The nationwide lockdowns imposed due to COVID 19 wreaked havoc on retail service businesses, with a complete stop on revenues while fixed costs and loss of inventory piled up. One such business which faced these problems in 2020-2021 was tea cafe retail chain Chai point, which saw the closure of a large number of stores and scaled back operations.

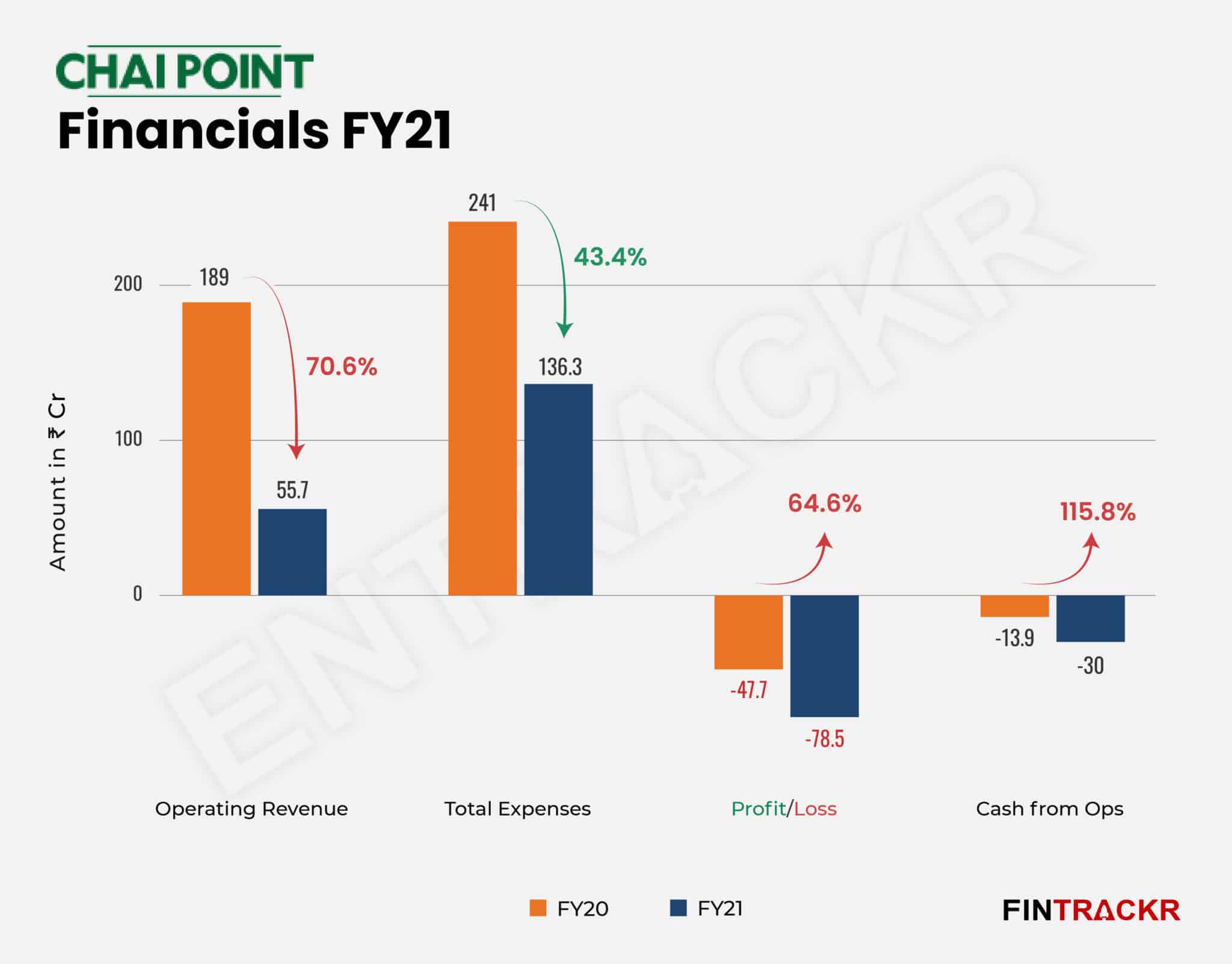

The severe impact of the pandemic on Chai Point could also be noticed in a massive fall in its collections during FY21. During the fiscal, its operating revenue dwindled 70.6% to Rs 55.7 crore from Rs 189 crore in FY20, its annual financial statements with the RoC show.

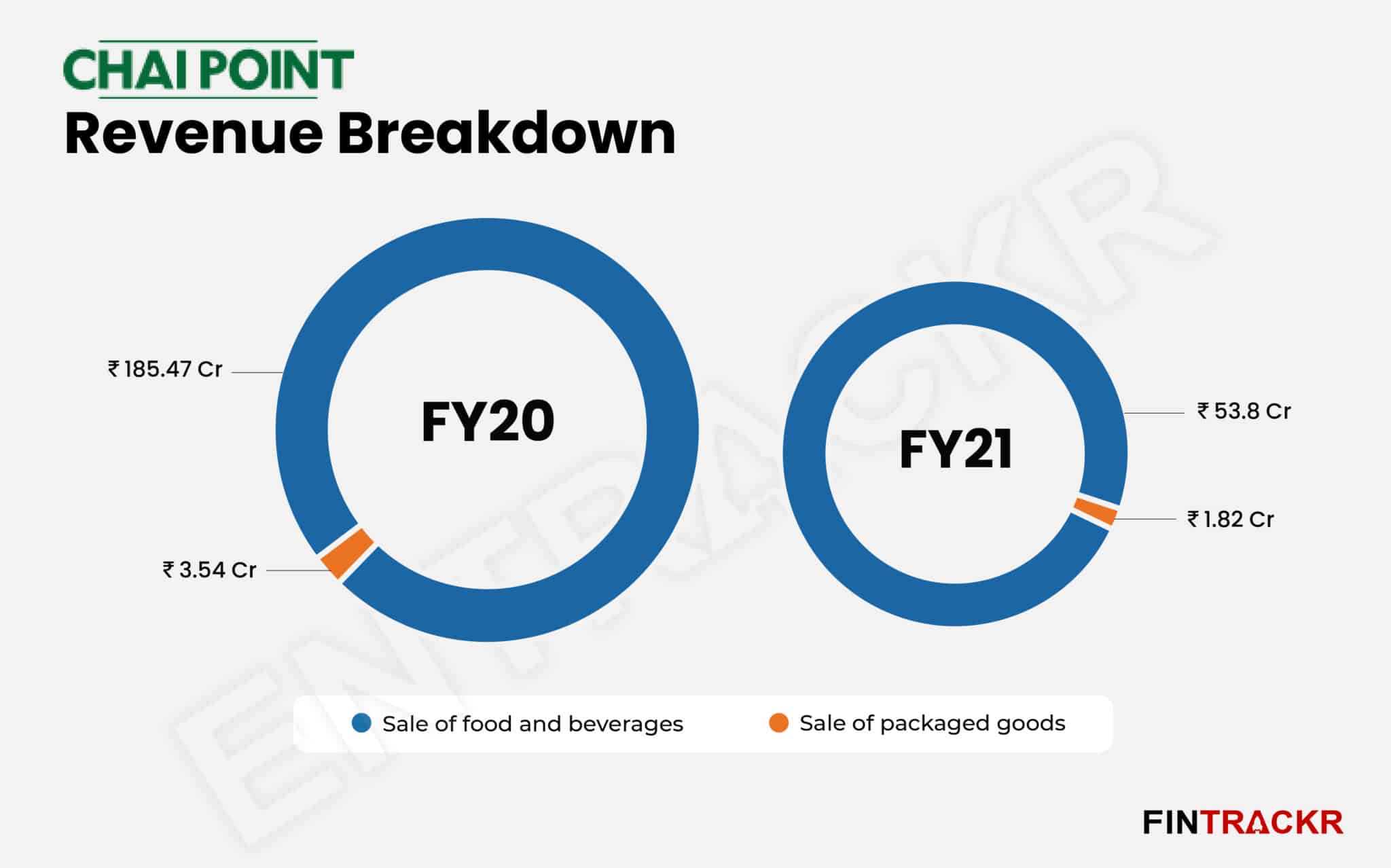

While the sale of food and beverages via online deliveries helped cushion the blow, the damage was primarily driven by non-functioning or inconsistent operations of retail outlets in FY21. As a result, Chai Point’s income from the sale of food and beverages went down by 71% to Rs 53.8 crore in FY21 from Rs 185.47 crore in the previous fiscal year (FY20).

Meanwhile, the sale of packaged goods including cookies, tea and snacks was reduced by 48.6% YoY to Rs 1.82 crore in FY21.

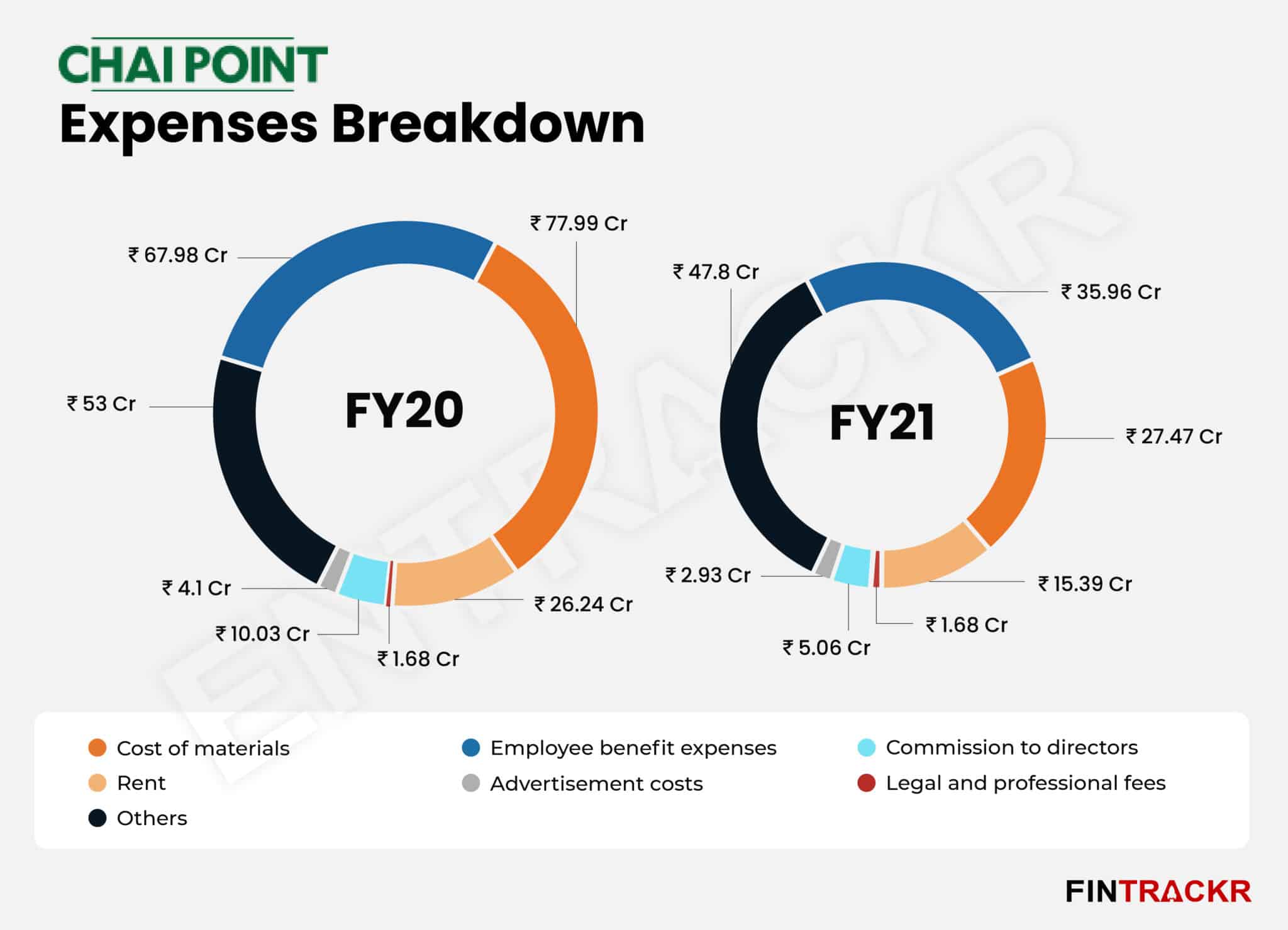

As the scale of operations shrank keeping pace with the closure of outlets, the company had to let go of a significant number of employees to cut costs. As a result, employee benefit payments were down 47.1% to Rs 35.96 crore during FY21 from Rs 68 crore in FY20. Despite the reduction, employee benefit expenditure remained the most significant cost centre of the company, accounting for 26.4% of the annual expenses.

The impact of the closure of outlets is also evident in the expense sheet of the company as rental costs were reduced by 41.3% to Rs 15.4 crore in FY21 from Rs 26.24 crore in FY20.

Due to limited demand, Chai Point also scaled back procurement of goods and the cost of materials diminished by 64.8% to Rs 27.47 crore in FY21 from Rs 77.99 crore in the previous fiscal year (FY20).

Austerity measures implemented by the management were stark as commission to directors decreased 49.6% YoY to Rs 5.06 crore while advertisement and promotional costs were reduced by 28.5% YoY to Rs 2.93 crore during FY21.

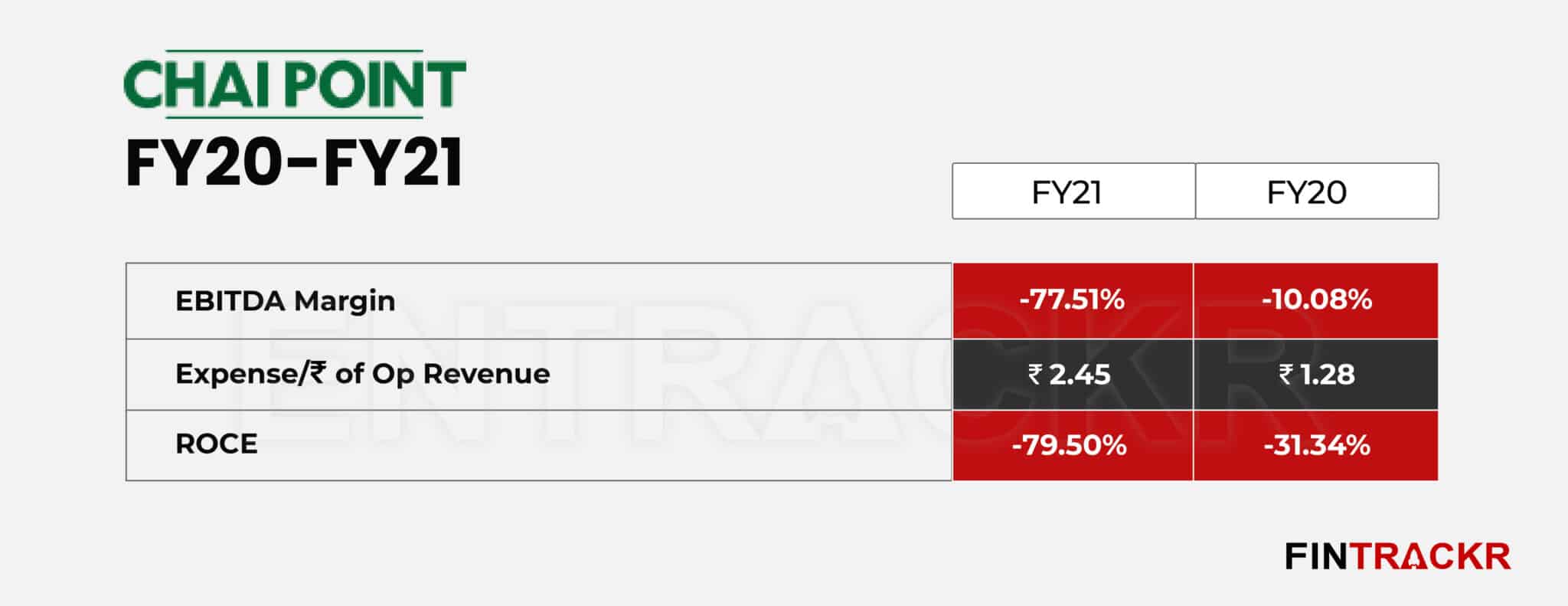

Another Rs 1.68 crore was borne for legal and professional costs, pushing annual expenditure to Rs 136.3 crore in FY21, reducing by 43.4% as compared to the total expenditure of Rs 241 crore during FY20. On a unit level, Chai Point spent Rs 2.45 to earn a single unit of operating revenue in FY21, compared to Rs 1.28 spent to earn the same during FY20.

The company also cut back on external borrowings, it recorded Rs 1.93 crore during FY21, down by 96% from Rs 48.35 crore borrowed in FY20 (mostly for the working capital requirements).

With the company losing over 70% of its scale, its losses soared 64.6% to Rs 78.5 crore in FY21, even as this figure stood at Rs 47.7 crore in the previous fiscal year (FY20). Chai Point’s cash flow also suffered due to a significant drop in sales resulting in cash outflows from operations jumping 115.8% to Rs 30 crore in FY21 from Rs 13.9 crore in FY20.

The challenge for businesses like Chai Point that are riding offline outlets is that business recovery doesn’t come cheap, thanks to the high fixed costs of the business. That is why so many stand-alone restaurants have simply shut for good after the pandemic. For Chai Point, it will take a supreme effort, and the continued backing of its investors to relive and build on the glory days again. Otherwise, the two years of the pandemic might have pushed back its growth ambitions by 4 years or more.