Sachin Bansal led financial services company Navi Technologies has filed its Draft Red Herring Prospectus (DRHP) with market regulator SEBI. The company is looking to raise Rs 3,350 crore via a fresh issue of equity and may consider raising up to Rs 670 crore via private placement as well in a pre-IPO round.

The Bengaluru-based company has appointed Axis Capital, BofA Securities, Credit Suisse, Edelweiss and ICICI Securities as the book-running managers for the issue while Link Intime India Private Limited shall be the registrar.

Currently, Navi’s promoter Sachin Bansal is the largest shareholder of the company controlling a 97.77% stake in the company with other Co-founder Ankit Agarwal holding 0.98% as of the date of DRHP.

Navi Technologies controls eight subsidiaries namely Anmol Como Broking, Navi Finserv, Navi General Insurance, Navi Investment Advisors, Navi Securities, Mavenhive Technologies and BACQ Acquisitions. Further, the step-down subsidiaries are Navi AMC, Navi Trustees and Chaitanya India Fin Credit Limited.

The DRHP states that out of the total Rs 3,350 crore the company is looking to raise via IPO, around 2,370 crore shall be invested into its subsidiary Navi Finserv Pvt Ltd (NFPL).

NFPL is categorised as a non-deposit taking systemically important non-banking financial corporation (NBFC) having gross asset under management (AUM) of Rs 1,596.4 crore as of December 31, 2021, with over 4.8 lakh loan accounts. Navi intends to infuse the above-mentioned amount to augment NFPL’s capital base, helping it to meet capital requirements with its growth perspectives in the lending business.

Further, the DRHP states that Navi will invest Rs 1090 crore from the process for fresh issue into Navi General Insurance Limited (NGIL) which was launched after the company acquired erstwhile DHFL General Insurance Limited in February 2020.

The company intends to increase NGIL’s capital base, helping it to reach the IRDAI prescribed solvency levels and to meet its future capital requirements.

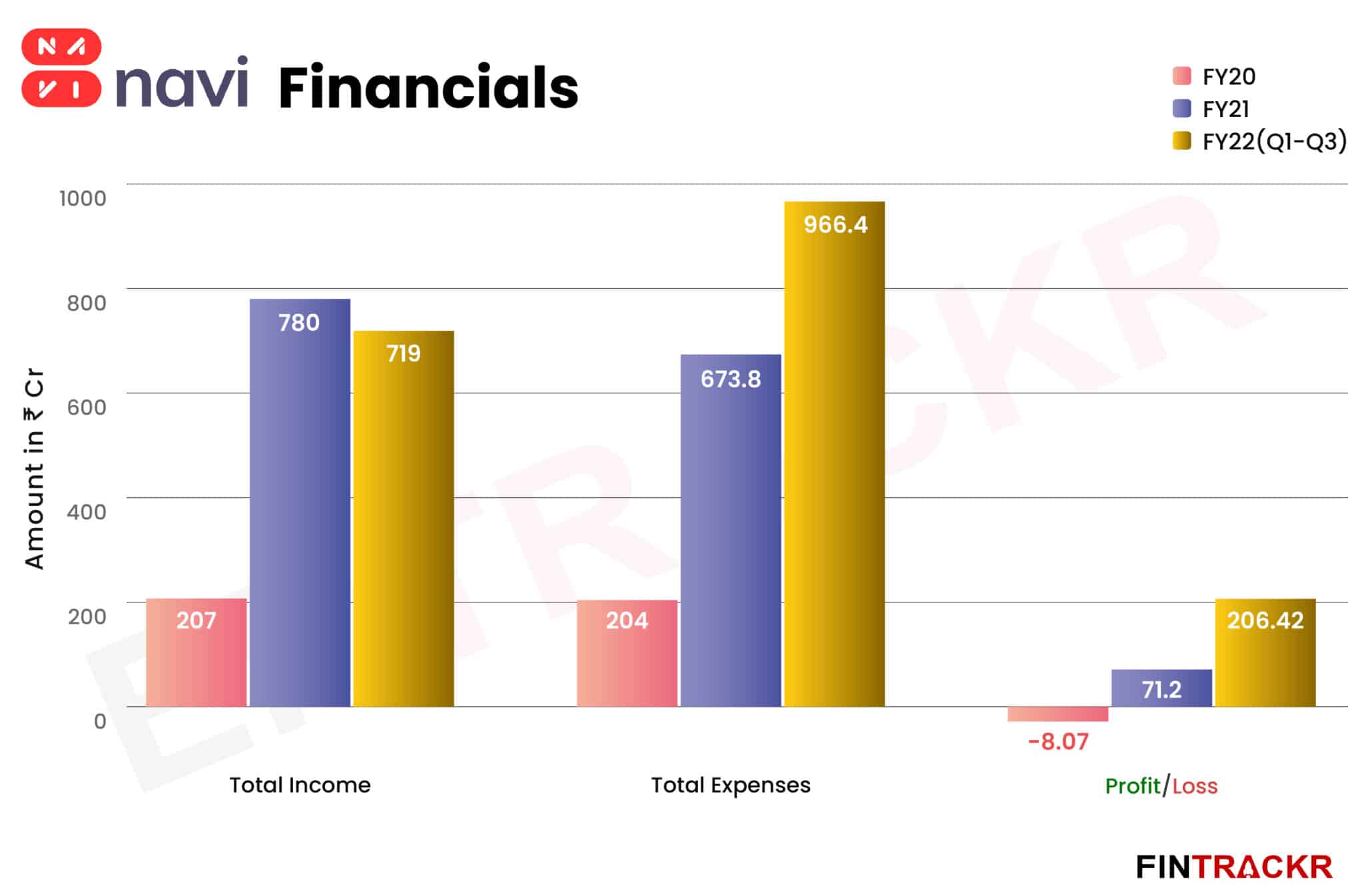

The company had turned profitable during the fiscal year ended in March 2021, posting annual profits of Rs 71.2 crore with a total income of Rs 780 crore. The company has also disclosed its financial figures for the Q1-Q3 FY22 along with the DRHP, during which the company generated a total income of Rs 719.4 crore with a loss of Rs 247 crore.

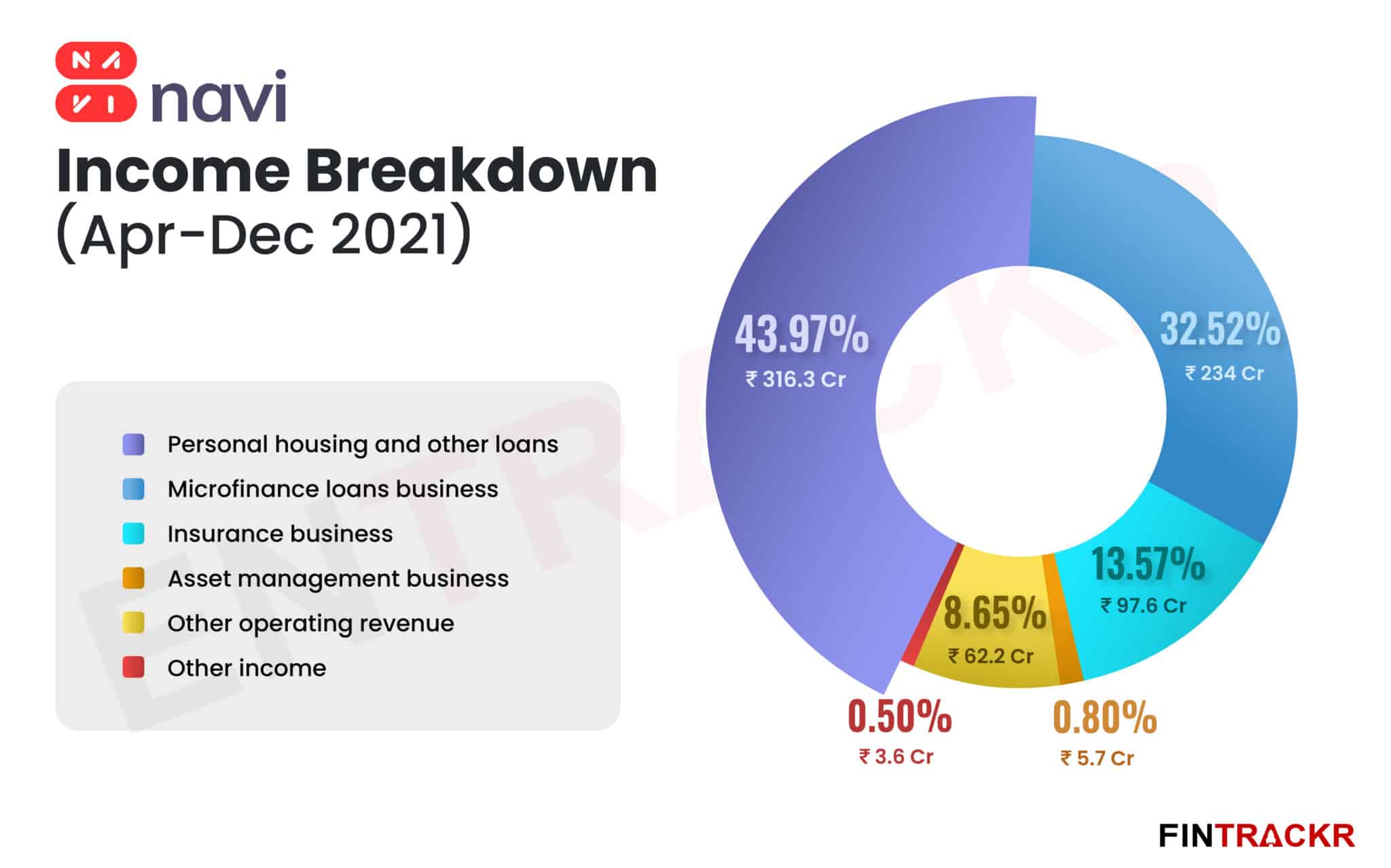

The financial services firm generates 44% of its income via personal and housing loans segment, followed by its Microfinance business run via Chaitanya India Fin Credit Pvt Ltd which brought in 32.5% of the annual income. Have a look at all of Navi’s business segments and their collections for Q1-Q3FY22 :

Navi is a full-stack financial service provider which offers personal, home, loan against property among other offerings and going public will pave the way for it to accept public deposits and elevate its status as an investment platform as well. At present, it has a disbursal rate of about Rs 2,000 crore and aspires to build a 15,000 crore worth loan book in the next 18 months.