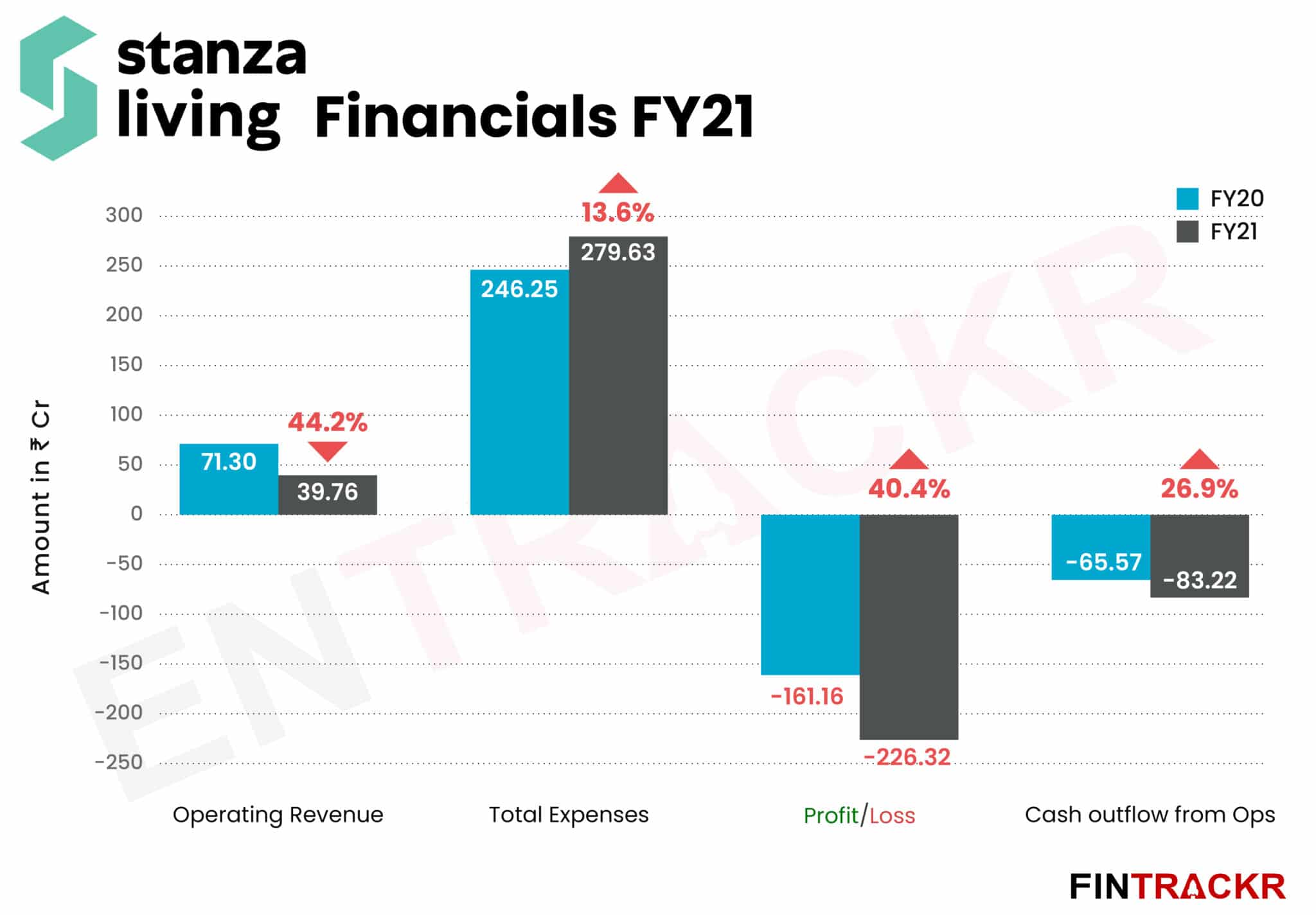

Hospitality and accommodation startups were impacted heavily due to the pandemic in the financial year ending March 2021. One such upstart is Stanza Living which suffered a 44% loss in its scale during that time period.

The company’s operating revenue reduced by around 44% to Rs 39.76 crore during FY21 from Rs 71.3 crore in the preceding fiscal year (2020), according to its annual financial statements.

For the uninitiated, Stanza Living is a full-stack co-living destination for students and migrating people which includes food, housekeeping, security and other amenities.

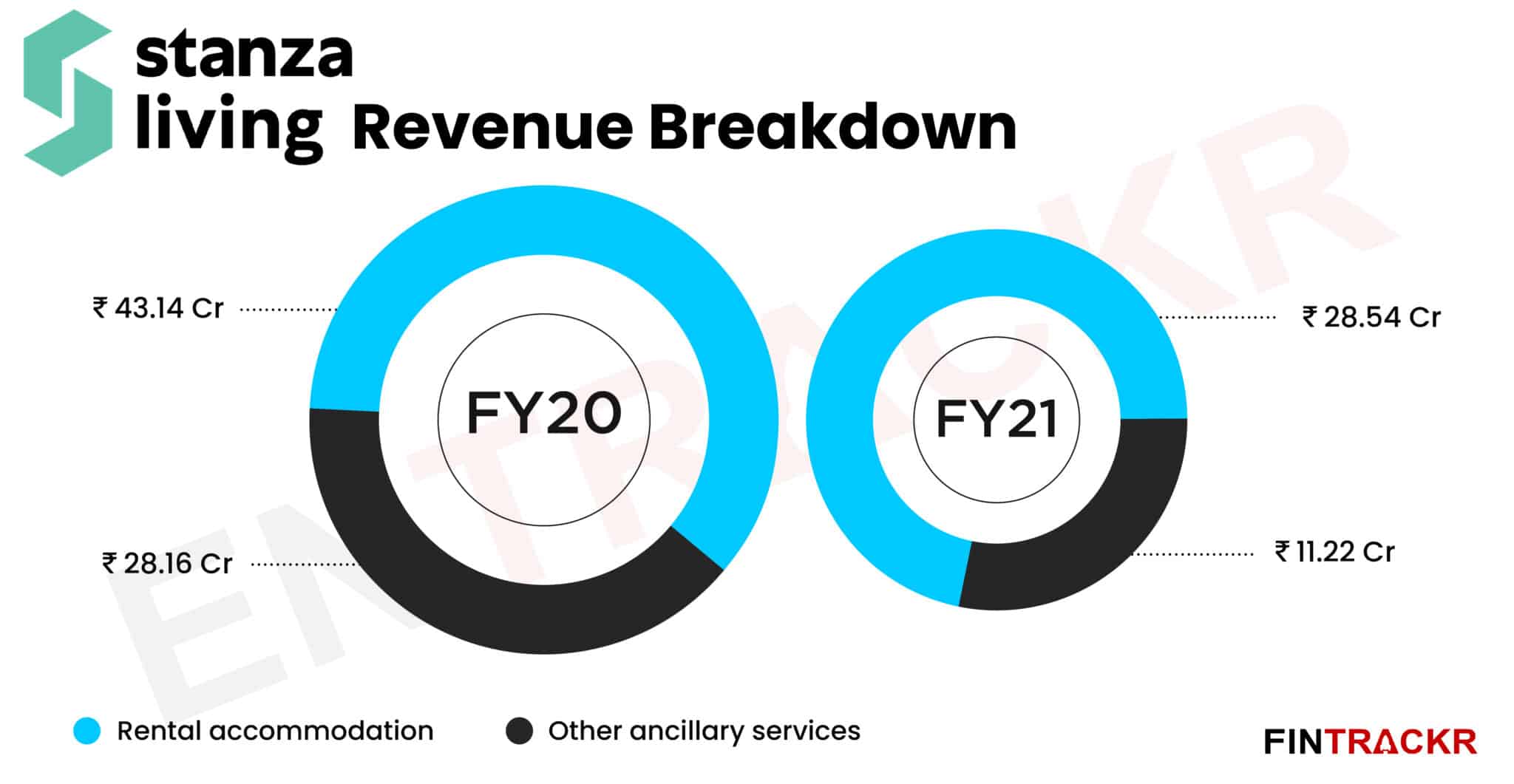

Its main source of income was rental accommodation during the fiscal year, contributing nearly 72% of the total operating revenue. Such revenue shrank 33.8% to Rs 28.54 crore in the financial year 2021 from Rs 43.14 crore in FY20 as a large number of renters moved back to their hometowns after work-from-home orders were put in place.

Stanza Living also provides other ancillary services such as laundry and food to the customers which make up the remaining 28.2% of the operating revenues. This collection dropped by 60.2% from Rs 28.16 crore in FY20 to only Rs 11.22 crore during FY21.

The New Delhi-based firm also collected non-operating income of Rs 13.53 crore from its financial assets during FY21.

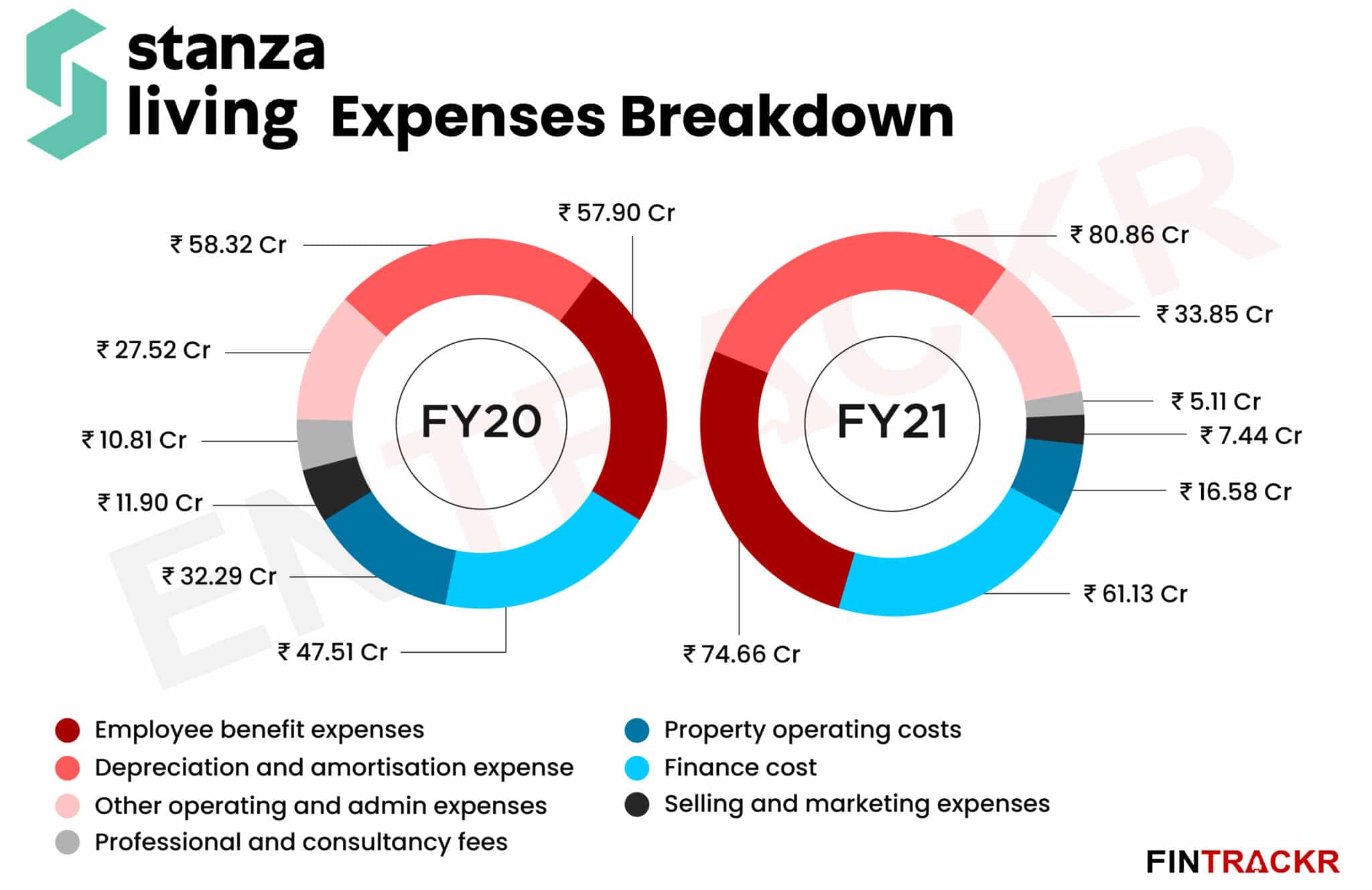

Stanza Living’s expense sheet shows employee benefits expense as the largest payment made by the company, accounting for 26.7% of its annual expenditure. These payments grew around 29% to Rs 74.6 crore during FY21 from Rs 58 crore paid out in FY20.

Expenses incurred in operating the rental properties such as utility payments, consumables and housekeeping costs made up around 6% of the annual expenses. Such payments also reduced with the scale of operations, dropping by nearly 49% YoY to Rs 16.6 crore during FY21.

The co-living startup leases out its properties from the owners and finances its leases from financial institutions. As a result, finance cost appears to be the second-largest payment by the company, making up nearly 22% of its annual expenses. These interest payments rose by 28.7% to Rs 61.13 crore during FY21 from Rs 47.51 crore paid in FY20.

Stanza Living’s selling and marketing expenses reduced by 37.5% YoY to Rs 7.44 crore and professional and consultancy expenses also shrank by 52.7% YoY respectively—Rs 5.11 crore in FY21 from Rs 11.9 crore and Rs 10.81 crore paid out during the previous fiscal.

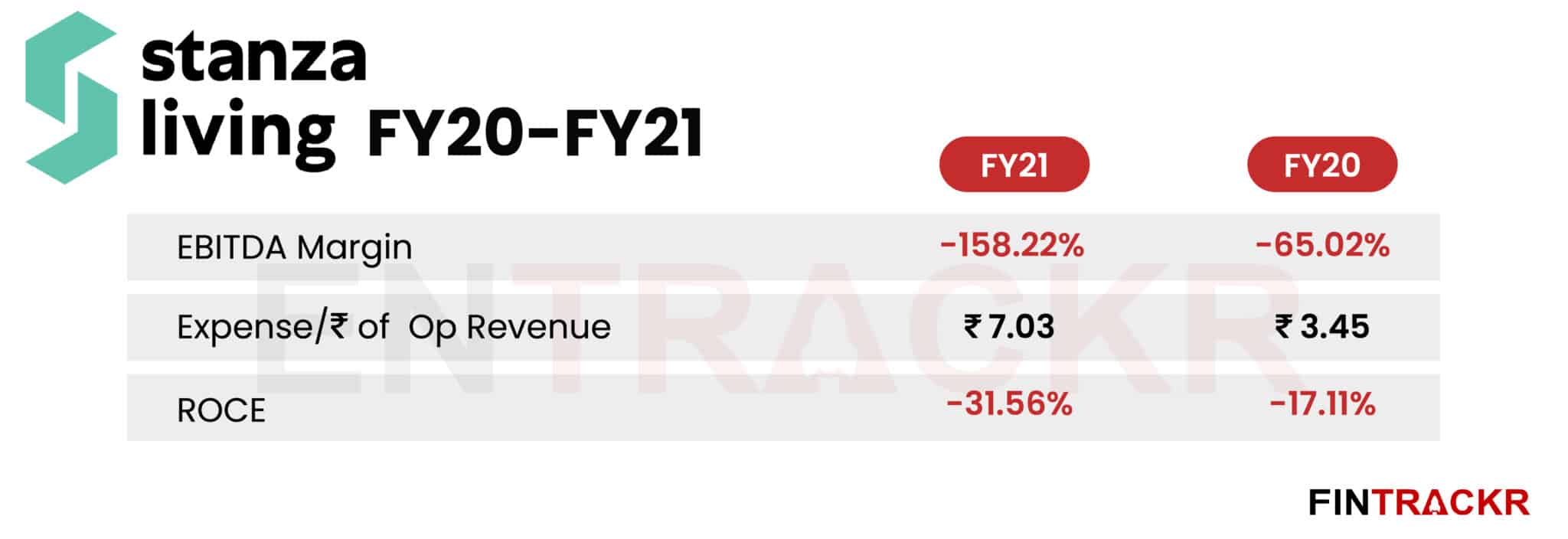

The five-year-old company’s total expenditure increased by 13.6% to Rs 279.63 crore in FY21 against Rs 246.25 crore spent in FY20. On a unit level, Stanza Living spent Rs 7.03 to earn a rupee of operating revenue in FY21 degrading from Rs 3.25 spent to earn the same during FY20.

The Falcon Edge-backed startup reported a loss of Rs 226.32 crore during FY21, increasing by 40.4% from Rs 161.16 crore in FY20. The EBITDA margins of the company also worsened by 93 BPS to -158.22% during FY21. Stanza Living’s balance sheet sported outstanding losses of Rs 406.7 crore at the end of March 2021.

In April 2021, Stanza Living raised Rs 769 crore or $102 million in Series D funding round led by Falcon Edge. Entarckr had exclusively reported the development. The company has raised $172 million to date from investors including Sequoia Capital and Matrix Partners.

Stanza Living’s loss in scale is evident as the company experienced disruption in services due to the Covid-19 induced pandemic. Its losses also jumped due to contraction of operational income. While the situation has improved for co-living and co-working spaces in the ongoing fiscal, Stanza Living is likely to have flat or tepid growth in FY22 as the company is yet to achieve pre-Covid peak in business.