The last quarter has been quite a rollercoaster ride for EV mobility company Ola Electric as the company saw a slew of issues such as fires, and drivetrain malfunctions plague its maiden product Ola S1 while also trumping other EVs in terms of sales, following its record bookings earlier.

The Bhavish Aggarwal-led company has leapfrogged to the second rank in the electric two-wheeler rankings in the country, delivering 9,127 units in the month of March, only behind the long term incumbent Hero Electric, which sold just over 13,000 units.

The Softbank-backed unicorn has been consistently raising funds during the last two fiscals and had recently raised a $200 million round at a reported valuation of $5 billion led by Tekne Private Ventures and Alpine Opportunity Fund. The five year company has finally filed its annual statements for the first time during the last three years with the regulator (RoC). Let’s take a look at the numbers that matter for FY21.

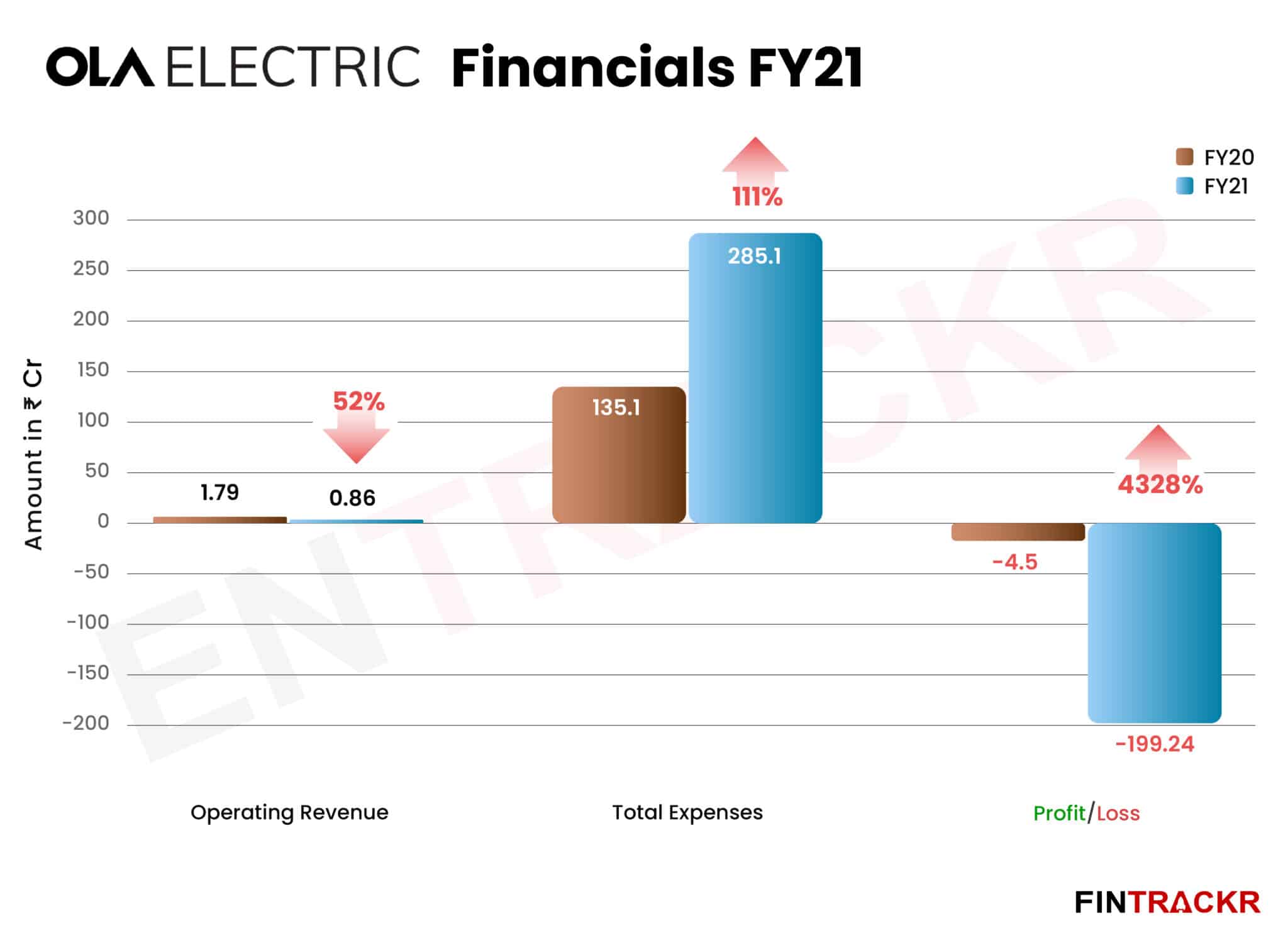

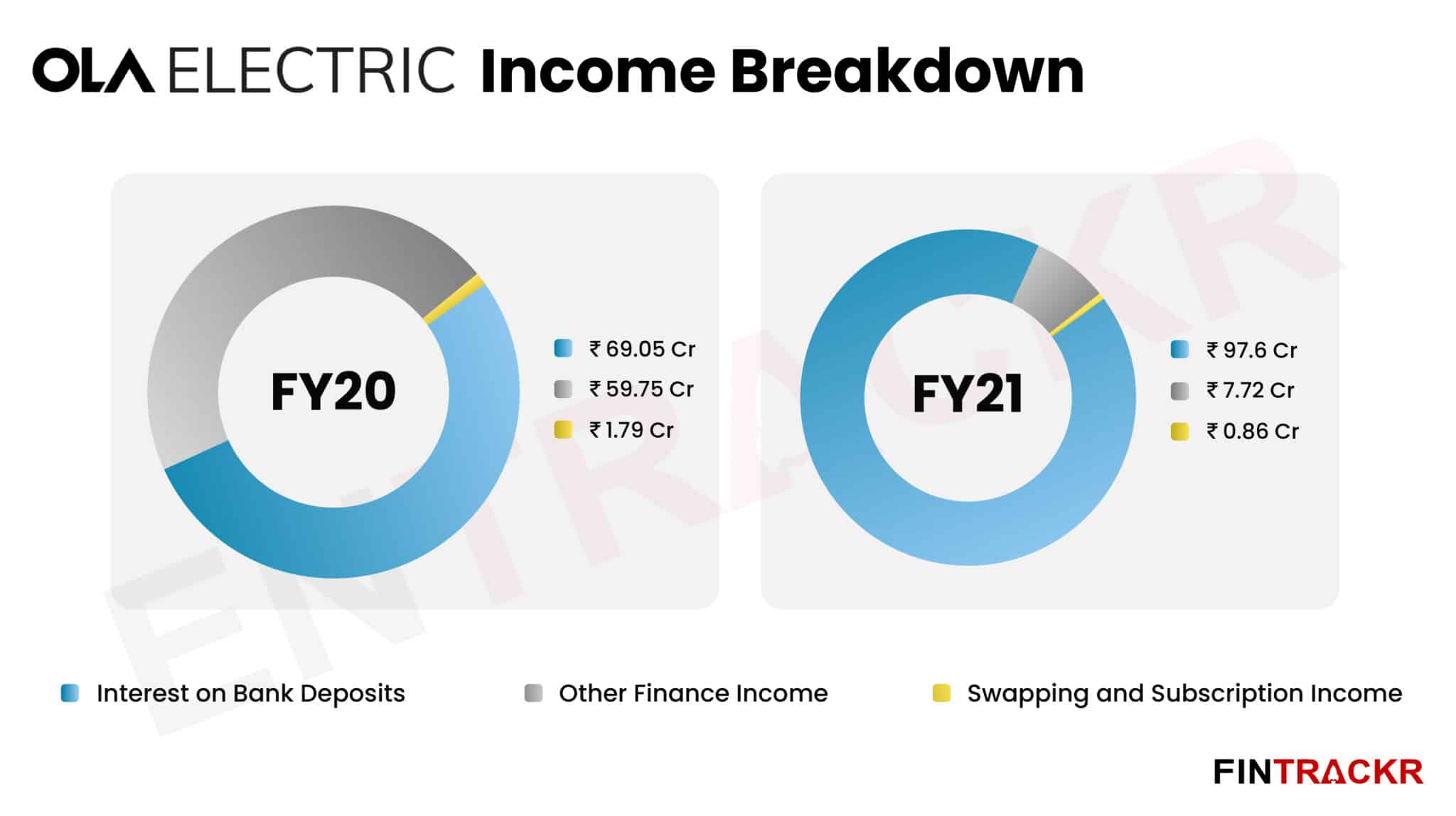

The EV startup started deliveries of its electric scooters in December 2021 and before that, it had been operating as an infrastructure provider for the charging and battery swapping network in India. Its revenue from operations has dropped by 52% to only Rs 86 lakhs during FY21 as compared to revenue of Rs 1.8 crore generated in FY20.

The Bengaluru-based startup has been on a fundraising spree during the last three years collecting more than $850 million from investors. The interest income from its financial assets and its non-operating collections amounted to Rs 105.3 crore during FY21, making up 99.2% of its annual income.

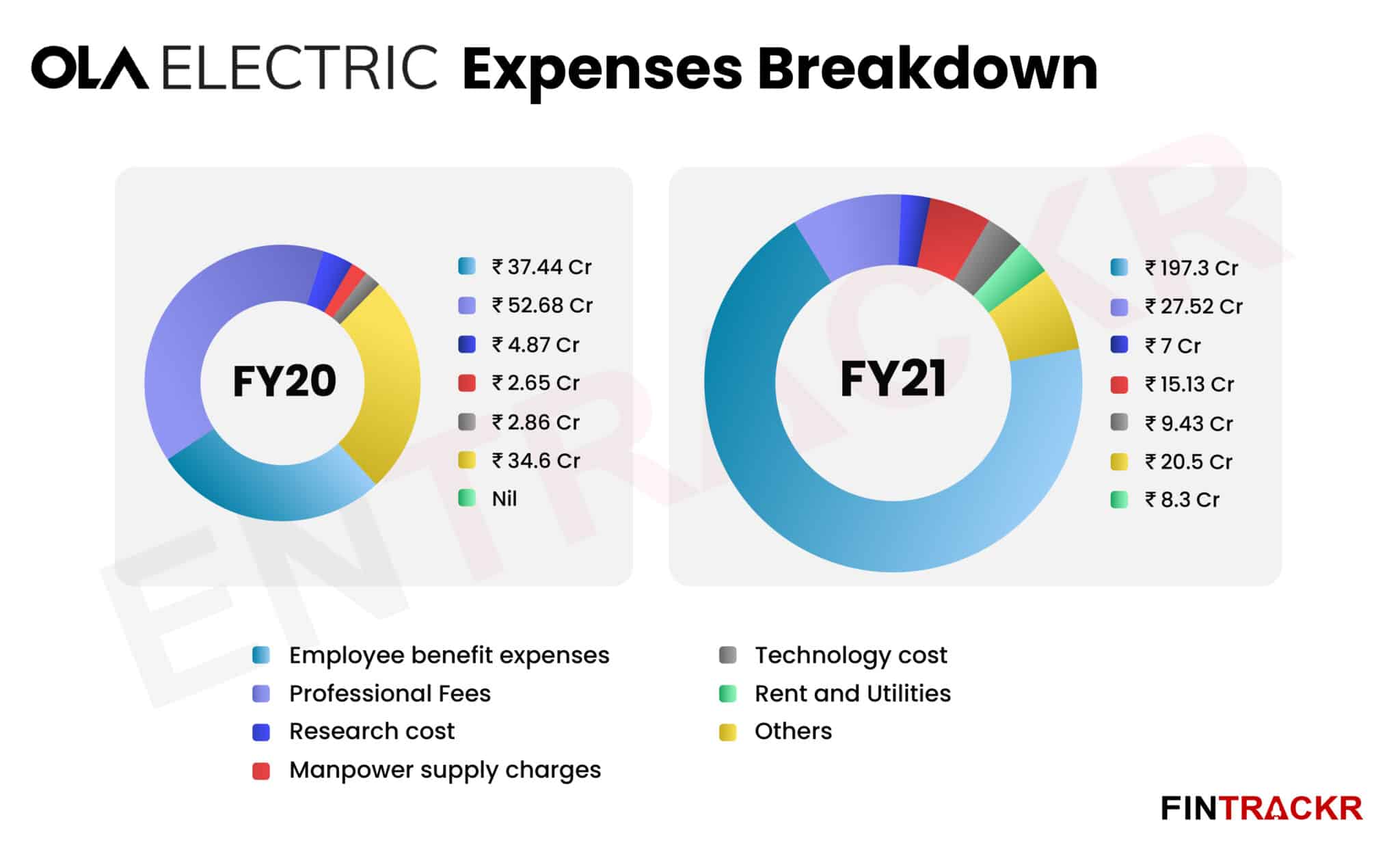

The company launched operations in its 500-acre production facility in mid-2021, so production/ sales related expenditures will reflect in its income statement for FY22. As of FY21, employee benefits payment was the largest cost centre incurred by the company accounting for 69.2% of its annual expenditure. Notably, the firm has an all-woman workforce at the two-wheeler plant.

As the company increased its scope of operations from EV infra provider to EV manufacturer, Ola electric made significant additions to its employee base during the last fiscal. As a result, its employee cost surged around 5.3X from Rs 37.44 crore in FY20 to Rs 197.3 crore during FY21 which included ESOP payments of Rs 42.74 crore.

The company employed external manpower to manage its EV infra business and on-ground operations and its manpower costs ballooned 5.7X to Rs 15.13 crore during FY21 from Rs 2.65 crore in FY20.

Moving further down the expense sheet, we observe that the EV startup spent Rs 7 crore in research and development while another 27.52 crore were shelled out on professional and legal fees during FY21. The company’s technology costs also grew by 230% to Rs 9.43 crore in FY21 as compared to Rs 2.86 crore spent on the same in FY20.

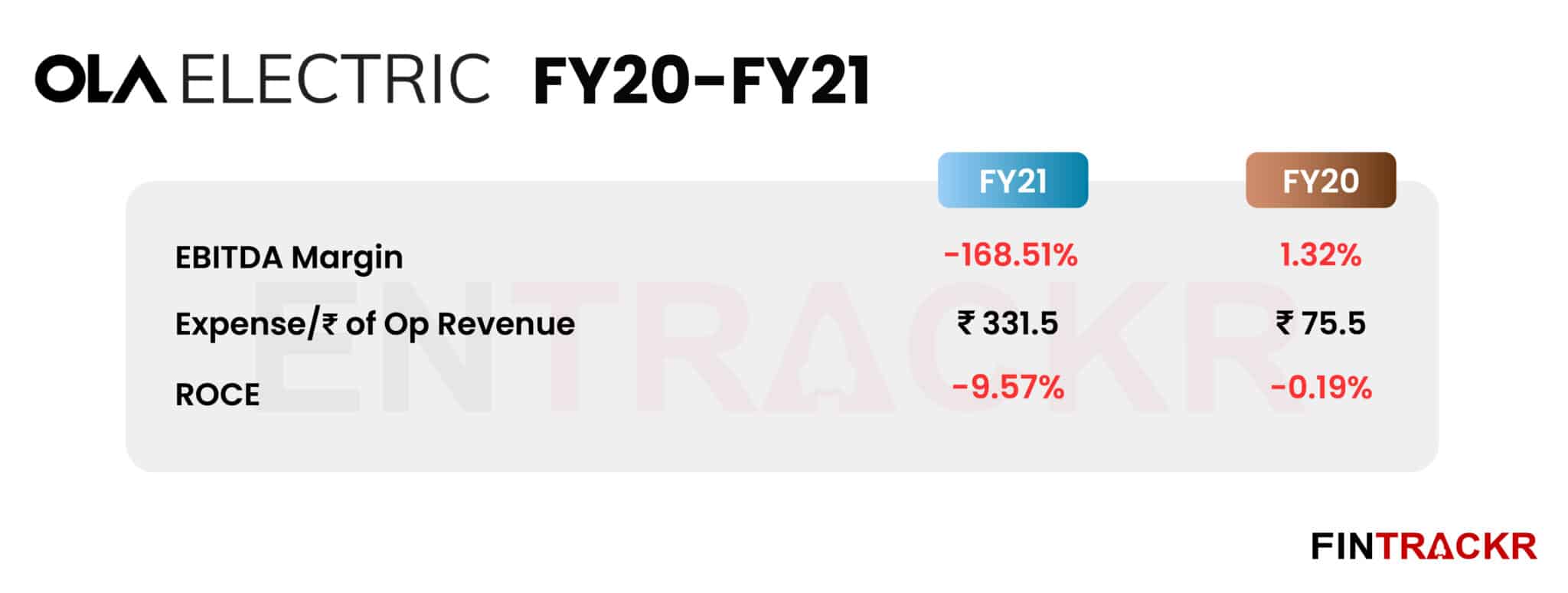

Rent and utility costs of Rs 8.3 crore pushed the company’s annual expenses to over Rs 285.1 crore in FY21, registering a 111% jump as compared to Rs 135.1 crore spent in total during FY20. Ola electric spent Rs 331.5 to earn a single unit of operating revenue.

While its annual cash burn has doubled, its total income has dropped by 18.7% to Rs 106.2 crore during the fiscal ended March 2021. As a result, Ola Electric’s annual losses have shot up 44.3X to Rs 199.2 crore during FY21 from Rs 4.5 crore lost in FY20.

These numbers, while effectively being pre-operative numbers, do set a base for the cost structure going forward. The revenues to balance those will take some time coming, especially going by the extraordinary rush that Ola Electric’s go to market strategy has forced on its team. There have been too many issues to highlight, but issues like batteries catching fire are too serious to be ignored among its many quality issues. There will be additional compliance costs for the whole sector, and soon.

With ever more competitors as well as policy changes on the anvil, be it a battery swapping policy or the many state-level subsidy programs, the firm faces an uphill challenge to deliver on its ambitious projections in an increasingly crowded market. Customer service, always a niggling issue with the group, could yet come back to haunt them as smaller, nimbler players carve out their own niches.