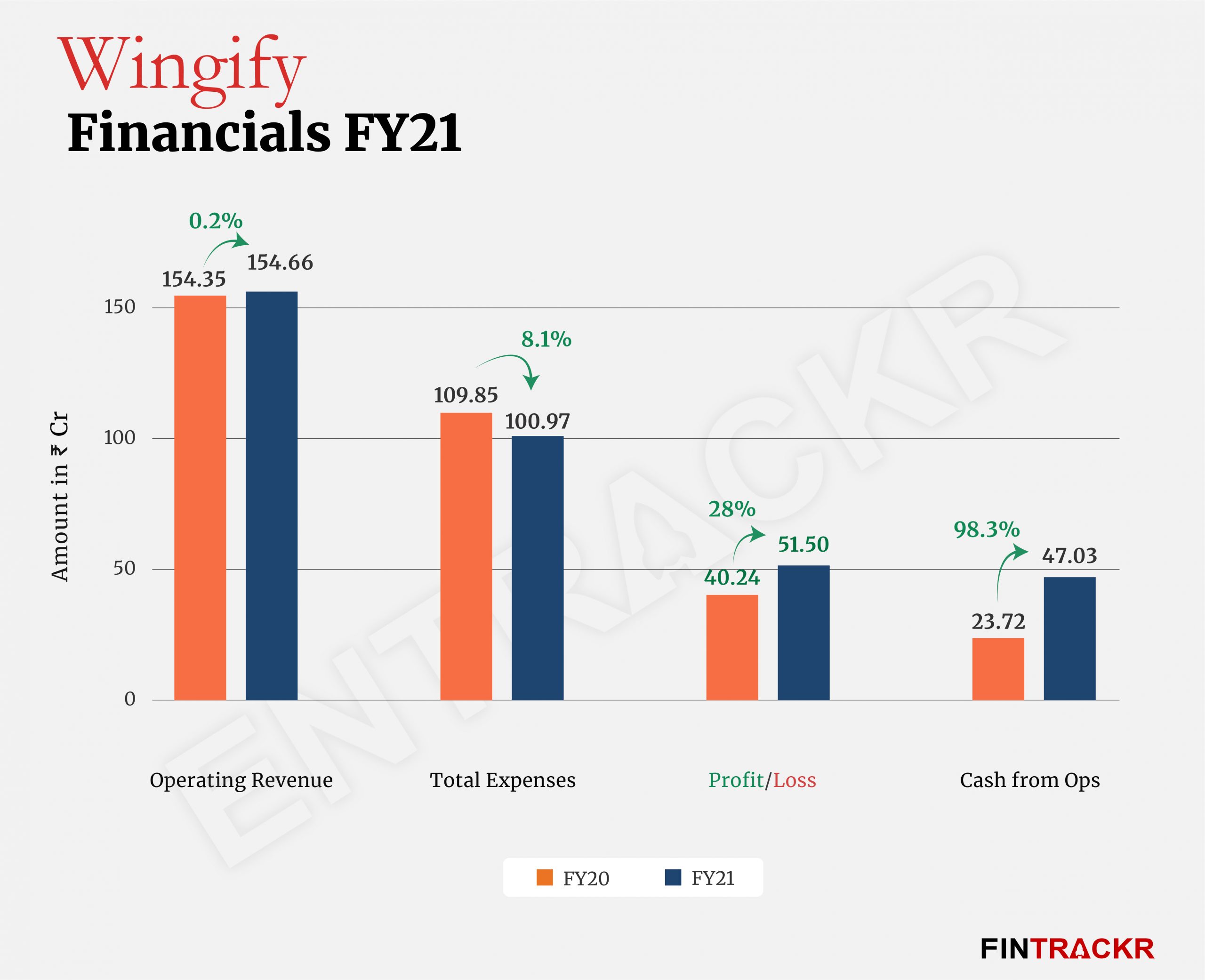

Indian SaaS startups have led from the front to achieve sustainable growth at scale while being bootstrapped, with the likes of Zoho, WebEngage and Wingify pushing their growth with profit. Twelve-year-old Wingify has recorded profitable growth during the last three fiscals, posting a profit of Rs 51.5 crore for FY21, recording a 28% jump in profit compared to Rs 40.24 crore earned in the previous fiscal. (FY20).

Delhi-based Wingify provides SaaS tools to online businesses for their conversion rate optimisation (CRO) process via its internally developed tool, Visual Website Optimiser (VWO). The company boasts of over four thousand clients across ninety countries worldwide including global business giants such as Ubisoft, eBay, Target and Virgin holidays amongst others.

During the fiscal affected by Covid 19 disruptions, Wingify’s revenue remained stable at Rs 154.7 crore in FY21 growing only 0.2% as compared to Rs 154.4 crore earned in FY20. Importantly, it generated 98.7% of its collections from international customers bringing in Rs 152.71 crore ($19.82 million) worth of foreign currency in the country (including interest and dividends).

On the other hand, Wingify’s offerings are beginning to find more takers domestically with revenue from domestic clients up 91.6% to Rs 1.95 crore during FY21 from Rs 1.01 crore in FY20. The company also generated non-operating revenue of Rs 12.7 crore from its financial assets during FY21.

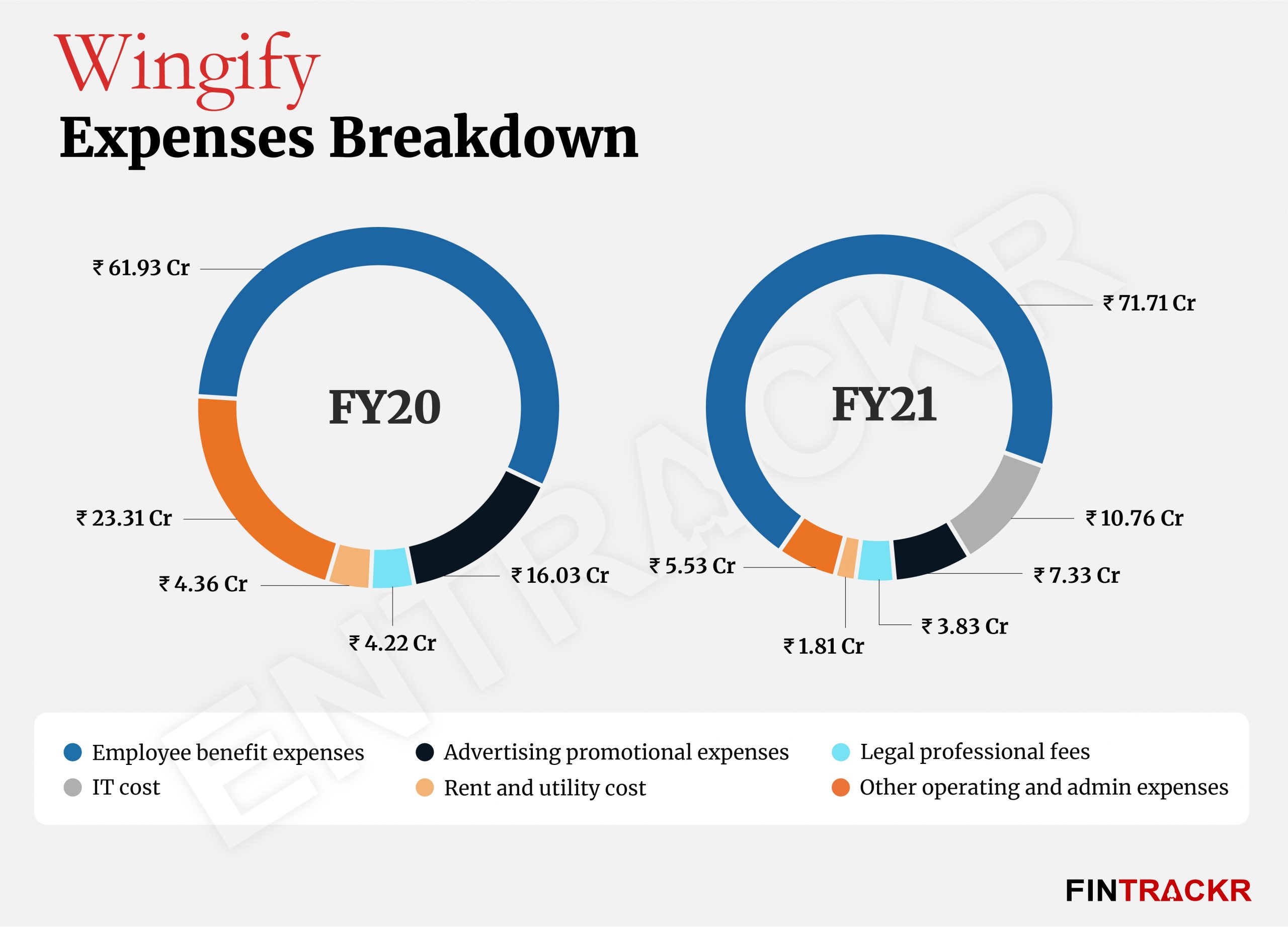

Harnessing domestic software development talent to serve clients across the world has been the key for startups in the Indian SaaS ecosystem and naturally, salaries have remained their largest expenditure. This is also clearly evident in Wingify’s expense sheet as employee benefit payments account for 71% of its annual expenditure. These costs grew by 15.8% to Rs 71.71 crore during FY21 from Rs 61.93 crore handed out in FY20.

While the growth of overall revenue was affected during FY20-21, Wingify focussed on bringing down overall costs to improve margins. Hence, the company initiated cost controls to ensure expenses stayed within control.

The company had plans to expand its physical presence and move into a bigger office at the start of 2020, which was delayed due to the global pandemic. Eventually, Wingify’s Chairperson Paras Chopra and CEO Sparsh Gupta announced their remote-first policy for the organisation via an internal email in July 2020.

The financial impact of this decision was also clearly visible in the company’s profit/loss statement as expenditure on rent and utilities dropped by nearly 58.5% YoY to Rs 1.81 crore during FY21. Similarly, expenditure on travel and conveyance also dropped by 90.5% YoY to only Rs 10.05 Lakhs during the same period.

Advertising and promotional expenses were also curtailed by 54.3% to Rs 7.33 crore in FY21 from Rs 16.03 crore in FY20.

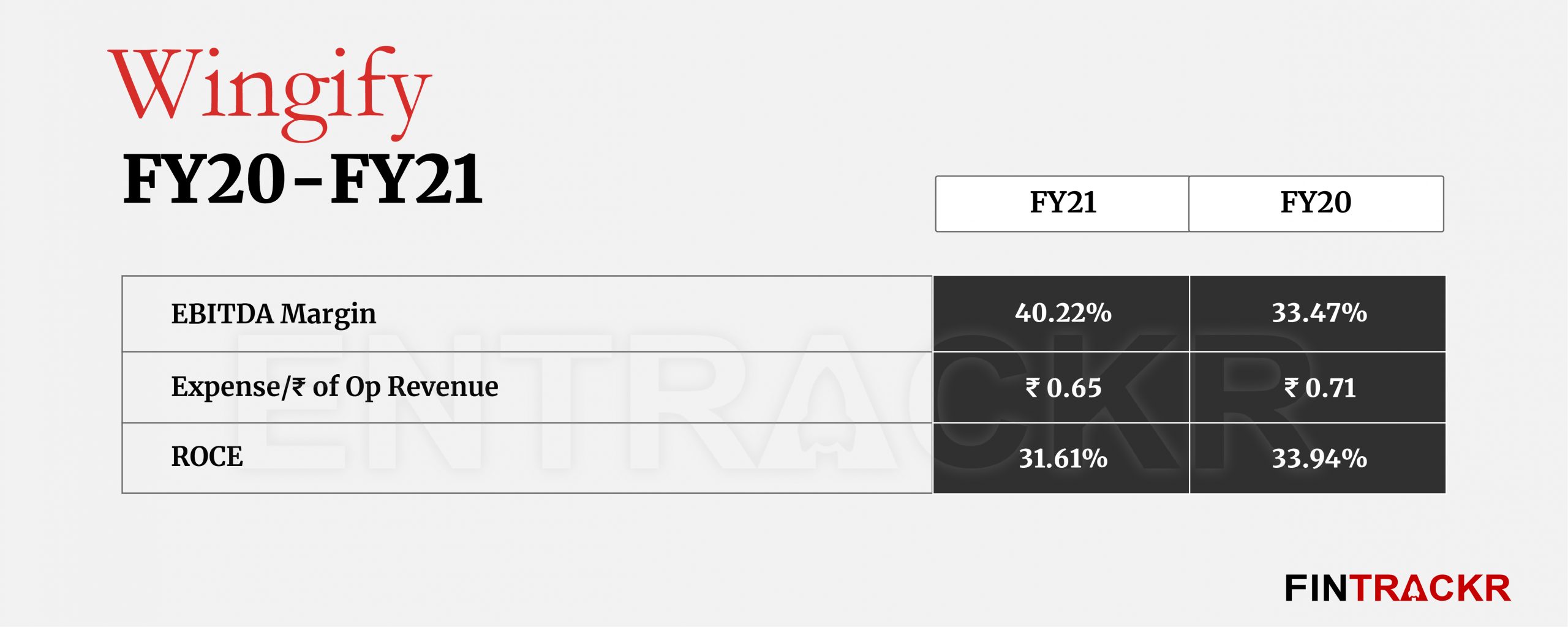

Information and technology costs of Rs 10.8 crore pushed annual expenditure to Rs 100.97 crore in FY21 from Rs 109.85 crore spent in total during FY20. On a unit level, Wingify spent Rs 0.65 to earn a single rupee during the fiscal ended in March 2021.

Due to the strategic decisions taken by the management, Wingify has managed to improve its EBITDA margin from 33.47% in FY20 to 40.22% during FY21. As a result, annual profits have grown by 28% YoY to Rs 51.5 crore despite the negligible growth in overall revenue.

As an early success story in the Indian SaaS space, Wingify has had its share of detractors claiming that the firm could have grown faster with fundraises and faster scale up to gun for an entry into the unicorn club. The firm’s founders took a contrarian stand, however, and it remains to be seen if it changes course now, on what is a very profitable business but one that requires constant involvement to keep up with the market. For now, it is clear that the founders have preferred to focus on their product offering over the distraction of fundraising.