The Indian fantasy sports market is on its way to becoming an international behemoth, estimated to grow from $4.6 billion in FY21 to over $22 billion by FY25 as per a recent report by the Federation of Indian Fantasy Sports in partnership with Deloitte. One of the oldest Indian fantasy sports companies, Dream11 has been leading the charge, even as it enjoys its status as the poster boy of the fantasy sports industry.

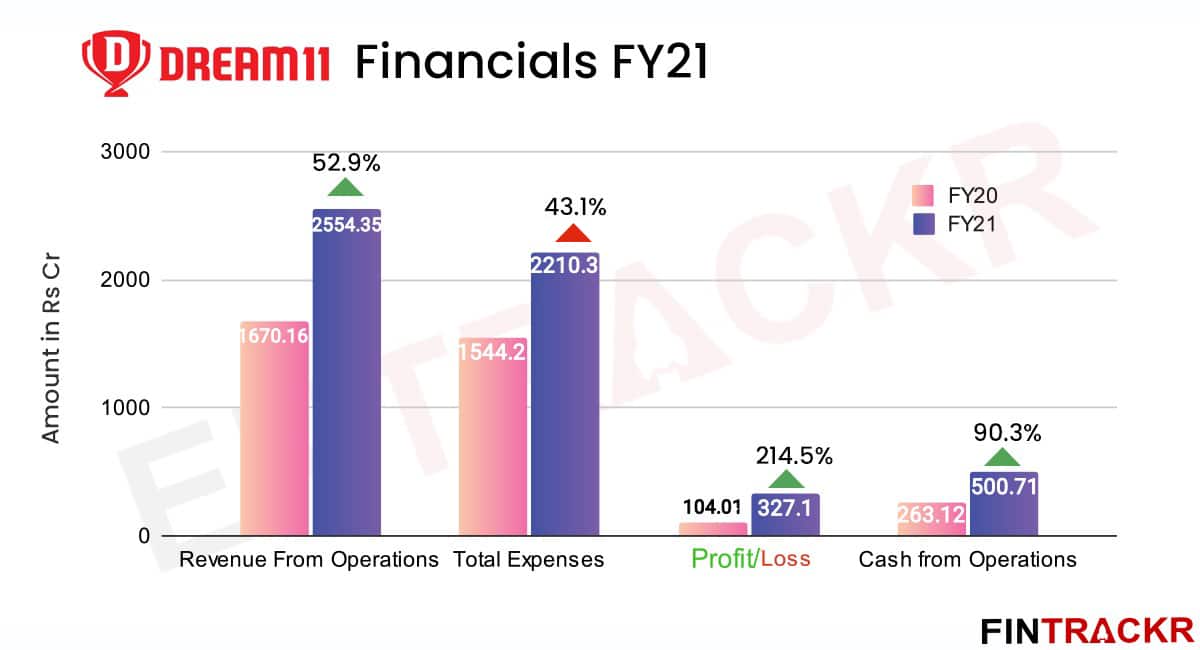

Besides its valuation ($8 billion), the company has also been leading the segment in terms of business and managed to grow its profit by over 3X. Dream11’s revenue from operations grew by 53% to Rs 2,554.4 crore ($340 million) during the fiscal ended in March 2021 as compared to Rs 1,670.2 crore earned in FY20, according to the company’s annual financial statements filed with RoC.

The Tiger Global-backed unicorn claims to have over twelve crore users on its platform. This, even when the application is not available on the Google Play store, reaching 5 million daily active users by mid FY21.

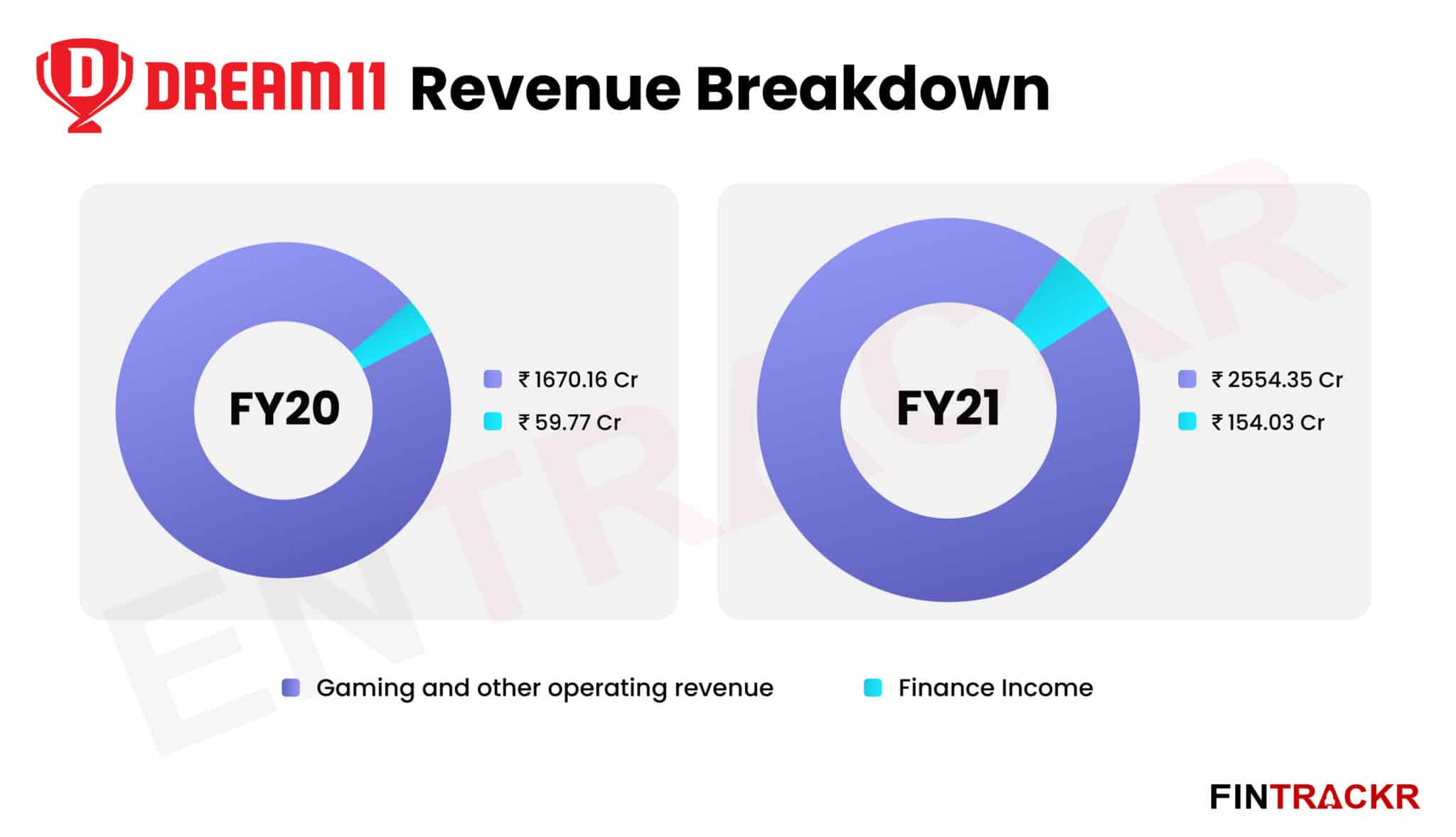

The 13-year-old company generated its revenues primarily by charging platform fees from its users participating in fantasy sports contests which it recognises as Gross Gaming Revenue (excluding GST). During FY21, Dream11 earned 99.5% of its revenues from gaming which amounted to Rs 2,451.2 crore for which it awarded promotional credits worth Rs 500.21 crore to its users.

While fantasy gaming remains the mainstay of its collections, Dream11 has tried to diversify with other operating segments including bespoke sports travel, video game development, merchandising and content creation. Dream11 sold sports jerseys and related merchandise worth Rs 1.2 crore whereas another Rs 1.2 crore came from its travel vertical DreamSet Go. It also generated Rs 8.24 crore from subscriptions and Rs 154.03 crore from its financial assets during FY21.

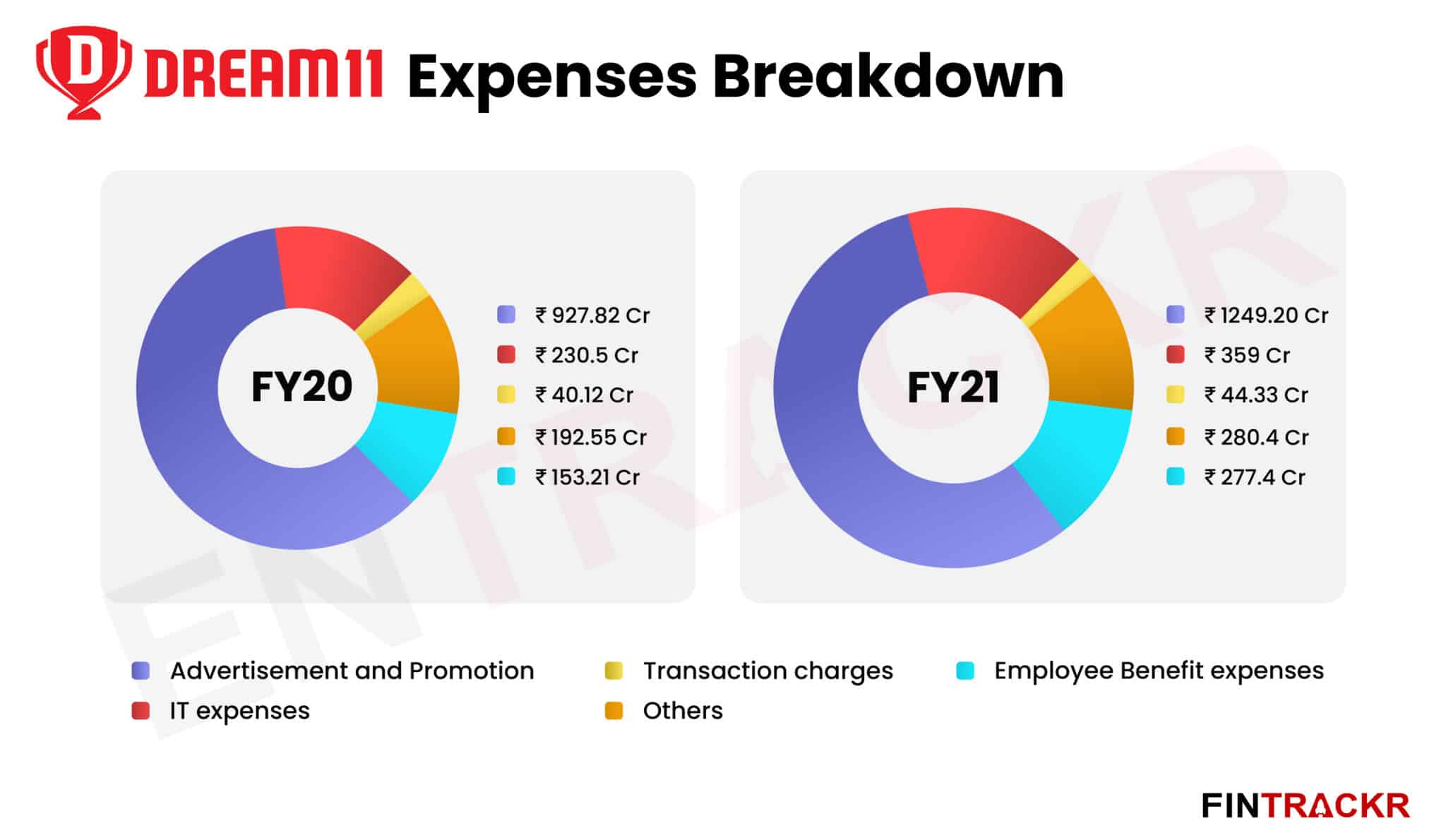

Dream11 became the title sponsor for the Indian Premier League in 2020 for Rs 222 crore which helped to propel its adoption amongst cricket fans in India. As a result customer acquisition is the largest cost centre of the company, accounting for 57% of its annual costs. Advertisement and promotion expenses grew by 35% to Rs 1,249.2 crore during FY21 from Rs 927.82 crore spent in FY20.

Due to the launch of other operating segments including travel, game development, merchandising and growth in the fantasy gaming operations, Dream11 increased its employee base significantly and its employee benefits payments grew by 81% to Rs 277.4 crore in FY21 from Rs 153.21 crore paid out in FY20.

These payments made up 13% of Dream11’s annual expenses and also included share-based payments of Rs 20.32 crore. Importantly, the salary drawn (not including stock options) by the co-founders — Harsh Jain and Bhavith Sheth — was 14% of the total salary paid by the company during FY21.

Further, Dream11’s expenditure on information technology infrastructure and product development was the second largest cost for the fantasy sports company making up 16% of its annual costs. These expenses grew in line with the operational scale, increasing by 56% to Rs 359 crore in FY21 from Rs 230.5 crore in FY20. Corporate social responsibility expenditure paid by the company amounted to Rs 44 Lakh during FY2020-21.

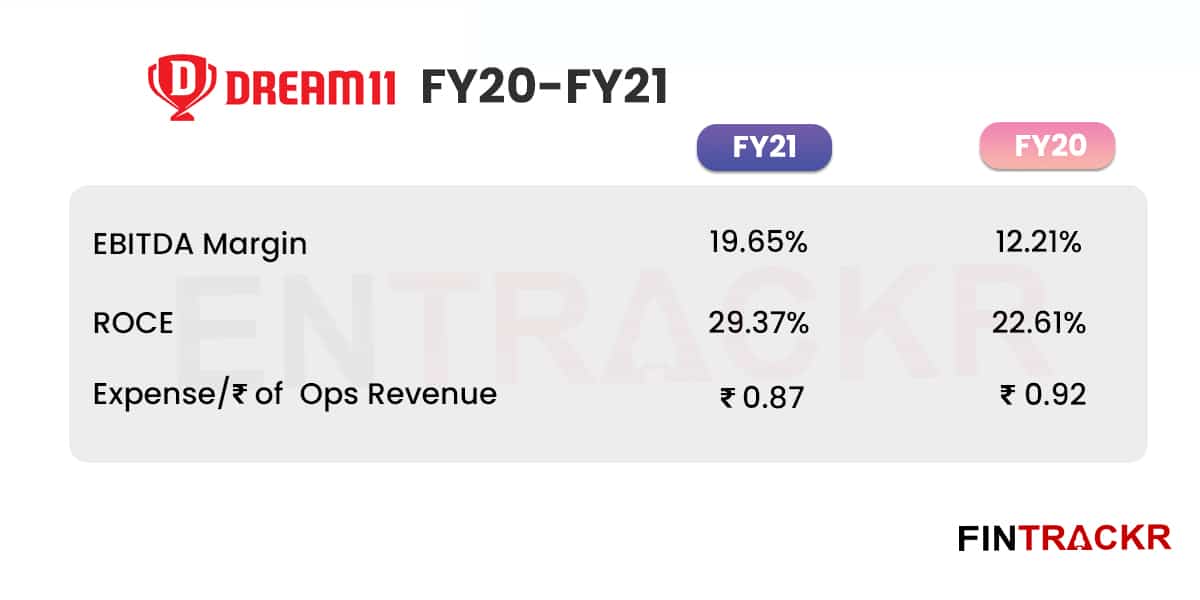

Rs 44.33 crore was the bill for processing the transactions on Dream11’s platform, pushing its annual expenditure to Rs 2,210.3 crore during the fiscal ended in March 2021. This marked a 43.1% jump in the company’s annual costs which stood at Rs 1,544.2 crore in FY20. Thus, Dream11 spent Rs 0.87 to earn a single unit of operating revenue during FY21.

The management at Dream11 has managed to improve operational efficiencies while growing its operational scale by 53%. As a result, annual profits have ballooned over three times to Rs 327.1 crore during FY21 from Rs 104.01 crore earned in FY20. EBITDA margins have improved by 744 BPS to 19.65% in FY21 from 12.21% BPS in FY20.

Dream11 FY21’s numbers have been impressive and set it apart from most of the unicorns as well as decacorns, simply for being profitable.

However, let’s face it. The firm, along with others in its category enjoys a charmed existence thanks to its offerings qualifying legally as a game of skill, rather than chance.

Any change in that status could lead to a major upheaval for the whole category which has emerged out of seemingly nowhere. That also explains the speed with which the players have banded together to speak in one voice and manage the environment. However till the time betting is formally legalised in India, the risk of getting on the wrong side of the law someday, will remain.