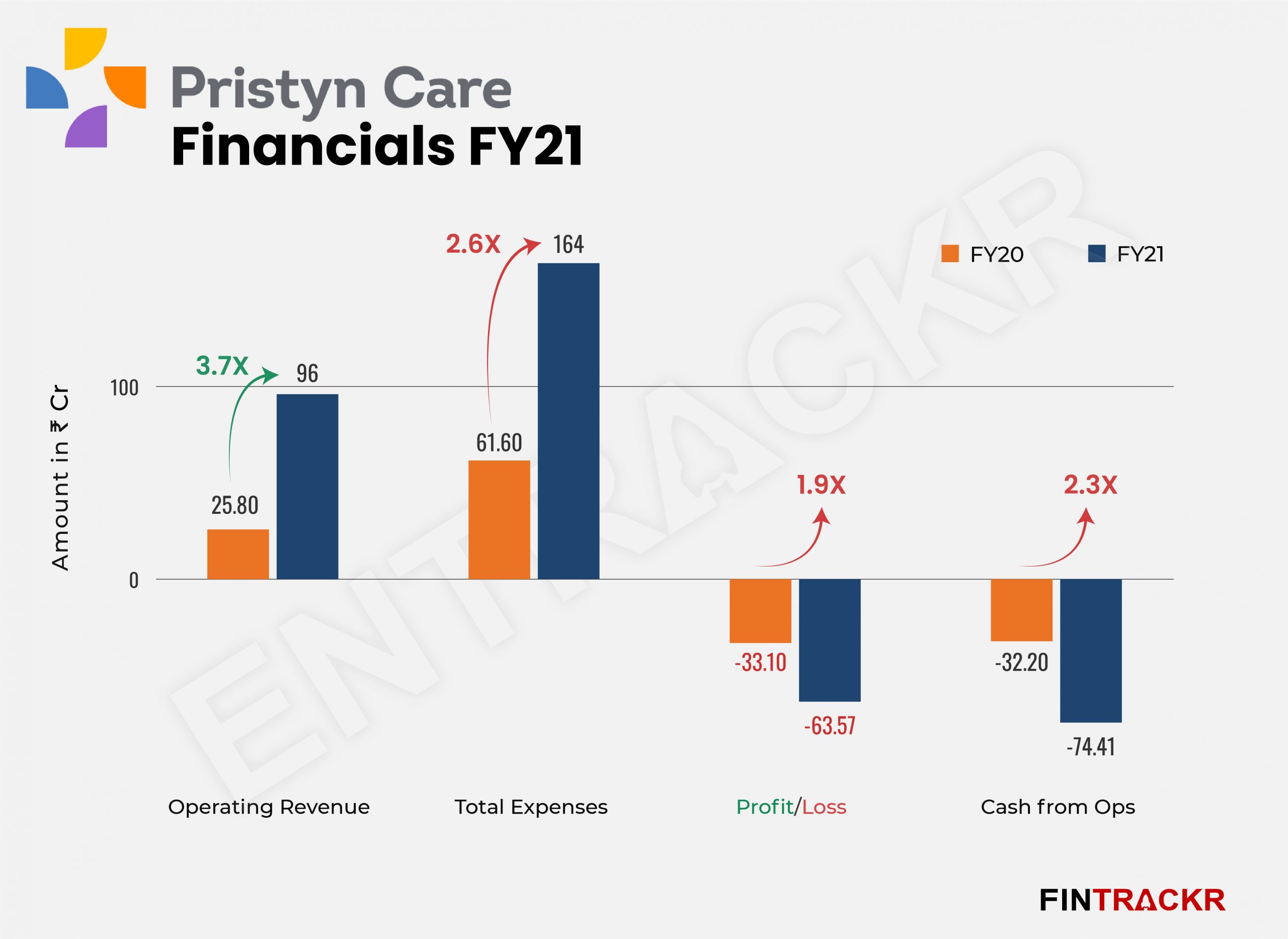

On the back of expansion, Pristyn Care has registered a 3.7X growth in its operating revenue which stood at Rs 96 crore in FY21 as compared to Rs 25.8 crore in FY20, according to its annual financial statement filed with RoC.

Pristyn Care follows a hybrid model where the company sets up its own clinics and utilizes third-party hospital infrastructure to provide surgeries across 10 specialisations. In February, the company attracted an $85 million worth Series E round which placed it into the coveted club of unicorns.

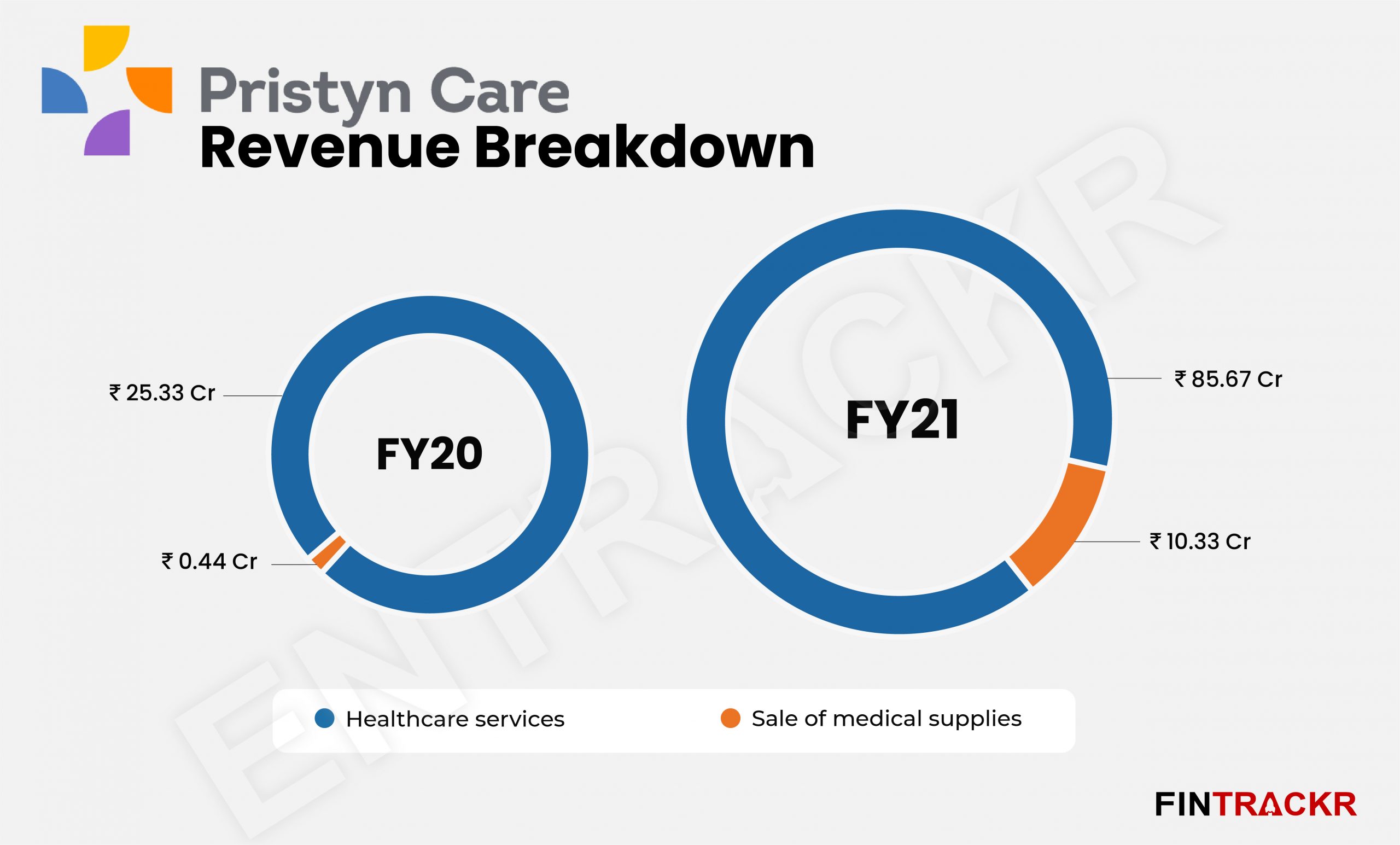

Healthcare services provided through its hospital partners have constituted 89% of Pristyn Care’s operating revenue which increased 3.4X to Rs 85.67 crore in FY21 from Rs 25.33 crore in FY20.

The sale of medical supplies jumped a whopping 23X to Rs 10.33 crore in FY21 from a mere Rs 44 lakh in the previous fiscal year (FY20). These supplies primarily consist of equipment and medicines for surgery as well as pre and post care.

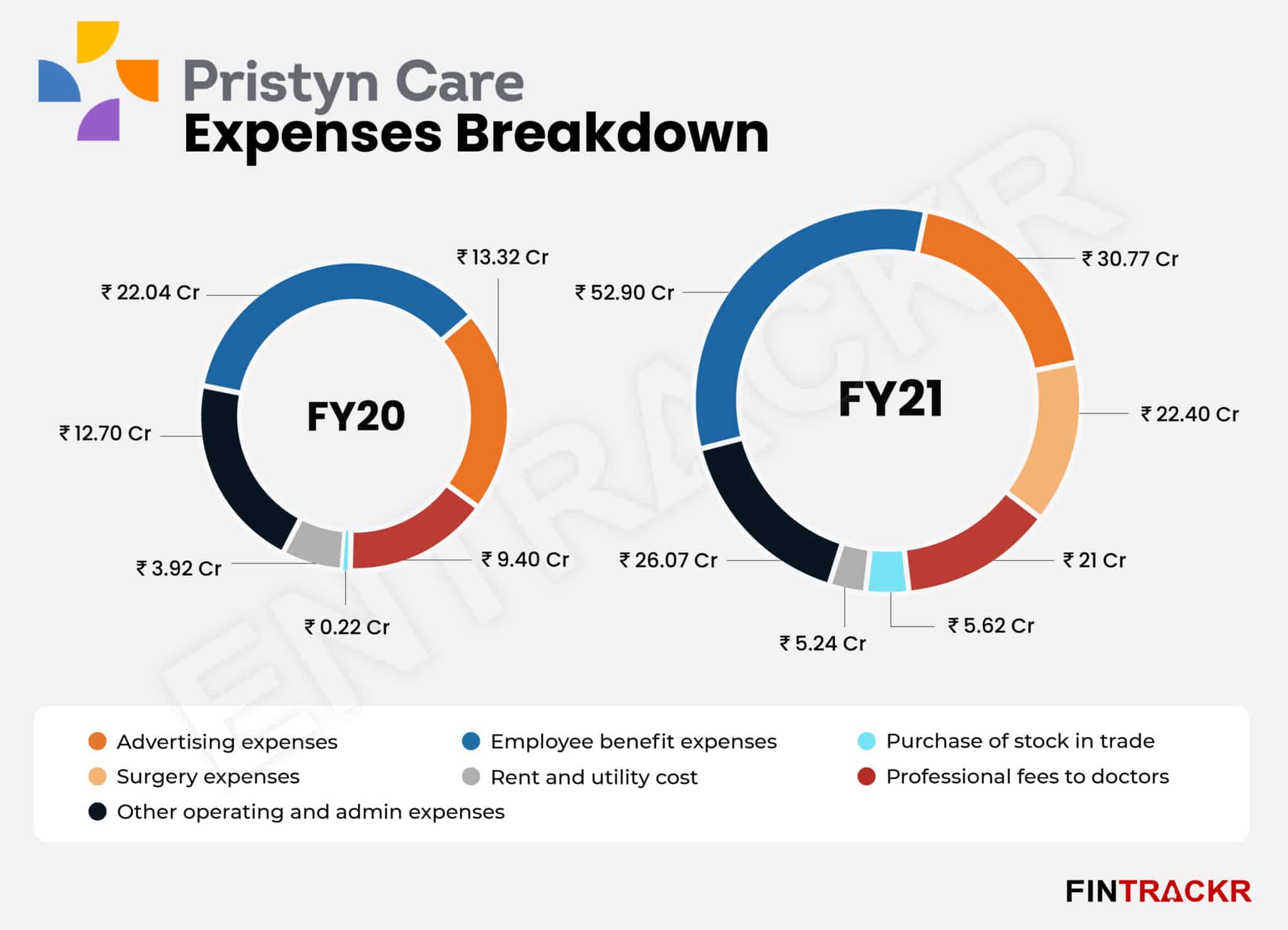

As scale soared, Pristyn Care’s total expenditure also multiplied 2.6X to Rs 164 crore in FY21 from Rs 61.60 crore in FY20. To harness growth, the company had ramped up its workforce and hired hundreds of employees during FY21. As a result, its employee benefits expense turned out to be the largest cost center accounting for 32.3% of the total expenses. This cost surged 2.4X to Rs 52.9 crore in FY21 from Rs 22.04 crore in FY20.

Over the past two years, Pristyn Care has been advertising heavily and this is reflected on its balance sheet in FY21. The company spent Rs 30.77 crore on advertising in FY21, a 2.3X jump from Rs 13.32 crore in FY20.

Pristyn care spent Rs 22.40 crore in FY21 as surgery expenses out of which Rs 21 crore was professional fees given to doctors. Purchase of stock, rent (including office premises and equipment on lease) and utility expenses collectively cost nearly Rs 11 crore in FY21.

At the end, Pristyn Care’s losses increased 92.1% to Rs 63.57 crore in FY21. With the spurt in scale, the outflows of the company also surged, resulting in an increase of 131% in cash outflow to Rs 74.41 crore in FY21 from Rs 32.2 crore in the previous year (FY20).

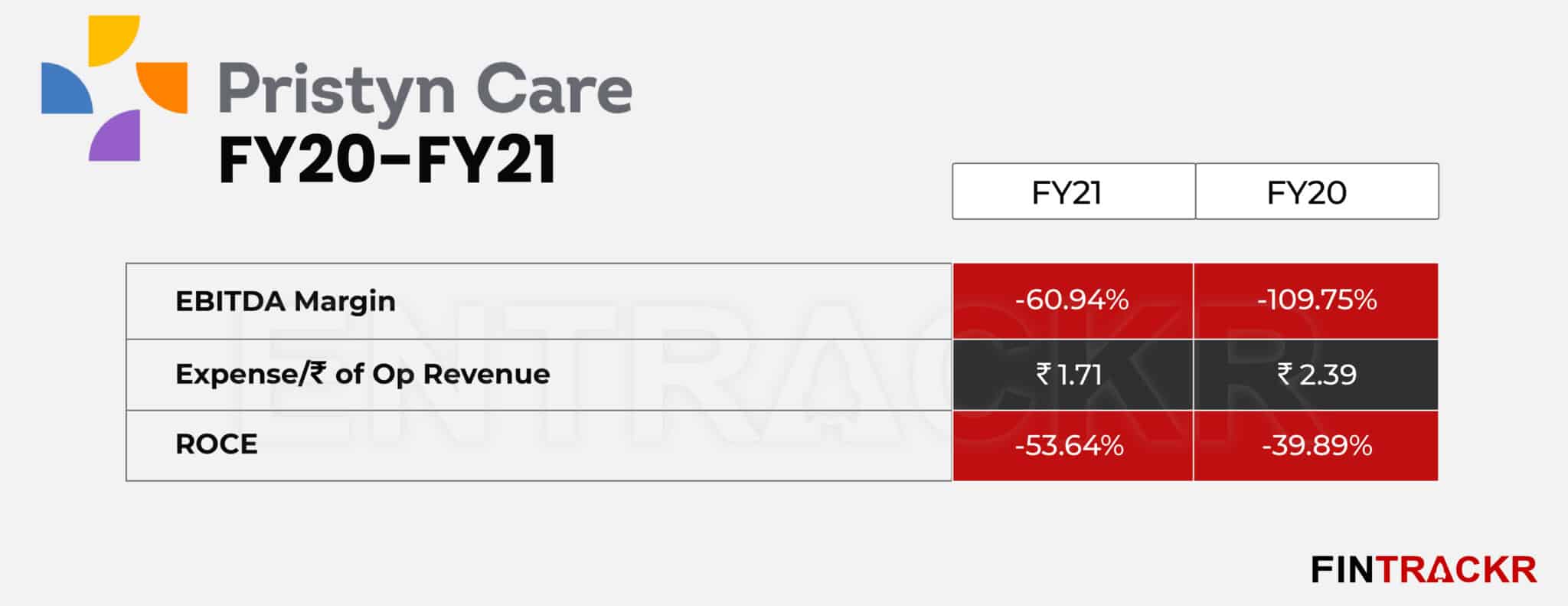

With increased sales, the EBITDA margin improved a bit, while ROCE was impacted adversely. On a unit level, the company spent Rs 1.71 to earn a single unit of operating revenue.

Entry into the unicorn club has led to the inevitable scale-up in ambition, and one result has been the novelty of seeing surgeries at Pristyn care advertised in the super pricey IPL. However, Pristyn care’s efforts indicate a sharp targeting strategy, not any specific cost or other competitive advantages yet. Scaling up its unicorn valuations will require much more innovations on those fronts, or it risks expanding its suite of offerings for the same narrow customer base, instead of a broader group for sustained growth. Those advertising costs are an outlier, and in the healthcare business, have to be lower for the kind of services Pristyn offers. In fact, we would argue that the best judge of the firm’s prospects would be its word of mouth referrals in some time.